Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill in the blanks with correct terms. Circle the correct terms. Financial Management Vocab (7.4) The statement of cash flows organizes sources and uses of

Fill in the blanks with correct terms. Circle the correct terms. Financial Management Vocab

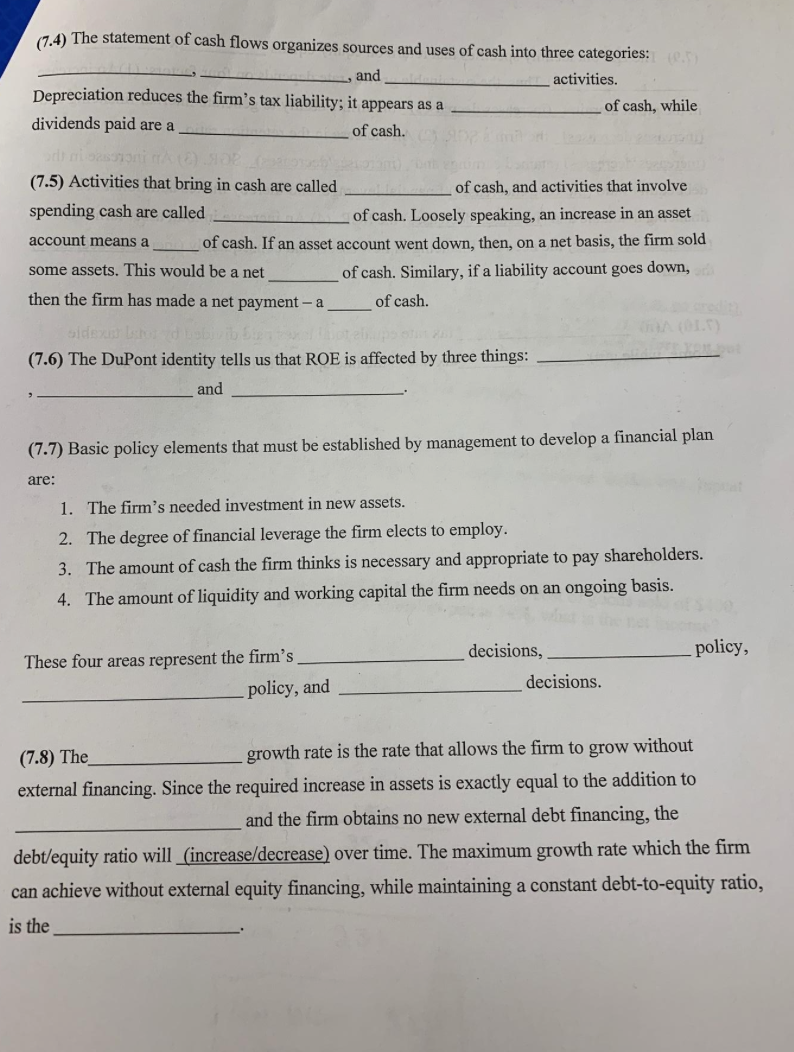

(7.4) The statement of cash flows organizes sources and uses of cash into three categories: and_ activities. Depreciation reduces the firm's tax liability; it appears as a o f cash, while dividends paid are a of cash. TOP (7.5) Activities that bring in cash are called of cash, and activities that involve spending cash are called of cash. Loosely speaking, an increase in an asset account means a s of cash. If an asset account went down, then, on a net basis, the firm sold some assets. This would be a net of cash. Similary, if a liability account goes down, then the firm has made a net payment-a of cash. (7.6) The DuPont identity tells us that ROE is affected by three things: and (7.7) Basic policy elements that must be established by management to develop a financial plan are: 1. The firm's needed investment in new assets. 2. The degree of financial leverage the firm elects to employ. 3. The amount of cash the firm thinks is necessary and appropriate to pay shareholders. 4. The amount of liquidity and working capital the firm needs on an ongoing basis. policy, These four areas represent the firm's _policy, and _ decisions, decisions. (7.8) The growth rate is the rate that allows the firm to grow without external financing. Since the required increase in assets is exactly equal to the addition to and the firm obtains no new external debt financing, the debt/equity ratio will increase/decrease) over time. The maximum growth rate which the firm can achieve without external equity financing, while maintaining a constant debt-to-equity ratio, is theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started