Answered step by step

Verified Expert Solution

Question

1 Approved Answer

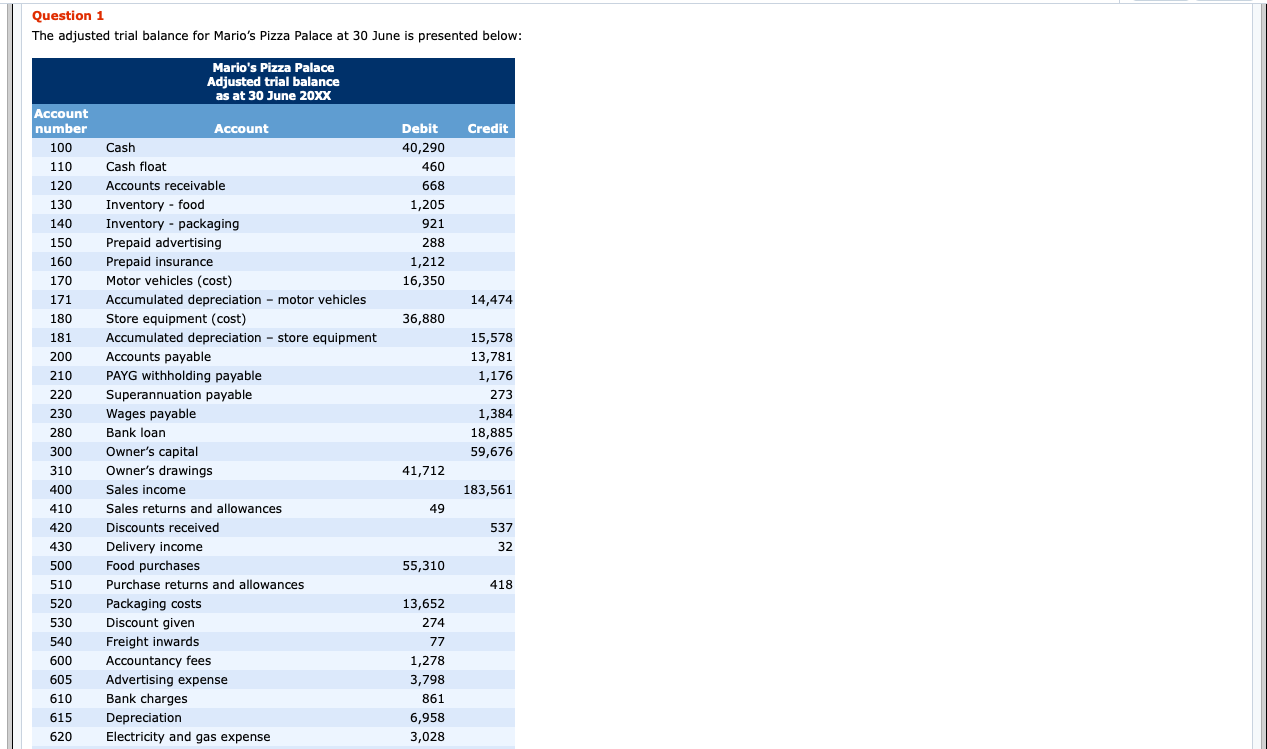

Fill in the blanks Question 1 The adjusted trial balance for Mario's Pizza Palace at 30 June is presented below: Mario's Pizza Palace Adjusted trial

