Answered step by step

Verified Expert Solution

Question

1 Approved Answer

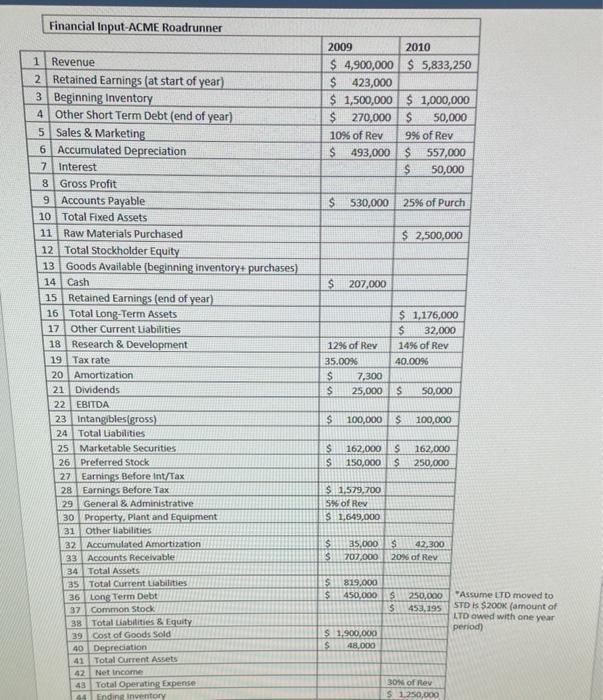

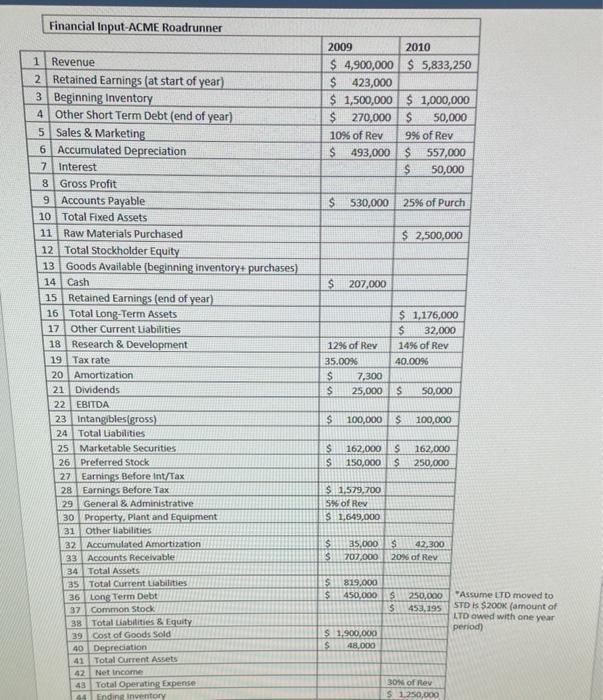

filling in the blanks ? Financial Input-ACME Roadrunner 2009 2010 $ 4,900,000 $ 5,833,250 $ 423,000 $ 1,500,000 $1,000,000 $ 270,000 $ 50,000 10% of

filling in the blanks ?

