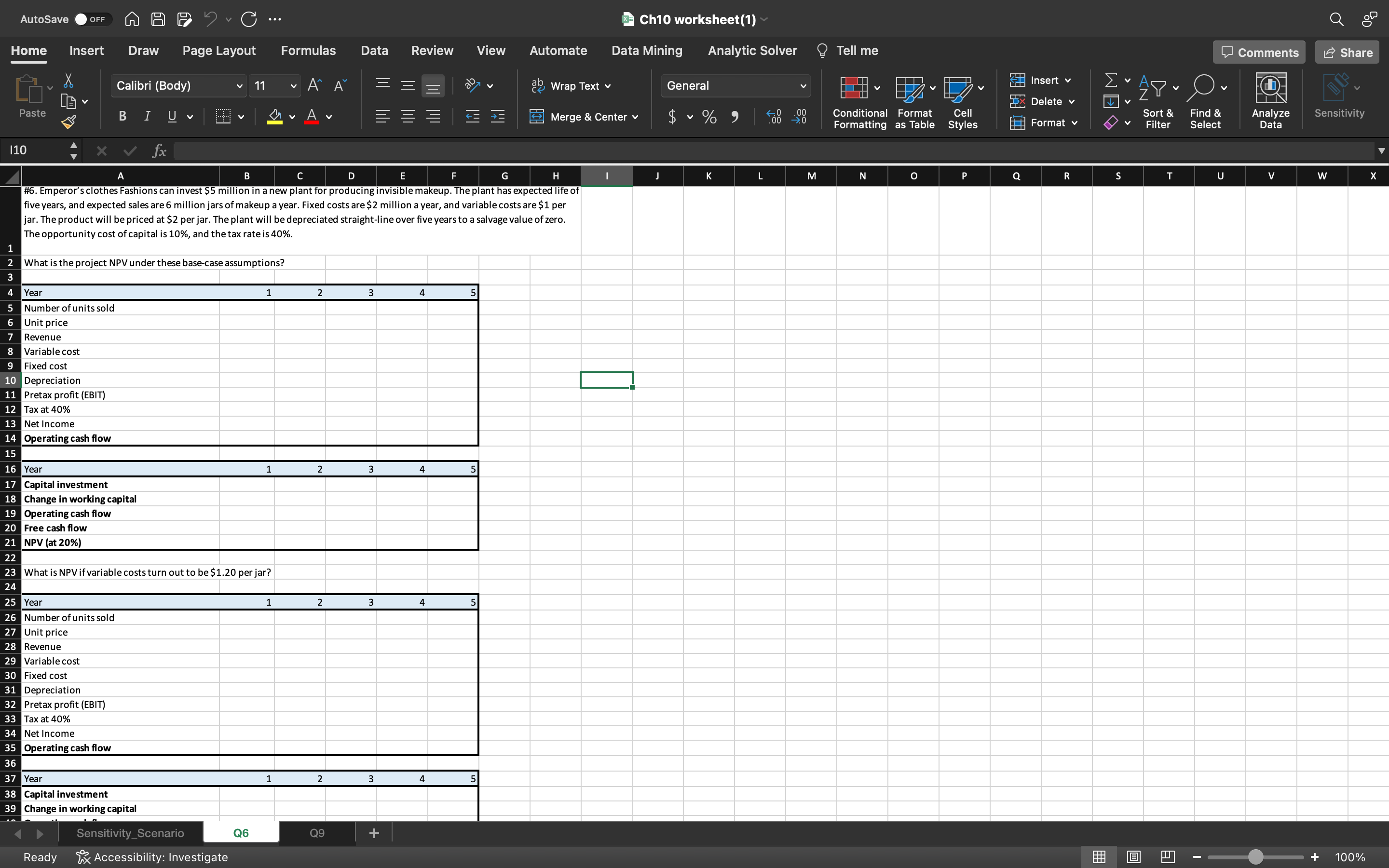

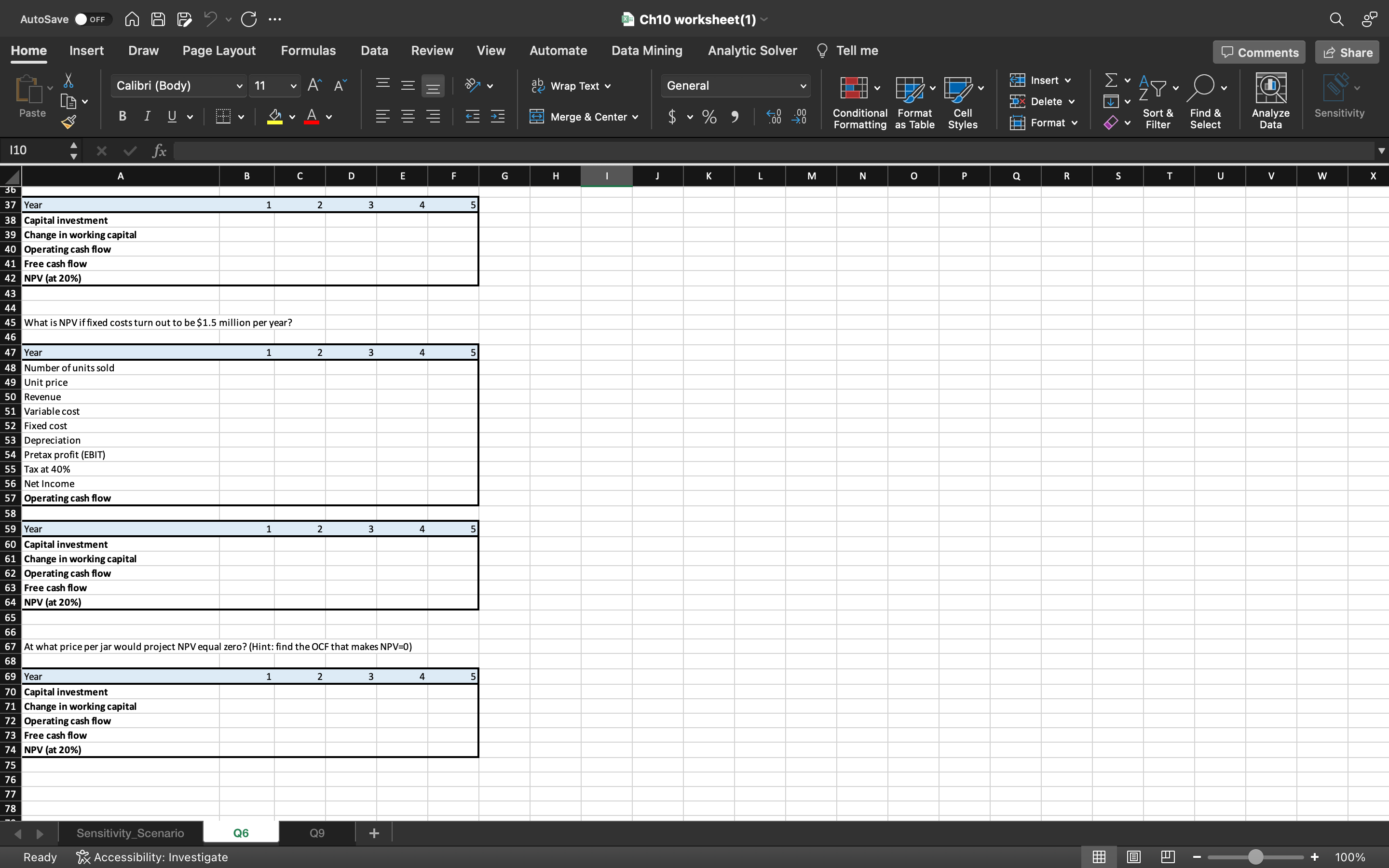

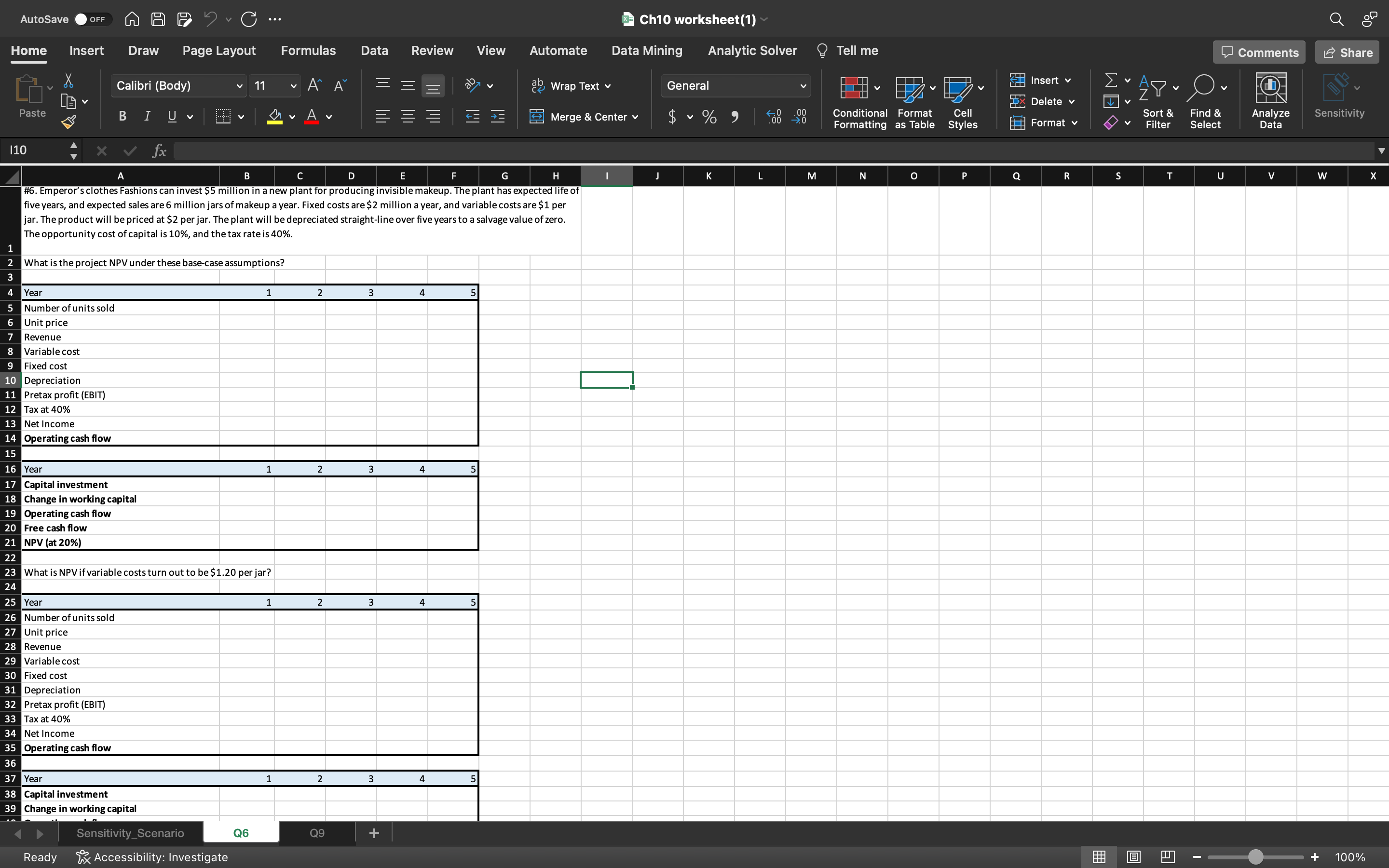

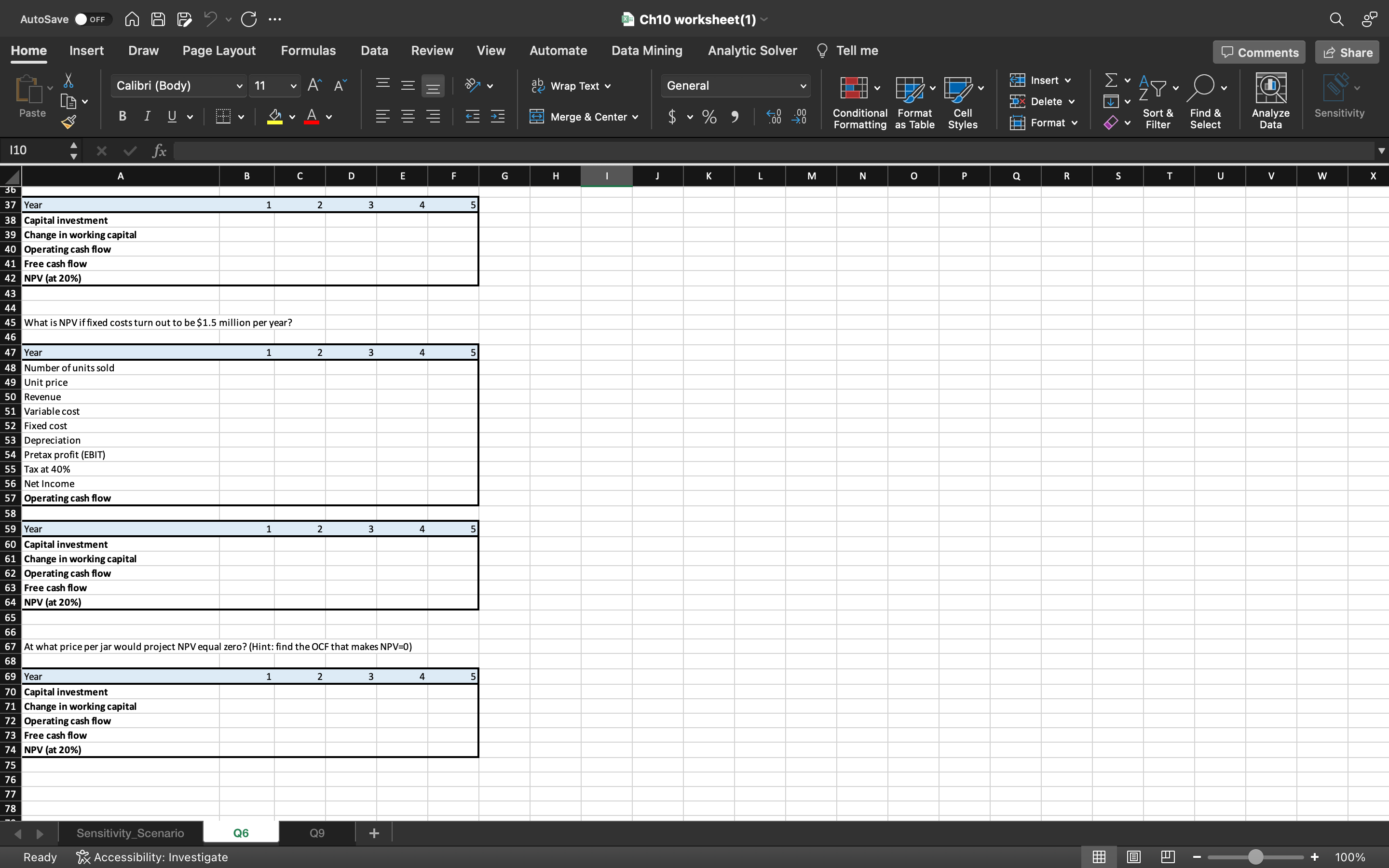

Fill out chart and show work in Excel

Fill out chart and show work in Excel

five years, and expected sales are 6 million jars of makeup a year. Fixed costs are $2 million a year, and variable costs are $1 per jar. The product will be priced at $2 per jar. The plant will be depreciated straight-line over five years to a salvage value of zero. The opportunity cost of capital is 10%, and the tax rate is 40%. Ch10 worksheet(1) Home Insert Draw Page Layout Formulas Data Review View