Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fill out the charts. Required information Problem 1-7A (Algo) Analyzing transactions and preparing financial statements LO P1, P2 The following information applies to the questions

fill out the charts.

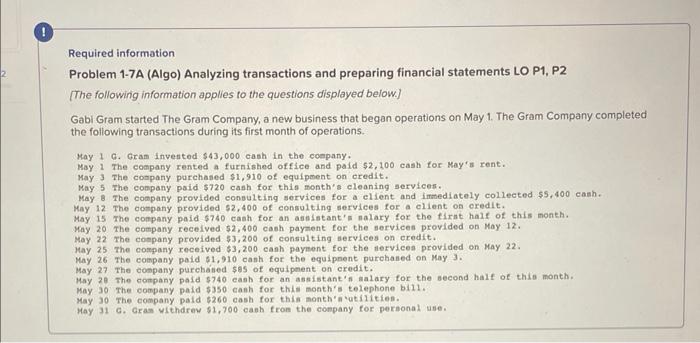

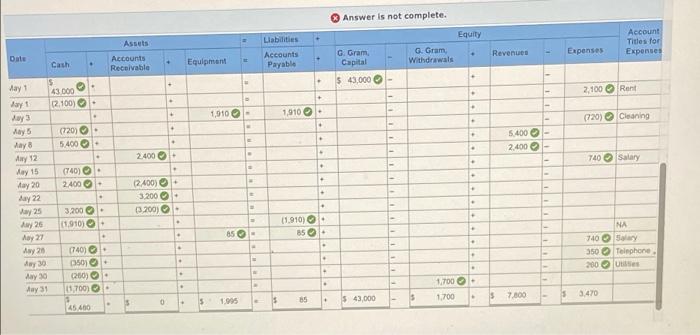

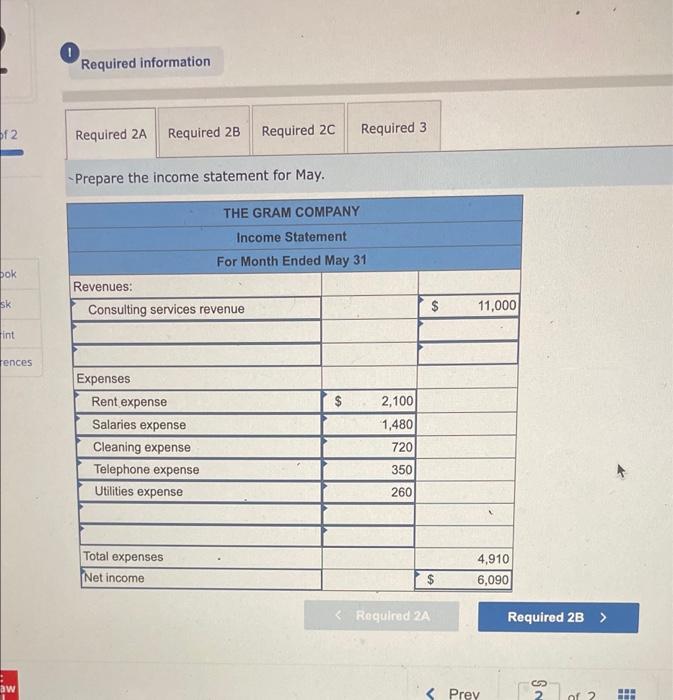

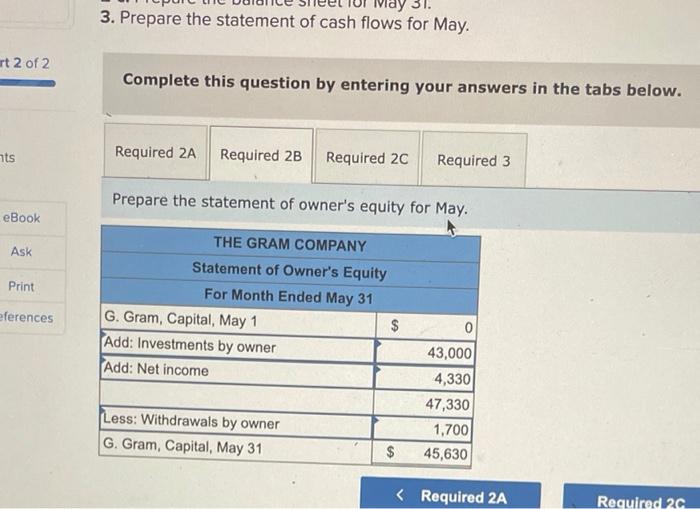

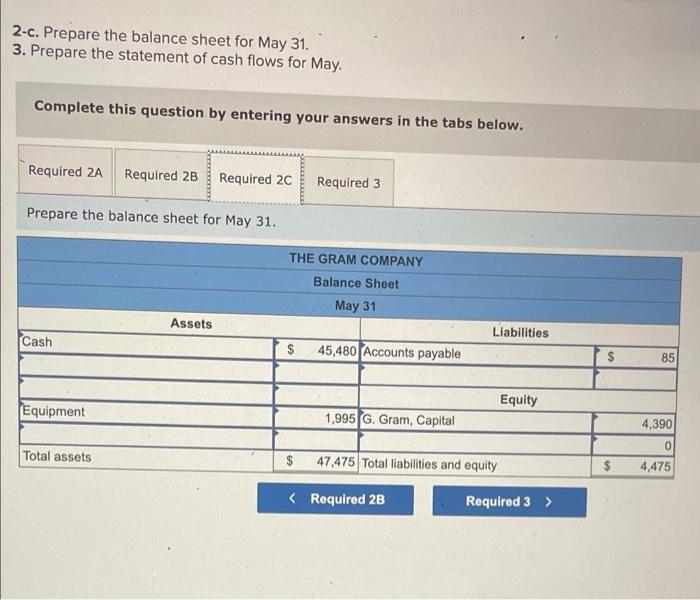

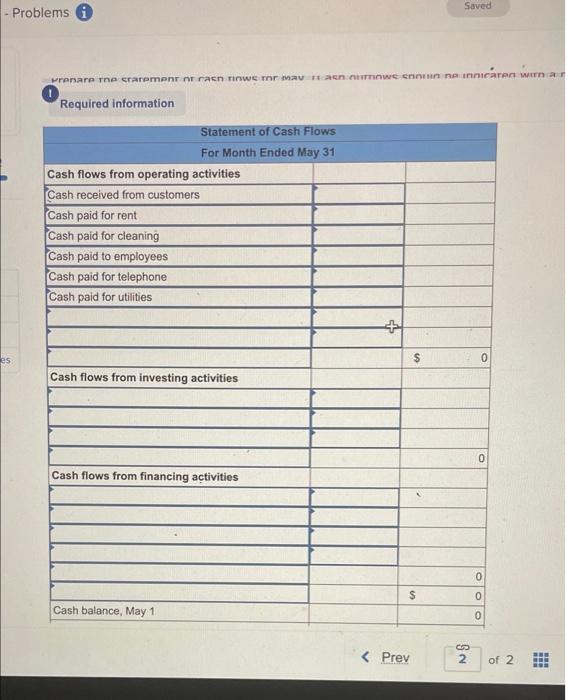

Required information Problem 1-7A (Algo) Analyzing transactions and preparing financial statements LO P1, P2 The following information applies to the questions displayed below.) Gabi Gram started The Gram Company, a new business that began operations on May 1. The Gram Company completed the following transactions during its first month of operations. May 1 G. Gram invested $43,000 cash in the company. May 1 The company rented a furnished office and paid $2,100 cash for May's rent. May 3 The company purchased $1,910 of equipment on credit. May 5 The company paid $720 cash for this month's cleaning services. May & The company provided consulting services for a client and immediately collected $5,400 cash. May 12 The company provided $2,400 of consulting services for a client on credit. May 15 The company paid $740 cash for an assistant's salary for the tirst half of this month. May 20 The company received $2,400 cash payment for the services provided on May 12. May 22 The company provided $3,200 of consulting services on credit. Hay 25 The company received $3,200 canh payment for the services provided on May 22. May 26 The company paid $1,910 cash for the equipment purchased on May 3. May 27 The company purchased ses of equipment on credit. May 20 