ff

ff

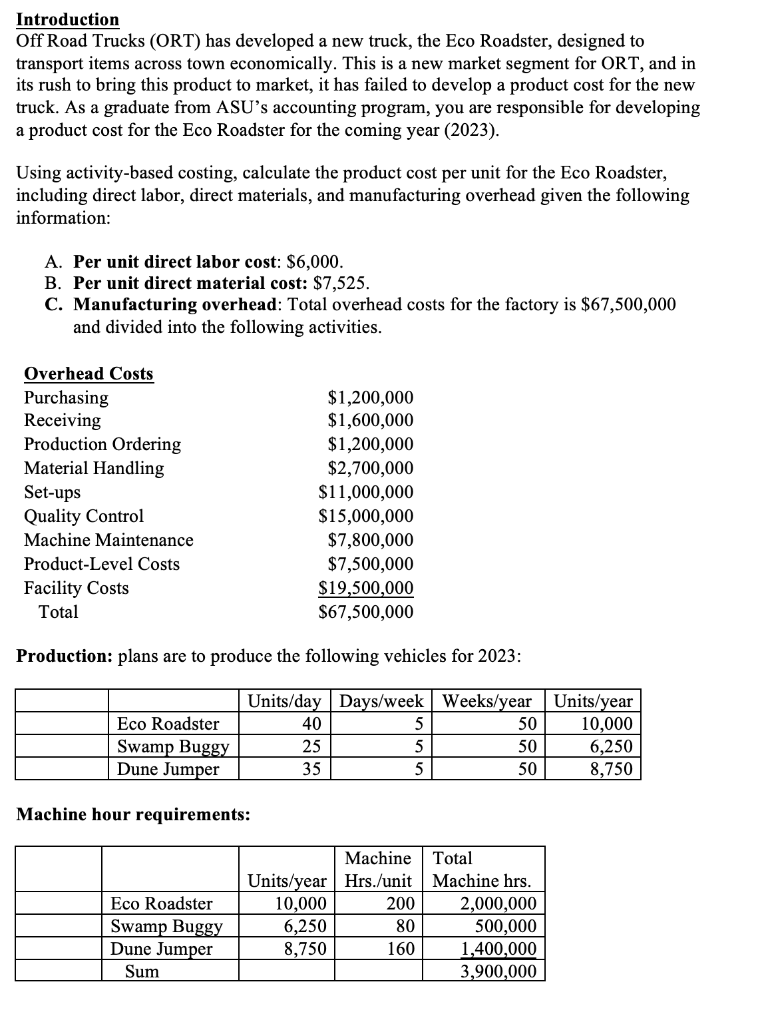

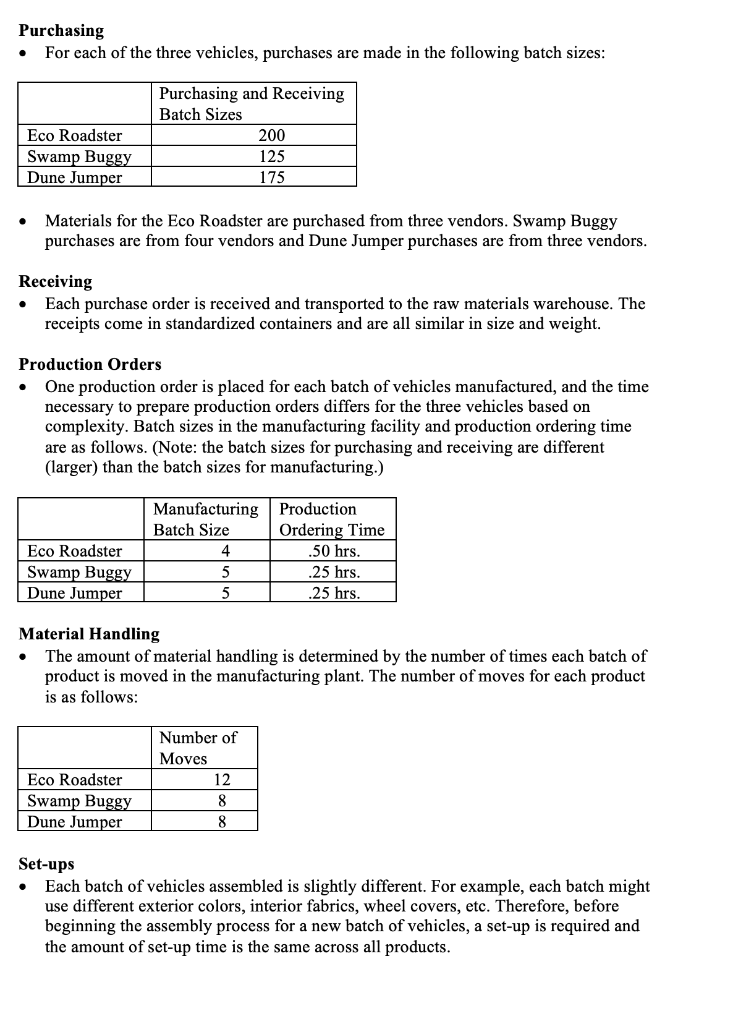

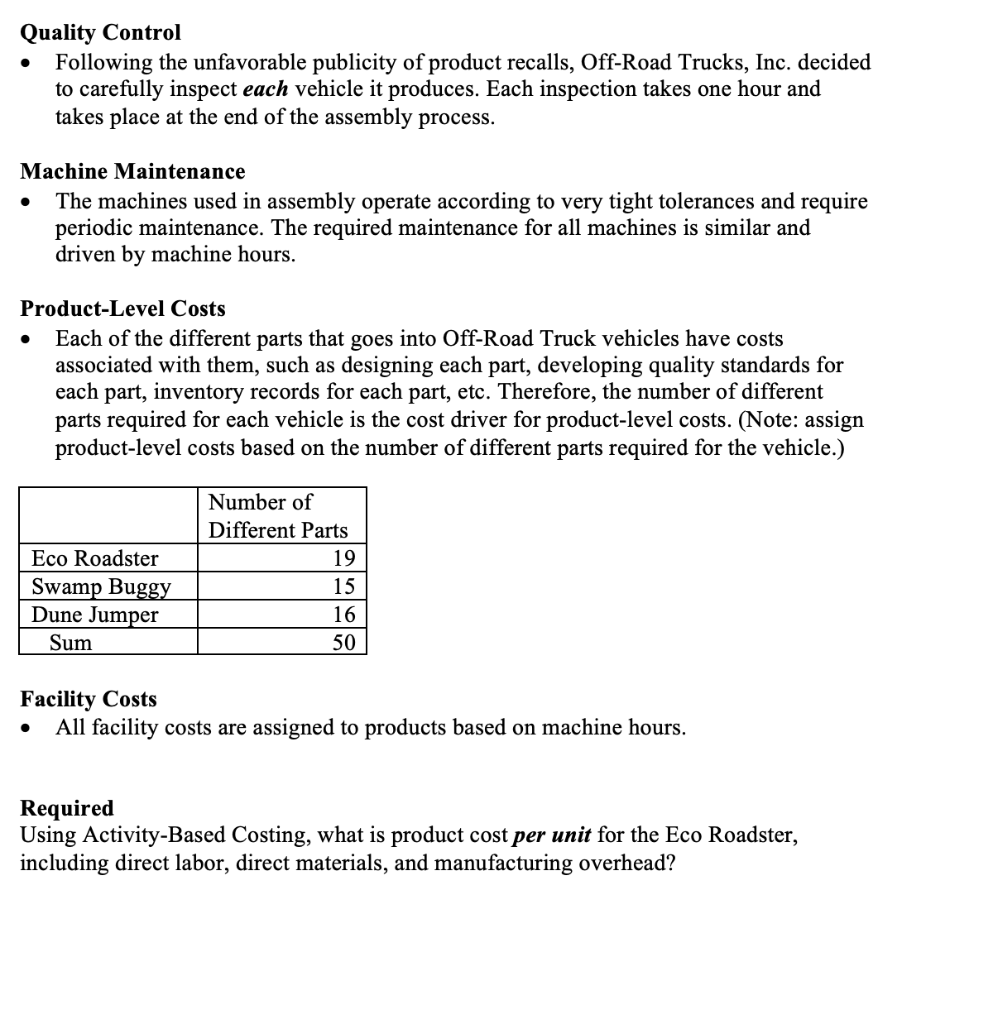

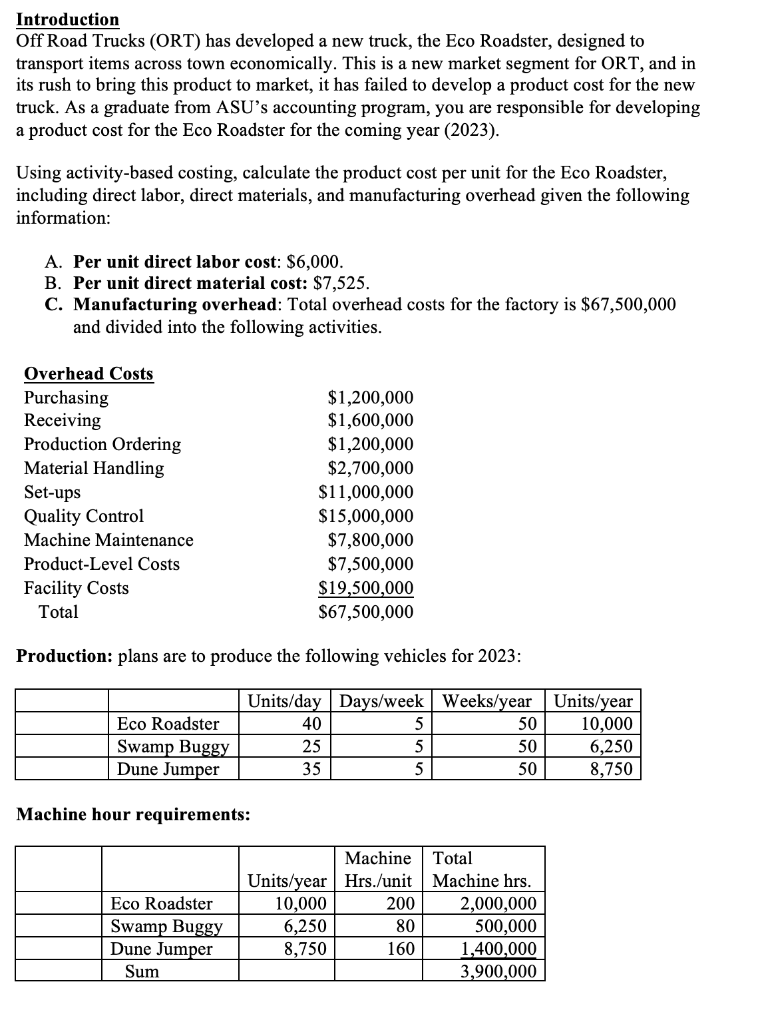

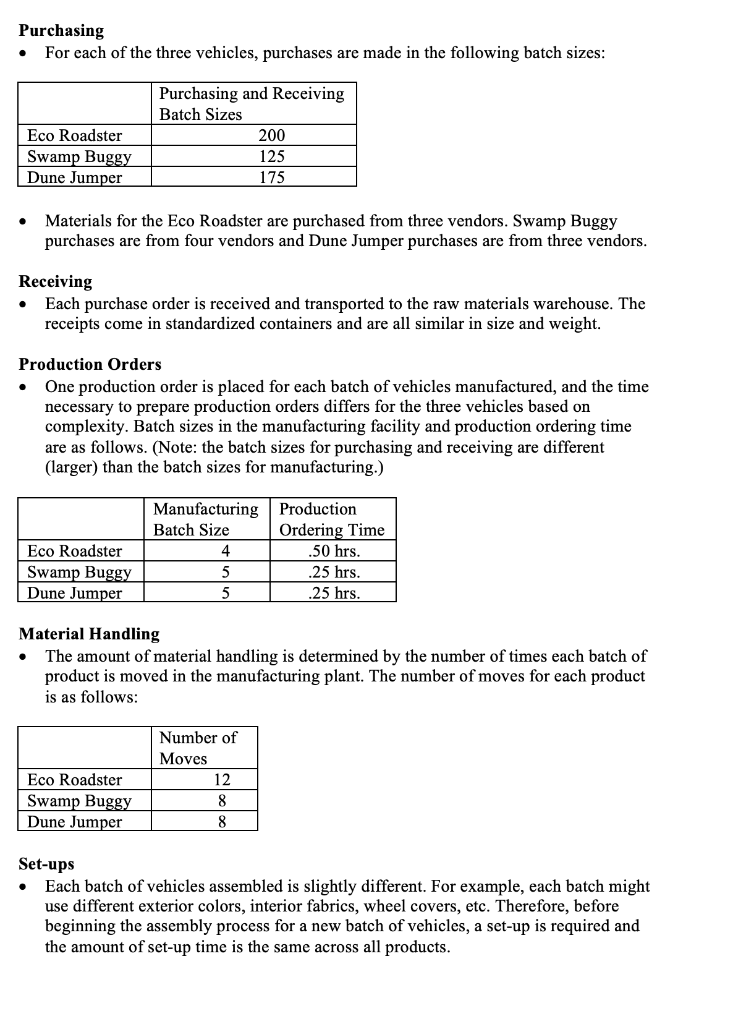

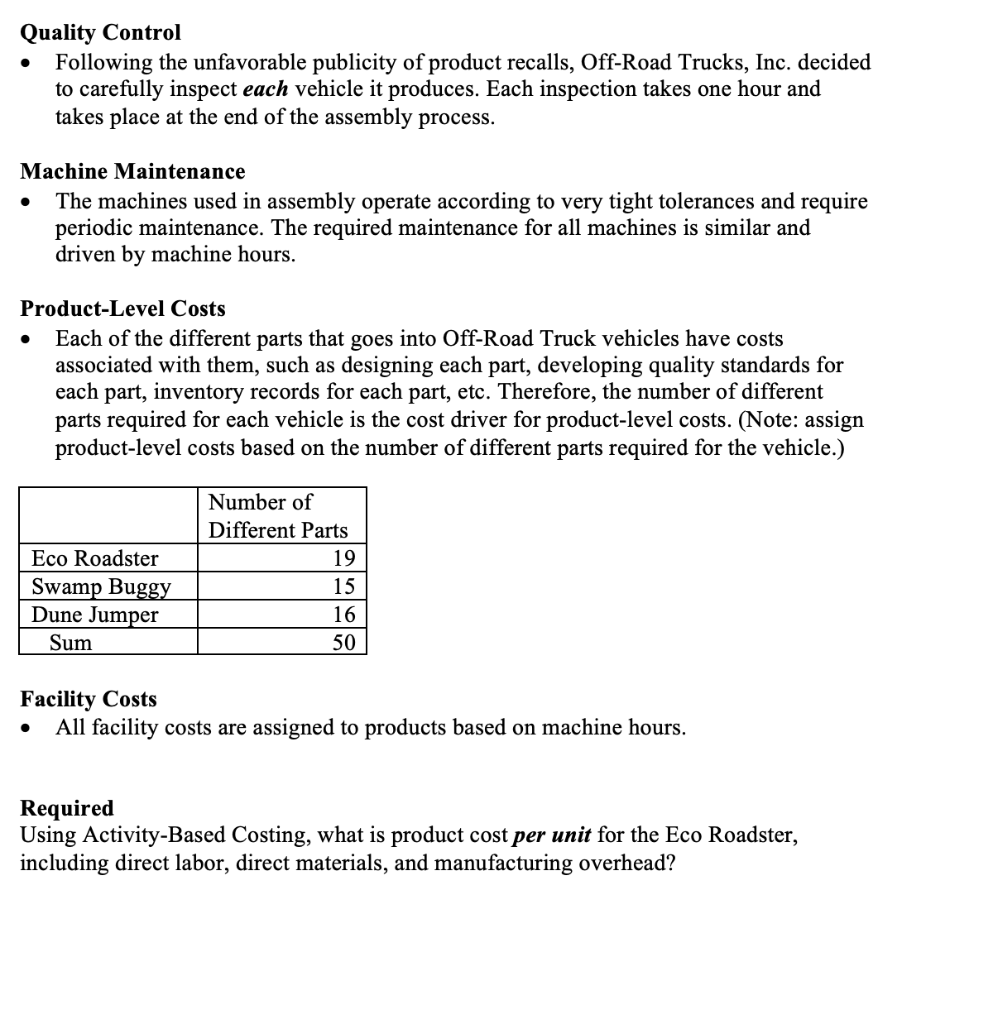

Introduction Off Road Trucks (ORT) has developed a new truck, the Eco Roadster, designed to transport items across town economically. This is a new market segment for ORT, and in its rush to bring this product to market, it has failed to develop a product cost for the new truck. As a graduate from ASU's accounting program, you are responsible for developing a product cost for the Eco Roadster for the coming year (2023). Using activity-based costing, calculate the product