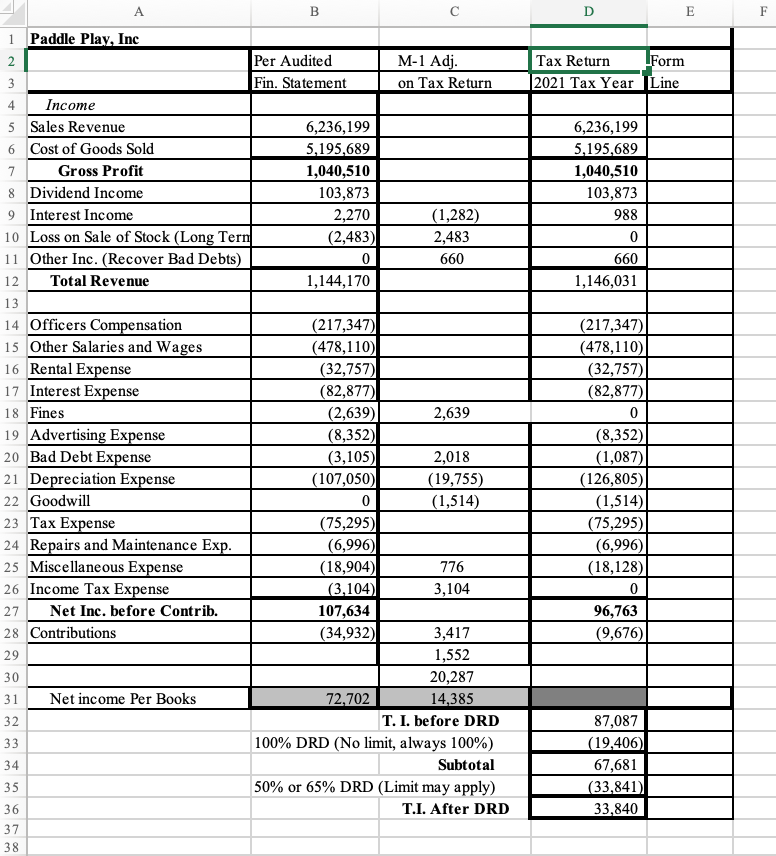

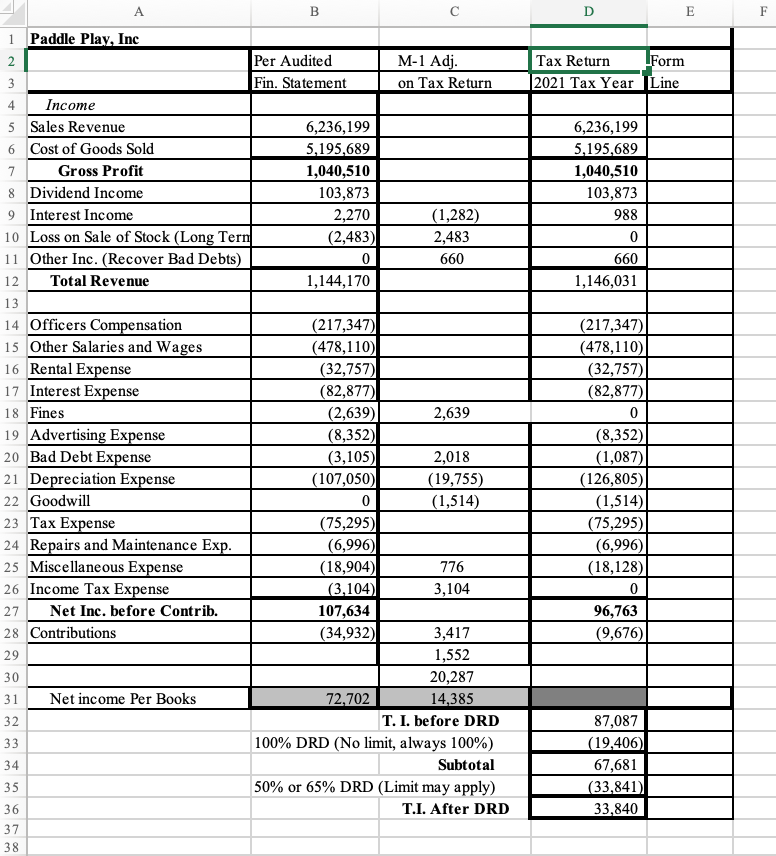

Fill the form line with the information you have.