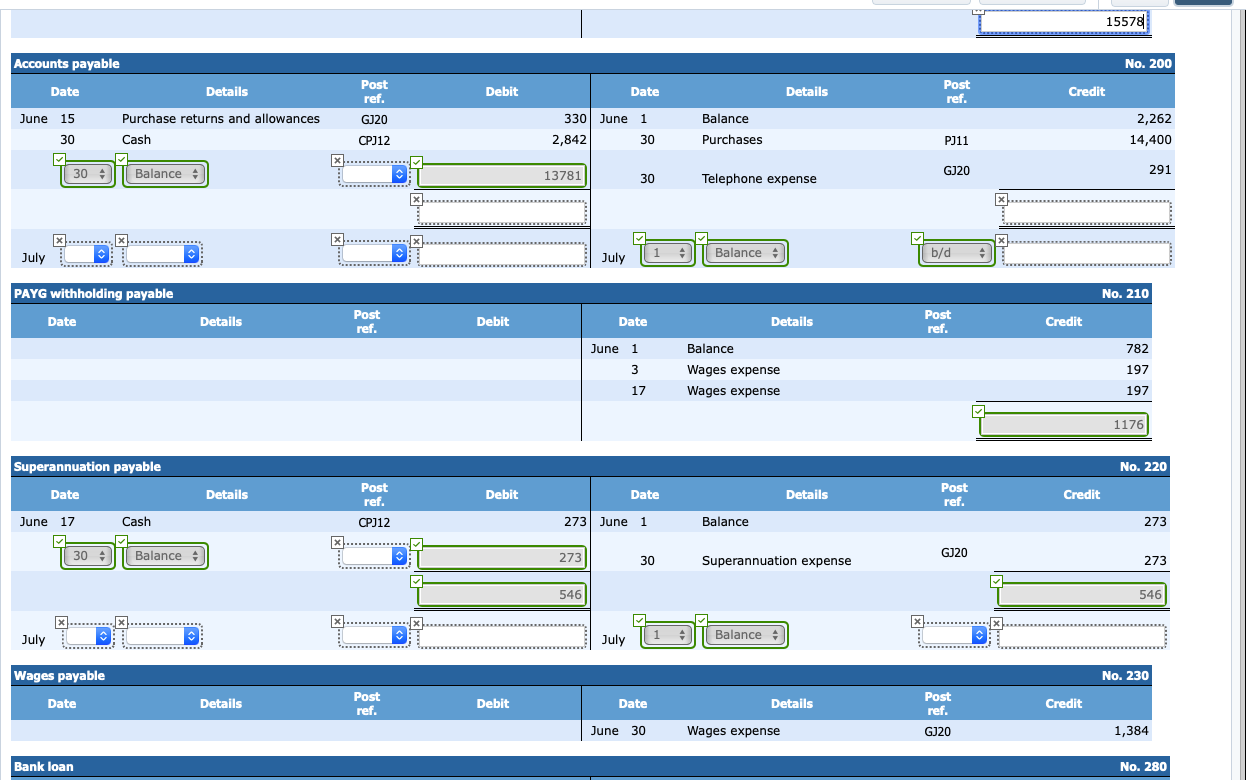

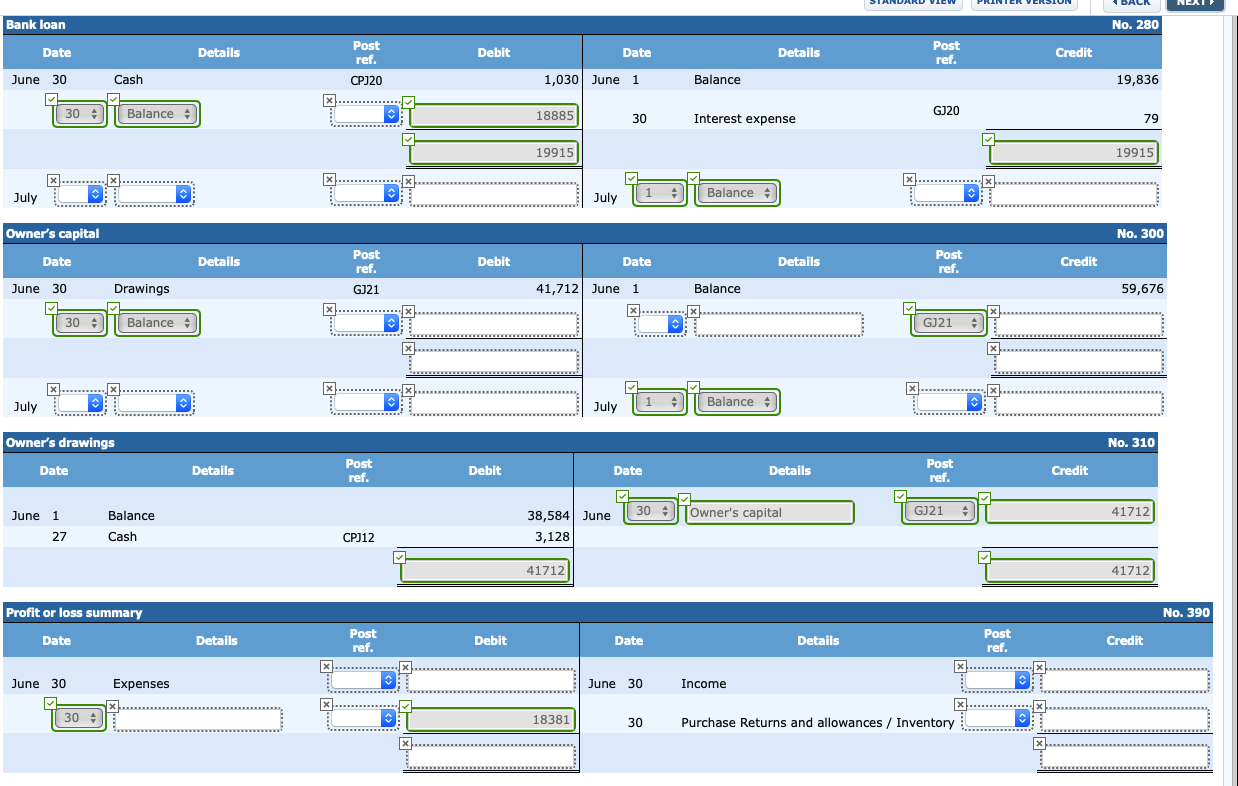

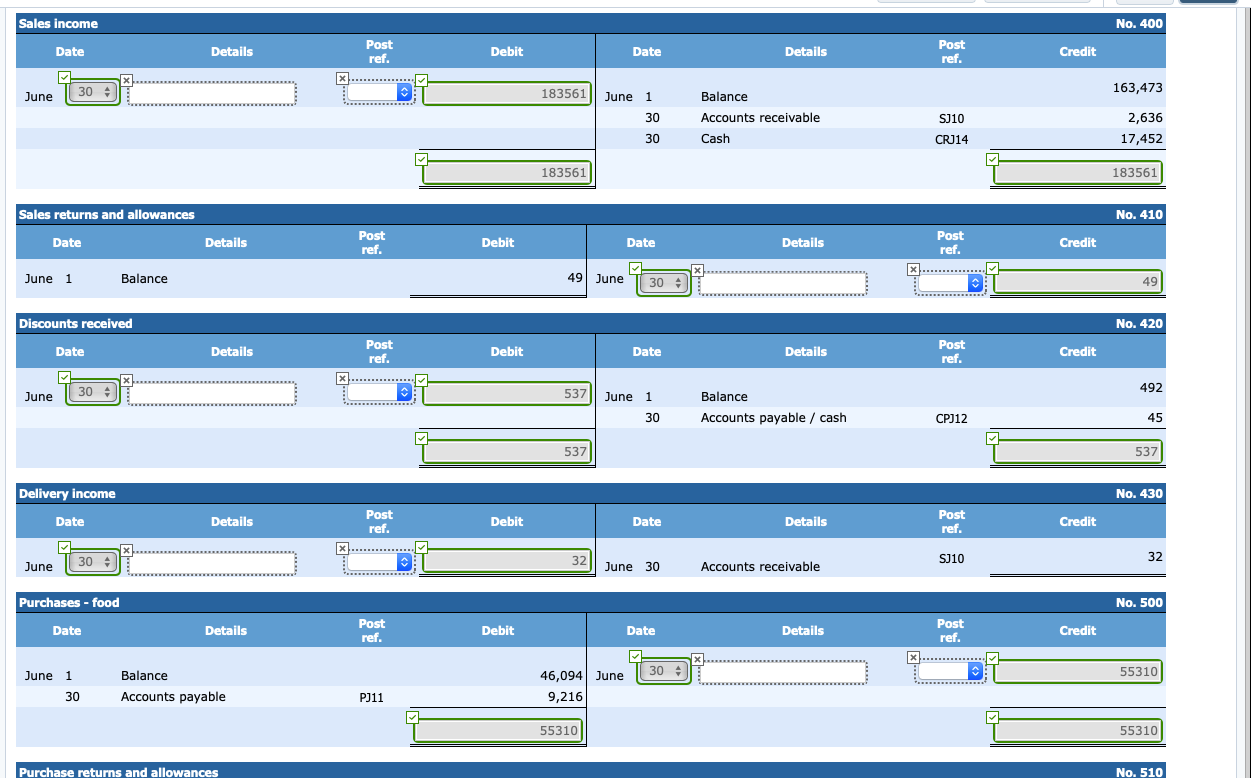

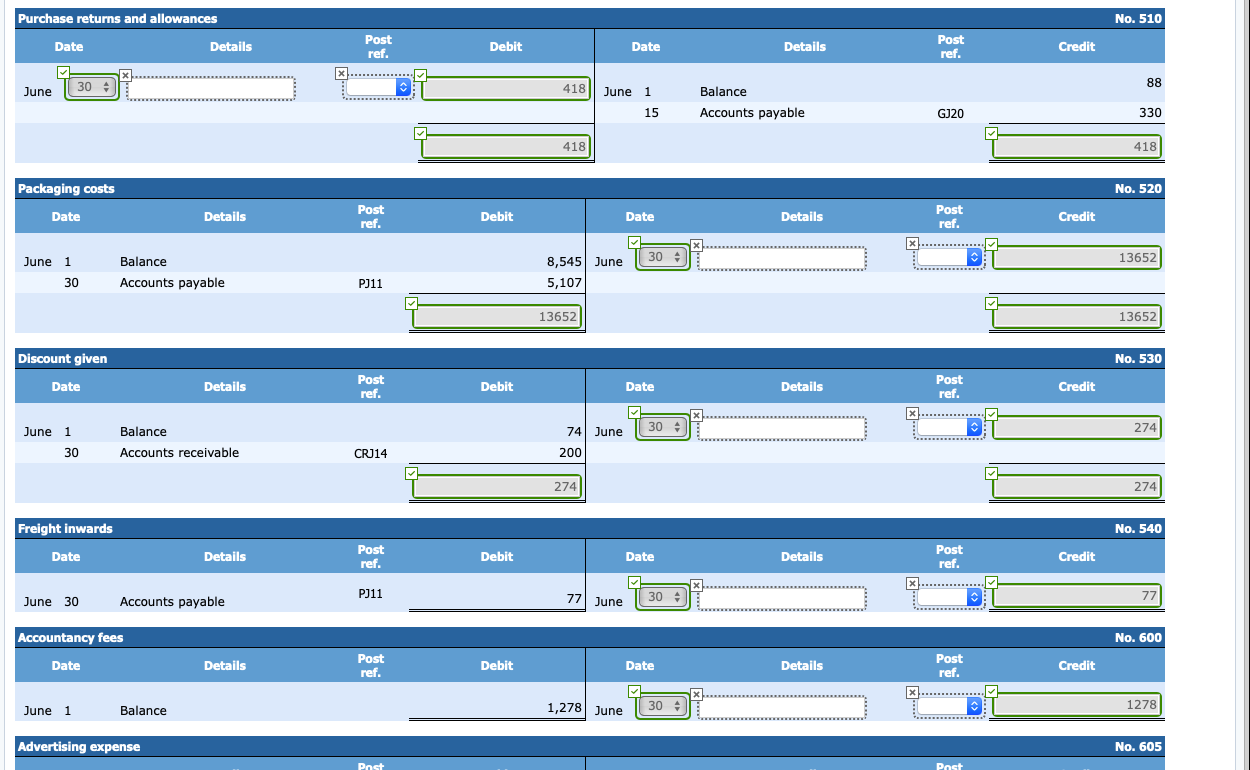

Fill in the blanks

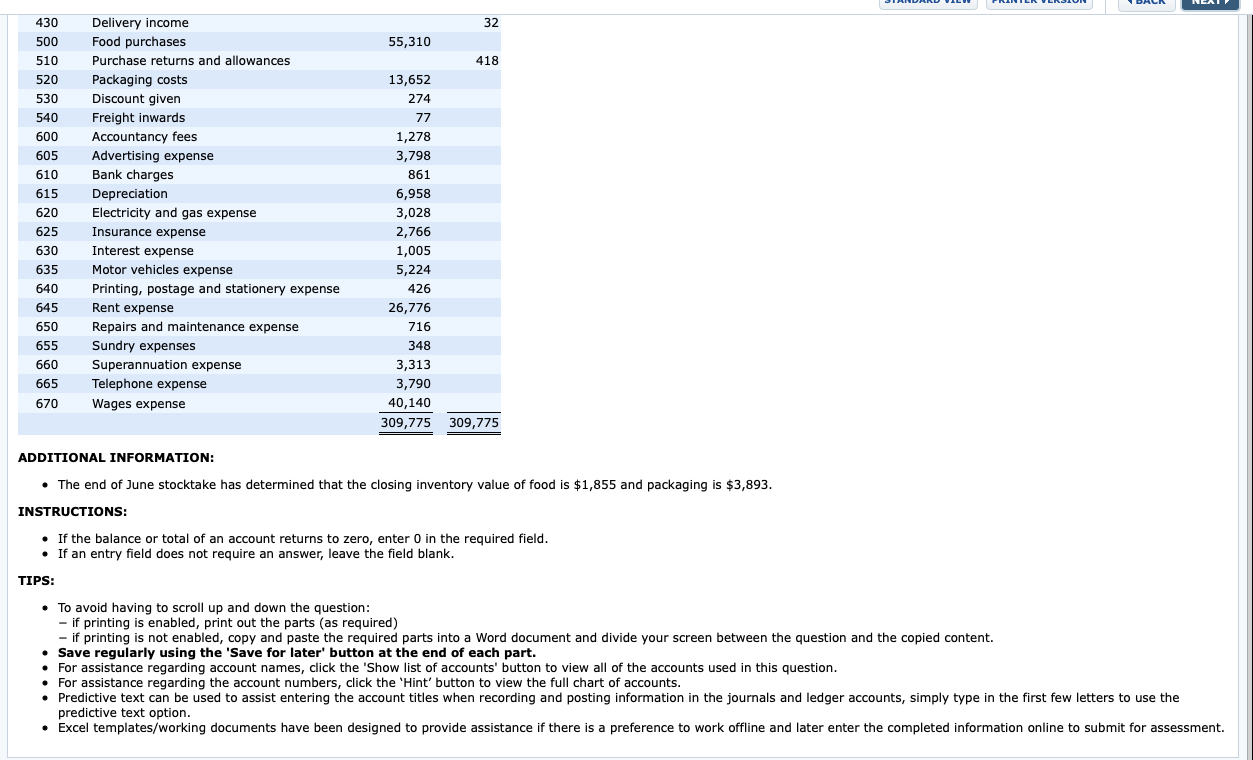

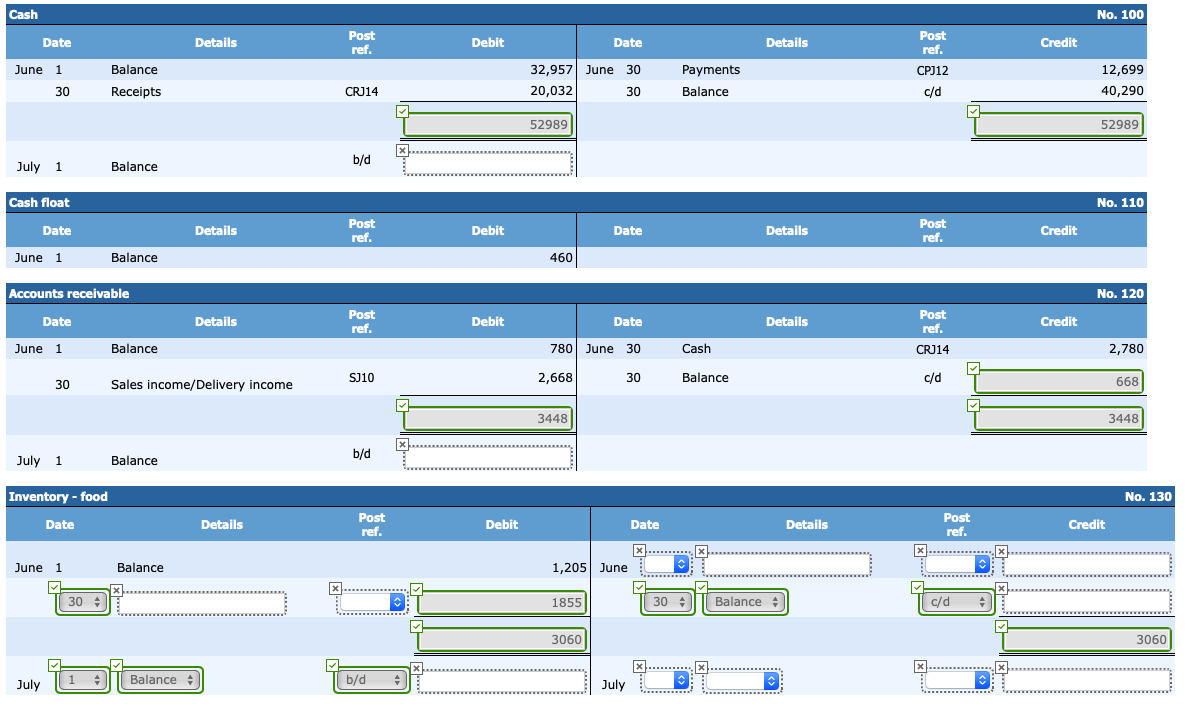

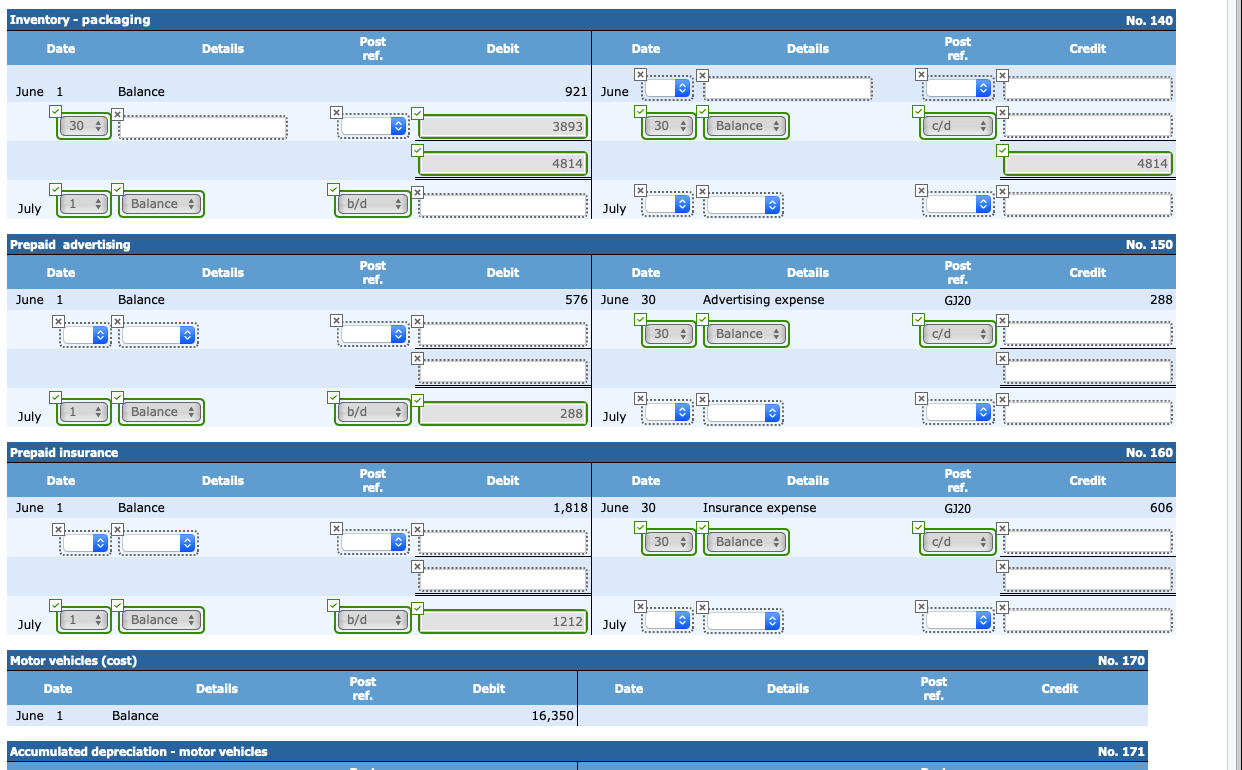

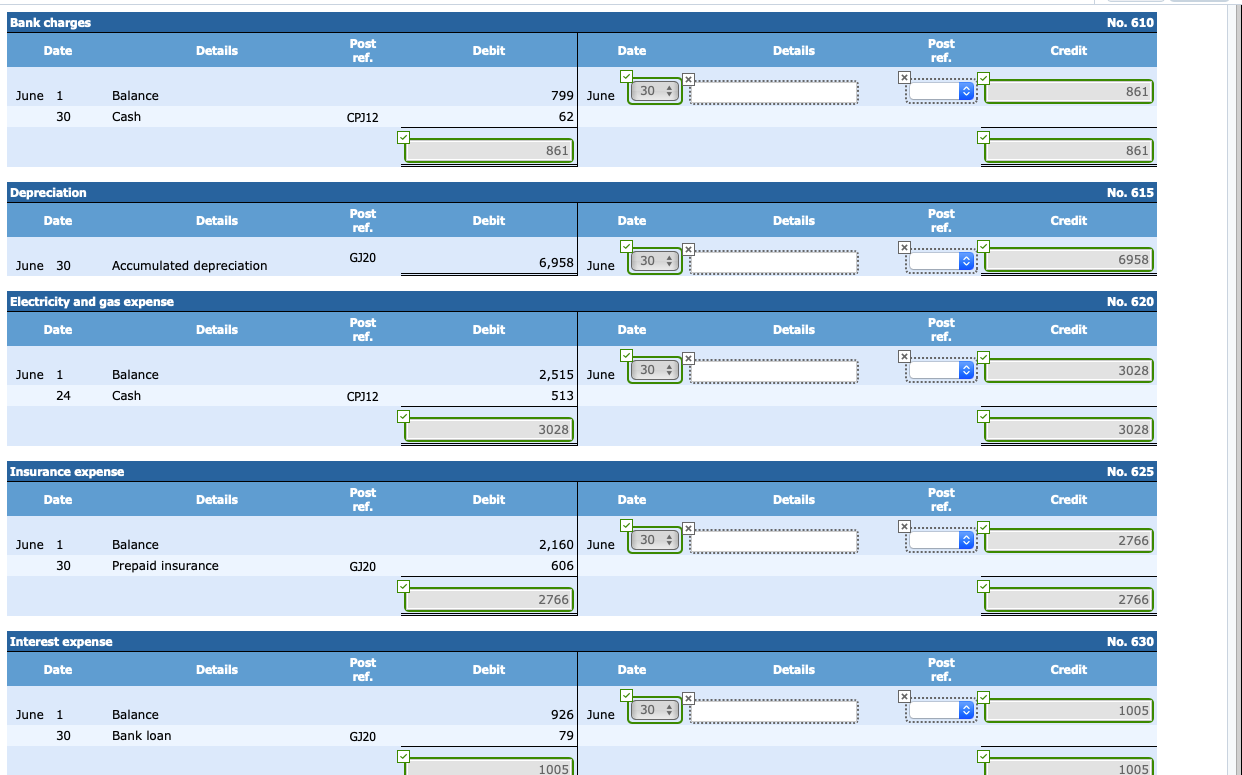

Question 1 The adjusted trial balance for Mario's Pizza Palace at 30 June is presented below: Mario's Pizza Palace Adjusted trial balance as at 30 June 20XX Account Credit number Account Debit 100 Cash 40,290 Cash float 110 460 Accounts receivable 120 668 130 Inventory - food Inventory - packaging Prepaid advertising 1,205 140 921 150 288 160 Prepaid insurance 1,212 Motor vehicles (cost) 170 16,350 - motor vehicles 171 Accumulated depreciation - 14,474 Store equipment (cost) 180 36,880 Accumulated depreciation - store equipment Accounts payable PAYG withholding payable 15,578 181 13,781 200 210 1,176 Superannuation payable Wages payable 220 273 1,384 230 Bank loan 280 18,885 Owner's capital Owner's drawings 300 59,676 41,712 310 Sales income 400 183,561 Sales returns and allowances 410 49 Discounts received 420 537 Delivery income 430 32 Food purchases 500 55,310 Purchase returns and allowances 510 418 