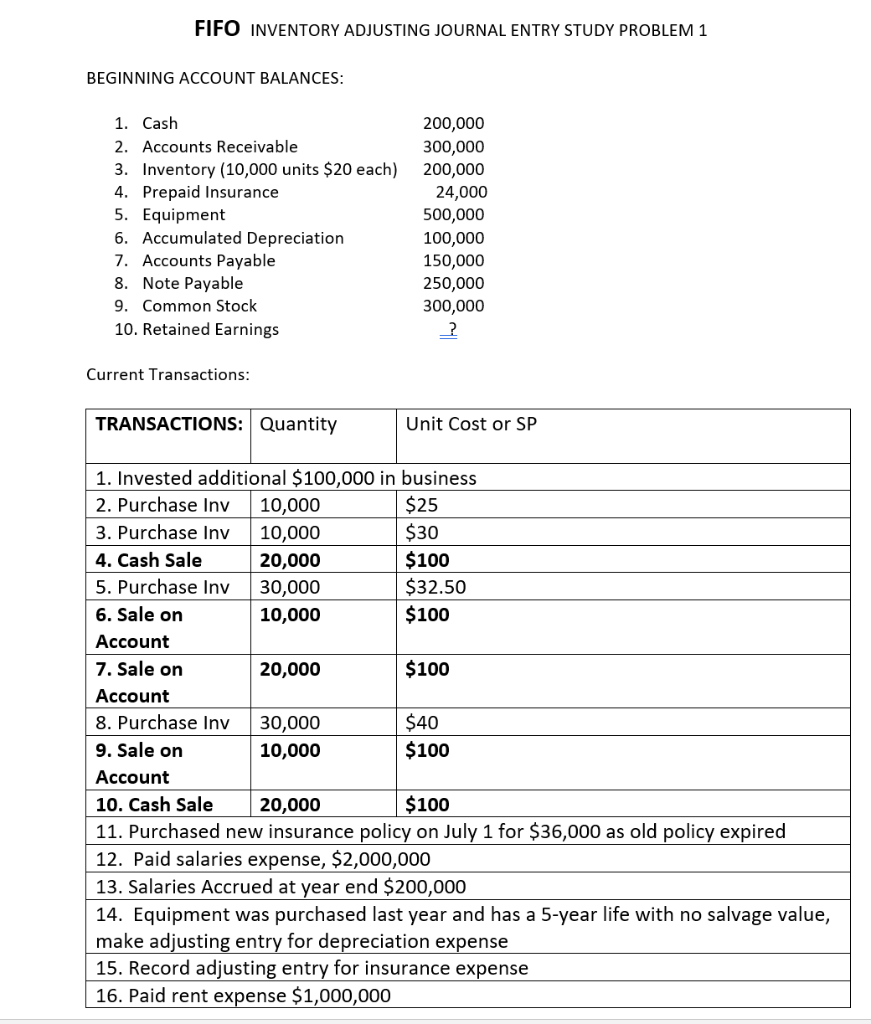

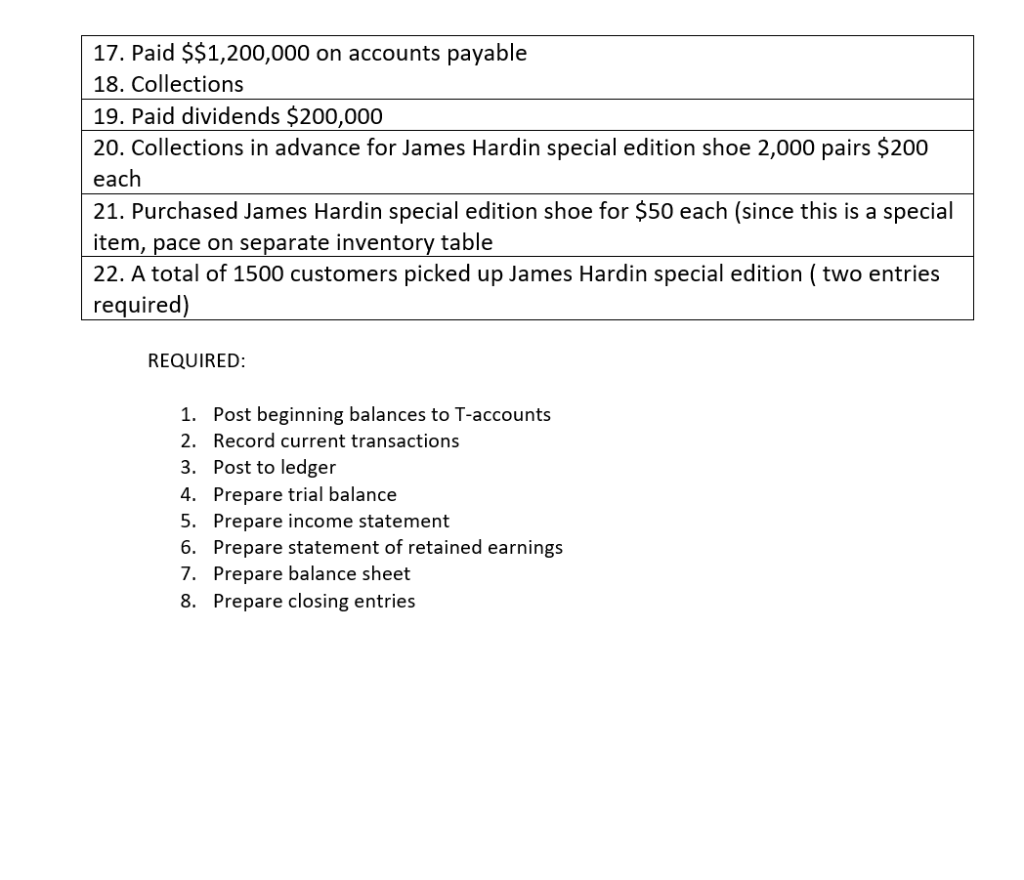

FIFO INVENTORY ADJUSTING JOURNAL ENTRY STUDY PROBLEM 1 BEGINNING ACCOUNT BALANCES 1. Cash 2. Accounts Receivable 3. Inventory (10,000 units $20 each) 4. Prepaid Insurance 5. Equipment 6. Accumulated Depreciation 7. Accounts Payable 8. Note Payable 9. Common Stock 10. Retained Earnings 200,000 300,000 200,000 24,000 500,000 100,000 150,000 250,000 300,000 Current Transactions Unit Cost or SP TRANSACTIONS: Quantity 1. Invested additional $100,000 in business 2. Purchase Inv10,000 3. Purchase Inv 10,000 4. Cash Sale 5. Purchase Inv 30,000 6. Sale on Account 7. Sale on Account 8. Purchase Inv30,000 9. Sale on Account 10. Cash Sale 20,000 11. Purchased new insurance policy on July 1 for $36,000 as old policy expired 12. Paid salaries expense, $2,000,000 13. Salaries Accrued at year end $200,000 14. Equipment was purchased last year and has a 5-year life with no salvage value, make adiusting entry for depreciation expense 15. Record adjusting entry for insurance expense 16. Paid rent expense $1,000,000 S25 $100 $32.50 $100 20,000 10,000 20,000 $100 S40 $100 10,000 $100 17. Paid $$1,200,000 on accounts payable 18. Collections 19. Paid dividends $200,000 20. Collections in advance for James Hardin special edition shoe 2,000 pairs $200 each 21. Purchased James Hardin special edition shoe for $50 each (since this is a special item, pace on separate inventory table 22. A total of 1500 customers picked up James Hardin special edition (two entries required REQUIRED 1. Post beginning balances to T-accounts 2. Record current transactions 3. Post to ledger 4. Prepare trial balance 5. Prepare income statement 6. Prepare statement of retained earnings 7. Prepare