Fill in the blanks please

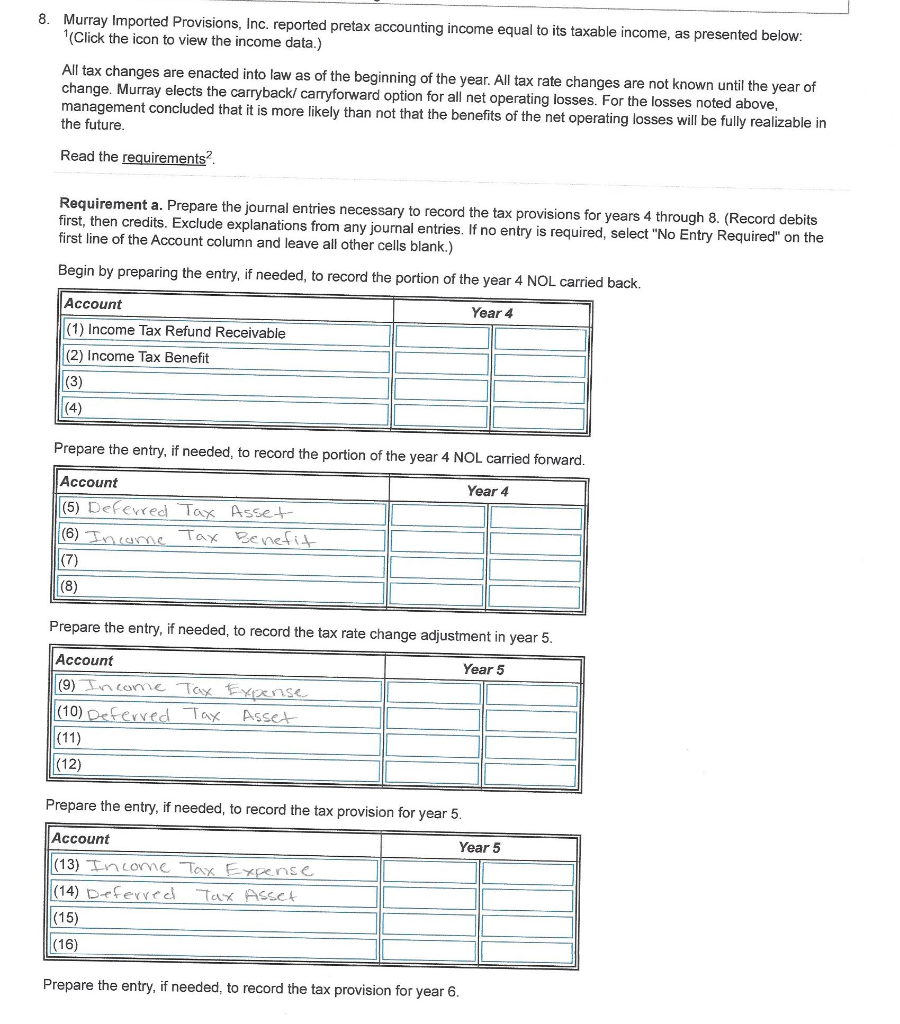

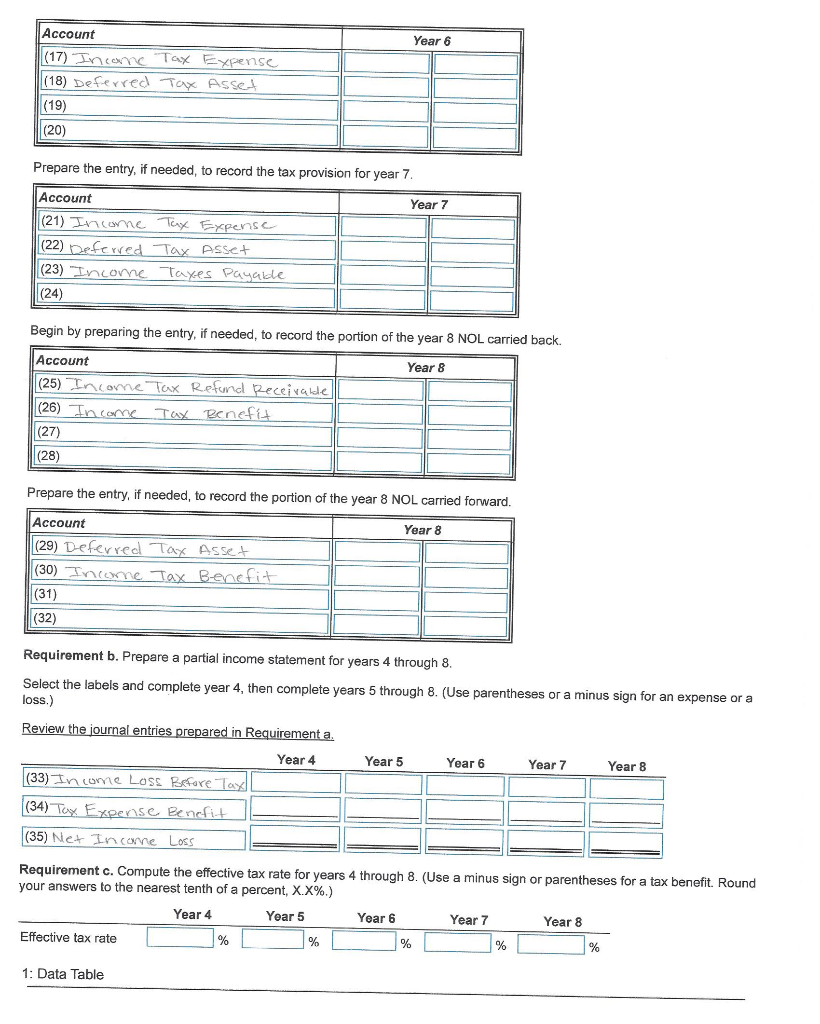

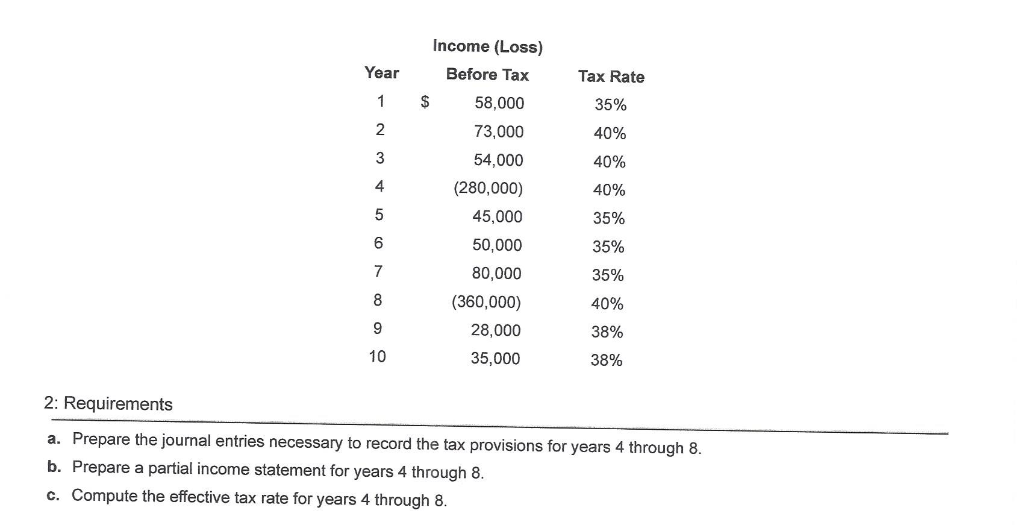

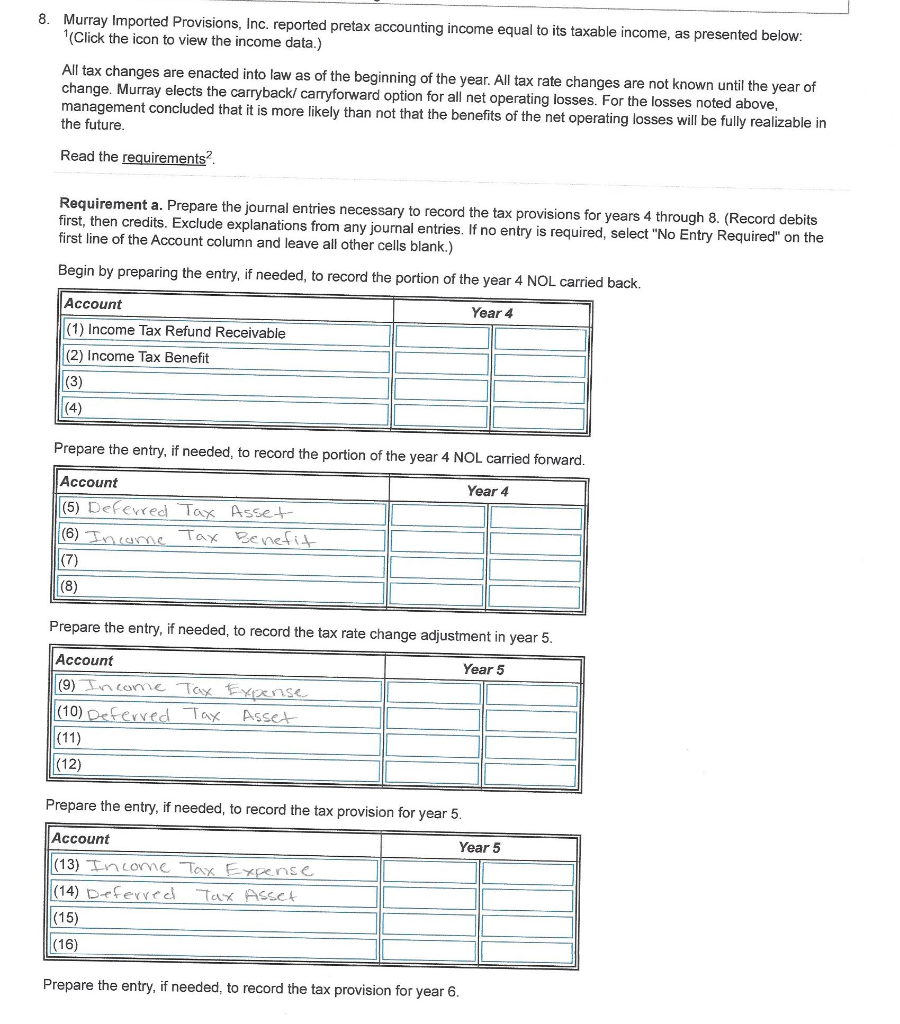

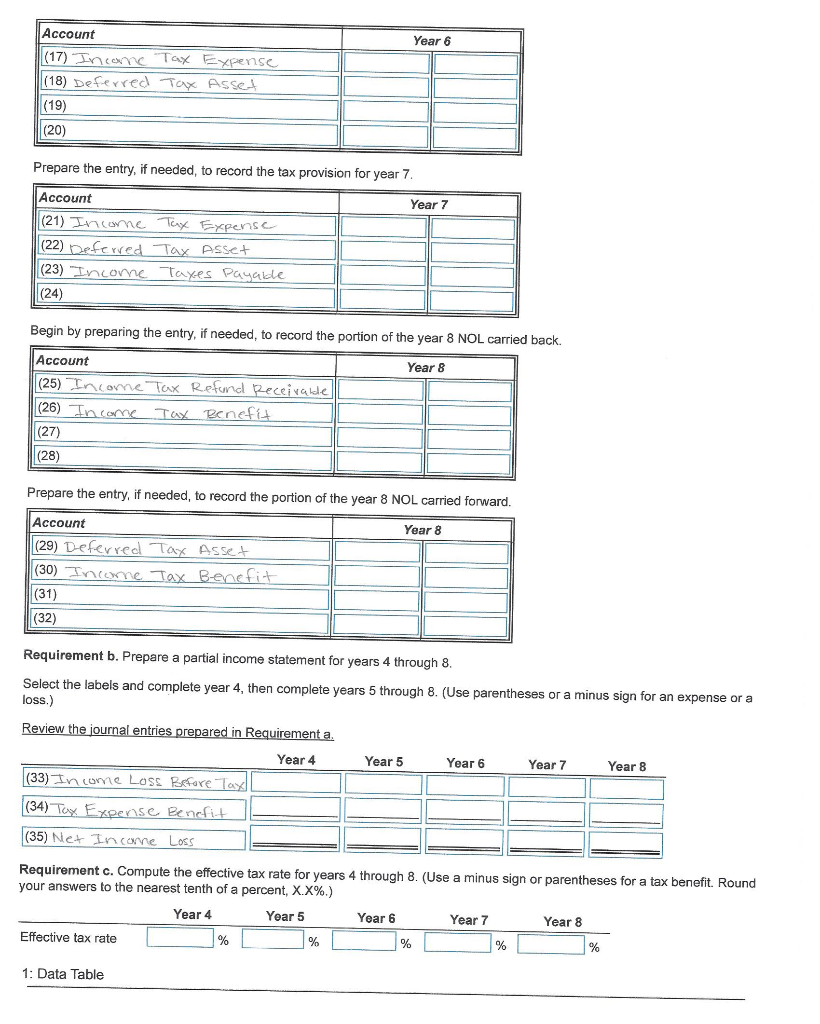

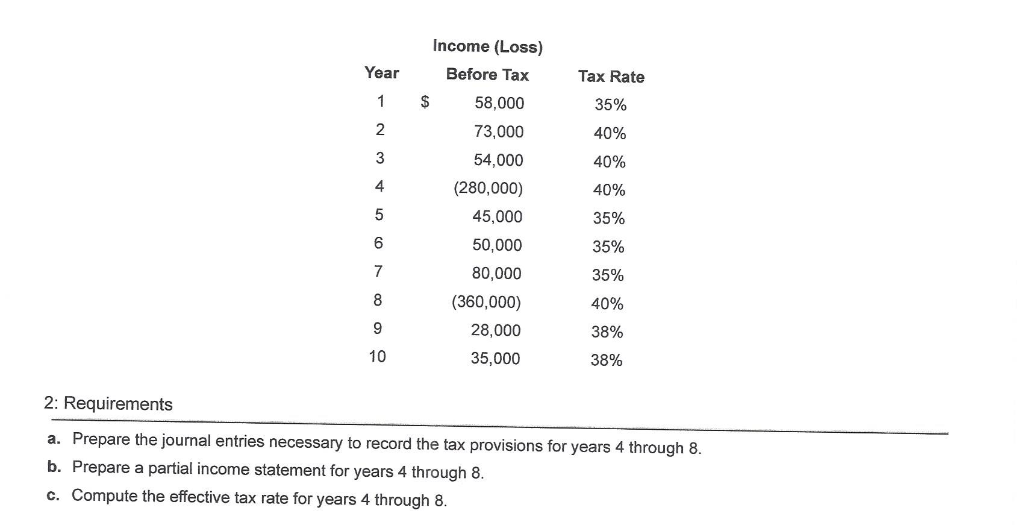

8. Murray Imported Provisions, Inc. reported pretax accounting income equal to its taxable income, as presented below: (Click the icon to view the income data.) All tax changes are enacted into law as of the beginning of the year. All tax rate changes are not known until the year of change. Murray elects the carryback/ carryforward option for all net operating losses. For the losses noted above, management concluded that it is more likely than not that the benefits of the net operating losses will be fully realizable in the future. Read the requirements Requirement a. Prepare the journal entries necessary to record the tax provisions for years 4 through 8. (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required, select "No Entry Required" on the first line of the Account column and leave all other cells blank.) Begin by preparing the entry, if needed, to record the portion of the year 4 NOL carried back. Year 4 Account (1) Income Tax Refund Receivable (2) Income Tax Benefit (3) Prepare the