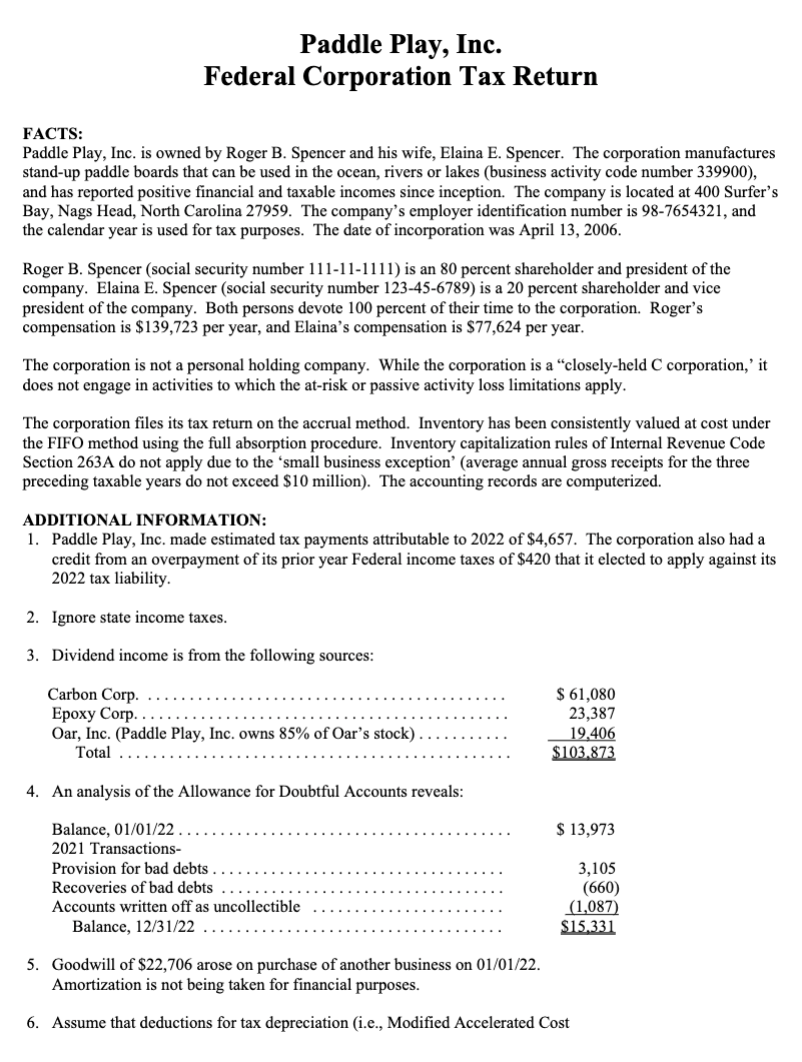

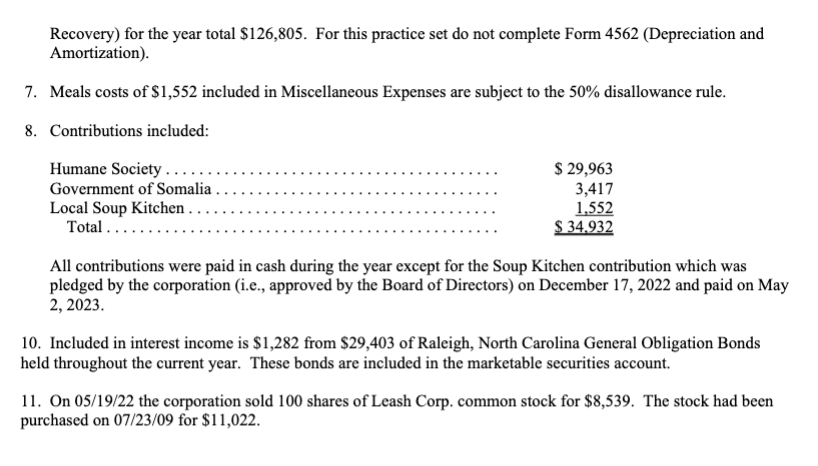

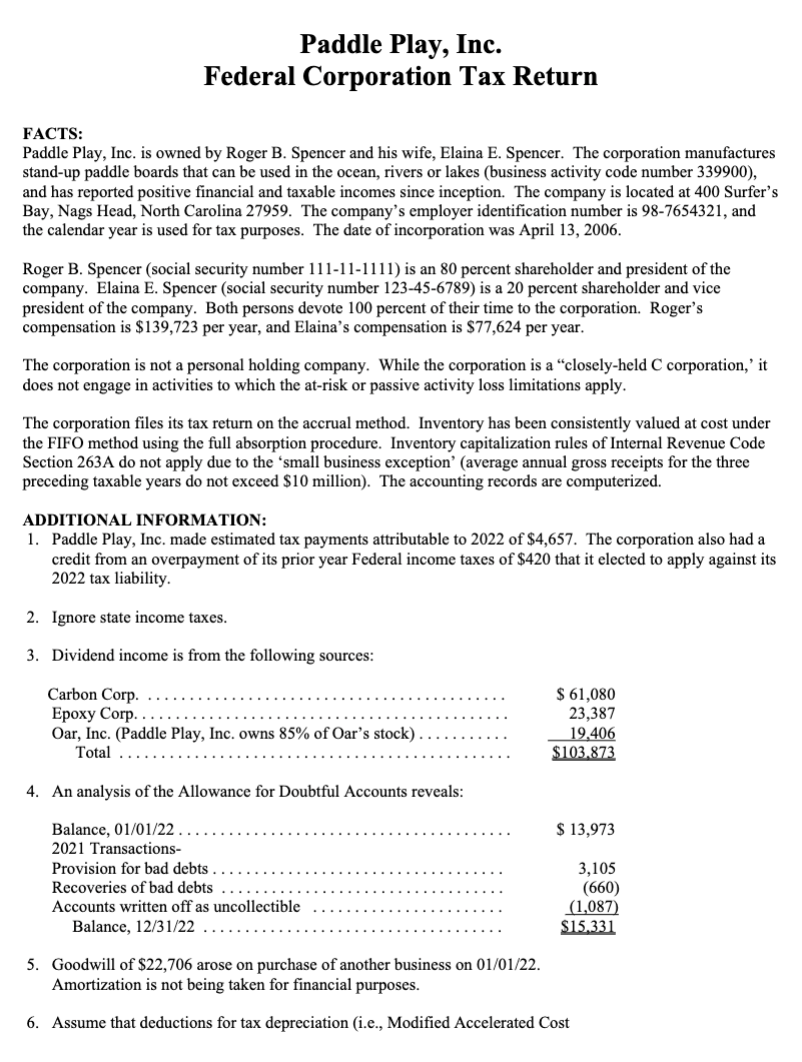

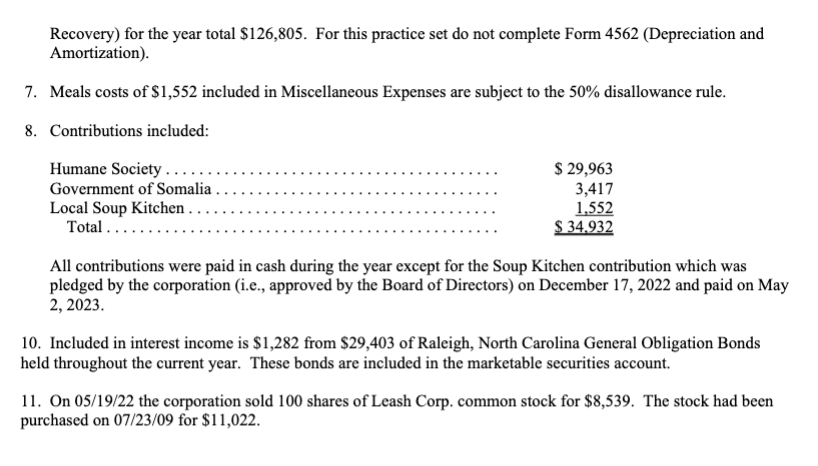

Paddle Play, Inc. Federal Corporation Tax Return FACTS: Paddle Play, Inc. is owned by Roger B. Spencer and his wife, Elaina E. Spencer. The corporation manufactures stand-up paddle boards that can be used in the ocean, rivers or lakes (business activity code number 339900), and has reported positive financial and taxable incomes since inception. The company is located at 400 Surfer's Bay, Nags Head, North Carolina 27959. The company's employer identification number is 98-7654321, and the calendar year is used for tax purposes. The date of incorporation was April 13, 2006. Roger B. Spencer (social security number 111-11-1111) is an 80 percent shareholder and president of the company. Elaina E. Spencer (social security number 123-45-6789) is a 20 percent shareholder and vice president of the company. Both persons devote 100 percent of their time to the corporation. Roger's compensation is $139,723 per year, and Elaina's compensation is $77,624 per year. The corporation is not a personal holding company. While the corporation is a "closely-held C corporation,' it does not engage in activities to which the at-risk or passive activity loss limitations apply. The corporation files its tax return on the accrual method. Inventory has been consistently valued at cost under the FIFO method using the full absorption procedure. Inventory capitalization rules of Internal Revenue Code Section 263A do not apply due to the 'small business exception' (average annual gross receipts for the three preceding taxable years do not exceed $10 million). The accounting records are computerized. ADDITIONAL INFORMATION: 1. Paddle Play, Inc. made estimated tax payments attributable to 2022 of $4,657. The corporation also had a credit from an overpayment of its prior year Federal income taxes of $420 that it elected to apply against its 2022 tax liability. 2. Ignore state income taxes. 