balance sheet 8. Prepare closing entries FIFO INVENTORY ADJUSTING JOURNAL ENTRY STUDY PROBLEM 1 BEGINNING ACCOUNT BALANCES 1. Cash 2. Accounts Receivable 3. Inventory (10,000 units $20 each) 4. Prepaid Insurance 5. Equipment 6. Accumulated Depreciation 7. Accounts Payable 8. Note Payable 9. Common Stock 10. Retained Earnings 200,000 300,000 200,000 24,000 500,000 100,000 150,000 250,000 300,000 Current Transactions Unit Cost or SP TRANSACTIONS: Quantity 1. Invested additional $100,000 in business 2. Purchase Inv10,000 3. Purchase Inv 10,000 4. Cash Sale 5. Purchase Inv 30,000 6. Sale on Account 7. Sale on Account 8. Purchase Inv30,000 9. Sale on Account 10. Cash Sale 20,000 11. Purchased new insurance policy on July 1 for $36,000 as old policy expired 12. Paid salaries expense, $2,000,000 13. Salaries Accrued at year end $200,000 14. Equipment was purchased last year and has a 5-year life with no salvage value, make adiusting entry for depreciation expense 15. Record adjusting entry for insurance expense 16. Paid rent expense $1,000,000 S25 $100 $32.50 $100 20,000 10,000 20,000 $100 S40 $100 10,000 $100 17. Paid $$1,200,000 on accounts payable 18. Collections 19. Paid dividends $200,000 20. Collections in advance for James Hardin special edition shoe 2,000 pairs $200 each 21. Purchased James Hardin special edition shoe for $50 each (since this is a special item, pace on separate inventory table 22. A total of 1500 customers picked up James Hardin special edition (two entries required REQUIRED 1. Post beginning balances to T-accounts 2. Record current transactions 3. Post to ledger 4. Prepare trial balance 5. Prepare income statement 6. Prepare statement of retained earnings 7. Prepare balance sheet 8. Prepare closing entries