Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Percent of Sales and Accounts Receivable Method to estimate bad debt expense Opportunity Ltd. had the following opening account balances on January 1, 2020:

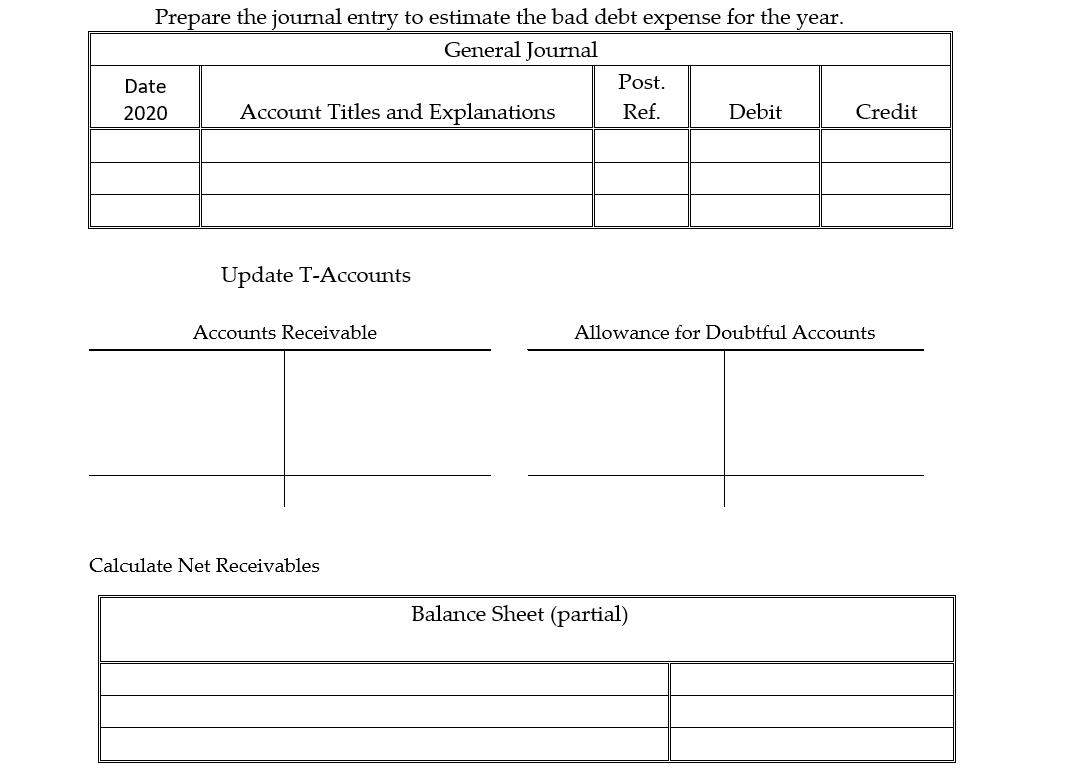

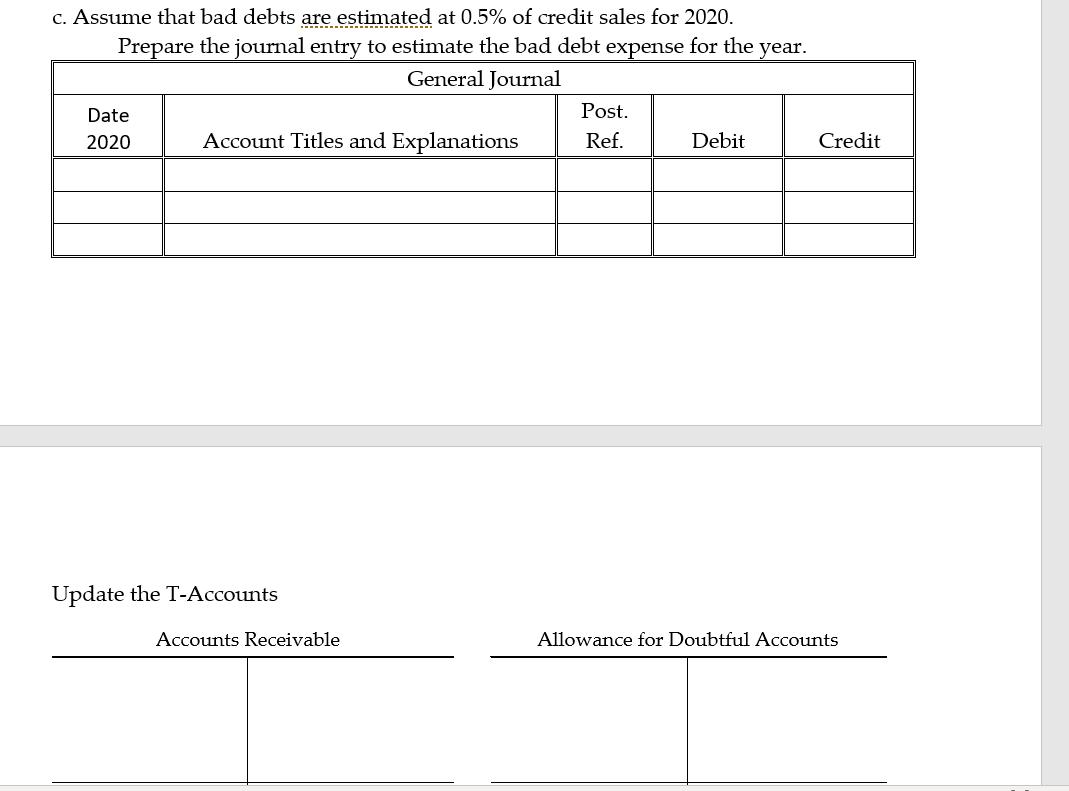

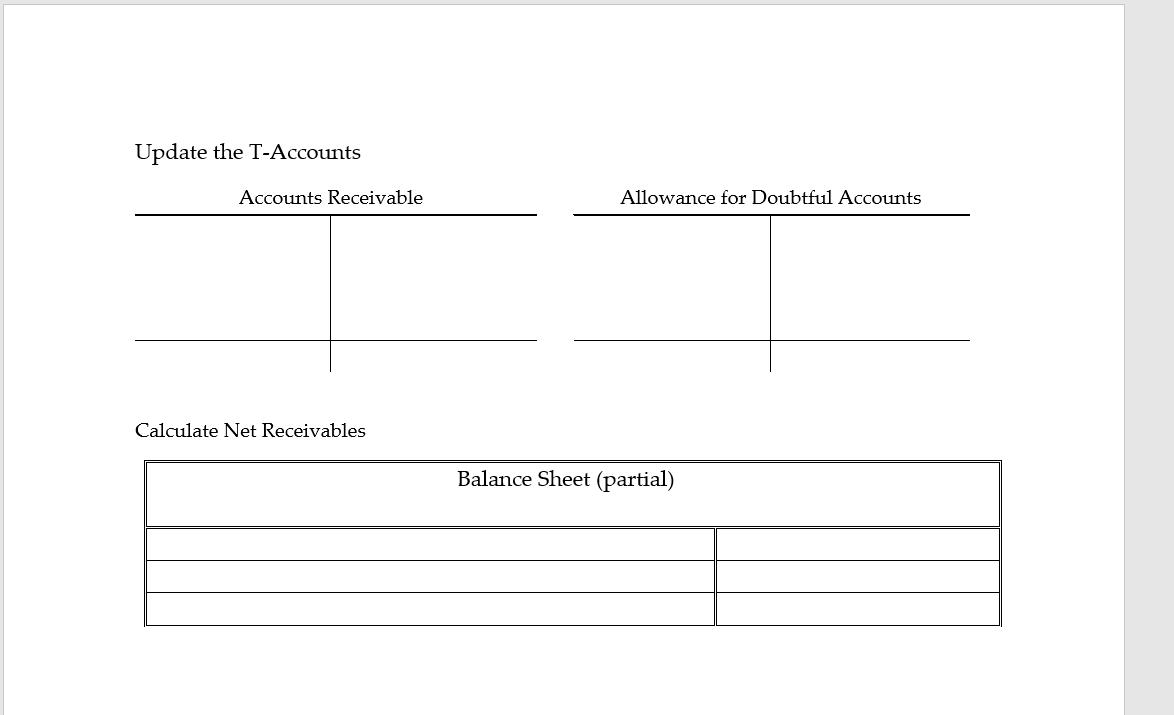

Percent of Sales and Accounts Receivable Method to estimate bad debt expense Opportunity Ltd. had the following opening account balances on January 1, 2020: Accounts receivable $1,225,000 debit balance Allowance for doubtful accounts 29,000 credit balance Transactions during the year were: Sales (all on credit) Collections on accounts Accounts receivable written off as uncollectible Date 2020 a. Prepare the journal entry for the accounts receivable written off during the year. General Journal Account Titles and Explanations $ 2,837,100 3,250,000 35,000 Post. Ref. Debit Credit Prepare the journal entry to estimate the bad debt expense for the year. General Journal Date 2020 Account Titles and Explanations Update T-Accounts Accounts Receivable Calculate Net Receivables Post. Ref. Debit Balance Sheet (partial) Credit Allowance for Doubtful Accounts c. Assume that bad debts are estimated at 0.5% of credit sales for 2020. Prepare the journal entry to estimate the bad debt expense for the year. General Journal Date 2020 Account Titles and Explanations Update the T-Accounts Accounts Receivable Post. Ref. Debit Credit Allowance for Doubtful Accounts Update the T-Accounts Accounts Receivable Calculate Net Receivables Allowance for Doubtful Accounts Balance Sheet (partial)

Step by Step Solution

★★★★★

3.45 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Bal Sales Bal Accounts Receivable 1225000 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started