Answered step by step

Verified Expert Solution

Question

1 Approved Answer

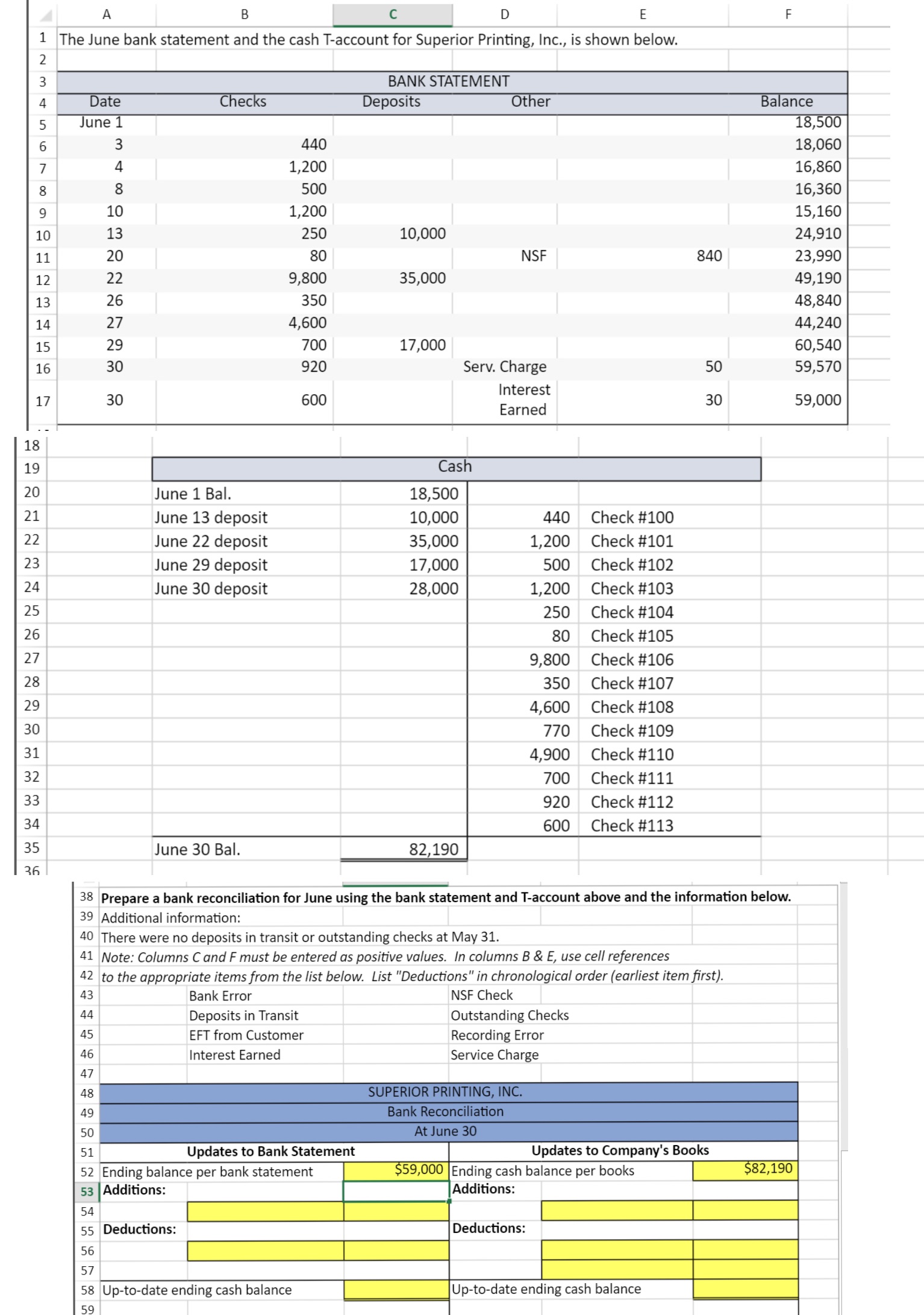

Fill out the yellow blanks A B C D E 1 The June bank statement and the cash T-account for Superior Printing, Inc., is shown

Fill out the yellow blanks

A B C D E 1 The June bank statement and the cash T-account for Superior Printing, Inc., is shown below. 2 F 34567 8 O Date June 1 Checks BANK STATEMENT Deposits Other Balance 18,500 3 440 18,060 4 1,200 16,860 8 500 16,360 9 10 1,200 15,160 10 13 250 10,000 24,910 11 20 80 NSF 840 23,990 12 22 9,800 35,000 49,190 13 26 350 48,840 14 27 4,600 44,240 15 29 700 17,000 60,540 16 30 920 Serv. Charge 50 59,570 Interest 17 30 600 30 59,000 Earned 18 19 Cash 20 June 1 Bal. 18,500 21 June 13 deposit 10,000 440 Check #100 22 June 22 deposit 35,000 1,200 Check #101 23 June 29 deposit 17,000 500 Check #102 24 June 30 deposit 28,000 1,200 Check #103 25 250 Check #104 26 80 Check #105 27 9,800 Check #106 28 350 Check #107 29 4,600 Check #108 30 770 Check #109 31 4,900 Check #110 32 700 Check #111 33 920 Check #112 34 600 Check #113 35 June 30 Bal. 82,190 36 38 Prepare a bank reconciliation for June using the bank statement and T-account above and the information below. 39 Additional information: 40 There were no deposits in transit or outstanding checks at May 31. 41 Note: Columns C and F must be entered as positive values. In columns B & E, use cell references 42 to the appropriate items from the list below. List "Deductions" in chronological order (earliest item first). Interest Earned 43 44 Bank Error Deposits in Transit 45 EFT from Customer 46 47 48 49 50 51 Updates to Bank Statement NSF Check Outstanding Checks Recording Error Service Charge SUPERIOR PRINTING, INC. Bank Reconciliation At June 30 Updates to Company's Books $59,000 Ending cash balance per books $82,190 52 Ending balance per bank statement 53 Additions: 54 55 Deductions: 56 Additions: Deductions: 57 58 Up-to-date ending cash balance Up-to-date ending cash balance 59

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The adjusted bank balance adjusted book balance is 81330 Bank Reconcili...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started