Answered step by step

Verified Expert Solution

Question

1 Approved Answer

+ Filter Builder OFF D E F G H Cell Highlighter SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V

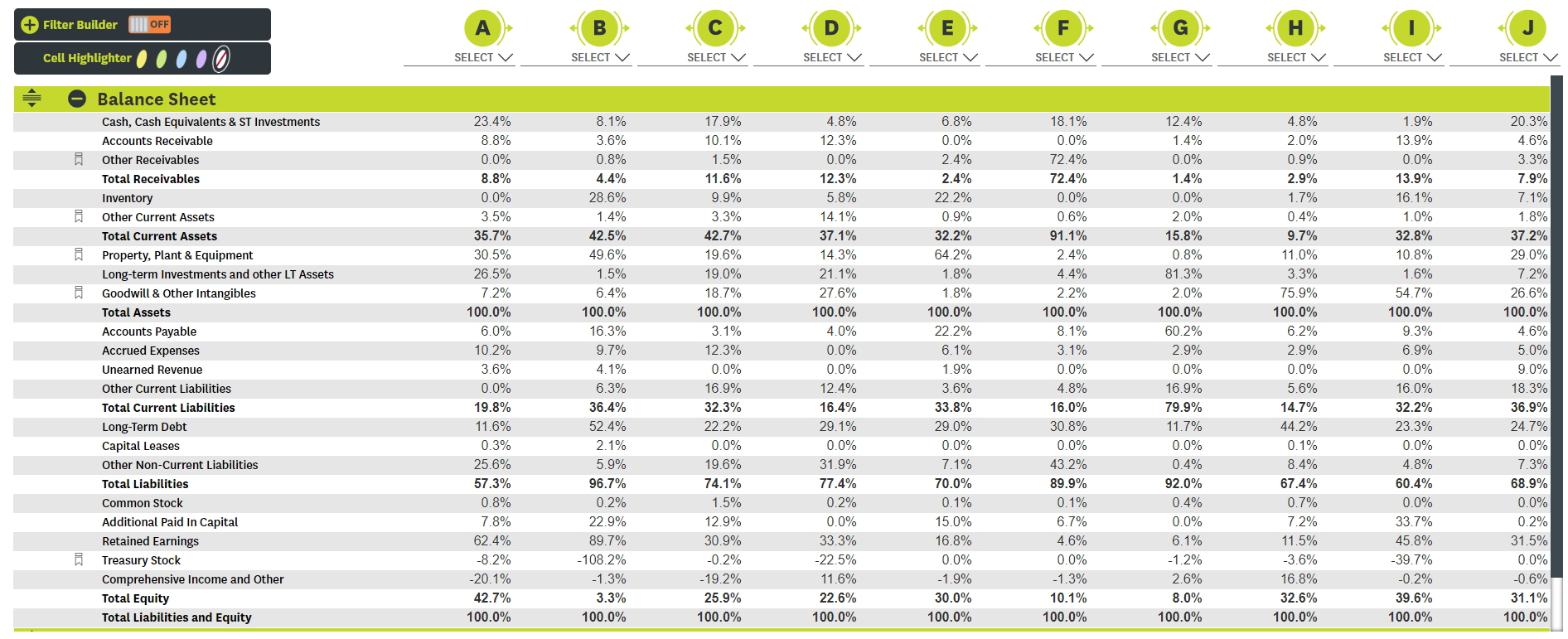

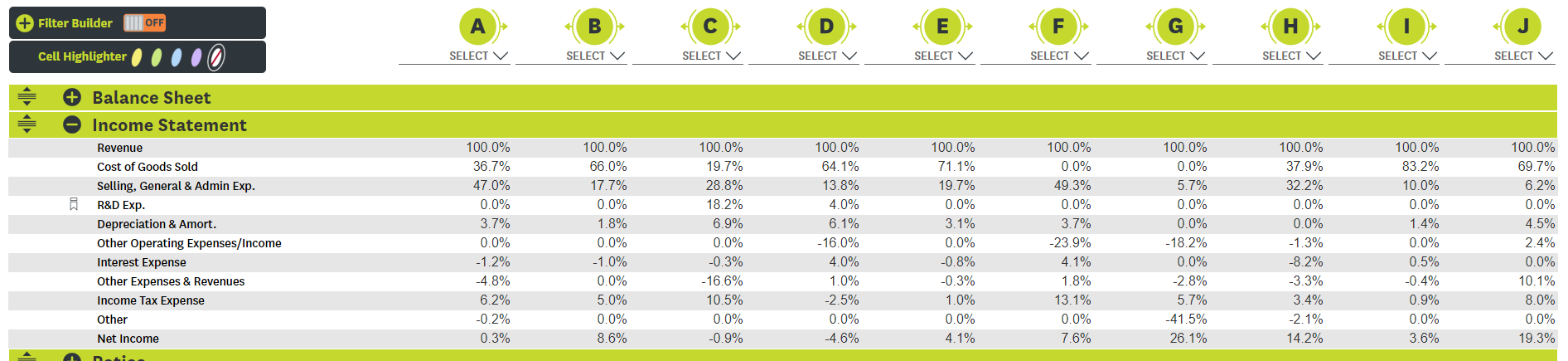

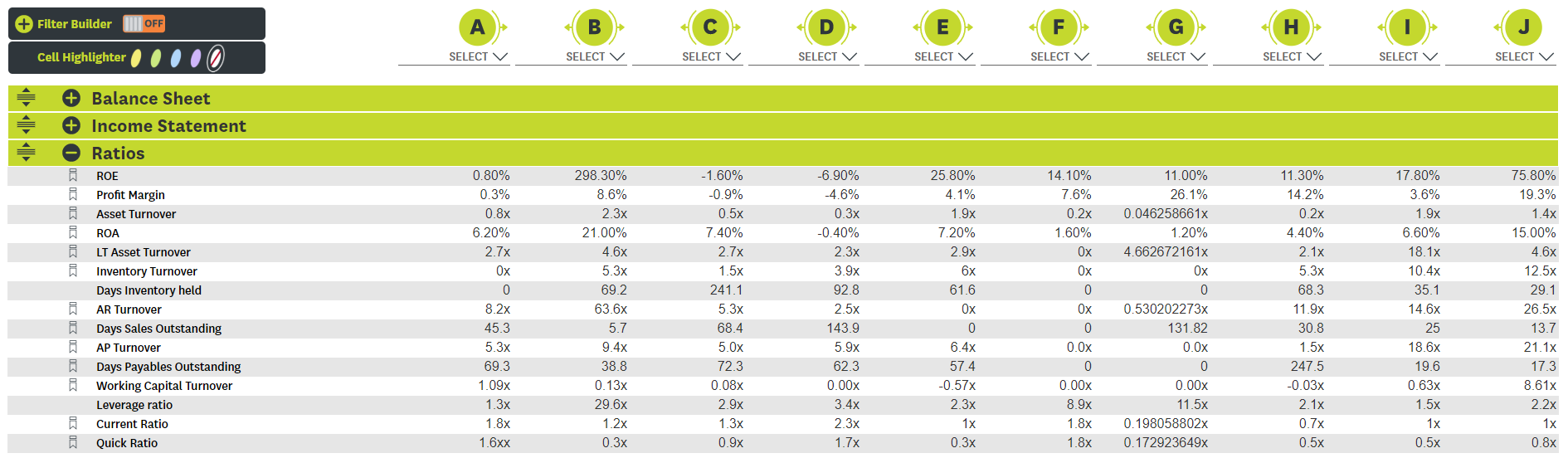

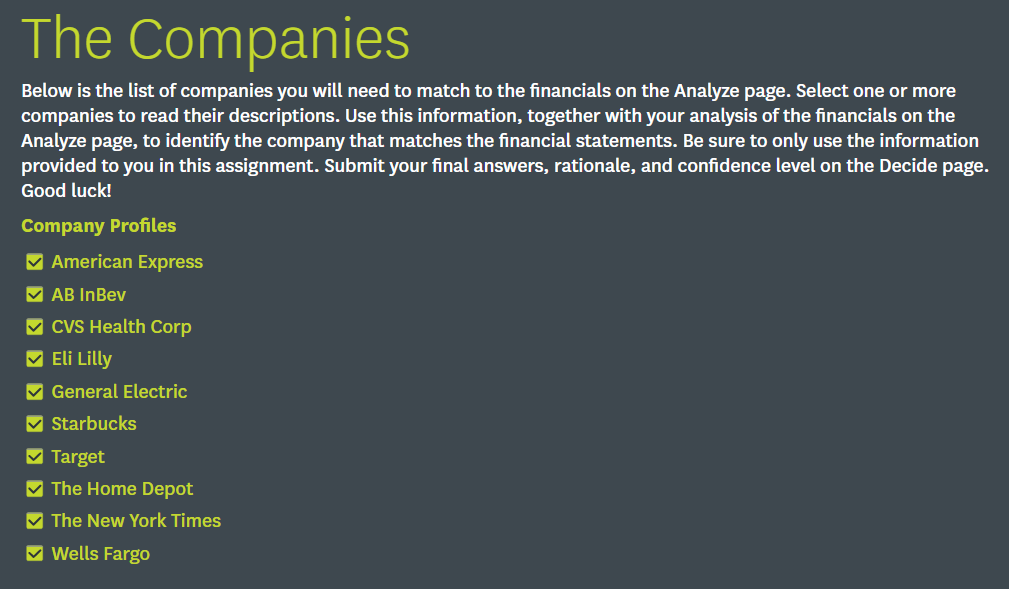

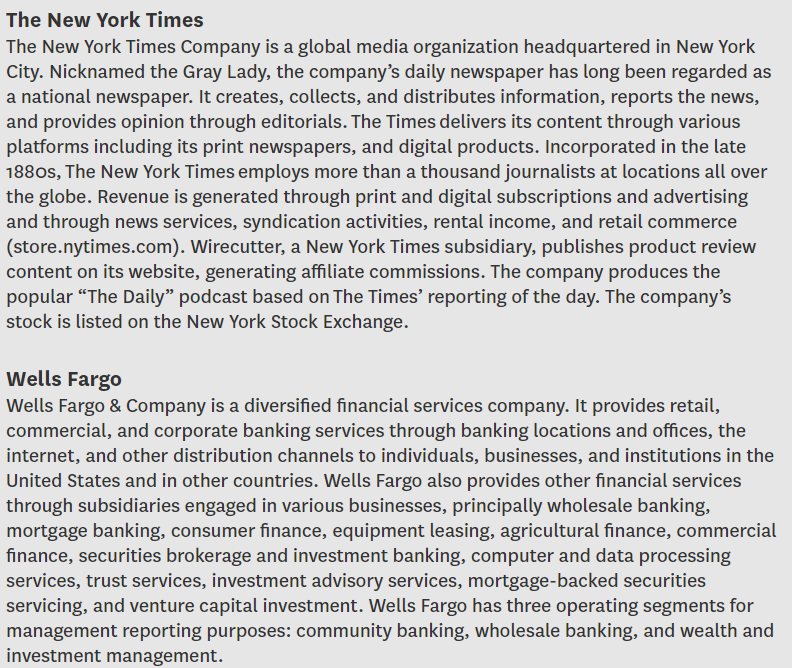

+ Filter Builder OFF D E F G H Cell Highlighter SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V Balance Sheet Cash, Cash Equivalents & ST Investments Accounts Receivable Other Receivables Total Receivables Inventory Other Current Assets Total Current Assets Property, Plant & Equipment Long-term Investments and other LT Assets Goodwill & Other Intangibles Total Assets Accounts Payable Accrued Expenses Unearned Revenue Other Current Liabilities Total Current Liabilities Long-Term Debt Capital Leases Other Non-Current Liabilities Total Liabilities Common Stock Additional Paid In Capital Retained Earnings Treasury Stock Comprehensive Income and Other Total Equity Total Liabilities and Equity 23.4% 8.8% 0.0% 8.8% 0.0% 3.5% 35.7% 30.5% 26.5% 7.2% 100.0% 6.0% 10.2% 3.6% 0.0% 19.8% 11.6% 0.3% 25.6% 57.3% 0.8% 7.8% 62.4% -8.2% -20.1% 42.7% 100.0% 8.1% 3.6% 0.8% 4.4% 28.6% 1.4% 42.5% 49.6% 1.5% 6.4% 100.0% 16.3% 9.7% 4.1% 6.3% 36.4% 52.4% 2.1% 5.9% 96.7% 0.2% 22.9% 89.7% -108.2% -1.3% 3.3% 100.0% 17.9% 10.1% 1.5% 11.6% 9.9% 3.3% 42.7% 19.6% 19.0% 18.7% 100.0% 3.1% 12.3% 0.0% 16.9% 32.3% 22.2% 0.0% 19.6% 74.1% 1.5% 12.9% 30.9% -0.2% -19.2% 25.9% 100.0% 4.8% 12.3% 0.0% 12.3% 5.8% 14.1% 37.1% 14.3% 21.1% 27.6% 100.0% 4.0% 0.0% 0.0% 12.4% 16.4% 29.1% 0.0% 31.9% 77.4% 0.2% 0.0% 33.3% -22.5% 11.6% 22.6% 100.0% 6.8% 0.0% 2.4% 2.4% 22.2% 0.9% 32.2% 64.2% 1.8% 1.8% 100.0% 22.2% 6.1% 1.9% 3.6% 33.8% 29.0% 0.0% 7.1% 70.0% 0.1% 15.0% 16.8% 0.0% -1.9% 30.0% 100.0% 18.1% 0.0% 72.4% 72.4% 0.0% 0.6% 91.1% 2.4% 4.4% 2.2% 100.0% 8.1% 3.1% 0.0% 12.4% 1.4% 0.0% 1.4% 0.0% 2.0% 15.8% 0.8% 81.3% 2.0% 100.0% 60.2% 2.9% 0.0% 16.9% 79.9% 11.7% 0.0% 0.4% 92.0% 0.4% 0.0% 6.1% -1.2% 2.6% 8.0% 100.0% 4.8% 2.0% 0.9% 2.9% 1.7% 0.4% 9.7% 11.0% 3.3% 75.9% 100.0% 6.2% 2.9% 0.0% 5.6% 14.7% 44.2% 0.1% 8.4% 67.4% 0.7% 7.2% 11.5% -3.6% 16.8% 32.6% 100.0% 1.9% 13.9% 0.0% 13.9% 16.1% 1.0% 32.8% 10.8% 1.6% 54.7% 100.0% 9.3% 6.9% 0.0% 16.0% 32.2% 23.3% 0.0% 4.8% 60.4% 0.0% 33.7% 45.8% -39.7% -0.2% 39.6% 100.0% 20.3% 4.6% 3.3% 7.9% 7.1% 1.8% 37.2% 29.0% 7.2% 26.6% 100.0% 4.6% 5.0% 9.0% 18.3% 36.9% 24.7% 0.0% 7.3% 68.9% 0.0% 0.2% 31.5% 0.0% -0.6% 31.1% 100.0% 4.8% 16.0% 30.8% 0.0% 43.2% 89.9% 0.1% 6.7% 4.6% 0.0% -1.3% 10.1% 100.0% + Filter Builder OFF A B C D E F G H J Cell Highlighter SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V + Balance Sheet Income Statement 100.0% 19.7% 28.8% 18.2% Revenue Cost of Goods Sold Selling, General & Admin Exp. R&D Exp. Depreciation & Amort. Other Operating Expenses/Income Interest Expense Other Expenses & Revenues Income Tax Expense Other Net Income 6.9% 100.0% 36.7% 47.0% 0.0% 3.7% 0.0% -1.2% -4.8% 6.2% -0.2% 0.3% 100.0% 66.0% 17.7% 0.0% 1.8% 0.0% -1.0% 0.0% 5.0% 0.0% 8.6% 100.0% 64.1% 13.8% 4.0% 6.1% -16.0% 4.0% 1.0% -2.5% 0.0% -4.6% 0.0% -0.3% - 16.6% 10.5% 0.0% -0.9% 100.0% 71.1% 19.7% 0.0% 3.1% 0.0% -0.8% -0.3% 1.0% 0.0% 4.1% 100.0% 0.0% 49.3% 0.0% 3.7% -23.9% 4.1% 1.8% 13.1% 0.0% 7.6% 100.0% 37.9% 32.2% 0.0% 0.0% -1.3% -8.2% -3.3% 100.0% 0.0% 5.7% 0.0% 0.0% -18.2% 0.0% -2.8% 5.7% -41.5% 26.1% 100.0% 83.2% 10.0% 0.0% 1.4% 0.0% 0.5% -0.4% 0.9% 0.0% 3.6% 100.0% 69.7% 6.2% 0.0% 4.5% 2.4% 0.0% 10.1% 8.0% 0.0% 19.3% 3.4% -2.1% 14.2% + Filter Builder OFF B D