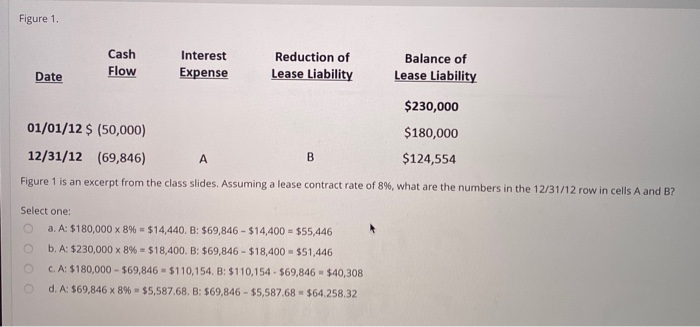

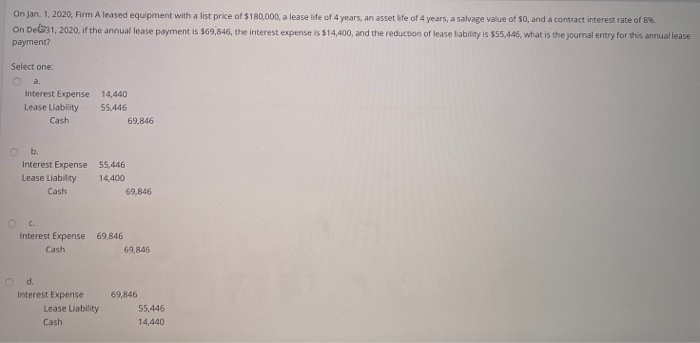

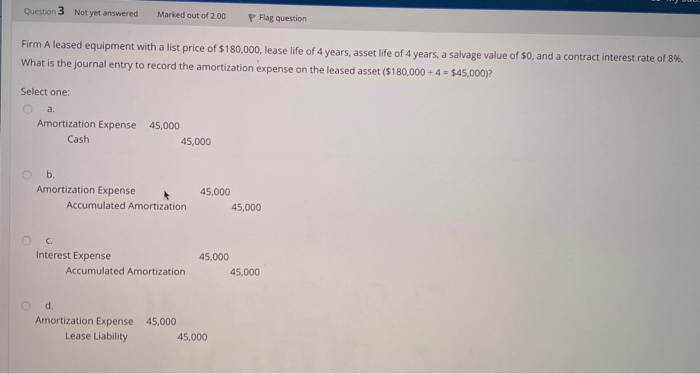

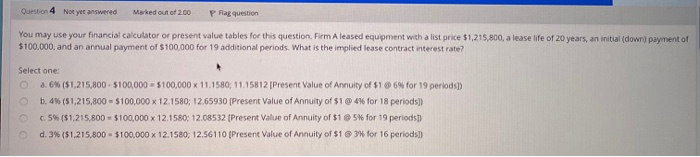

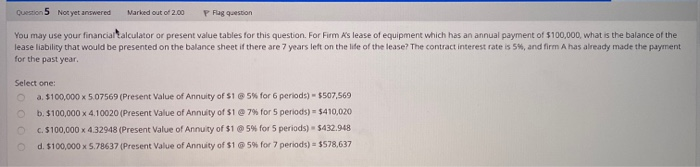

Figure 1. Cash Flow Interest Expense Reduction of Lease Liability Balance of Lease Liability Date $230,000 01/01/12 $ (50,000) $180,000 12/31/12 (69,846) $124,554 Figure 1 is an excerpt from the class slides. Assuming a lease contract rate of 8%, what are the numbers in the 12/31/12 row in cells A and B? Select one: a. A: $180,000 x 8% = $14,440. B: $69,846 - $14,400 = $55,446 b. A: $230,000 x 8% = $18,400. B: $69,846 - 518,400 - $51,446 CA: $180,000 - $69,846 - $110,154. B: $110,154 - 569,846 - 540,308 d. A $69,846 x 8% - $5,587.68.B: $69,846 - $5,587.68 $64.258,32 On Jan. 1. 2020, Firm Aleased equipment with a list price of $180,000, a lease life of 4 years, an asset ife of 4 years, a salvage value of 50, and a contract interest rate of B On De 31, 2020, if the annual lease payment is 569.846, the interest expense is $14,400, and the reduction of lease liability is 555.446, what is the journal entry for this annual lease payment? Select one Interest Expense Lease Liability Cash 14,440 55.446 69 846 Interest Expense Lease Liability Cash 55,446 14.400 69.846 Interest Expense Cash 69,846 69,845 Interest Expense Lease Liability Cash 69,846 55.446 14.440 Question 3 Not yet answered Marked out of 200 P Flag question Firm A leased equipment with a list price of $180,000, lease life of 4 years, asset life of 4 years, a salvage value of 50, and a contract interest rate of 89 What is the journal entry to record the amortization expense on the leased asset ($180,000 + 4 = 545,000)? Select one: Amortization Expense Cash 45,000 45,000 b. Amortization Expense Accumulated Amortization 45.000 45,000 Interest Expense Accumulated Amortization 45,000 45,000 O d. Amortization Expense Lease Liability 45,000 45,000 Question 4 Not yet answered Marked out of 200 Prag question You may use your financial calculator or present value tables for this question. Firm Aleased equipment with a list price $1,215,800, a lease life of 20 years, an initial (down payment of $100.000, and an annual payment of $100,000 for 19 additional periods. What is the implied lease contract interest rate? Select one: 2.6% ($1,215,800 $100,000 - $100,000 x 11.1580, 11.15812 [Present Value of Annuity of $1 6% for 19 periods] b. 4% (51.215,800 = $100,000 x 12.1580; 12.65930 [Present Value of Annuity of $1 4% for 18 periods]) C5% ($1,215,800 - $100,000 X 12.1580; 12.08532 [Present Value of Annuity of $1 5% for 19 periods]) 0.3% ($1,215,800 - $100,000 X 12.1580, 12.56110 [Present Value of Annuity of 51 34 for 16 periods) Question 5 Not yet answered Marked out of 2.00 P Flag question You may use your financial alculator or present value tables for this question. For Firm As lease of equipment which has an annual payment of $100,000, what is the balance of the lease liability that would be presented on the balance sheet if there are 7 years left on the life of the lease? The contract interest rate is 5%, and firm A has already made the payment for the past year. Select one: a $100,000 x 5.07569 (Present Value of Annuity of S15% for 6 periods) - $507,569 b. $100,000 x 4.10020 (Present Value of Annuity of S1 @ 7% for 5 periods) = $410,020 c.$100,000 x 4.32948 (Present Value of Annuity of $1 5% for 5 periods) - 5432.948 d. $100,000 x 5.78637 (Present Value of Annuity of $1@5% for 7 periods) - $578,637