The company paid $740 cash for an assistant's salary for the second half of this month. May 30 The company paid $350 cash for this month's telephone bill. May 30 The company paid $260 cash for this month's'utilities May 31 G. Gras withdrew $1,700 cash from the company for personal use. Answer is not complete. Equity Account Titles for Expenses Liabilities Accounts Payable Assets Accounts Receivable Expenses Date Revenues G: Gram Withdrawals Cash Equipment G. Gram Capital $ 45,000 . . - . 2,100 Rent 43.000 12.100) . - . 1,910 - 1,910. (720) Cleaning . (720) 5.400 . 5.400 - 2400 - . 2.400 740 Salary (740). 2400 May 1 Jay May 3 ay 8 Any 12 May 15 Aay 20 Lay 22 May 25 May 20 May 27 Any 20 day 30 May 30 ay 31 2.400) 3.200 3.2001 . 3.2001 11.910) (1.910) 85. . 85 - NA 7405 350 Teiphone 200 Us (740) 0501 (260) 0.700) . . 1.7001- 1,700 3.470 $ 0 3 $ . S 85 5 7.800 $ 43,000 . 45.400 0 Required information of 2 Required 2A Required 2B Required 2C Required 3 - Prepare the income statement for May. THE GRAM COMPANY Income Statement For Month Ended May 31 Revenues: Consulting services revenue pok Sk 11,000 fint rences $ Expenses Rent expense Salaries expense Cleaning expense Telephone expense Utilities expense 2,100 1,480 720 350 260 Total expenses 4,910 6,090 Net income : aw Saved - Problems wrenare ne rarement nr racn rinwer Mann wenn na ICAAN Required information Statement of Cash Flows For Month Ended May 31 Cash flows from operating activities Cash received from customers Cash paid for rent Cash paid for cleaning Cash paid to employees Cash paid for telephone Cash paid for utilities + es $ 0 Cash flows from investing activities 0 Cash flows from financing activities 0 $ 0 Cash balance, May 1 0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started