E F G - H J Cell Highlighter 0 SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V + Balance Sheet 14.10% 7.6% 6 0.2x 0.80% 0.3% 0.8x 6.20% 2.7x + Income Statement Ratios ROE Profit Margin Asset Turnover ROA LT Asset Turnover Inventory Turnover Days Inventory held AR Turnover Days Sales Outstanding AP Turnover Days Payables Outstanding Working Capital Turnover Leverage ratio Current Ratio Quick Ratio 0 298.30% 8.6% 2.3x 21.00% 4.6x 5.3x 69.2 63.6x 5.7 9.4x 38.8 0.13x 29.6x 1.2x 0.3x 8.2x 45.3 5.3x 69.3 1.09x 1.3x 1.8x 1.6xx -1.60% -0.9% 0.5x 7.40% 2.7x 1.5x 241.1 5.3x 68.4 5.Ox 72.3 0.08x 2.9x 1.3x 0.9x -6.90% -4.6% 0.3x -0.40% 2.3x 3.9x 92.8 2.5x 143.9 5.9x 62.3 0.00x 3.4x 2.3x 1.7x 25.80% 4.1% 1.9x 7.20% 2.9x 6x 61.6 0 6.4x 57.4 -0.57x 2.3x 1x 0.3x 11.30% 14.2% 0.2x 4.40% 2.1x 5.3x 68.3 11.9x 30.8 1.5x 247.5 -0.03x 2.1x 0.7x 1.60% Ox 0 0 0.0x 0 0.00x 8.9x 1.8x 1.8x 11.00% 26.1% 0.046258661x 1.20% 4.662672161% Ox 0 0.530202273x 131.82 0.0x 0 0.00x 11.5x 0.198058802x 0.172923649x 17.80% 3.6% 1.9x 6.60% 18.1x 10.4x 35.1 14.6x 25 18.6x 19.6 0.63x 1.5x 1x 0.5x 75.80% 19.3% 1.4x 15.00% 4.6x 12.5x 29.1 26.5x 13.7 21.1x 17.3 8.61x 2.2x 1x 0.8x 0.5x The Companies Below is the list of companies you will need to match to the financials on the Analyze page. Select one or more companies to read their descriptions. Use this information, together with your analysis of the financials on the Analyze page, to identify the company that matches the financial statements. Be sure to only use the information provided to you in this assignment. Submit your final answers, rationale, and confidence level on the Decide page. Good luck! Company Profiles American Express AB InBev CVS Health Corp Eli Lilly General Electric Starbucks Target The Home Depot The New York Times Wells Fargo American Express American Express, founded in 1850, is a Manhattan-based financial services firm organized as a bank holding company. A Dow component and Big Board listed, American Express is a financial force known around the globe, providing services to consumers, small businesses, mid-size firms, and large corporations. Its wide-ranging array of services includes credit cards and other financing products, network services, point-of-sale marketing and information services, expense management, and travel-related services. AB InBev Anheuser-Busch InBev is a leading global brewer with over 500 beer brands sold in more than 150 countries. It is one of the largest consumer products companies worldwide and has a significant market share in the beer industry. Anheuser-Busch InBev remains a profitable company in its industry. The company addresses market demand by maintaining a strong beer brand portfolio with global brands, multi-brands, and local brands. Anheuser-Busch InBev developed a cost-connect-win model to minimize cost, maximize sales, connect with consumers, and win market share for long-term growth. In recent years, the company has invested in additional brewing, packaging, and distribution capabilities in multiple countries to meet future market demand. Anheuser-Busch InBev has accumulated a significant amount of goodwill from various acquisitions. Although the company has a strong cash position, Anheuser-Busch InBev acknowledges that the company may face financial risks in the future and even a potential downgrading of its credit ratings because of the level of debt the company has incurred. CVS Health Corp Headquartered in the state of Rhode Island in the United States, CVS Health Corporation is an immense force in the health care industry. It is the largest integrated pharmacy