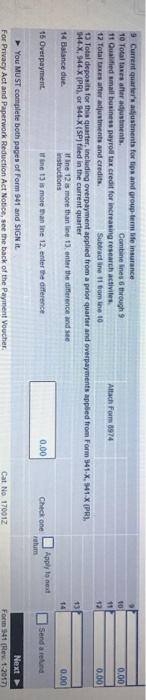

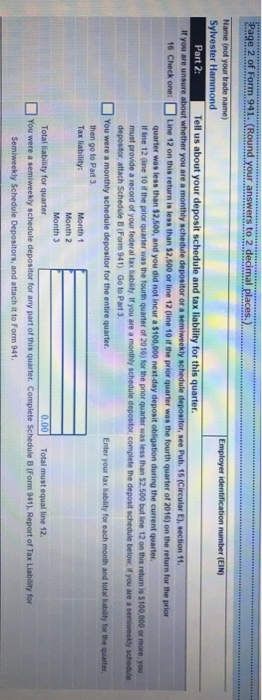

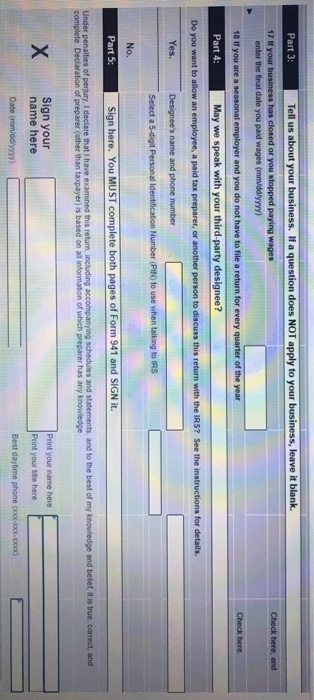

Fill out the blue out lined boxes with arrows.

