Answered step by step

Verified Expert Solution

Question

1 Approved Answer

File Home Insert Draw Formulas Data Review View Help R3 begin{tabular}{|c|c|} hline multicolumn{2}{|c|}{ Additional Paid-in Capital } hline Debit & Credit hline &

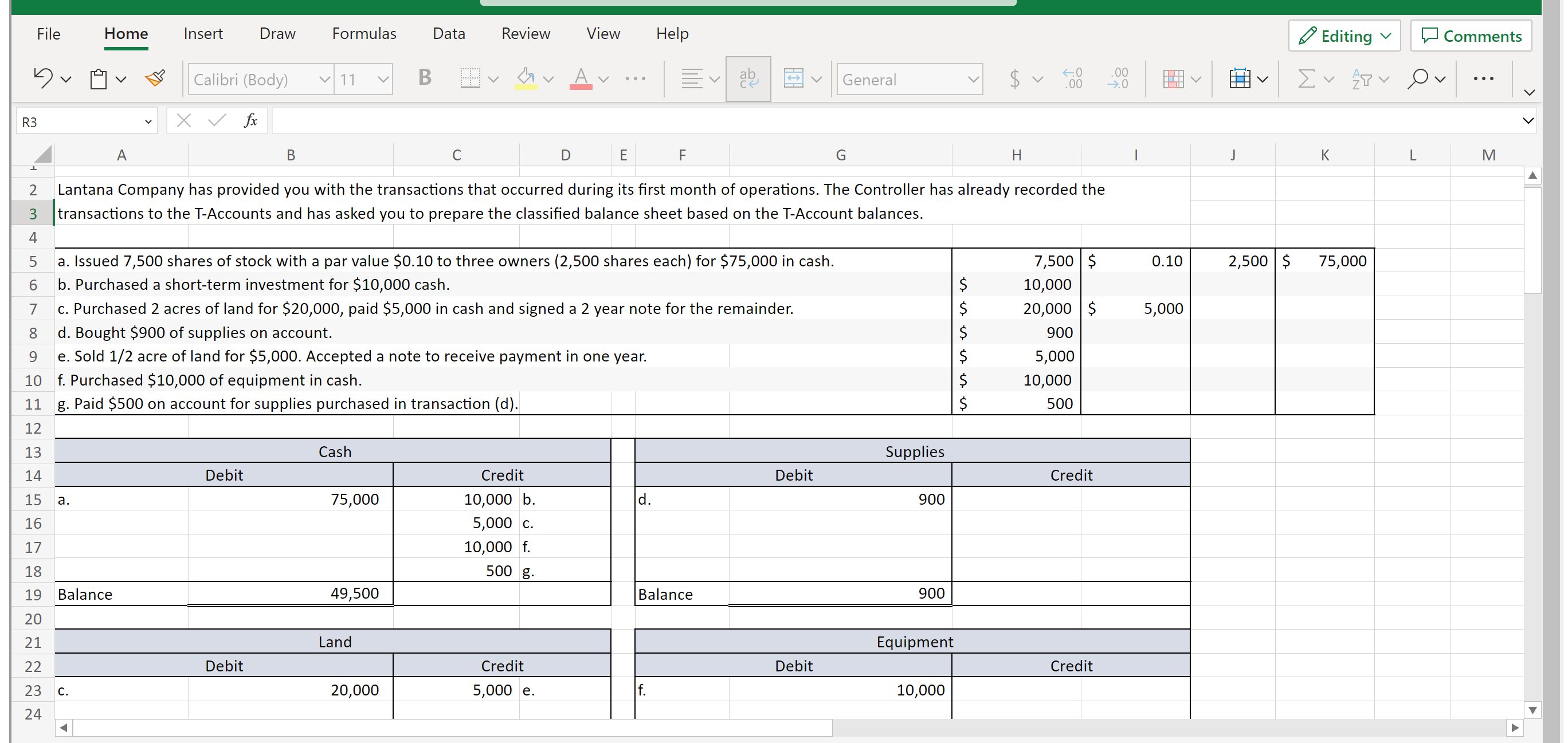

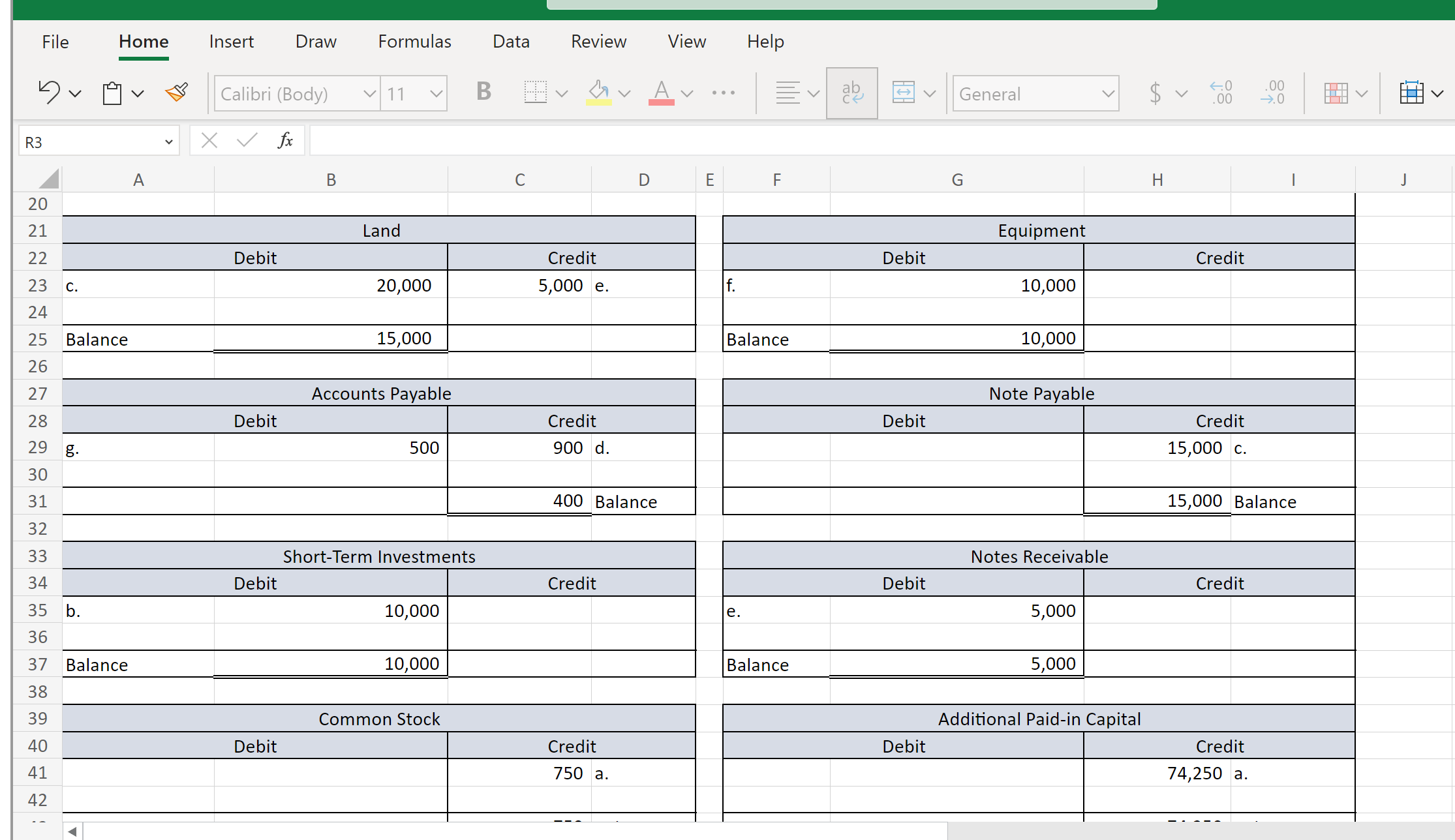

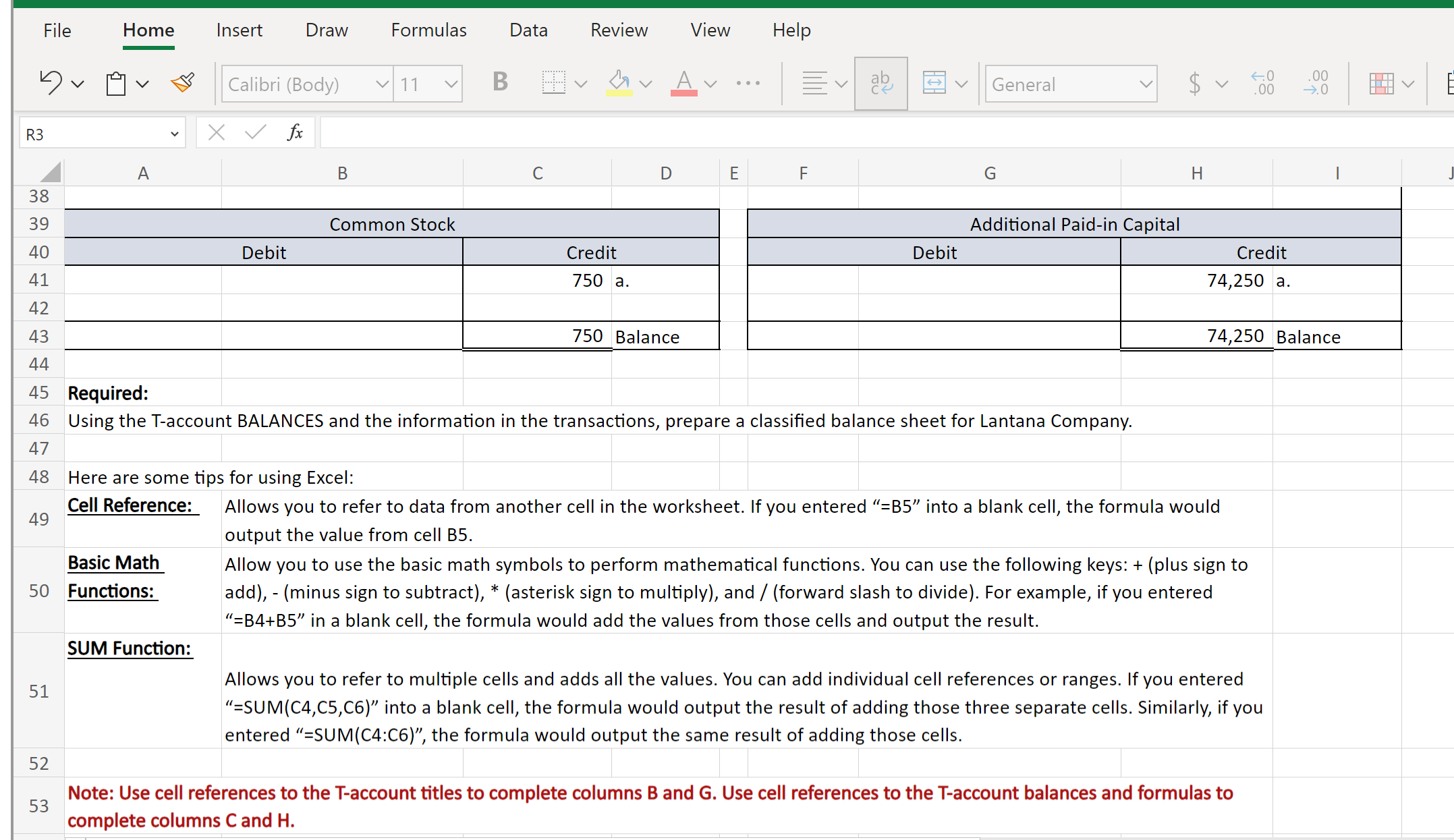

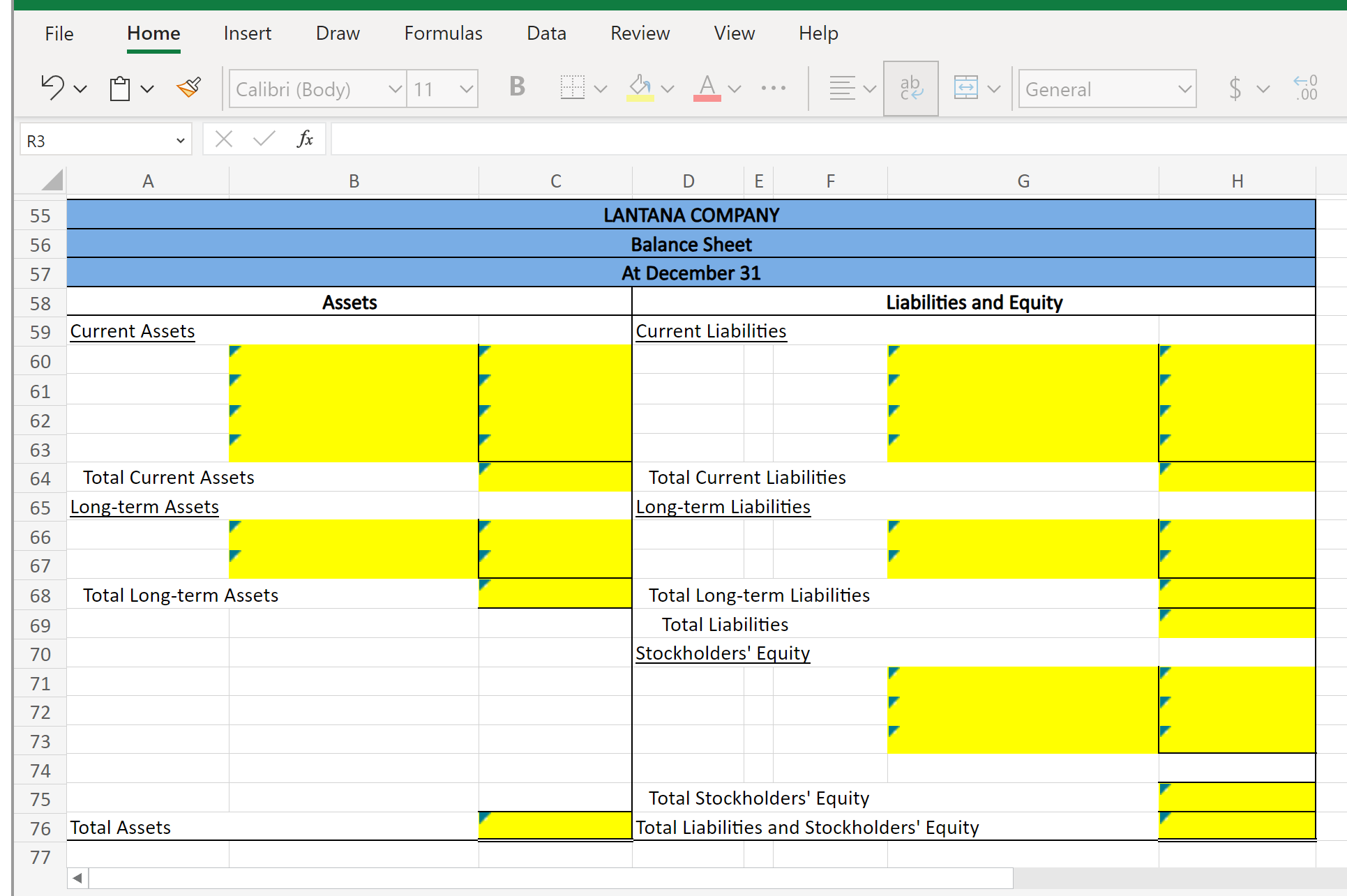

File Home Insert Draw Formulas Data Review View Help R3 \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Additional Paid-in Capital } \\ \hline Debit & Credit \\ \hline & 74,250 a. \\ \hline & 74,250 Balance \\ \hline \end{tabular} Required: Using the T-account BALANCES and the information in the transactions, prepare a classified balance sheet for Lantana Company. Here are some tips for using Excel: Cell Reference: Allows you to refer to data from another cell in the worksheet. If you entered "=B5" into a blank cell, the formula would output the value from cell B5. Basic Math Allow you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to 50 Functions: add), - (minus sign to subtract), * (asterisk sign to multiply), and / (forward slash to divide). For example, if you entered "=B4+B5" in a blank cell, the formula