health care company in the country and works with consumers, health care providers, and managers of health care benefit plans. In addition to operating thousands of pharmacy retail locations, CVS is a leading pharmacy benefits manager serving the needs of millions of plan members. It also operates more than a thousand health care walk-in clinics located in its stores. CVS pharmacies are located throughout the United States and in some Target stores. Beyond prescriptions, CVS retail locations sell over-the-counter medications, beauty products and cosmetics, personal care products, convenience foods, photo finishing services, and greeting cards. The company has created branded services such as CVS Caremark, MinuteClinic, and ExtraCare. Eli Lilly Eli Lilly and Company is a leading drug manufacturing company with two distinct business segments, human pharmaceutical products and animal health products. The company sells its products in over 125 countries and it operates in the United States, Puerto Rico, and 14 other countries. Eli Lilly owns a large number of domestic and international facilities. The company faces strong global competition, and as a result it invests heavily in research and development. The company employs more than 8,000 employees in its R&D operation. In addition, Eli Lilly owns a large number of patents to maintain its competitive edge. The company has been consistent in paying its shareholders cash dividends. In recent years, the company has repurchased a large amount of its common stock. General Electric General Electric Company is a global industrial conglomerate specializing in software- defined machines and solutions that are connected, responsive, and predictive. With products and services ranging from aircraft engines, power generation, and oil and gas production equipment to medical imaging, financing, and industrial products, GE serves customers in over 180 countries and employs approximately 313,000 people worldwide. Since its incorporation in 1892, GE has developed or acquired new technologies and services that have considerably broadened and changed the scope of its activities. The company operates through eight segments: power, oil and gas, aviation, healthcare, transportation, appliances and lighting, and GE Capital. GE's manufacturing operations are carried out at 191 manufacturing plants located in 38 states in the United States and Puerto Rico and at 348 manufacturing plants located in 43 other countries. Starbucks Starbucks Corporation, headquartered in Seattle, Washington, owns one of the world's most recognizable brands. Serving millions of customers each day in markets worldwide, Starbucks is a coffee roaster, marketer, and retailer of specialty coffees, teas, other beverages, and complimentary food and snack offerings. It is also a manufacturer of consumer packaged goods such as coffee beans, teas, and ready-to-drink beverages that are sold in grocery stores and by large merchandisers. Starbucks's products are purchased by foodservice companies that distribute to businesses, hospitals, hotels, colleges and universities, and restaurants. Starbucks stores are situated in high-traffic and very visible locations. In addition to the company owned stores, Starbucks Corporation owns and operates coffee roasting, manufacturing, warehousing, and distribution facilities in various US locations and in China, the Netherlands, and Thailand. The company has developed relationships with coffee producers and operates farmer support centers to promote best coffee production practices. Target Target Corporation is a