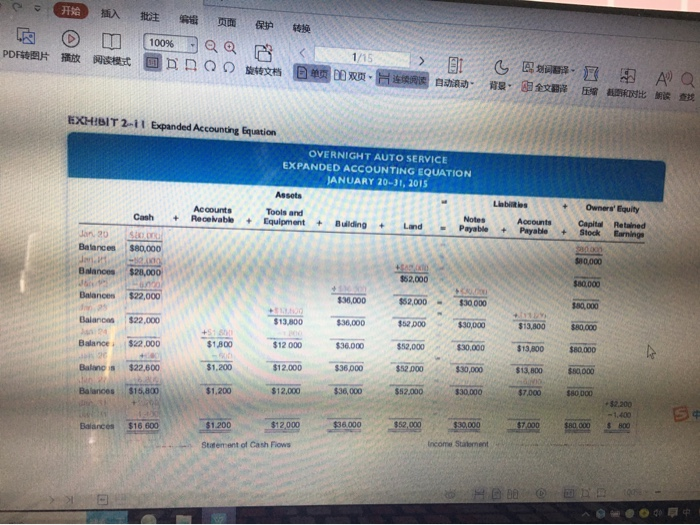

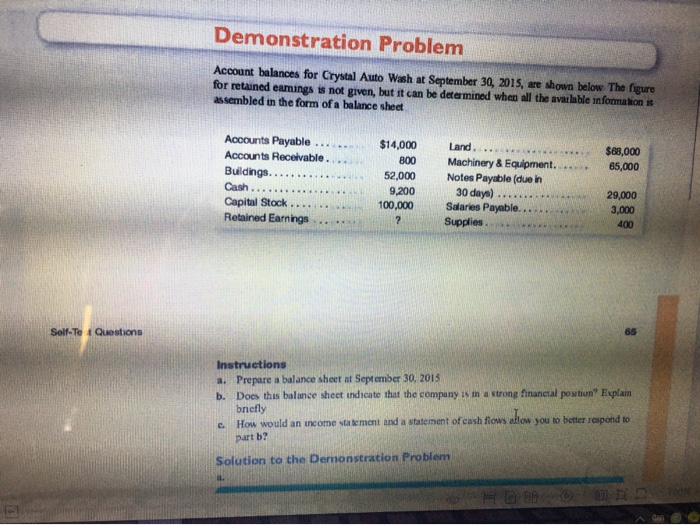

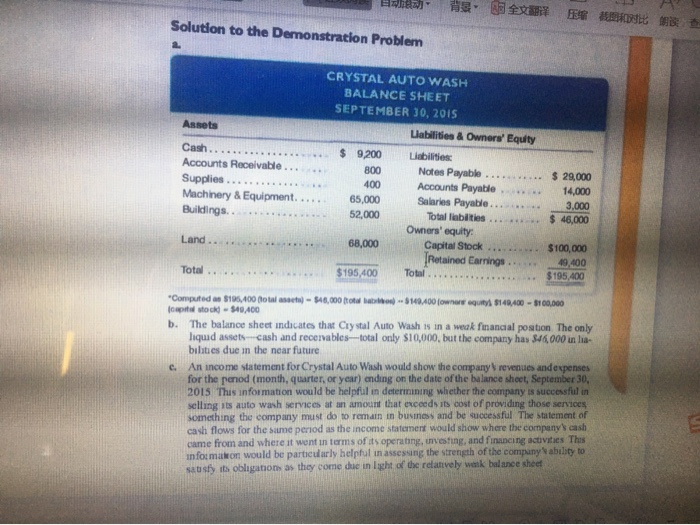

FESA 100% PDF DOS 1/15 91 CB A Q EXHIBIT 2-11 Expanded Accounting Equation OVERNIGHT AUTO SERVICE EXPANDED ACCOUNTING EQUATION JANUARY 20-31, 2015 Assets Labios Accounts Tools and Notes Cash + Receivable - Equipment Accounts + Building Land Payable Payat Owners' Equity Capital Retained Stock Earnings Jan 20 Balances $80,000 - $20,000 $80,000 Balances ASO $52.000 $80,000 Balance $22.000 $30,000 $52,000 $30,000 380,000 Balance $22.000 $13,800 $36,000 $52 DOO $30,000 $13,000 $80.000 Balance $22.000 $1,800 $12000 $36.000 $52,000 $30.000 $13,000 $80.000 Balans $22,600 $1,200 $12.000 $36.000 $52.000 $30,000 $13,500 $80,000 Balances $15,800 $1,200 $12,000 $36,000 $52,000 $30,000 $7,000 $80,000 +$2.200 - 1.400 s Balances $16 600 $1.200 $12000 $36.000 $52,000 $30,000 $7.000 $80.000 Statement of Cash Flows Income Statement Demonstration Problem Account balances for Crystal Auto Wash at September 30, 2015, are shown below. The figure for retained eamings is not given, but it can be determined when all the available informations assembled in the form of a balance sheet $68,000 65,000 Accounts Payable Accounts Receivable. Buildings... Cash.. Capital Stock Retained Earnings $14,000 800 52,000 9,200 100,000 ? Land. Machinery & Equipment. Notes Payable (due in 30 days) Salaries Payable.. Supplies 29,000 3,000 400 Self-Te Questions Instructions a. Prepare a balance sheet at September 30, 2015 b. Does this balance sheet indicate that the company is a strong financial position Explain briefly c. How would an income statement and a statement of cash flows allow you to better respond to part b? Solution to the Dernonstration Problem H BORD TE , Solution to the Demonstration Problem CRYSTAL AUTO WASH BALANCE SHEET SEPTEMBER 30, 2015 Assets Labilities & Owners' Equity $ 9,200 800 Cash.. Accounts Receivable.. Supplies Machinery & Equipment. Buildings. 400 65,000 52,000 Liabilities Notes Payable Accounts Payable Salaries Payable Total liabilities Owners' equity Capital Stock Retained Earrings Total $ 29,000 14,000 3.000 $ 46,000 Land .. 68,000 $100,000 49,400 $195,400 Total. $195,400 "Computed a $196,400 (total) - $46,000 tot 50400 W 8140.400 - 100,000 capital sock - 10400 b. The balance sheet indicates that Crystal Auto Wash in a weak financial position. The only liquid assets cash and recervables-total only $10,000, but the company has 846.000 in lia- bilities due in the near future e. An income statement for Crystal Auto Wash would show the company revenues and expenses for the peod (month, quarter, or year) ending on the date of the balance sheet, September 30, 2015 This information would be helpful in determining whether the company is successful in selling its auto wash services at an amount that exceeds its cost of providing those services Something the company must do to remain in business and be successful The statement of cash flows for the same period as the income statement would show where the company cash came from and where it went in terms of its operating, testing, and financing activities This information would be particularly helpful in assessing the strength of the company ability to satisfy its obligations as they come due in light of the relatively walk balance sheet 10