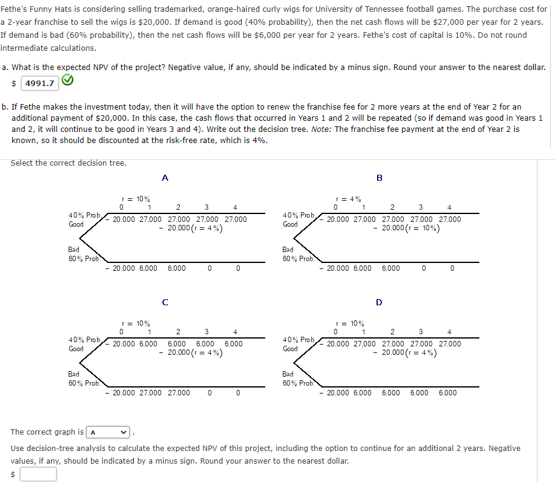

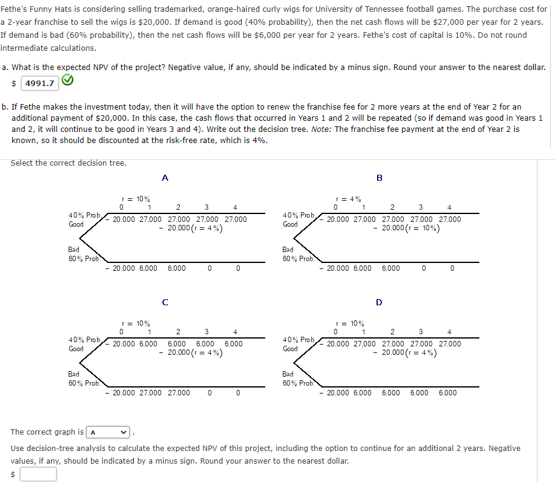

Fethe's Funny Hats is considering selling trademarked, orange-haired curly wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40\% probability), then the net cash flows will be $27,000 per year for 2 years. If demand is bad (60\% probability), then the net cash flows will be $6,000 per year for 2 years. Fethe's cost of capital is 10%. Do not round intermediate calculations. a. What is the expected NPV of the project? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest dollar. 5 (D) b. If Fethe makes the investment today, then it will have the option to renew the franchise fee for 2 more years at the end of Year 2 for an additional payment of $20,000. In this case, the cash flows that occurred in Years 1 and 2 will be repeated (so if demand was good in Years 1 and 2 , it will continue to be good in Years 3 and 4). Write out the decision tree. Note: The franchise fee payment at the end of Year 2 is known, so it should be discounted at the risk-free rate, which is 4%. Select the correct decision tree. C D The correct graph is Use decision-tree analysis to calculate the expected NPV of this project, including the option to continue for an additional 2 years. Negative values, if any, should be indicated by a minus sign. Round your answer to the nearest dollar. 5 Fethe's Funny Hats is considering selling trademarked, orange-haired curly wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40\% probability), then the net cash flows will be $27,000 per year for 2 years. If demand is bad (60\% probability), then the net cash flows will be $6,000 per year for 2 years. Fethe's cost of capital is 10%. Do not round intermediate calculations. a. What is the expected NPV of the project? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest dollar. 5 (D) b. If Fethe makes the investment today, then it will have the option to renew the franchise fee for 2 more years at the end of Year 2 for an additional payment of $20,000. In this case, the cash flows that occurred in Years 1 and 2 will be repeated (so if demand was good in Years 1 and 2 , it will continue to be good in Years 3 and 4). Write out the decision tree. Note: The franchise fee payment at the end of Year 2 is known, so it should be discounted at the risk-free rate, which is 4%. Select the correct decision tree. C D The correct graph is Use decision-tree analysis to calculate the expected NPV of this project, including the option to continue for an additional 2 years. Negative values, if any, should be indicated by a minus sign. Round your answer to the nearest dollar. 5