mass merchant retailer that offers everyday essentials and fashionable, differentiated merchandise at discounted prices. A significant portion of Target's sales come from national branded merchandise, while approximately one-third comes from Target's own exclusive brands. Target operates over 1,800 stores and 41 distribution centers in the United States. Target's stores fall into two main categories, large stores that offer a full line of food items comparable to traditional supermarkets and smaller stores that offer curated general merchandise and food assortments. As a part of its effort to expand its ecommerce and delivery options, in December 2017, Target acquired Shipt, an online delivery service platform. Target also has an agreement with CVS Pharmacy, which enables CVS to operate pharmacies and clinics inside Target stores under a perpetual operating agreement. The Home Depot The Home Depot is a big box retailer that offers a wide assortment of building materials, home improvement products, lawn and garden items, and dcor. Home Depot also provides a number of services including home improvement installation services and tool and equipment rental. In 2017, Home Depot was the largest retailer in the home improvement category and operated 2,284 stores throughout the United States, Canada, and Mexico. Home Depot's large stores average over 128,000 square feet, including both the main store and garden centers, and stock between 30,000 and 40,000 products each year. Home Depot also maintains a network of distribution and fulfillment centers and serves its ecommerce channel through its main website and those of supplemental products. Home Depots stores, product offerings, and services cater to do-it-yourself (DIY) and do-it-for-me (DIEM) customers and professionals, including contractors and specialty tradespeople. The New York Times The New York Times Company is a global media organization headquartered in New York City. Nicknamed the Gray Lady, the company's daily newspaper has long been regarded as a national newspaper. It creates, collects, and distributes information, reports the news, and provides opinion through editorials. The Times delivers its content through various platforms including its print newspapers, and digital products. Incorporated in the late 1880s, The New York Times employs more than a thousand journalists at locations all over the globe. Revenue is generated through print and digital subscriptions and advertising and through news services, syndication activities, rental income, and retail commerce (store.nytimes.com). Wirecutter, a New York Times subsidiary, publishes product review content on its website, generating affiliate commissions. The company produces the popular "The Daily podcast based on The Times' reporting of the day. The company's stock is listed on the New York Stock Exchange. Wells Fargo Wells Fargo & Company is a diversified financial services company. It provides retail, commercial, and corporate banking services through banking locations and offices, the internet, and other distribution channels to individuals, businesses, and institutions in the United States and in other countries. Wells Fargo also provides other financial services through subsidiaries engaged in various businesses, principally wholesale banking, mortgage banking, consumer finance, equipment leasing, agricultural finance, commercial finance, securities brokerage and investment banking, computer and data processing services, trust services, investment advisory services, mortgage-backed securities servicing, and venture capital