cost per unit for the Eco Roadster, including direct labor, direct materials, and manufacturing overhead given the following information: A. Per unit direct labor cost: $6,000. B. Per unit direct material cost: $7,525. C. Manufacturing overhead: Total overhead costs for the factory is $67,500,000 and divided into the following activities. Production: plans are to produce the following vehicles for 2023: Machine hour requirements: Purchasing - For each of the three vehicles, purchases are made in the following batch sizes: - Materials for the Eco Roadster are purchased from three vendors. Swamp Buggy purchases are from four vendors and Dune Jumper purchases are from three vendors. Receiving - Each purchase order is received and transported to the raw materials warehouse. The receipts come in standardized containers and are all similar in size and weight. Production Orders - One production order is placed for each batch of vehicles manufactured, and the time necessary to prepare production orders differs for the three vehicles based on complexity. Batch sizes in the manufacturing facility and production ordering time are as follows. (Note: the batch sizes for purchasing and receiving are different (larger) than the batch sizes for manufacturing.) Material Handling - The amount of material handling is determined by the number of times each batch of product is moved in the manufacturing plant. The number of moves for each product is as follows: Set-ups - Each batch of vehicles assembled is slightly different. For example, each batch might use different exterior colors, interior fabrics, wheel covers, etc. Therefore, before beginning the assembly process for a new batch of vehicles, a set-up is required and the amount of set-up time is the same across all products. Quality Control - Following the unfavorable publicity of product recalls, Off-Road Trucks, Inc. decided to carefully inspect each vehicle it produces. Each inspection takes one hour and takes place at the end of the assembly process. Machine Maintenance - The machines used in assembly operate according to very tight tolerances and require periodic maintenance. The required maintenance for all machines is similar and driven by machine hours. Product-Level Costs - Each of the different parts that goes into Off-Road Truck vehicles have costs associated with them, such as designing each part, developing quality standards for each part, inventory records for each part, etc. Therefore, the number of different parts required for each vehicle is the cost driver for product-level costs. (Note: assign product-level costs based on the number of different parts required for the vehicle.) Facility Costs - All facility costs are assigned to products based on machine hours. Required Using Activity-Based Costing, what is product cost per unit for the Eco Roadster, including direct labor, direct materials, and manufacturing overhead

ff

ff