entry, if needed, to record the portion of the year 4 NOL carried forward. Year 4 Account (5) Deferred Tax Asset (6) Income Tax Benefit Prepare the entry, if needed, to record the tax rate change adjustment in year 5. Year 5 Account |(9) Income Tax Expense (10) Deferred Tax Asset (11) (12) Prepare the entry, if needed, to record the tax provision for year 5. Year 5 Account |(13) Income Tax Expense (14) Deferred Tax Asset (15) (16) Prepare the entry, if needed, to record the tax provision for year 6. Year 6 Account (17) Income Tax Expense (18) Deferred Tax Asse (19) (20) Prepare the entry, if needed, to record the tax provision for year 7 Year 7 Account (21) Income Tax Expense (22) Deferred Tax Asset |(23) "Income Taxes Payable (24) Begin by preparing the entry, if needed, to record the portion of the year 8 NOL carried back. Account Year 8 |(25) Income Tax Refund Receivable |(26) Income Tax Benefit (27) (28) Prepare the entry, if needed, to record the portion of the year 8 NOL carried forward. Year 8 Account |(29) Deferred Tax Asset (30) Income Tax Benefit (32) Requirement b. Prepare a partial income statement for years 4 through 8. Select the labels and complete year 4, then complete years 5 through 8. (Use parentheses or a minus sign for an expense or a loss.) Review the journal