investment. Wells Fargo has three operating segments for management reporting purposes: community banking, wholesale banking, and wealth and investment management. + Filter Builder OFF D E F G H Cell Highlighter SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V Balance Sheet Cash, Cash Equivalents & ST Investments Accounts Receivable Other Receivables Total Receivables Inventory Other Current Assets Total Current Assets Property, Plant & Equipment Long-term Investments and other LT Assets Goodwill & Other Intangibles Total Assets Accounts Payable Accrued Expenses Unearned Revenue Other Current Liabilities Total Current Liabilities Long-Term Debt Capital Leases Other Non-Current Liabilities Total Liabilities Common Stock Additional Paid In Capital Retained Earnings Treasury Stock Comprehensive Income and Other Total Equity Total Liabilities and Equity 23.4% 8.8% 0.0% 8.8% 0.0% 3.5% 35.7% 30.5% 26.5% 7.2% 100.0% 6.0% 10.2% 3.6% 0.0% 19.8% 11.6% 0.3% 25.6% 57.3% 0.8% 7.8% 62.4% -8.2% -20.1% 42.7% 100.0% 8.1% 3.6% 0.8% 4.4% 28.6% 1.4% 42.5% 49.6% 1.5% 6.4% 100.0% 16.3% 9.7% 4.1% 6.3% 36.4% 52.4% 2.1% 5.9% 96.7% 0.2% 22.9% 89.7% -108.2% -1.3% 3.3% 100.0% 17.9% 10.1% 1.5% 11.6% 9.9% 3.3% 42.7% 19.6% 19.0% 18.7% 100.0% 3.1% 12.3% 0.0% 16.9% 32.3% 22.2% 0.0% 19.6% 74.1% 1.5% 12.9% 30.9% -0.2% -19.2% 25.9% 100.0% 4.8% 12.3% 0.0% 12.3% 5.8% 14.1% 37.1% 14.3% 21.1% 27.6% 100.0% 4.0% 0.0% 0.0% 12.4% 16.4% 29.1% 0.0% 31.9% 77.4% 0.2% 0.0% 33.3% -22.5% 11.6% 22.6% 100.0% 6.8% 0.0% 2.4% 2.4% 22.2% 0.9% 32.2% 64.2% 1.8% 1.8% 100.0% 22.2% 6.1% 1.9% 3.6% 33.8% 29.0% 0.0% 7.1% 70.0% 0.1% 15.0% 16.8% 0.0% -1.9% 30.0% 100.0% 18.1% 0.0% 72.4% 72.4% 0.0% 0.6% 91.1% 2.4% 4.4% 2.2% 100.0% 8.1% 3.1% 0.0% 12.4% 1.4% 0.0% 1.4% 0.0% 2.0% 15.8% 0.8% 81.3% 2.0% 100.0% 60.2% 2.9% 0.0% 16.9% 79.9% 11.7% 0.0% 0.4% 92.0% 0.4% 0.0% 6.1% -1.2% 2.6% 8.0% 100.0% 4.8% 2.0% 0.9% 2.9% 1.7% 0.4% 9.7% 11.0% 3.3% 75.9% 100.0% 6.2% 2.9% 0.0% 5.6% 14.7% 44.2% 0.1% 8.4% 67.4% 0.7% 7.2% 11.5% -3.6% 16.8% 32.6% 100.0% 1.9% 13.9% 0.0% 13.9% 16.1% 1.0% 32.8% 10.8% 1.6% 54.7% 100.0% 9.3% 6.9% 0.0% 16.0% 32.2% 23.3% 0.0% 4.8% 60.4% 0.0% 33.7% 45.8% -39.7% -0.2% 39.6% 100.0% 20.3% 4.6% 3.3% 7.9% 7.1% 1.8% 37.2% 29.0% 7.2% 26.6% 100.0% 4.6% 5.0% 9.0% 18.3% 36.9% 24.7% 0.0% 7.3% 68.9% 0.0% 0.2% 31.5% 0.0% -0.6% 31.1% 100.0% 4.8% 16.0% 30.8% 0.0% 43.2% 89.9% 0.1% 6.7% 4.6% 0.0% -1.3% 10.1% 100.0% + Filter Builder OFF A B C D E F G H J Cell Highlighter SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V + Balance Sheet Income Statement 100.0% 19.7% 28.8% 18.2% Revenue Cost of Goods Sold Selling, General & Admin Exp. R&D Exp. Depreciation & Amort. Other Operating Expenses/Income Interest Expense Other Expenses & Revenues Income Tax Expense Other Net Income 6.9% 100.0% 36.7% 47.0% 0.0% 3.7% 0.0% -1.2% -4.8% 6.2% -0.2% 0.3% 100.0% 66.0% 17.7% 0.0% 1.8% 0.0% -1.0% 0.0% 5.0% 0.0% 8.6% 100.0% 64.1% 13.8% 4.0% 6.1% -16.0% 4.0% 1.0% -2.5% 0.0% -4.6% 0.0% -0.3% - 16.6% 10.5% 0.0% -0.9% 100.0% 71.1% 19.7% 0.0% 3.1% 0.0% -0.8% -0.3% 1.0% 0.0% 4.1% 100.0% 0.0% 49.3% 0.0% 3.7% -23.9% 4.1% 1.8% 13.1% 0.0% 7.6% 100.0% 37.9% 32.2% 0.0% 0.0% -1.3% -8.2% -3.3% 100.0% 0.0% 5.7% 0.0% 0.0% -18.2% 0.0% -2.8% 5.7% -41.5% 26.1% 100.0% 83.2% 10.0% 0.0% 1.4% 0.0% 0.5% -0.4% 0.9% 0.0% 3.6% 100.0% 69.7% 6.2% 0.0% 4.5% 2.4% 0.0% 10.1% 8.0% 0.0% 19.3% 3.4% -2.1% 14.2% + Filter Builder OFF B D E F G - H J Cell Highlighter 0 SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V SELECT V + Balance Sheet 14.10% 7.6% 6 0.2x 0.80% 0.3% 0.8x 6.20% 2.7x + Income Statement Ratios ROE Profit Margin Asset Turnover ROA LT Asset