Automate Data Mining Analytic Solver @ Tell me B \begin{tabular}{|l|l|l|l|l|l|l|l} \hline C & D & E & F & G & H & I \end{tabular} K L M N Year 1 2 3 45 Change in working capital Operating cash flow Free cash flow NPV (at 20\%) What is NPV if fixed costs turn out to be $1.5 million per year? Year 1 Number of units sold 2 3 Unit price Revenue Variable cost Fixed cost Depreciation Pretax profit (EBIT) Tax at 40% Net Income Operating cash flow Year Capital investment Change in working capital Operating cash flow Free cash flow NPV (at 20\%) At what price per jar would project NPV equal zero? (Hint: find the OCF that makes NPV=0) Year Capital investment Change in working capital Operating cash flow Free cash flow NPV (at 20\%) five years, and expected sales are 6 million jars of makeup a year. Fixed costs are $2 million a year, and variable costs are $1 per jar. The product will be priced at $2 per jar. The plant will be depreciated straight-line over five years to a salvage value of zero. The opportunity cost of capital is 10%, and the tax rate is 40%. Ch10 worksheet(1) Home Insert Draw Page Layout Formulas Data Review View Automate Data Mining Analytic Solver @ Tell me B \begin{tabular}{|l|l|l|l|l|l|l|l} \hline C & D & E & F & G & H & I \end{tabular} K L M N Year 1 2 3 45 Change in working capital Operating cash flow Free cash flow NPV (at 20\%) What is NPV if fixed costs turn out to be $1.5 million per year? Year 1 Number of units sold 2 3 Unit price Revenue Variable cost Fixed cost Depreciation Pretax profit (EBIT) Tax at 40% Net Income Operating cash flow Year Capital investment Change in working capital Operating cash flow Free cash flow NPV (at 20\%) At what price per jar would project NPV equal zero? (Hint: find the OCF that makes NPV=0) Year Capital investment Change in working capital Operating cash flow Free cash flow NPV (at 20\%)

Fill out chart and show work in Excel

Fill out chart and show work in Excel