Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1st January 2020 Britanica acquired 4 million ordinary shares in Indica for 60 million Indian Rupees (INR). The reserves of Indica at that

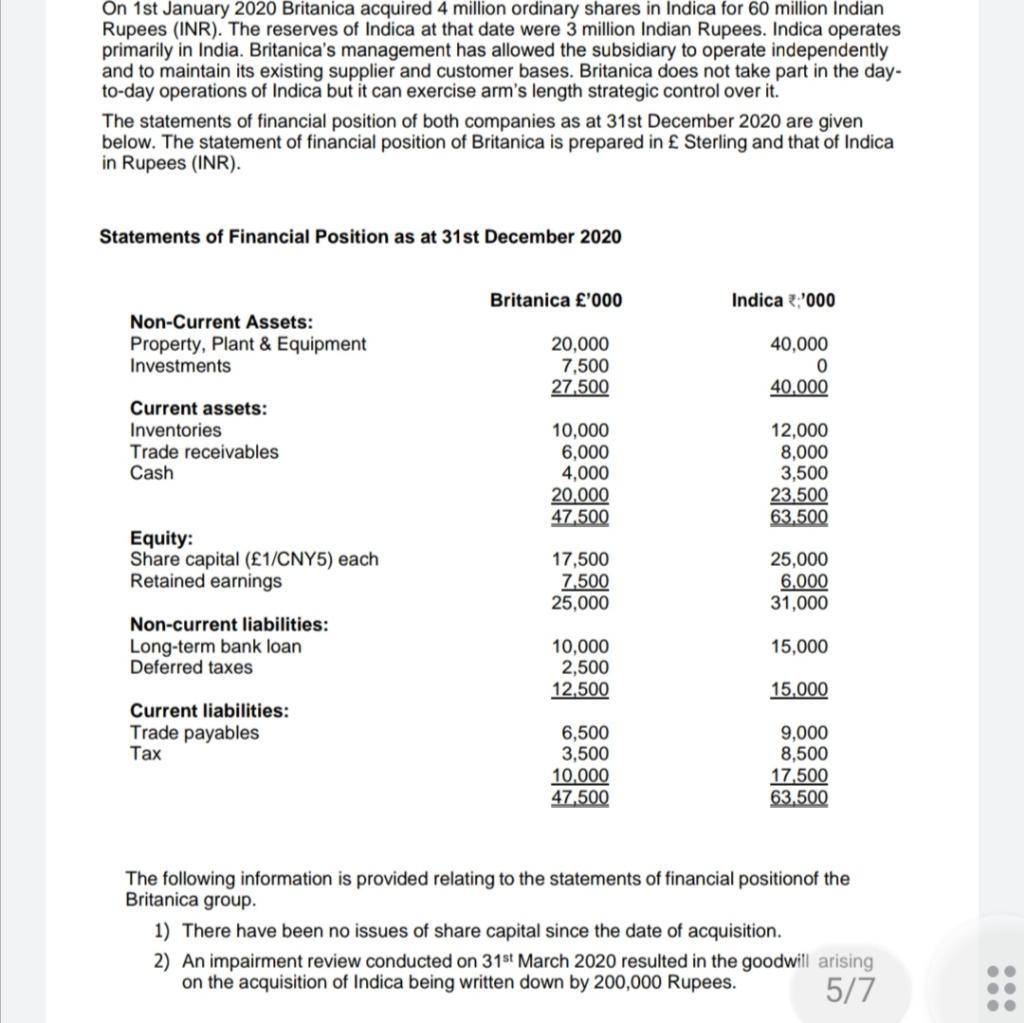

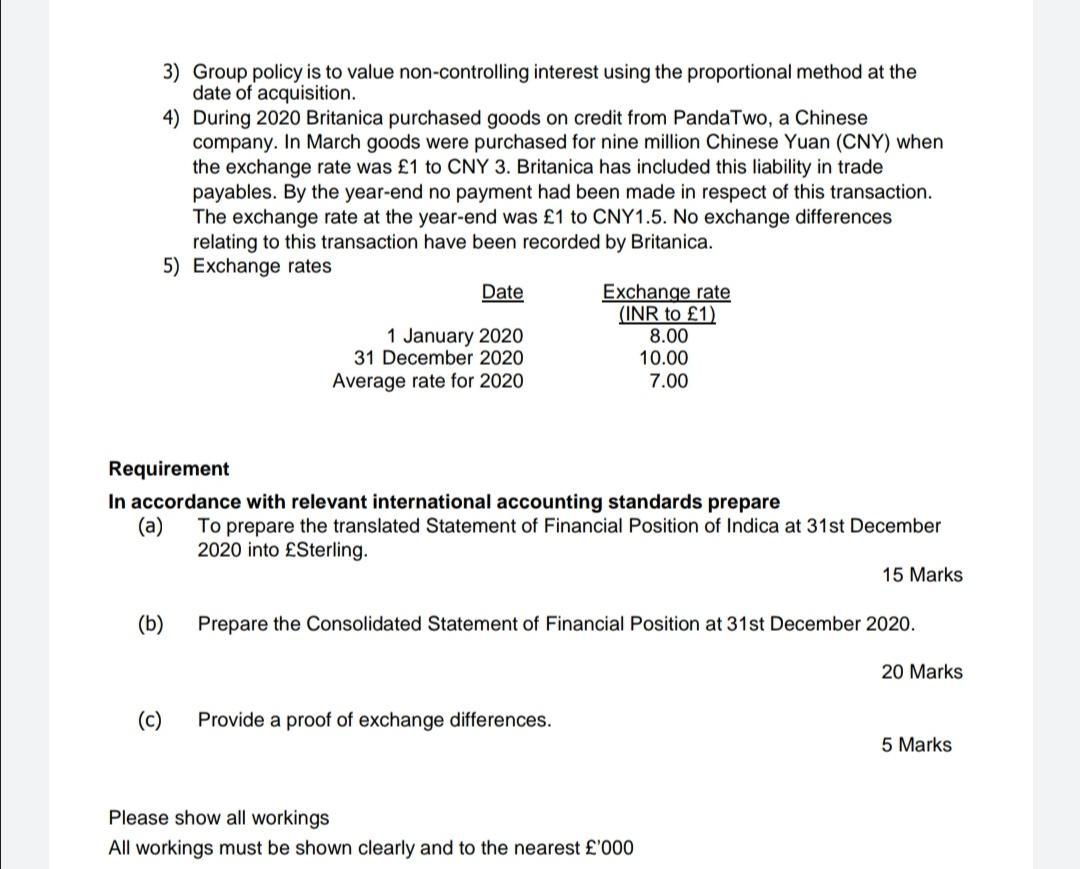

On 1st January 2020 Britanica acquired 4 million ordinary shares in Indica for 60 million Indian Rupees (INR). The reserves of Indica at that date were 3 million Indian Rupees. Indica operates primarily in India. Britanica's management has allowed the subsidiary to operate independently and to maintain its existing supplier and customer bases. Britanica does not take part in the day- to-day operations of Indica but it can exercise arm's length strategic control over it. The statements of financial position of both companies as at 31st December 2020 are given below. The statement of financial position of Britanica is prepared in Sterling and that of Indica in Rupees (INR). Statements of Financial Position as at 31st December 2020 Non-Current Assets: Property, Plant & Equipment Investments Current assets: Inventories Trade receivables Cash Equity: Share capital (1/CNY5) each Retained earnings Non-current liabilities: Long-term bank loan Deferred taxes Current liabilities: Trade payables Tax Britanica '000 20,000 7,500 27,500 10,000 6,000 4,000 20,000 47,500 17,500 7,500 25,000 10,000 2,500 12,500 6,500 3,500 10,000 47.500 Indica:'000 40,000 0 40,000 12,000 8,000 3,500 23,500 63,500 25,000 6,000 31,000 15,000 15,000 9,000 8,500 17,500 63.500 The following information is provided relating to the statements of financial positionof the Britanica group. 