Turnover Inventory Turnover Days Inventory held AR Turnover Days Sales Outstanding AP Turnover Days Payables Outstanding Working Capital Turnover Leverage ratio Current Ratio Quick Ratio 0 298.30% 8.6% 2.3x 21.00% 4.6x 5.3x 69.2 63.6x 5.7 9.4x 38.8 0.13x 29.6x 1.2x 0.3x 8.2x 45.3 5.3x 69.3 1.09x 1.3x 1.8x 1.6xx -1.60% -0.9% 0.5x 7.40% 2.7x 1.5x 241.1 5.3x 68.4 5.Ox 72.3 0.08x 2.9x 1.3x 0.9x -6.90% -4.6% 0.3x -0.40% 2.3x 3.9x 92.8 2.5x 143.9 5.9x 62.3 0.00x 3.4x 2.3x 1.7x 25.80% 4.1% 1.9x 7.20% 2.9x 6x 61.6 0 6.4x 57.4 -0.57x 2.3x 1x 0.3x 11.30% 14.2% 0.2x 4.40% 2.1x 5.3x 68.3 11.9x 30.8 1.5x 247.5 -0.03x 2.1x 0.7x 1.60% Ox 0 0 0.0x 0 0.00x 8.9x 1.8x 1.8x 11.00% 26.1% 0.046258661x 1.20% 4.662672161% Ox 0 0.530202273x 131.82 0.0x 0 0.00x 11.5x 0.198058802x 0.172923649x 17.80% 3.6% 1.9x 6.60% 18.1x 10.4x 35.1 14.6x 25 18.6x 19.6 0.63x 1.5x 1x 0.5x 75.80% 19.3% 1.4x 15.00% 4.6x 12.5x 29.1 26.5x 13.7 21.1x 17.3 8.61x 2.2x 1x 0.8x 0.5x The Companies Below is the list of companies you will need to match to the financials on the Analyze page. Select one or more companies to read their descriptions. Use this information, together with your analysis of the financials on the Analyze page, to identify the company that matches the financial statements. Be sure to only use the information provided to you in this assignment. Submit your final answers, rationale, and confidence level on the Decide page. Good luck! Company Profiles American Express AB InBev CVS Health Corp Eli Lilly General Electric Starbucks Target The Home Depot The New York Times Wells Fargo American Express American Express, founded in 1850, is a Manhattan-based financial services firm organized as a bank holding company. A Dow component and Big Board listed, American Express is a financial force known around the globe, providing services to consumers, small businesses, mid-size firms, and large corporations. Its wide-ranging array of services includes credit cards and other financing products, network services, point-of-sale marketing and information services, expense management, and travel-related services. AB InBev Anheuser-Busch InBev is a leading global brewer with over 500 beer brands sold in more than 150 countries. It is one of the largest consumer products companies worldwide and has a significant market share in the beer industry. Anheuser-Busch InBev remains a profitable company in its industry. The company addresses market demand by maintaining a strong beer brand portfolio with global brands, multi-brands, and local brands. Anheuser-Busch InBev developed a cost-connect-win model to minimize cost, maximize sales, connect with consumers, and win market share for long-term growth. In recent years, the company has invested in additional brewing, packaging, and distribution capabilities in multiple countries to meet future market demand. Anheuser-Busch InBev has accumulated a significant amount of goodwill from various acquisitions. Although the company has a strong cash position, Anheuser-Busch InBev acknowledges that the company may face financial risks in the future and even a potential downgrading of its credit ratings because of the level of debt the company has incurred. CVS Health Corp Headquartered in the state of Rhode Island in the United States, CVS Health Corporation is an immense force in the health care industry. It is the largest integrated pharmacy health care company in the country and works with consumers, health care providers, and managers of health care benefit plans. In addition to operating thousands of pharmacy retail locations, CVS is a leading pharmacy