Packaging costs Discount given 520 13,652 530 274 Freight inwards 540 77 Accountancy fees 600 1,278 Advertising expense 605 3,798 Bank charges 610 861 Depreciation 615 6,958 Electricity and gas expense 620 3,028 Delivery income 430 32 500 Food purchases 55,310 510 Purchase returns and allowances 418 13,652 520 Packaging costs Discount given 530 274 Freight inwards 540 77 600 Accountancy fees 1,278 Advertising expense Bank charges 605 3,798 610 861 Depreciation Electricity and gas expense 615 6,958 3,028 620 Insurance expense 625 2,766 Interest expense Motor vehicles expense 630 1,005 5,224 635 Printing, postage and stationery expense 640 426 Rent expense 645 26,776 Repairs and maintenance expense 650 716 Sundry expenses 348 655 Superannuation expense 660 3,313 Telephone expense 665 3,790 40,140 670 Wages expense 309,775 309,775 ADDITIONAL INFORMATION: The end of June stocktake has determined that the closing inventory value of food is $1,855 and packaging is $3,893. INSTRUCTIONS: If the balance or total of an account returns to zero, enter 0 in the required field. If an entry field does not require an answer, leave the field blank. TIPS: To avoid having to scroll up and down the question: - if printing is enabled, print out the parts (as required) if