Question

Fill in the missing information on how much for each asset is included in the Gross Estate, Probate Estate, and the new Basis for the

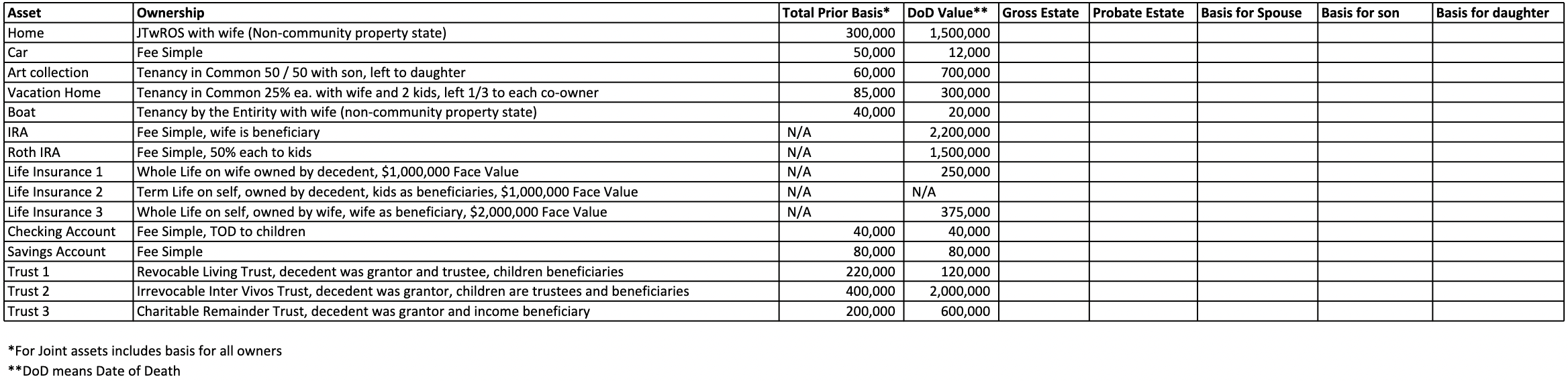

Fill in the missing information on how much for each asset is included in the Gross Estate, Probate Estate, and the new Basis for the heirs if applicable.

As an example, for the first item, the home, you will list the value (if any) that is included in the Gross Estate, the value (if any) that is included in the Probate Estate, and since it will pass to the wife, what her total basis in the property is after the estate is settled. If there are multiple heirs make sure to include what each heir will have as their basis after the estate settles. FOR TRUST 3 - please put the charity's basis under "Basis for Spouse".

WILL UPVOTE! Need answered sooner than later, thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started