benefits manager serving the needs of millions of plan members. It also operates more than a thousand health care walk-in clinics located in its stores. CVS pharmacies are located throughout the United States and in some Target stores. Beyond prescriptions, CVS retail locations sell over-the-counter medications, beauty products and cosmetics, personal care products, convenience foods, photo finishing services, and greeting cards. The company has created branded services such as CVS Caremark, MinuteClinic, and ExtraCare. Eli Lilly Eli Lilly and Company is a leading drug manufacturing company with two distinct business segments, human pharmaceutical products and animal health products. The company sells its products in over 125 countries and it operates in the United States, Puerto Rico, and 14 other countries. Eli Lilly owns a large number of domestic and international facilities. The company faces strong global competition, and as a result it invests heavily in research and development. The company employs more than 8,000 employees in its R&D operation. In addition, Eli Lilly owns a large number of patents to maintain its competitive edge. The company has been consistent in paying its shareholders cash dividends. In recent years, the company has repurchased a large amount of its common stock. General Electric General Electric Company is a global industrial conglomerate specializing in software- defined machines and solutions that are connected, responsive, and predictive. With products and services ranging from aircraft engines, power generation, and oil and gas production equipment to medical imaging, financing, and industrial products, GE serves customers in over 180 countries and employs approximately 313,000 people worldwide. Since its incorporation in 1892, GE has developed or acquired new technologies and services that have considerably broadened and changed the scope of its activities. The company operates through eight segments: power, oil and gas, aviation, healthcare, transportation, appliances and lighting, and GE Capital. GE's manufacturing operations are carried out at 191 manufacturing plants located in 38 states in the United States and Puerto Rico and at 348 manufacturing plants located in 43 other countries. Starbucks Starbucks Corporation, headquartered in Seattle, Washington, owns one of the world's most recognizable brands. Serving millions of customers each day in markets worldwide, Starbucks is a coffee roaster, marketer, and retailer of specialty coffees, teas, other beverages, and complimentary food and snack offerings. It is also a manufacturer of consumer packaged goods such as coffee beans, teas, and ready-to-drink beverages that are sold in grocery stores and by large merchandisers. Starbucks's products are purchased by foodservice companies that distribute to businesses, hospitals, hotels, colleges and universities, and restaurants. Starbucks stores are situated in high-traffic and very visible locations. In addition to the company owned stores, Starbucks Corporation owns and operates coffee roasting, manufacturing, warehousing, and distribution facilities in various US locations and in China, the Netherlands, and Thailand. The company has developed relationships with coffee producers and operates farmer support centers to promote best coffee production practices. Target Target Corporation is a mass merchant retailer that offers everyday essentials and fashionable, differentiated merchandise at discounted prices. A significant portion of Target's sales come from national branded merchandise, while approximately