Question

Fill the table Our simple example considers a firm that engages in business for five periods. In each period, the firm makes an initial investment

Fill the table

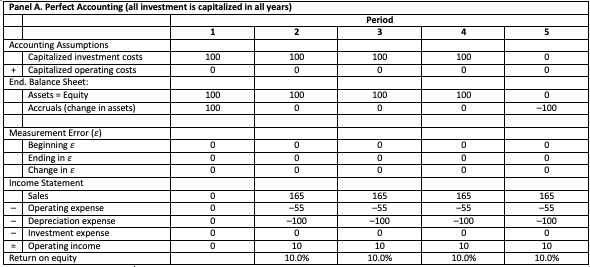

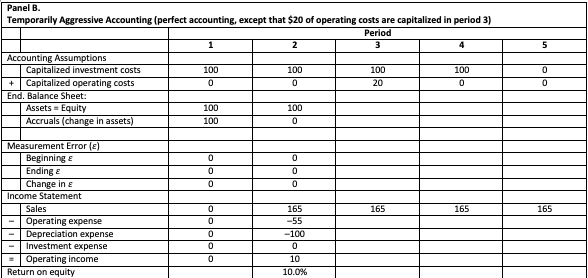

Our simple example considers a firm that engages in business for five periods. In each period, the firm makes an initial investment of $100. This investment generates sales in the next period, and nothing thereafter. The proceeds from these sales are assumed to be collected in cash, and the firm also is assumed to incur additional cash operating costs in generating these sales. Cash sales are assumed to be 165 percent of the prior periods real investment and cash operating costs are assumed to be 55 percent of the prior periods real investment. These are the only consequences of the investment. Thus, the firm invests $100 in each period in order to generate a net cash inflow of $110 (=$165 $55) in the next period. The economic income on this investment is therefore $110 $100 = $10 and the economic rate of return is $10/$100 = 10%. We will assume that the firm invests $100 in each of the first four periods, and then ceases to make any further investments in period five and beyond. We also assume that any surplus cash is immediately distributed to the owners of the firm (i.e. $10 in periods 25). Required: Fill the missing numbers in Panels B E.

Requirements

- Operating income in Period 3 of Panel B

- Return on equity (ROE)* in Period 4 of Panel B (ROI= operating income divided by beginning equity)

- ROE in Period 3 of Panel C

- ROE in Period 4 of Panel C

- Let's assume that you are appointed as a CEO in the beginning of Period 3. The board sets a compensation scheme where you are entitled to a bonus compensation that is computed as ROE * 10,000. In case of a loss year, no bonus compensation is paid. Which of the different settings (from A to E) gives you the highest cumulative undiscounted (i.e., time value of money is ignored) bonus compensation over the period 3-5?

Panel B. Temporarily Aggressive Accounting (perfect accounting, except that $20 of operating costs are capitalized in period 3) Panel B. Temporarily Aggressive Accounting (perfect accounting, except that $20 of operating costs are capitalized in period 3)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started