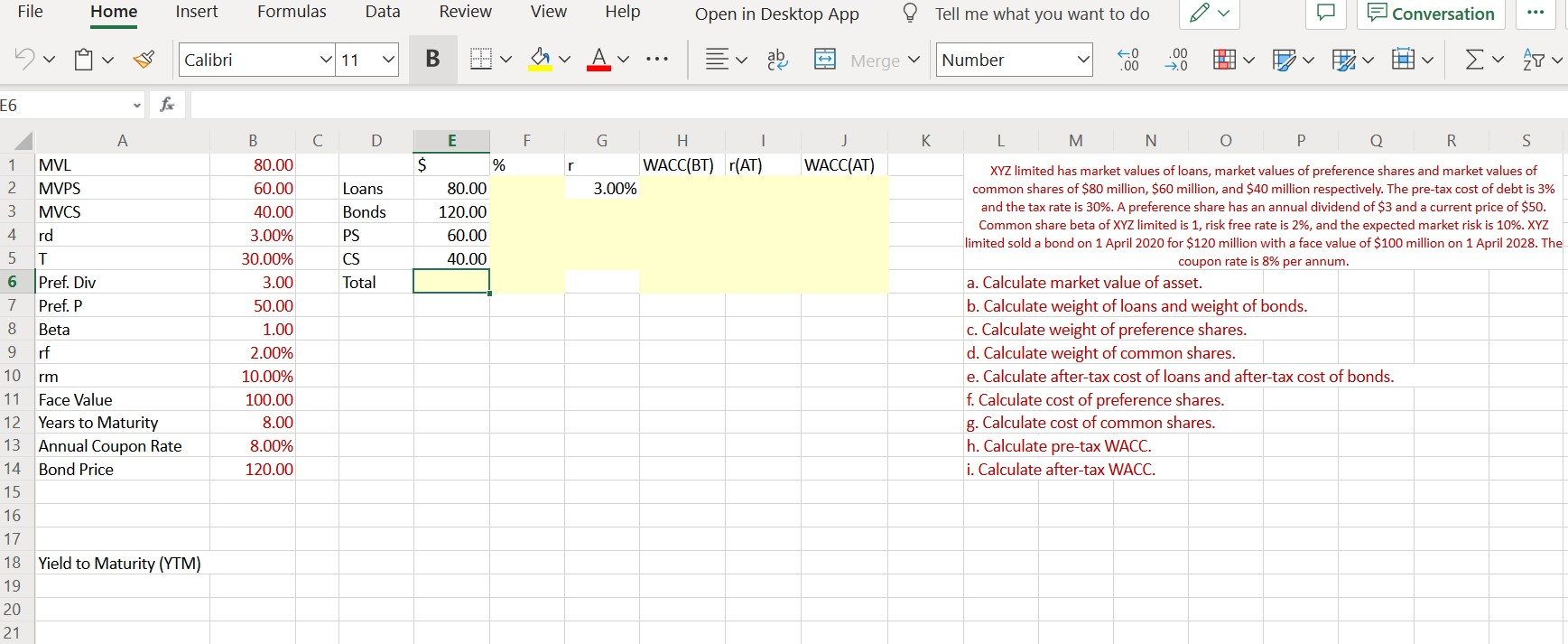

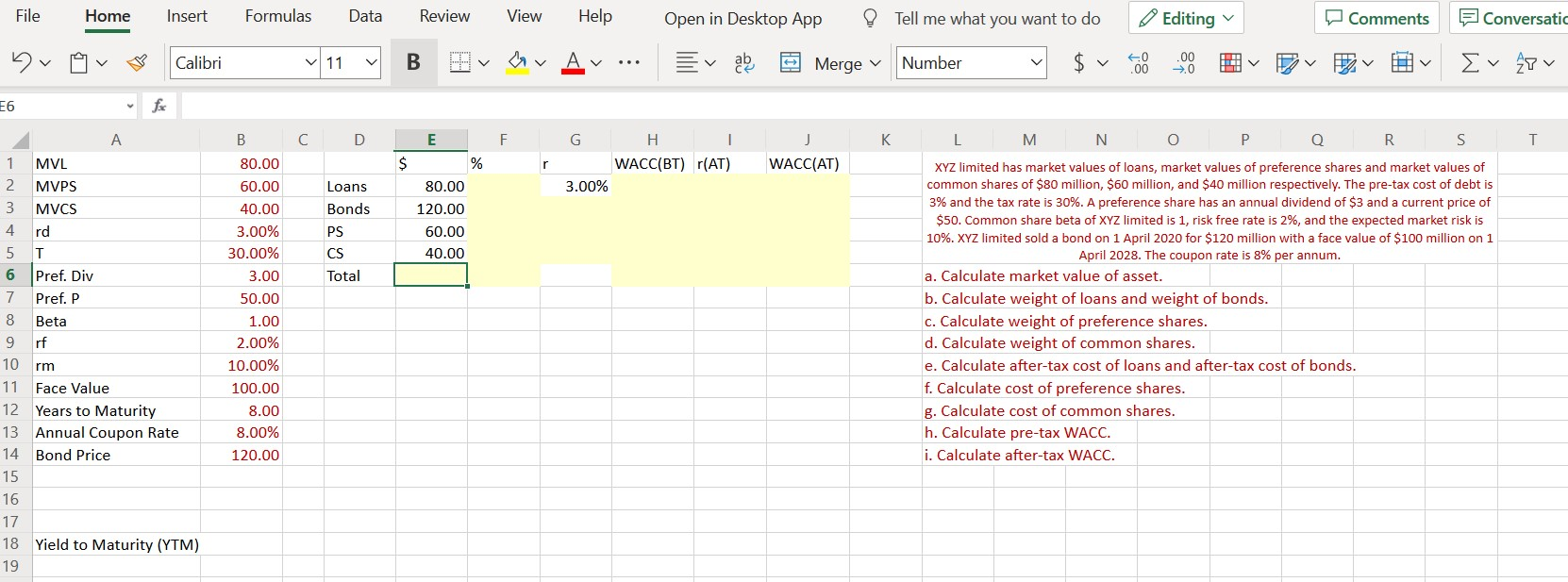

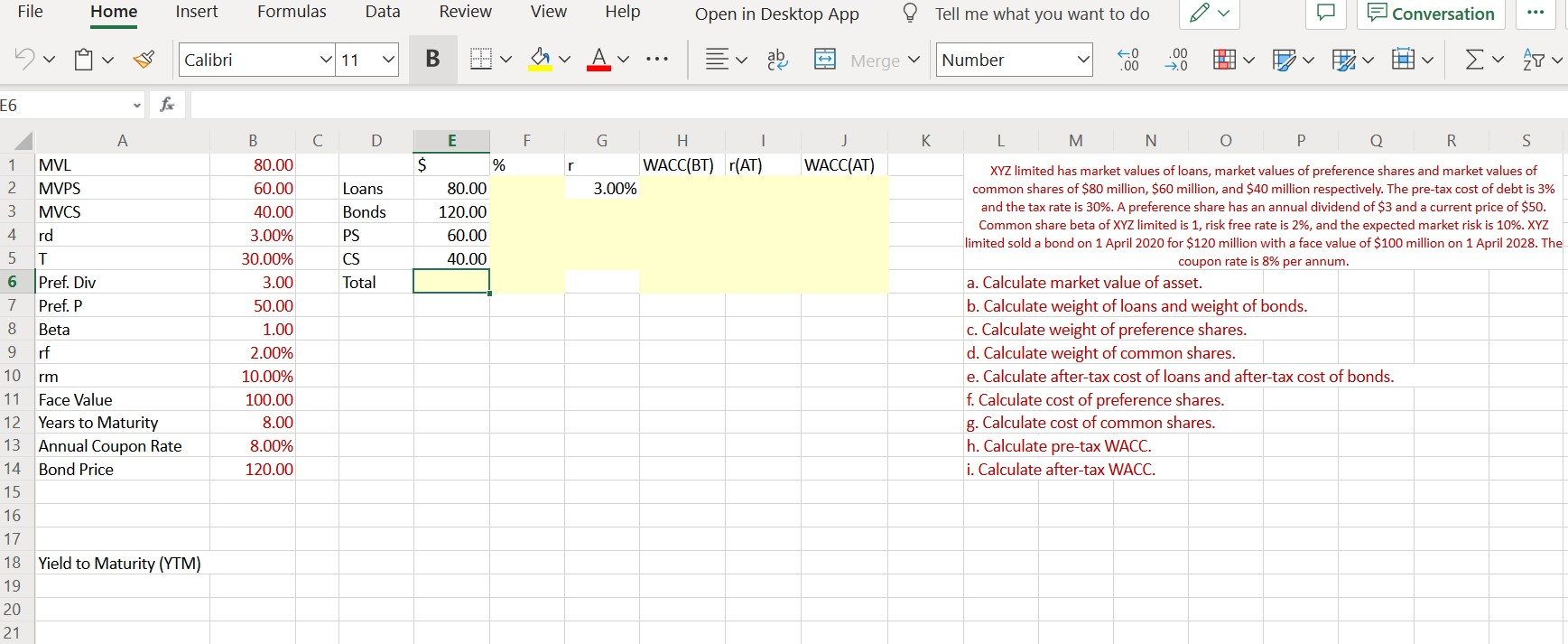

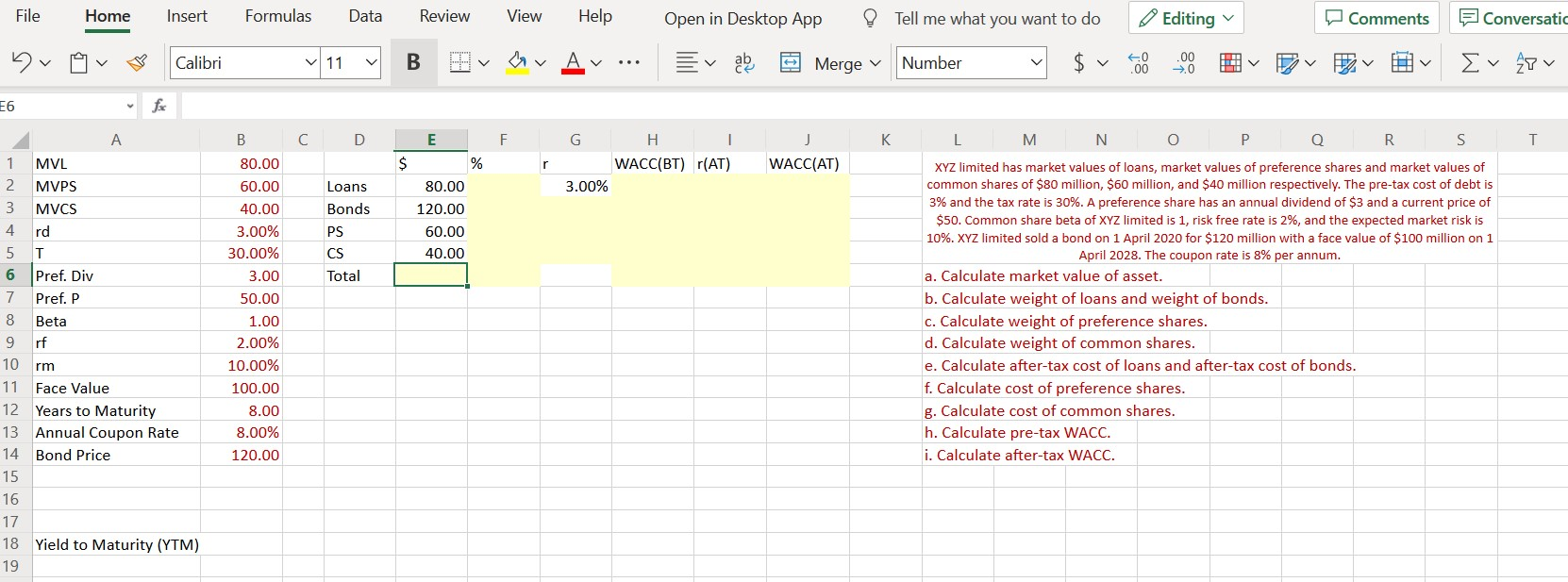

File Home Insert Formulas Data Review View Help Open in Desktop App Tell me what you want to do F Conversation V Calibri 11 B Merge v Number 60 .00 .00 0 E E6 D E F K - L M N O P R S 1 $ % r G H WACC(BT) r(AT) 3.00% WACC(AT) 2 MVL MVPS MVCS rd Loans Bonds 3 80.00 120.00 60.00 40.00 4 PS 5 T CS Total 6 Pref. Div Pref. P 8 Beta 9 rf 10 rm 11 Face Value 12 Years to Maturity 13 Annual Coupon Rate 14 Bond Price 15 B 80.00 60.00 40.00 3.00% 30.00% 3.00 50.00 1.00 2.00% 10.00% 100.00 8.00 8.00% 120.00 XYZ limited has market values of loans, market values of preference shares and market values of common