would add the values from those cells and output the result. SUM Function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges. If you entered "=SUM(C4,C5,C6)" into a blank cell, the formula would output the result of adding those three separate cells. Similarly, if you entered "=SUM(C4:C6)", the formula would output the same result of adding those cells. 52 Note: Use cell references to the T-account titles to complete columns B and G. Use cell references to the T-account balances and formulas to complete columns C and H. File Home Insert Draw Formulas Data Review View Help R3 A B C G H I Lantana Company has provided you with the transactions that occurred during its first month of operations. The Controller has already recorded the transactions to the T-Accounts and has asked you to prepare the classified balance sheet based on the T-Account balances. a. Issued 7,500 shares of stock with a par value $0.10 to three owners (2,500 shares each) for $75,000 in cash. b. Purchased a short-term investment for $10,000 cash. c. Purchased 2 acres of land for $20,000, paid $5,000 in cash and signed a 2 year note for the remainder. d. Bought $900 of supplies on account. e. Sold 1/2 acre of land for $5,000. Accepted a note to receive payment in one year. f. Purchased $10,000 of equipment in cash. g. Paid $500 on account for supplies purchased in transaction (d). \begin{tabular}{|rr|lr|r|ll|} & 7,500 & $ & 0.10 & 2,500 & $ & 75,000 \\ $ & 10,000 & & & & & \\ $ & 20,000 & $ & 5,000 & & & \\ $ & 900 & & & & \\ $ & 5,000 & & & & \\ $ & 10,000 & & & & \\ $ & 500 & & & & \\ \hline \end{tabular} 12 \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Cash } \\ \hline & & Credit & \\ \hline a. & 75,000 & 10,000 & b. \\ \hline & & 5,000 & c. \\ \hline & & 10,000 & f. \\ \hline & & 500 & g. \\ \hline Balance & 49,500 & & \\ \hline \end{tabular} 24 c. Debit Land c. \begin{tabular}{|c|c|} \hline 20,000 & Credit \\ \hline & 5,000 e. \end{tabular} \begin{tabular}{|c|c|} \hline 20,000 & 5,000 e. \\ \hline \end{tabular} 1

File Home Insert Draw Formulas Data Review View Help R3 \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Additional Paid-in Capital } \\ \hline Debit & Credit \\ \hline & 74,250 a. \\ \hline & 74,250 Balance \\ \hline \end{tabular} Required: Using the T-account BALANCES and the information in the transactions, prepare a classified balance sheet for Lantana Company. Here are some tips for using Excel: Cell Reference: Allows you to refer