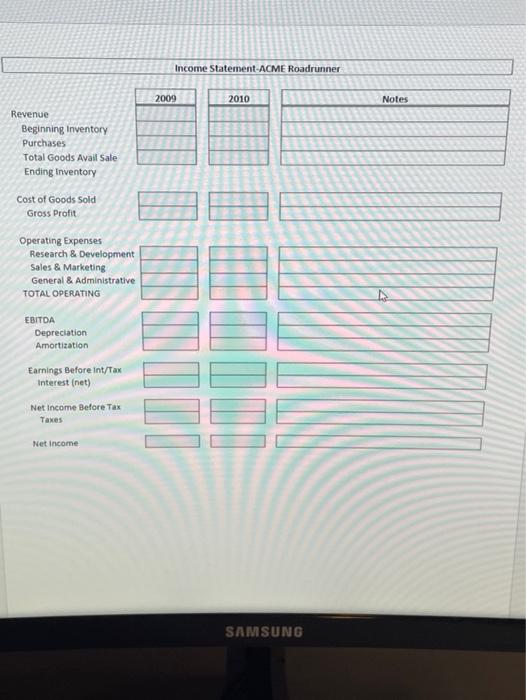

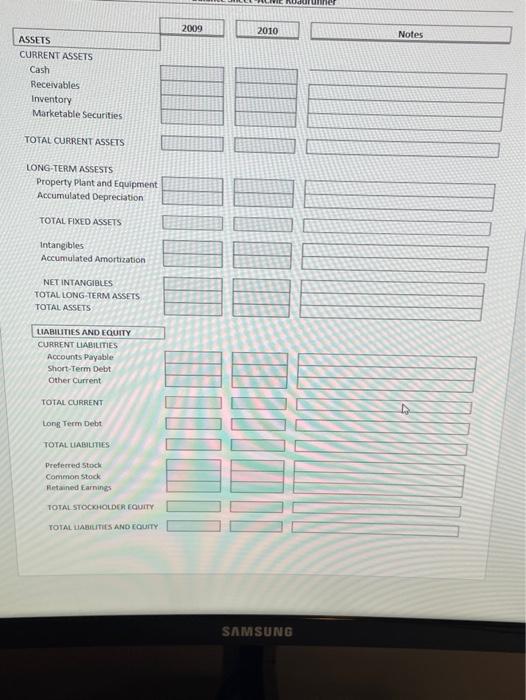

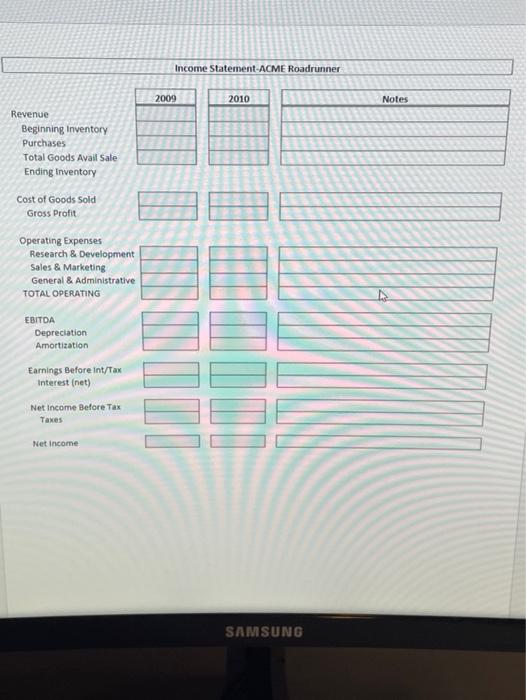

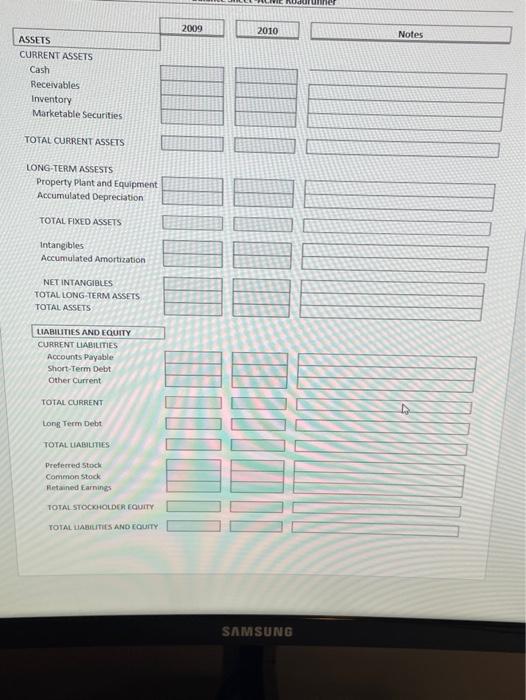

Financial Input-ACME Roadrunner 2009 2010 $ 4,900,000 $ 5,833,250 $ 423,000 $ 1,500,000 $1,000,000 $ 270,000 $ 50,000 10% of Rev 9% of Rev $ 493,000 $ 557,000 $ 50,000 $ 530,000 2596 of Purch $ 2,500,000 S 207,000 1 Revenue 2 Retained Earnings (at start of year) 3 Beginning Inventory 4 Other Short Term Debt (end of year) 5 Sales & Marketing 6 Accumulated Depreciation 7 Interest 8 Gross Profit 9 Accounts Payable 10 Total Fixed Assets 11 Raw Materials Purchased 12 Total Stockholder Equity 13 Goods Available (beginning inventory+ purchases) 14 Cash 15 Retained Earnings (end of year) 16 Total Long-Term Assets 17 Other Current Liabilities 18 Research & Development 19 Tax rate 20 Amortization 21 Dividends 22 EBITDA 23 Intangibles gross) 24 Total Liabilities 25 Marketable Securities 26 Preferred Stock 27 Earnings Before Int/Tax 28 Earnings Before Tax 29 General & Administrative 30 Property. Plant and Equipment 31 Other liabilities 32. Accumulated Amortization 33 Accounts Receivable 34 Total Assets 35 Total Current Liabilities 36 Long Term Debt 37 Common Stock 38 Total Liabilities & Equity 39 Cost of Goods Sold 40 Depreciation 41 Total Current Assets 42 Net Income 43 Total Operating Expense Ending inventory $ 1,176,000 $ 32,000 12% of Rev 14% of Rev 35.00% 40.00% $ 7,300 $ 25,000 $ 50,000 $ 100,000 $ 100,000 $ s 162,000 $ 150,000 S 162,000 250,000 $ 1,579,700 5% of Rey $ 1,649,000 $ $ 35,000 707.000 $ 42,300 20% of Rey $ $ 819,000 450,000 S $ 250,000 453,195 Assume LTD moved to STD is $200K (amount of LTD owed with one year period S 1.900,000 $ 48.000 30 of Rov $ 1.250,000 44 Income Statement-ACME Roadrunner 2009 2010 Notes Revenue Beginning Inventory Purchases Total Goods Avail Sale Ending inventory Cost of Goods sold Gross Profit Operating Expenses Research & Development Sales & Marketing General & Administrative TOTAL OPERATING EBITDA Depreciation Amortization Earnings Before int/Tax Interest (net) Net Income Before Tax Taxes III Net Income SAMSUNG 2009 2010 Notes ASSETS CURRENT ASSETS Cash Receivables Inventory Marketable Securities TOTAL CURRENT ASSETS LONG-TERM ASSESTS Property Plant and Equipment Accumulated Depreciation TOTAL FIXED ASSETS Intangibles Accumulated Amortization NET INTANGIBLES TOTAL LONG-TERM ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts Payable Short-Term Debt Other Current TOTAL CURRENT Long Term Debt II HIZOUT TOTAL LIABILITIES Preferred Stock Common Stock Retained Earnings TOTALSTOCKHOLDER EQUITY TOTAL LIABILITIES AND EQUITY SAMSUNG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started