Question

Fill out a 2017 IRS TAX Form 1040 Schedule D based on the following information: The Awesomes are married filing jointly. The wife had a

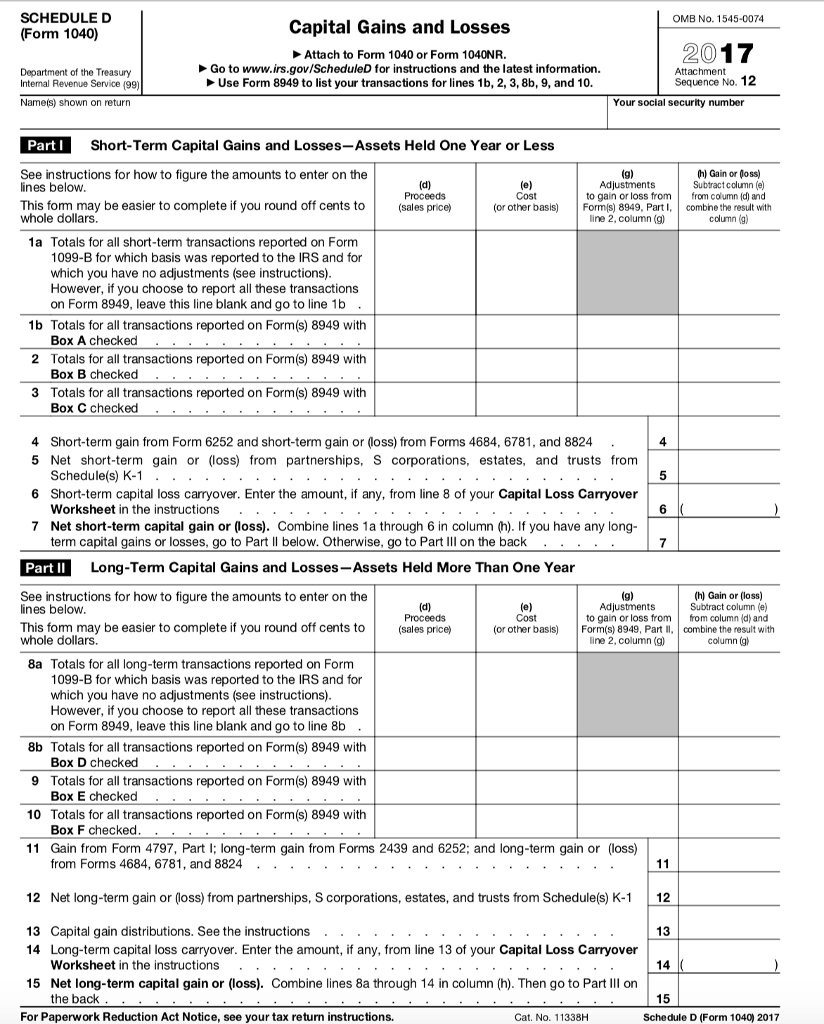

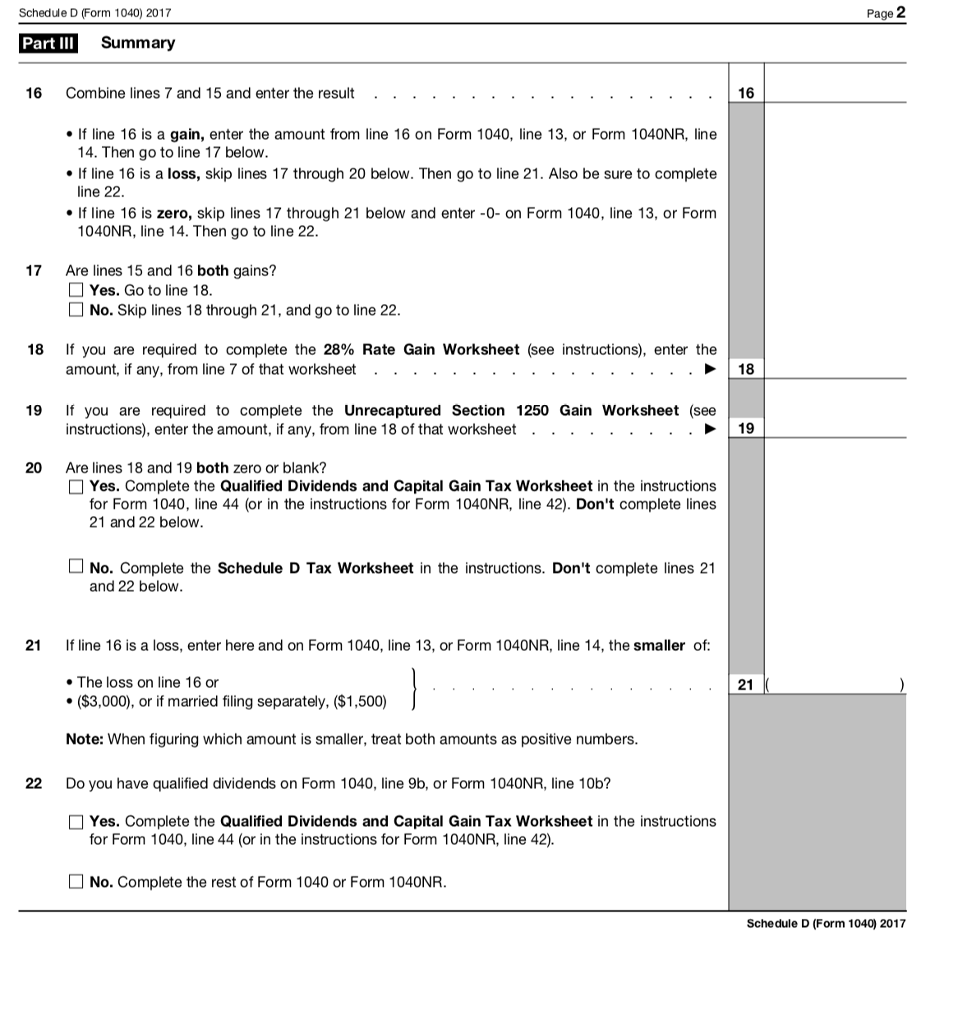

Fill out a 2017 IRS TAX Form 1040 Schedule D based on the following information:

The Awesomes are married filing jointly. The wife had a LT capital gain from being a shareholder in an S corp in the amount of $2000.

