Answered step by step

Verified Expert Solution

Question

1 Approved Answer

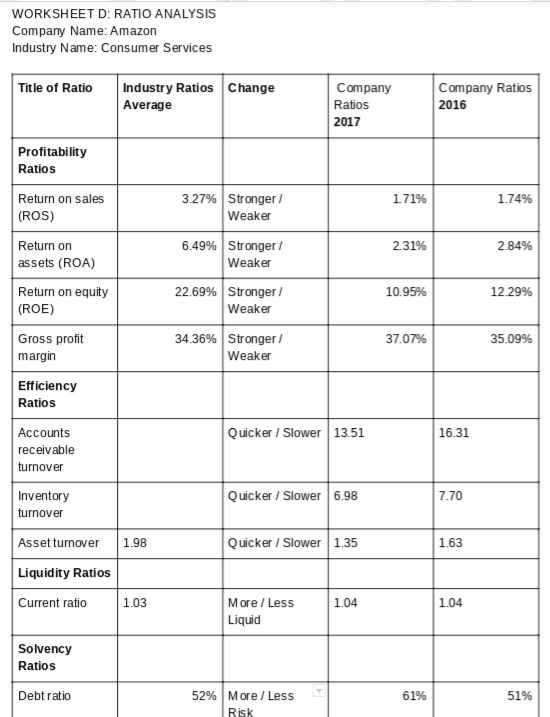

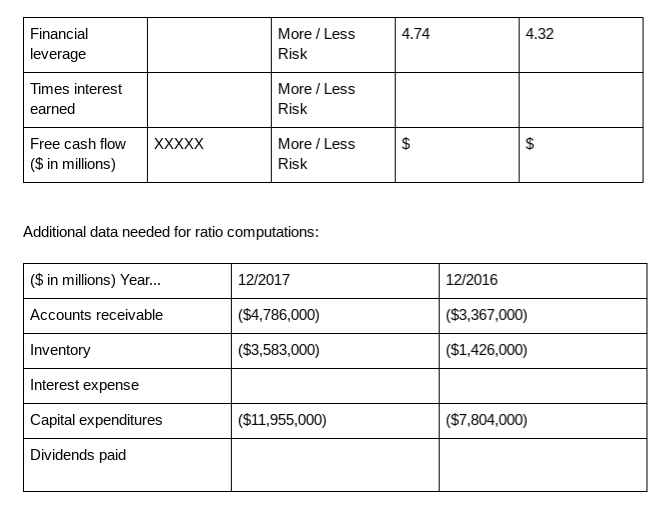

Fill in the missing data for Amazon (AMZM) and for the industry average, and identify whether or not Amazon is stronger/weaker, quicker/slower, more or less

Fill in the missing data for Amazon (AMZM) and for the industry average, and identify whether or not Amazon is stronger/weaker, quicker/slower, more or less lquid, and whether Amazon is more or less of a risk than the industry averages.

WORKSHEET D: RATIO ANALYSIS Company Name: Amazon Industry Name: Consumer Services Title of Ratio Industry Ratios Change Company Ratios 2017 Company Ratios 2016 Average Profitability Ratios 32796 | Stronger / 1.71% 1.74% Return on sales (ROS) Weaker 6.49% | Stronger / 2.31% 2.84% Return on assets (ROA) Weaker Return on equity (ROE) 22.69% Stronger 10.95% 12.29% Weaker 34.36% | Stronger, 37.0796 35.09% Gross profit margin Weaker Efficiency Ratios Quicker Slower 13.51 16.31 Accounts receivable turnover Quicker /Slower 6.98 7.70 Inventory turnover Quicker Slower 1.35 1.63 Asset turnover1.98 Liquidity Ratios Current ratio 1.03 More / Less 1.04 1.04 Liquid Solvency Ratios 61% 5296 | More / Less Risk Debt ratio 51% WORKSHEET D: RATIO ANALYSIS Company Name: Amazon Industry Name: Consumer Services Title of Ratio Industry Ratios Change Company Ratios 2017 Company Ratios 2016 Average Profitability Ratios 32796 | Stronger / 1.71% 1.74% Return on sales (ROS) Weaker 6.49% | Stronger / 2.31% 2.84% Return on assets (ROA) Weaker Return on equity (ROE) 22.69% Stronger 10.95% 12.29% Weaker 34.36% | Stronger, 37.0796 35.09% Gross profit margin Weaker Efficiency Ratios Quicker Slower 13.51 16.31 Accounts receivable turnover Quicker /Slower 6.98 7.70 Inventory turnover Quicker Slower 1.35 1.63 Asset turnover1.98 Liquidity Ratios Current ratio 1.03 More / Less 1.04 1.04 Liquid Solvency Ratios 61% 5296 | More / Less Risk Debt ratio 51%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started