Answered step by step

Verified Expert Solution

Question

1 Approved Answer

file juitily, and heve $240,000 of tarabie inoome Vaw the stanctard deduction atriounis View the 2022 taik rate schedule for the Married filhg lointly filing

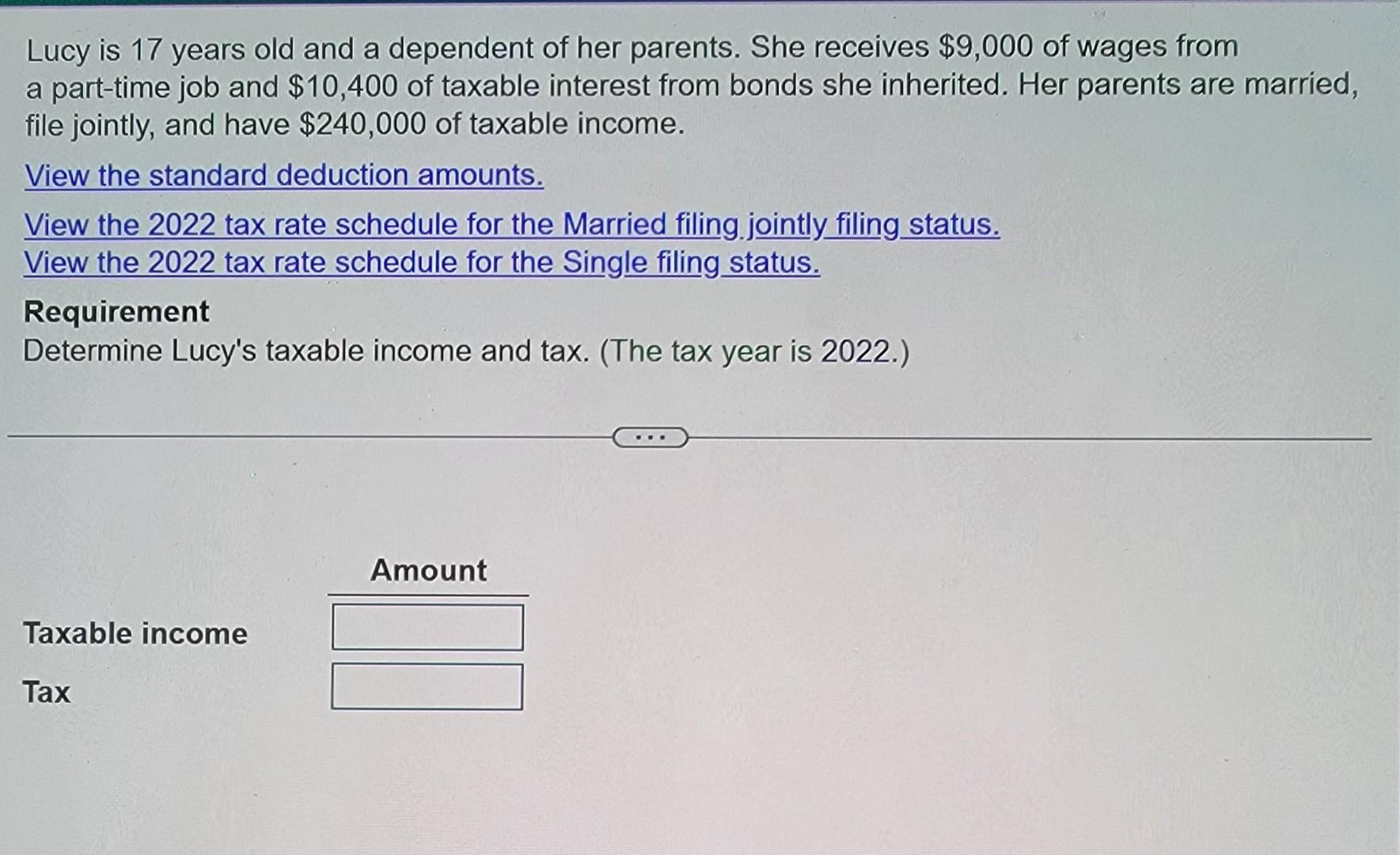

file juitily, and heve $240,000 of tarabie inoome Vaw the stanctard deduction atriounis View the 2022 taik rate schedule for the Married filhg lointly filing status. Viaw the 2022 tax rete schedule for the Single filng status. Fequirement Detannine Lucy's takable income and tax. (The tax year is 2022.) Lucy is 17 years old and a dependent of her parents. She receives $9,000 of wages from a part-time job and $10,400 of taxable interest from bonds she inherited. Her parents are married, file jointly, and have $240,000 of taxable income. View the standard deduction amounts. View the 2022 tax rate schedule for the Married filing. jointly filing status. View the 2022 tax rate schedule for the Single filing status. Requirement Determine Lucy's taxable income and tax. (The tax year is 2022.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started