printing is not enabled, copy and paste the required parts into a Word document and divide your screen between the question and the copied content. Save regularly using the 'Save for later' button at the end of each part. For assistance regarding account names, click the 'Show list of accounts' button to view all of the accounts used in this question. For assistance regarding the account numbers, click the 'Hint' button to view the full chart of accounts. Predictive text can be used to assist entering the account titles when recording and posting information in the journals and ledger accounts, simply type in the first few letters to use the predictive text option. Excel templates/working documents have been designed to provide assistance if there is a preference to work offline and later enter the completed information online to submit for assessment. Cash No. 100 Post Post Date Details Debit Date Details Credit ref. ref. 32,957 June 30 June 1 Balance Payments 12,699 CPJ12 Receipts 20,032 c/d 40,290 30 CRJ14 30 Balance 52989 52989 b/d Balance July 1 Cash float No. 110 Post Post Date Details Details Credit Debit Date ref. ref. June 1 Balance 460 No. 120 Accounts receivable Post Post Date Details Debit Date Details Credit ref. ref. 780 June 30 June 1 Balance Cash CRJ14 2,780 2,668 SJ10 30 Balance c/d 668 Sales income/Delivery income 30 3448 3448 b/d Balance July 1 Inventory - food No. 130 Post Post Date Details Debit Details Credit Date ref. ref. x........ x...........X 1,205 June June 1 Balance 30 : Balance c/d 1855 3060 3060 Balance b/d 1. July July Inventory - packaging No. 140 Post Post Credit Date Details Debit Date Details ref. ref. x...........x X....... 921 June June 1 Balance Balance 30 : 30 : c/d 3893 4814 4814 Balance b/d July July Prepaid advertising No. 150 Post Post Details Debit Details Date Date Credit ref. ref. 576 June 30 Advertising expense June 1 Balance 288 GJ20 x....... 30 : Balance : c/d Balance : b/d 288 July July Prepaid insurance No. 160 Post Post Details Details Credit Date Debit Date ref. ref. 1,818 June 30 Balance Insurance expense 606 June 1 GJ20 30 : Balance + c/d Balance : b/d 1212 July July Motor vehicles (cost) No. 170 Post Post Details Debit Date Date Details Credit ref. ref. Balance 16,350 June 1 Accumulated depreciation - motor vehicles No. 171 15578 Accounts payable No. 200 Post Post Date Details Debit Date Details Credit ref. ref. 330 June 1 June 15 Purchase returns and allowances Balance 2,262 GJ20 Purchases 30 Cash 2,842 30 14,400 CPJ12 PJ11 291 GJ20 Balance : 30 : 13781 Telephone expense 30 x........... July Balance b/d July PAYG withholding payable No. 210 Post Post Date Details Debit Credit s Date Details ref. ref. 782 June 1 Balance 197 3 Wages expense 17 Wages expense 197 1176 Superannuation payable No. 220 Post Post Details Details Date Debit Date Credit ref. ref. 273 June 1 Balance June 17 Cash 273 CPJ12 30 : Balance : GJ20 273 Superannuation expense 30 273 546 546 Balance : July July Wages payable No. 230 Post Post Date Debit Details Details Date Credit ref. ref. June 30 Wages expense 1,384 GJ20 Bank loan No. 280 NEXT P Bank loan No. 280 Post Post ref. Details Debit Details Date Date Credit ref. 1,030 June 1 Cash 19,836 June 30 Balance CPJ20 30 : GJ20 Balance 18885 Interest expense 30 79 19915 19915 Balance : July July Owner's capital No. 300 Post Post Details Date Debit Date Details Credit ref. ref. 41,712 June 1 June 30 Drawings GJ21 Balance 59,676 30 : Balance : GJ21 Balance July July Owner's drawings No. 310 Post Post ref. Details Details Date Debit Date Credit ref. 30 +Towner's capital GJ21 41712 38,584 June June 1 Balance 27 Cash 3,128 CPJ12 41712 41712 Profit or loss summary No. 390 Post Post Date Details Debit Date Details Credit ref. ref. x.......... .......... June 30 Expenses June 30 Income ............. 