3. Dividend income is from the following sources: 4. An analysis of the Allowance for Doubtful Accounts reveals: 5. Goodwill of $22,706 arose on purchase of another business on 01/01/22. Amortization is not being taken for financial purposes. 6. Assume that deductions for tax depreciation (i.e., Modified Accelerated Cost Recovery) for the year total $126,805. For this practice set do not complete Form 4562 (Depreciation and Amortization). 7. Meals costs of $1,552 included in Miscellaneous Expenses are subject to the 50% disallowance rule. 8. Contributions included: All contributions were paid in cash during the year except for the Soup Kitchen contribution which was pledged by the corporation (i.e., approved by the Board of Directors) on December 17, 2022 and paid on May 2,2023. 10. Included in interest income is $1,282 from $29,403 of Raleigh, North Carolina General Obligation Bonds held throughout the current year. These bonds are included in the marketable securities account. 11. On 05/19/22 the corporation sold 100 shares of Leash Corp. common stock for $8,539. The stock had been purchased on 07/23/09 for $11,022. Paddle Play, Inc. Federal Corporation Tax Return FACTS: Paddle Play, Inc. is owned by Roger B. Spencer and his wife, Elaina E. Spencer. The corporation manufactures stand-up paddle boards that can be used in the ocean, rivers or lakes (business activity code number 339900), and has reported positive financial and taxable incomes since inception. The company is located at 400 Surfer's Bay, Nags Head, North Carolina 27959. The company's employer identification number is 98-7654321, and the calendar year is used for tax purposes. The date of incorporation was April 13, 2006. Roger B. Spencer (social security number 111-11-1111) is an 80 percent shareholder and president of the company. Elaina E. Spencer (social security number 123-45-6789) is a 20 percent shareholder and vice president of the company. Both persons devote 100 percent of their time to the corporation. Roger's compensation is $139,723 per year, and Elaina's compensation is $77,624 per year. The corporation is not a personal holding company. While the corporation is a "closely-held C corporation,' it does not engage in activities to which the at-risk or passive activity loss limitations apply. The corporation files its tax return on the accrual method. Inventory has been consistently valued at cost under the FIFO method using the full absorption procedure. Inventory capitalization rules of Internal Revenue Code Section 263A do not apply due to the 'small business exception' (average annual gross receipts for the three preceding taxable years do not exceed $10 million). The accounting records are computerized. ADDITIONAL INFORMATION: 1. Paddle Play, Inc. made estimated tax payments attributable to 2022 of $4,657. The corporation also had a credit from an overpayment of its prior year Federal income taxes of $420 that it elected to apply against its 2022 tax liability. 2. Ignore state income taxes. 3. Dividend income is from the following sources: 4. An analysis of the Allowance for Doubtful Accounts reveals: 5. Goodwill of $22,706 arose on purchase of another business on 01/01/22. Amortization is not being taken for financial purposes. 6. Assume that deductions for tax depreciation (i.e., Modified Accelerated Cost Recovery) for the year total $126,805. For this practice set do not complete Form 4562 (Depreciation and Amortization). 7. Meals costs of $1,552 included in Miscellaneous Expenses are subject to the 50% disallowance rule. 8. Contributions included: All contributions were paid in cash during the year except for the Soup Kitchen contribution which was pledged by the corporation (i.e., approved by the Board of Directors) on December 17, 2022 and paid on May 2,2023. 10. Included in interest income is $1,282 from $29,403 of Raleigh, North Carolina General Obligation Bonds held throughout the current year. These bonds are included in the marketable securities account. 11. On 05/19/22 the corporation sold 100 shares of Leash Corp. common stock for $8,539. The stock had been purchased on 07/23/09 for $11,022