Answered step by step

Verified Expert Solution

Question

1 Approved Answer

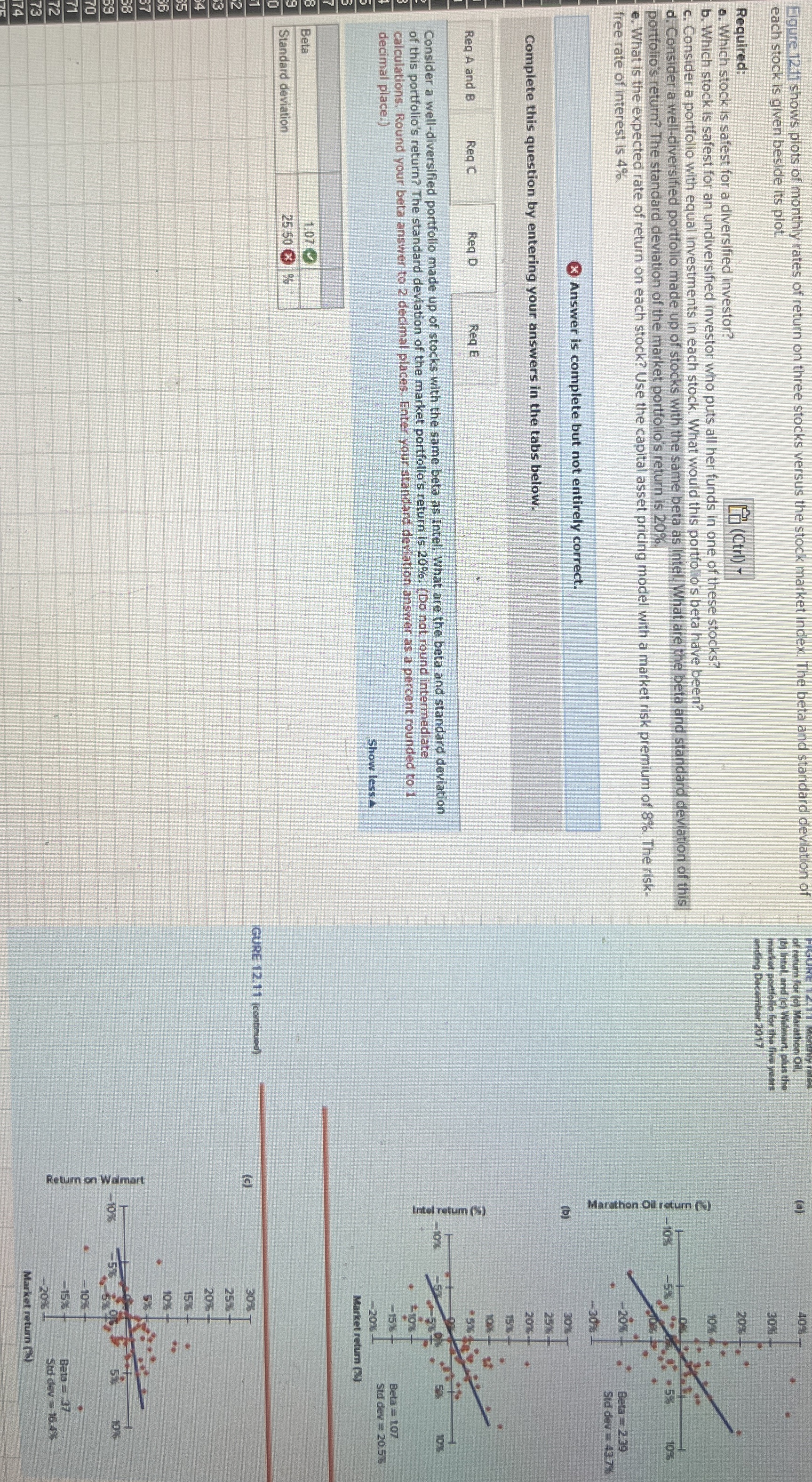

Figure 1 2 . 1 1 shows plots of monthly rates of return on three stocks versus the stock market index. The beta and standard

Figure shows plots of monthly rates of return on three stocks versus the stock market index. The beta and standard deviation of each stock is glven beside its plot Required: Consider a portfolio with equal investments in each stock. What would this portfollo's beta have been? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A and Req Req Req E Consider a welldiversified portfollo made up of stocks with the same beta as Intel. What are the beta and standard deviation of this portfolio's return? The standard deviation of the market portfolio's return is Do not round intermediate calculations. Round your beta answer to decmal places. Enter your standard deviston answer as a percent rounded to i decimal place. Show less A tableBetaStandard deviation,

Figure shows plots of monthly rates of return on three stocks versus the stock market index. The beta and standard deviation of each stock is glven beside its plot

Required:

Consider a portfolio with equal investments in each stock. What would this portfollo's beta have been?

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Req A and

Req

Req

Req E

Consider a welldiversified portfollo made up of stocks with the same beta as Intel. What are the beta and standard deviation of this portfolio's return? The standard deviation of the market portfolio's return is Do not round intermediate calculations. Round your beta answer to decmal places. Enter your standard deviston answer as a percent rounded to i decimal place.

Show less A

tableBetaStandard deviation,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started