Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question # 5 A stock is selling for $ 1 0 0 . Each year it will either increase or decrease in value by 2

Question #

A stock is selling for $ Each year it will either increase or decrease in value by The continuously compounded riskless rate is such that A European put option on this stock with an exercise price of $ matures in two years years In the binomial pricing, one period corresponds to one year.

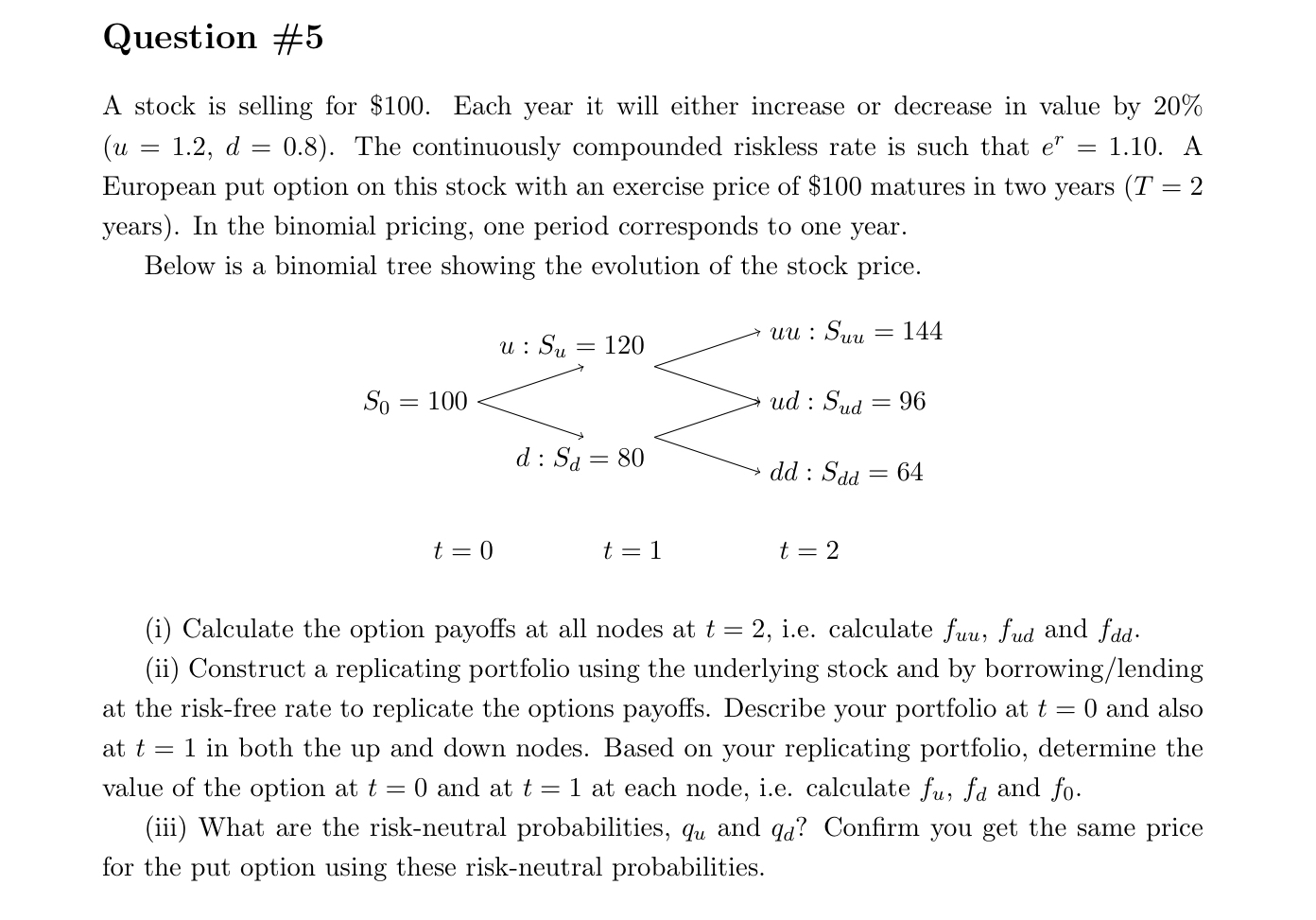

Below is a binomial tree showing the evolution of the stock price.

i Calculate the option payoffs at all nodes at ie calculate and

ii Construct a replicating portfolio using the underlying stock and by borrowinglending at the riskfree rate to replicate the options payoffs. Describe your portfolio at and also at in both the up and down nodes. Based on your replicating portfolio, determine the value of the option at and at at each node, ie calculate and

iii What are the riskneutral probabilities, and Confirm you get the same price for the put option using these riskneutral probabilities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started