30 : 18381 30 Purchase Returns and allowances / Inventory uw1144 Sales income No. 400 Post Post Credit Date Details Debit Date Details ref. ref. x........ 163,473 30 + 183561 Balance June June 1 2,636 30 Accounts receivable SJ10 Cash 17,452 30 CRJ14 183561 183561 Sales returns and allowances No. 410 Post Post Details Date Debit Date Details Credit ref. ref. X...... 49 June June 1 Balance 30 : 49 Discounts received No. 420 Post Post Date Details Details Debit Date Credit ref. ref. 492 30 : 537 June June 1 Balance Accounts payable / cash 30 45 CPJ12 537 537 Delivery income No. 430 Post Post Date Details Details Debit Date Credit ref. ref. x.......... 32 30 : SJ10 32 June 30 June Accounts receivable Purchases - food No. 500 Post Post Details Date Debit Date Details Credit ref. ref. 30 55310 46,094 June Balance June 1 Accounts payable 30 PJ11 9,216 55310 55310 No. 510 Purchase returns and allowances Purchase returns and allowances No. 510 Post Post ref. Date Details Debit Date Details Credit ref. ........... 88 30 : 418 June June 1 Balance Accounts payable 15 330 GJ20 418 418 Packaging costs No. 520 Post ref. Post Details Details Date Debit Date Credit ref. 30 : 13652 8,545 June June 1 Balance Accounts payable 30 5,107 PJ11 13652 13652 