entries prepared in Requirement a Year 4 (33) Income Loss Before Tay Year 5 Year 6 Year 7 Year 8 (34) Toy Expense Benefit (35) Net Income Loss Requirement c. Compute the effective tax rate for years 4 through 8. (Use a minus sign or parentheses for a tax benefit. Round your answers to the nearest tenth of a percent, X.X%.) Year 4 Year 5 Year 6 Year 7 Year 8 Effective tax rate % % % 1: Data Table Year 1 Tax Rate 35% 40% 40% Income (Loss) Before Tax $ 58,000 73,000 54,000 (280,000) 45,000 50,000 80,000 (360,000) 28,000 35,000 40% 35% 35% 35% 40% 38% 38% 2: Requirements a. Prepare the journal entries necessary to record the tax provisions for years 4 through 8. b. Prepare a partial income statement for years 4 through 8. c. Compute the effective tax rate for years 4 through 8. 8. Murray Imported Provisions, Inc. reported pretax accounting income equal to its taxable income, as presented below: (Click the icon to view the income data.) All tax changes are enacted into law as of the beginning of the year. All tax rate changes are not known until the year of change. Murray elects the carryback/ carryforward option for all net operating losses. For the losses noted above, management concluded that it is more likely than not that the benefits of the net operating losses will be