Answered step by step

Verified Expert Solution

Question

1 Approved Answer

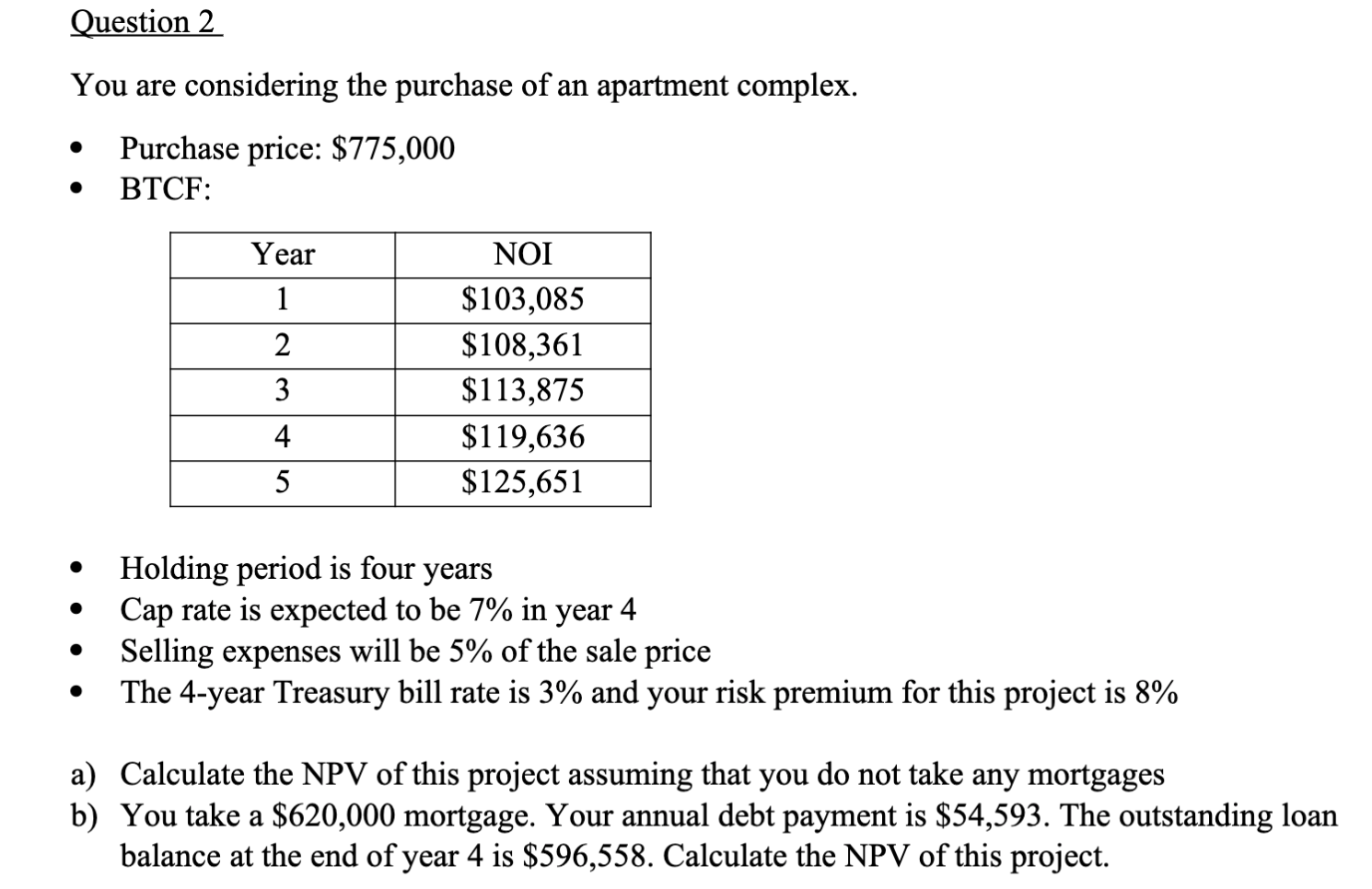

Please provide a step by step explanation answering all parts of the questions. Question 2 You are considering the purchase of an apartment complex. Purchase

Please provide a step by step explanation answering all parts of the questions.

Question 2 You are considering the purchase of an apartment complex. Purchase price: $775,000 BTCF: Year 1 2 NOI $103,085 $108,361 $113,875 $119,636 $125,651 3 4 5 . Holding period is four years Cap rate is expected to be 7% in year 4 Selling expenses will be 5% of the sale price The 4-year Treasury bill rate is 3% and your risk premium for this project is 8% a) Calculate the NPV of this project assuming that you do not take any mortgages b) You take a $620,000 mortgage. Your annual debt payment is $54,593. The outstanding loan balance at the end of year 4 is $596,558. Calculate the NPV of this projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started