They also sold their principal residence in California and bought one in Texas. They previously lived 5 years in the house. Sale Price was $900,000, basis was $400,000 and costs of sale were $25,000.

The Awesome Family were also avid Investors and sold the following in 2017:

1. Apple for $7000. Bought stock 6 months earlier for $2000.

2. CommVault for $30,000. Bought stock 2 years earlier for $70,000.

3. Land in Missouri for $150,000. The land was inherited from the husband's great grandfather 3 years ago. At that time, grandpa had basis of $2000 and Fair Market Value was $12,000.

4. Stock in Zippy Inc for $0 (worthless). The Awesomes invested $550,000 in Zippy 5 years go. The company had made a 1244 election.

5. Bond in Samsung for $3000. The bond originally cost the husband $5000 and he sold it to his sister.

I am unable to attach the form as i dont see an option here on chegg but I will post a picture and provide the link to download:

https://www.irs.gov/pub/irs-pdf/f1040sd.pdf

https://www.irs.gov/pub/irs-pdf/f1040sd.pdf

SCHEDULE D (Form 1040) OMB No. 1545-0074 Capital Gains and Losses Attach to Form 1040 or Form 1040NR Go to www.rs.gov/ScheduleD for instructions and the latest information Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. 2017 Department of the Treasury Internal Revenue Service (99 Attachment Sequence No. 12 Nameis) shown on return Your social security number PartShort-Term Capital Gains and Losses-Assets Held One Year or Less See instructions for how to figure the amounts to enter on the lines below h Gain or loss) Subtractcolumn (e) to gain or loss fromfrom column (d) and Adjustments Proceeds Cost This form may be easier to complete if you round off cents to (sales price) whole dollars. (or other basis) Form/s) 8949, Part,combhethe result with line 2, column (g) column (g) 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions) However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b . 1b Totals for all transactions reported on Form(s) 8949 with 2 3 Box A checked Totals for all transactions reported on Form(s) 8949 with Box B checked Totals for all transactions reported on Form(s) 8949 with Box C checked Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 . . 4 5 6 4 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part Il below. Otherwise, go to Part IlI on the back . . . PartIILong-Term Capital Gains and Losses- Assets Held More Than One Year See instructions for how to figure the amounts to enter on the lines below (h) Gain or (loss) Adjustments Subtract column (e) Proceeds Cost to gain or loss fromfrom column (d) and This form may be easier to complete if you round off cents to (sales price) whole dollars. (or other basis) Form(s) 8949, Part I, combine the result with line 2, column (g) column (g 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions) However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b 8b Totals for all transactions reported on Form(s) 8949 with 9 Totals for all transactions reported on Form(s) 8949 with 10 Totals for all transactions reported on Form(s) 8949 with 11 Gain from Form 4797, Part ; long-term gain from Forms 2439 and 6252; and long-term gain or (loss) Box D checked Box E checked Box F checked from Forms 4684, 6781, and 8824 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 . 12 12 13 Capital gain distributions. See the instructions... .. 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover 13 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then go to Part II on the back For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040) 2017 SCHEDULE D (Form 1040) OMB No. 1545-0074 Capital Gains and Losses Attach to Form 1040 or Form 1040NR Go to www.rs.gov/ScheduleD for instructions and the latest information Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. 2017 Department of the Treasury Internal Revenue Service (99 Attachment Sequence No. 12 Nameis) shown on return Your social security number PartShort-Term Capital Gains and Losses-Assets Held One Year or Less See instructions for how to figure the amounts to enter on the lines below h Gain or loss) Subtractcolumn (e) to gain or loss fromfrom column (d) and Adjustments Proceeds Cost This form may be easier to complete if you round off cents to (sales price) whole dollars. (or other basis) Form/s) 8949, Part,combhethe result with line 2, column (g) column (g) 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions) However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b . 1b Totals for all transactions reported on Form(s) 8949 with 2 3 Box A checked Totals for all transactions reported on Form(s) 8949 with Box B checked Totals for all transactions reported on Form(s) 8949 with Box C checked Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 . . 4 5 6 4 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part Il below. Otherwise, go to Part IlI on the back . . . PartIILong-Term Capital Gains and Losses- Assets Held More Than One Year See instructions for how to figure the amounts to enter on the lines below (h) Gain or (loss) Adjustments Subtract column (e) Proceeds Cost to gain or loss fromfrom column (d) and This form may be easier to complete if you round off cents to (sales price) whole dollars. (or other basis) Form(s) 8949, Part I, combine the result with line 2, column (g) column (g 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions) However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b 8b Totals for all transactions reported on Form(s) 8949 with 9 Totals for all transactions reported on Form(s) 8949 with 10 Totals for all transactions reported on Form(s) 8949 with 11 Gain from Form 4797, Part ; long-term gain from Forms 2439 and 6252; and long-term gain or (loss) Box D checked Box E checked Box F checked from Forms 4684, 6781, and 8824 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 . 12 12 13 Capital gain distributions. See the instructions... .. 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover 13 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then go to Part II on the back For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040) 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started