one-third comes from Target's own exclusive brands. Target operates over 1,800 stores and 41 distribution centers in the United States. Target's stores fall into two main categories, large stores that offer a full line of food items comparable to traditional supermarkets and smaller stores that offer curated general merchandise and food assortments. As a part of its effort to expand its ecommerce and delivery options, in December 2017, Target acquired Shipt, an online delivery service platform. Target also has an agreement with CVS Pharmacy, which enables CVS to operate pharmacies and clinics inside Target stores under a perpetual operating agreement. The Home Depot The Home Depot is a big box retailer that offers a wide assortment of building materials, home improvement products, lawn and garden items, and dcor. Home Depot also provides a number of services including home improvement installation services and tool and equipment rental. In 2017, Home Depot was the largest retailer in the home improvement category and operated 2,284 stores throughout the United States, Canada, and Mexico. Home Depot's large stores average over 128,000 square feet, including both the main store and garden centers, and stock between 30,000 and 40,000 products each year. Home Depot also maintains a network of distribution and fulfillment centers and serves its ecommerce channel through its main website and those of supplemental products. Home Depots stores, product offerings, and services cater to do-it-yourself (DIY) and do-it-for-me (DIEM) customers and professionals, including contractors and specialty tradespeople. The New York Times The New York Times Company is a global media organization headquartered in New York City. Nicknamed the Gray Lady, the company's daily newspaper has long been regarded as a national newspaper. It creates, collects, and distributes information, reports the news, and provides opinion through editorials. The Times delivers its content through various platforms including its print newspapers, and digital products. Incorporated in the late 1880s, The New York Times employs more than a thousand journalists at locations all over the globe. Revenue is generated through print and digital subscriptions and advertising and through news services, syndication activities, rental income, and retail commerce (store.nytimes.com). Wirecutter, a New York Times subsidiary, publishes product review content on its website, generating affiliate commissions. The company produces the popular "The Daily podcast based on The Times' reporting of the day. The company's stock is listed on the New York Stock Exchange. Wells Fargo Wells Fargo & Company is a diversified financial services company. It provides retail, commercial, and corporate banking services through banking locations and offices, the internet, and other distribution channels to individuals, businesses, and institutions in the United States and in other countries. Wells Fargo also provides other financial services through subsidiaries engaged in various businesses, principally wholesale banking, mortgage banking, consumer finance, equipment leasing, agricultural finance, commercial finance, securities brokerage and investment banking, computer and data processing services, trust services, investment advisory services, mortgage-backed securities servicing, and venture capital investment. Wells Fargo has three operating segments for management reporting purposes: community banking, wholesale banking, and wealth and investment management

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started