Answered step by step

Verified Expert Solution

Question

1 Approved Answer

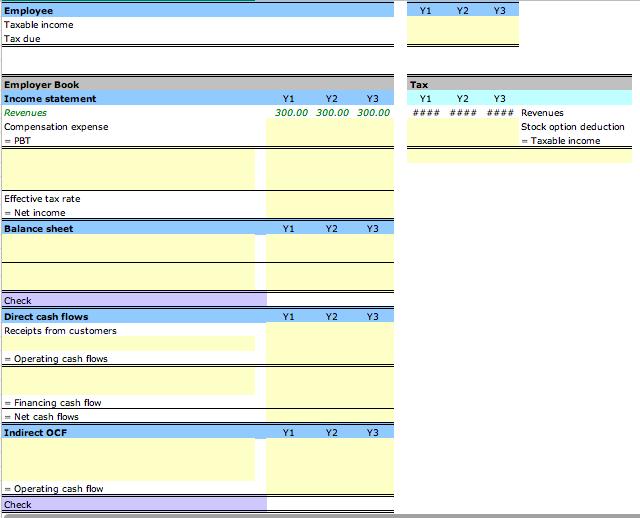

Fill out the Excel below: Assume the following: 1. The award is tax deductible. 2. Taxes due are paid in cash immediately. 3. To avoid

Fill out the Excel below:

Assume the following:

1. The award is tax deductible.

2. Taxes due are paid in cash immediately.

3. To avoid dilution, the company buys back shares in the market on the same date that the employee exercises the options. However, the options are still equity classified because the entity does not commit to buy back shares from the employees. It chooses to buy them back in the market at its discretion.

| Inputs | ||

| Corporate tax rate | 25.00% | |

| Ordinary income tax rate for the employee | 35.00% | |

| Capital gains tax rate for the employee | 20.00% | |

| Option is granted at the beginning of Y1 | ||

| Stock price on the grant date | 50.00 | |

| Exercise price of options | 50.00 | |

| Fair value of the option on the grant date | 16.00 | |

| Vesting period of the options in years | 2.00 | |

| Option is exercised in Y3 | ||

| Stock price on the exercise date | 150.00 |

Employee Taxable income Tax due Employer Book Income statement Revenues Compensation expense = PBT Effective tax rate = Net income Balance sheet Check Direct cash flows Receipts from customers - Operating cash flows - Financing cash flow -Net cash flows Indirect OCF Operating cash flow Check Y1 Y2 Y3 300.00 300.00 300.00 Y1 Y1 Y1 Y2 Y2 Y2 Y3 Y3 Y3 Y1 Tax Y2 Y3 Y1 Y2 Y3 #### #### #### Revenues Stock option deduction - Taxable income Employee Taxable income Tax due Employer Book Income statement Revenues Compensation expense = PBT Effective tax rate = Net income Balance sheet Check Direct cash flows Receipts from customers - Operating cash flows - Financing cash flow -Net cash flows Indirect OCF Operating cash flow Check Y1 Y2 Y3 300.00 300.00 300.00 Y1 Y1 Y1 Y2 Y2 Y2 Y3 Y3 Y3 Y1 Tax Y2 Y3 Y1 Y2 Y3 #### #### #### Revenues Stock option deduction - Taxable income

Step by Step Solution

★★★★★

3.56 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

The Excel below is filled out based on the inputs and assumptions provided Employee Y2 Y3 Y1 Taxable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started