fully realizable in the future. Read the requirements Requirement a. Prepare the journal entries necessary to record the tax provisions for years 4 through 8. (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required, select "No Entry Required" on the first line of the Account column and leave all other cells blank.) Begin by preparing the entry, if needed, to record the portion of the year 4 NOL carried back. Year 4 Account (1) Income Tax Refund Receivable (2) Income Tax Benefit (3) Prepare the entry, if needed, to record the portion of the year 4 NOL carried forward. Year 4 Account (5) Deferred Tax Asset (6) Income Tax Benefit Prepare the entry, if needed, to record the tax rate change adjustment in year 5. Year 5 Account |(9) Income Tax Expense (10) Deferred Tax Asset (11) (12) Prepare the entry, if needed, to record the tax provision for year 5. Year 5 Account |(13) Income Tax Expense (14) Deferred Tax Asset (15) (16) Prepare the entry, if needed, to record the tax provision for year 6. Year 6 Account (17) Income Tax Expense (18) Deferred Tax Asse (19) (20) Prepare the entry, if needed, to record the tax provision for year 7 Year 7 Account (21) Income Tax Expense (22) Deferred Tax Asset |(23) "Income Taxes Payable (24) Begin by preparing the entry, if needed, to record the portion of the year 8 NOL carried back. Account Year 8 |(25) Income Tax Refund Receivable |(26) Income Tax Benefit (27) (28) Prepare the entry, if needed, to record the portion of the year 8 NOL carried forward. Year 8 Account |(29) Deferred Tax Asset (30) Income Tax Benefit (32) Requirement b. Prepare a partial income statement for years 4 through 8. Select the labels and complete year 4, then complete years 5 through 8. (Use parentheses or a minus sign for an expense or a loss.) Review the journal entries prepared in Requirement a Year 4 (33) Income Loss Before Tay Year 5 Year 6 Year 7 Year 8 (34) Toy Expense Benefit (35) Net Income Loss Requirement c. Compute the effective tax rate for years 4 through 8. (Use a minus sign or parentheses for a tax benefit. Round your answers to the nearest tenth of a percent, X.X%.) Year 4 Year 5 Year 6 Year 7 Year 8 Effective tax rate % % % 1: Data Table Year 1 Tax Rate 35% 40% 40% Income (Loss) Before Tax $ 58,000 73,000 54,000 (280,000) 45,000 50,000 80,000 (360,000) 28,000 35,000 40% 35% 35% 35% 40% 38% 38% 2: Requirements a. Prepare the journal entries necessary to record the tax provisions for years 4 through 8. b. Prepare a partial income statement for years 4 through 8. c. Compute the effective tax rate for years 4 through 8