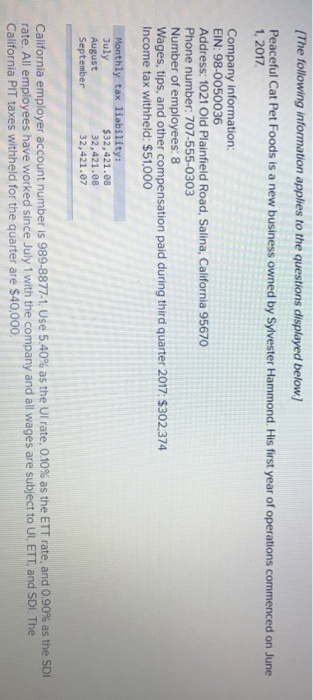

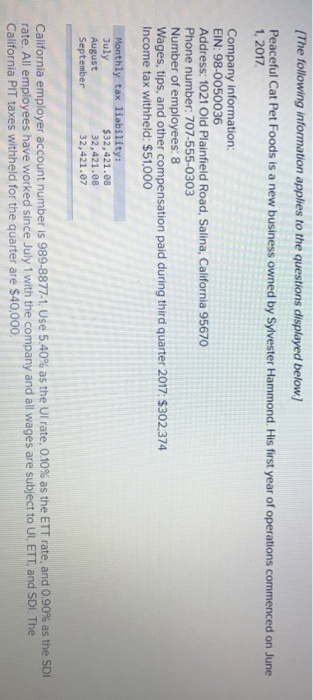

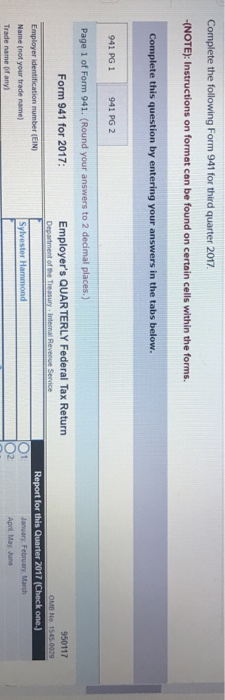

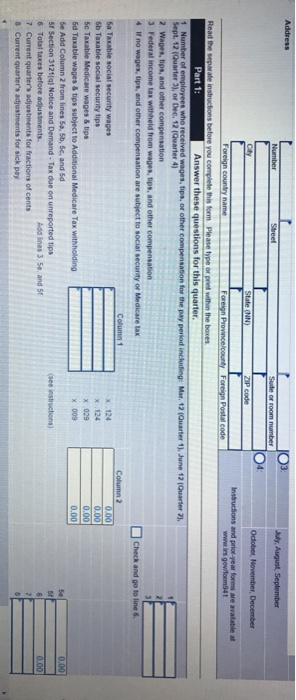

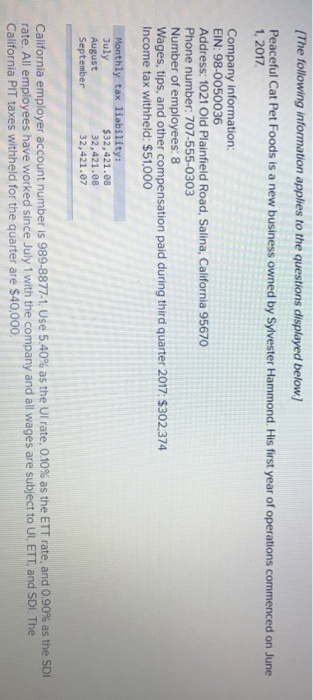

The following information applies to the questions displayed below.) Peaceful Cat Pet Foods is a new business owned by Sylvester Hammond. His first year of operations commenced on June 1, 2017 Company information: EIN: 98-0050036 Address: 1021 Old Plainfield Road, Salina, California 95670 Phone number: 707-555-0303 Number of employees: 8 Wages, tips, and other compensation paid during third quarter 2017: $302.374 Income tax withheld: $51,000 thly tax liability: July August September $32,421.08 32,421.08 32,421.07 California employer account number is 989-88771. Use 5.40% as the ul rate, 010% as the ETT rate, and 090% as the SDI rate. All employees have worked since July 1 with the company and all wages are subject to Ul, ETT, and SDI The California PIT taxes withheld for the quarter are $40.000. Complete the following Form 941 for third quarter 2017 (NOTE): Instructions on format can be found on certain cells within the forms. Complete this question by entering your answers in the tabs below 941 PG 1 941 PG 2 Page 1 of Form 941. (Round your answers to 2 decimal places.) Form 941 for 2017: Employer's QUARTERLY Federal Tax Return 950117 Sylvester Hammond Name (not your trade name) Trade name of any) Apil. May June Check and go to line 6. 5a Taxable social security wages 5b Taxable social security tips 5c Taxable Medicare wages & tips x 009 0.00 for fractions of cents ines 6 through9 activites and credits 15 Overpayment 0.00 Check one Send a refund 941 Total liability for quarter Part 3: Part 4 Sign your The following information applies to the questions displayed below.) Peaceful Cat Pet Foods is a new business owned by Sylvester Hammond. His first year of operations commenced on June 1, 2017 Company information: EIN: 98-0050036 Address: 1021 Old Plainfield Road, Salina, California 95670 Phone number: 707-555-0303 Number of employees: 8 Wages, tips, and other compensation paid during third quarter 2017: $302.374 Income tax withheld: $51,000 thly tax liability: July August September $32,421.08 32,421.08 32,421.07 California employer account number is 989-88771. Use 5.40% as the ul rate, 010% as the ETT rate, and 090% as the SDI rate. All employees have worked since July 1 with the company and all wages are subject to Ul, ETT, and SDI The California PIT taxes withheld for the quarter are $40.000. Complete the following Form 941 for third quarter 2017 (NOTE): Instructions on format can be found on certain cells within the forms. Complete this question by entering your answers in the tabs below 941 PG 1 941 PG 2 Page 1 of Form 941. (Round your answers to 2 decimal places.) Form 941 for 2017: Employer's QUARTERLY Federal Tax Return 950117 Sylvester Hammond Name (not your trade name) Trade name of any) Apil. May June Check and go to line 6. 5a Taxable social security wages 5b Taxable social security tips 5c Taxable Medicare wages & tips x 009 0.00 for fractions of cents ines 6 through9 activites and credits 15 Overpayment 0.00 Check one Send a refund 941 Total liability for quarter Part 3: Part 4 Sign your