Answered step by step

Verified Expert Solution

Question

1 Approved Answer

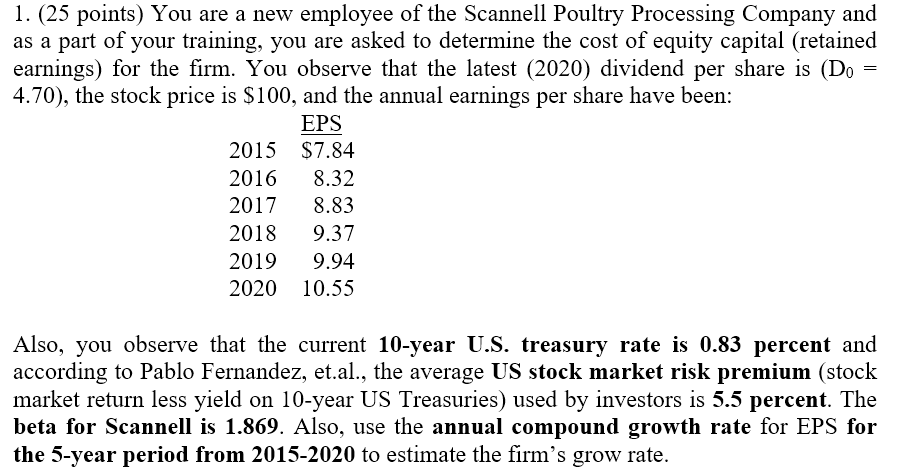

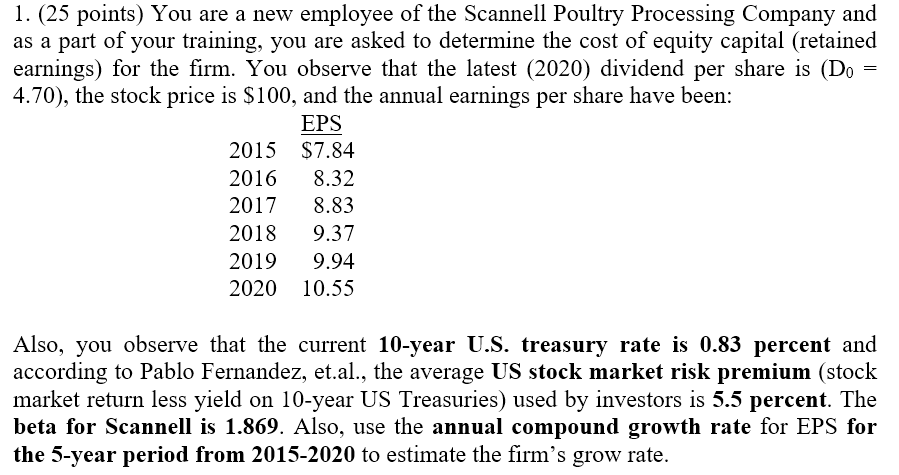

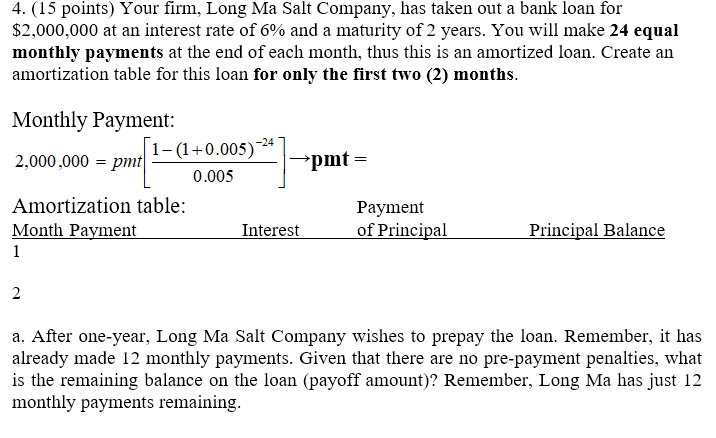

l. (25 points) You are a new employee of the Scannell Poultry Processing Company and as a part of your training, you are asked

l. (25 points) You are a new employee of the Scannell Poultry Processing Company and as a part of your training, you are asked to determine the cost of equity capital (retained earnings) for the firm. You observe that the latest (2020) dividend per share is (Do = 4.70), the stock price is Sl 00, and the annual earnings per share have been: 2015 2016 2017 2018 2019 2020 EPS $7.84 8.32 8.83 9.37 9.94 10.55 Also, you observe that the current 10-year U.S. treasury rate is 0.83 percent and according to Pablo Fernandez, et.al., the average US stock market risk premium (stock market return less yield on 10-year US Treasuries) used by investors is 5.5 percent. The beta for Scannell is 1.869. Also, use the annual compound growth rate for EPS for the 5-year period from 2015-2020 to estimate the firm's grow rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started