to data from another cell in the worksheet. If you entered "=B5" into a blank cell, the formula would output the value from cell B5. Basic Math Allow you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to 50 Functions: add), - (minus sign to subtract), * (asterisk sign to multiply), and / (forward slash to divide). For example, if you entered "=B4+B5" in a blank cell, the formula would add the values from those cells and output the result. SUM Function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges. If you entered "=SUM(C4,C5,C6)" into a blank cell, the formula would output the result of adding those three separate cells. Similarly, if you entered "=SUM(C4:C6)", the formula would output the same result of adding those cells. 52 Note: Use cell references to the T-account titles to complete columns B and G. Use cell references to the T-account balances and formulas to complete columns C and H. File Home Insert Draw Formulas Data Review View Help R3 A B C G H I Lantana Company has provided you with the transactions that occurred during its first month of operations. The Controller has already recorded the transactions to the T-Accounts and has asked you to prepare the classified balance sheet based on the T-Account balances. a. Issued 7,500 shares of stock with a par value $0.10 to three owners (2,500 shares each) for $75,000 in cash. b. Purchased a short-term investment for $10,000 cash. c. Purchased 2 acres of land for $20,000, paid $5,000 in cash and signed a 2 year note for the remainder. d. Bought $900 of supplies on account. e. Sold 1/2 acre of land for $5,000. Accepted a note to receive payment in one year. f. Purchased $10,000 of equipment in cash. g. Paid $500 on account for supplies purchased in transaction (d). \begin{tabular}{|rr|lr|r|ll|} & 7,500 & $ & 0.10 & 2,500 & $ & 75,000 \\ $ & 10,000 & & & & & \\ $ & 20,000 & $ & 5,000 & & & \\ $ & 900 & & & & \\ $ & 5,000 & & & & \\ $ & 10,000 & & & & \\ $ & 500 & & & & \\ \hline \end{tabular} 12 \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Cash } \\ \hline & & Credit & \\ \hline a. & 75,000 & 10,000 & b. \\ \hline & & 5,000 & c. \\ \hline & & 10,000 & f. \\ \hline & & 500 & g. \\ \hline Balance & 49,500 & & \\ \hline \end{tabular} 24 c. Debit Land c. \begin{tabular}{|c|c|} \hline 20,000 & Credit \\ \hline & 5,000 e. \end{tabular} \begin{tabular}{|c|c|} \hline 20,000 & 5,000 e. \\ \hline \end{tabular} 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started