shares of $80 million, $60 million, and $40 million respectively. The pre-tax cost of debt is 3% and the tax rate is 30%. A preference share has an annual dividend of $3 and a current price of $50. Common share beta of XYZ limited is 1, risk free rate is 2%, and the expected market risk is 10%. XYZ limited sold a bond on 1 April 2020 for $120 million with a face value of $100 million on 1 April 2028. The coupon rate is 8% per annum. a. Calculate market value of asset. b. Calculate weight of loans and weight of bonds. c. Calculate weight of preference shares. d. Calculate weight of common shares. e. Calculate after-tax cost of loans and after-tax cost of bonds. f. Calculate cost of preference shares. g. Calculate cost of common shares. h. Calculate pre-tax WACC. i. Calculate after-tax WACC. 16 17 18 Yield to Maturity (YTM) 19 20 21 File Home Insert Formulas Data Review View Help Open in Desktop App Tell me what you want to do Editing Comments E Conversatic bv 1 V Calibri 11 B GVA Merge Number 60 .00 .00 >0 Ev V E6 fac B C D E F G H K - M N O R T $ % r WACC(BT) r(AT) WACC(AT) 3.00% Loans Bonds 80.00 120.00 60.00 40.00 PS CS Total A 1 MVL 2 MVPS 3 MVCS 4 rd 5 T 6 Pref. Div Pref. P 8 Beta 9 rf 10 rm 11 Face Value 12 Years to Maturity 13 Annual Coupon Rate 14 Bond Price 15 16 17 18 Yield to Maturity (YTM) 19 80.00 60.00 40.00 3.00% 30.00% 3.00 50.00 1.00 2.00% 10.00% 100.00 8.00 8.00% XYZ limited has market values of loans, market values of preference shares and market values of common shares of $80 million, $60 million, and $40 million respectively. The pre-tax cost of debt is 3% and the tax rate is 30%. A preference share has an annual dividend of $3 and a current price of $50. Common share beta of XYZ limited is 1, risk free rate is 2%, and the expected market risk is 10%. XYZ limited sold a bond on 1 April 2020 for $120 million with a face value of $100 million on 1 April 2028. The coupon rate is 8% per annum. a. Calculate market value of asset. b. Calculate weight of loans and weight of bonds. c. Calculate weight of preference shares. d. Calculate weight of common shares. e. Calculate after-tax cost of loans and after-tax cost of bonds. f. Calculate cost of preference shares. g. Calculate cost of common shares. h. Calculate pre-tax WACC. i. Calculate after-tax WACC. 120.00