Discount given No. 530 Post Post Details Date Debit Date Details Credit ref. ref. x........ 30 : 274 74 June June 1 Balance Accounts receivable 30 200 CRJ14 274 274 Freight inwards No. 540 Post Post Details Debit Details Date Date Credit ref. ref. 30 : PJ11 77 June 77 Accounts payable June 30 Accountancy fees No. 600 Post ref. Post ref. Details Date Debit Date Details Credit 1278 1,278 June 30 + Balance June 1 Advertising expense No. 605 Post Post Bank charges No. 610 Post ref. Post Date Details Debit Date Details Credit ref. 30 : 861 799 June June 1 Balance 62 30 Cash CPJ12 861 861 Depreciation No. 615 Post Post Credit Date Details Debit Date Details ref. ref. 30 : GJ20 6,958 June 6958 Accumulated depreciation June 30 No. 620 Electricity and gas expense Post Post Details Date Details Debit Date Credit ref. ref. 30 + 3028 2,515 June Balance June 1 24 Cash CPJ12 513 3028 3028 Insurance expense No. 625 Post Post Debit Date Date Details Details Credit ref. ref. 30 : 2766 2,160 June Balance June 1 Prepaid insurance 30 606 GJ20 2766 2766 Interest expense No. 630 Post Post Date Details Debit Date Details Credit ref. ref. X.............. 30 : 1005 926 June Balance June 1 30 Bank loan GJ20 79 1005 1005Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started