Answered step by step

Verified Expert Solution

Question

1 Approved Answer

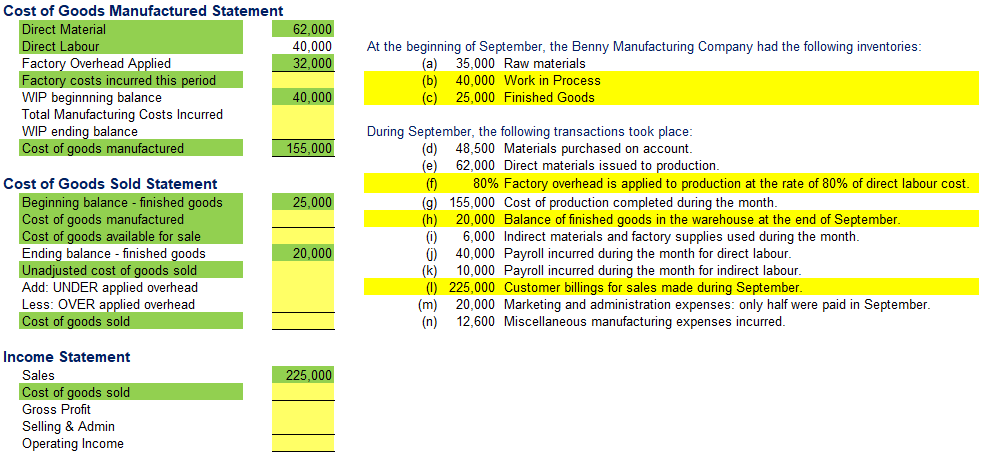

fill in the blanks. Can you explain how you got each of the missing values please Cost of Goods Manufactured Statement Direct Material 62,000 Direct

fill in the blanks.

Can you explain how you got each of the missing values please

Cost of Goods Manufactured Statement Direct Material 62,000 Direct Labour 40,000 Factory Overhead Applied 32,000 Factory costs incurred this period WIP beginnning balance 40,000 Total Manufacturing Costs Incurred WIP ending balance Cost of goods manufactured 155,000 At the beginning of September, the Benny Manufacturing Company had the following inventories: (a) 35,000 Raw materials (b) 40,000 Work in Process (c) 25,000 Finished Goods 25,000 Cost of Goods Sold Statement Beginning balance - finished goods Cost of goods manufactured Cost of goods available for sale Ending balance - finished goods Unadjusted cost of goods sold Add: UNDER applied overhead Less: OVER applied overhead Cost of goods sold During September, the following transactions took place: (d) 48,500 Materials purchased on account. (e) 62,000 Direct materials issued to production. (f) 80% Factory overhead is applied to production at the rate of 80% of direct labour cost. (9) 155,000 Cost of production completed during the month. (h) 20,000 Balance of finished goods in the warehouse at the end of September. 0 6,000 Indirect materials and factory supplies used during the month 0 40,000 Payroll incurred during the month for direct labour. (k) 10,000 Payroll incurred during the month for indirect labour. (1) 225,000 Customer billings for sales made during September. (m) 20,000 Marketing and administration expenses: only half were paid in September. (n) 12,600 Miscellaneous manufacturing expenses incurred. 20,000 225,000 Income Statement Sales Cost of goods sold Gross Profit Selling & Admin Operating IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started