1) There have been no issues of share capital since the date of acquisition. 2) An impairment review conducted on 31st March 2020 resulted in the goodwill arising on the acquisition of Indica being written down by 200,000 Rupees. 5/7 3) Group policy is to value non-controlling interest using the proportional method at the date of acquisition. 4) During 2020 Britanica purchased goods on credit from PandaTwo, a Chinese company. In March goods were purchased for nine million Chinese Yuan (CNY) when the exchange rate was 1 to CNY 3. Britanica has included this liability in trade payables. By the year-end no payment had been made in respect of this transaction. The exchange rate at the year-end was 1 to CNY1.5. No exchange differences relating to this transaction have been recorded by Britanica. 5) Exchange rates (b) Date 1 January 2020 31 December 2020 Average rate for 2020 Requirement In accordance with relevant international accounting standards prepare (a) (c) Exchange rate (INR to 1) 8.00 10.00 7.00 To prepare the translated Statement of Financial Position of Indica at 31st December 2020 into Sterling. 15 Marks Prepare the Consolidated Statement of Financial Position at 31st December 2020. 20 Marks Provide a proof of exchange differences. Please show all workings All workings must be shown clearly and to the nearest '000 5 Marks

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Britanica 000 Indica INR000 NonCurrent Assets Property Plant Equipment 20000 40000 Investments 750...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started