Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FIN 3 2 0 Managerial Finance Fall Semester 2 0 2 4 Case Study 1 Due 0 9 / 1 0 / 2 0 2

FIN Managerial Finance

Fall Semester

Case Study

Due

Background Information and Learning Objectives

ABC Tech Inc. is a midsized technology company specializing in software development and IT services. The company has experienced rapid growth over the past five years but has recently faced increased competition and market challenges.

This case study is intended to give you a practical application of financial statement analysis. Specifically, the case asks youto evaluate the financial health and performance of ABC Tech Inc. over time and to compare it with peer firms in the same industry.

Instructions

All the requiredinformation for this assignment is attached to this case. You may work on this case study independently or in groups of up to four students. If you work in groups, please only hand in one copy of your writeupper group and make sure to list the full names of allyour group members. You will hand in a typewritten copy of your writeup at the beginning of class on the due date. The first page should have the title "FIN Case Study and list your full names I will not accept late submissions, handwritten submissions, or submissions by email.

Point Distribution

Below is the point distributionfor this case. How you format and presentyour report is very important. You can find an example of what I generally expect in terms of formatting and presentation on the Blackboard course site. I will take off points for reports that are poorly formatted and presented. Examples of poorly formatted or presented reports include, but are not limited to:

Tables not properly fitting on one page

Results not presented in the templates provided

Excessive use of decimals in most cases rounding to or three decimals is sufficient

Frequent grammatical or spelling mistakes

tableQuestionPolntsQQQQTotal

Question

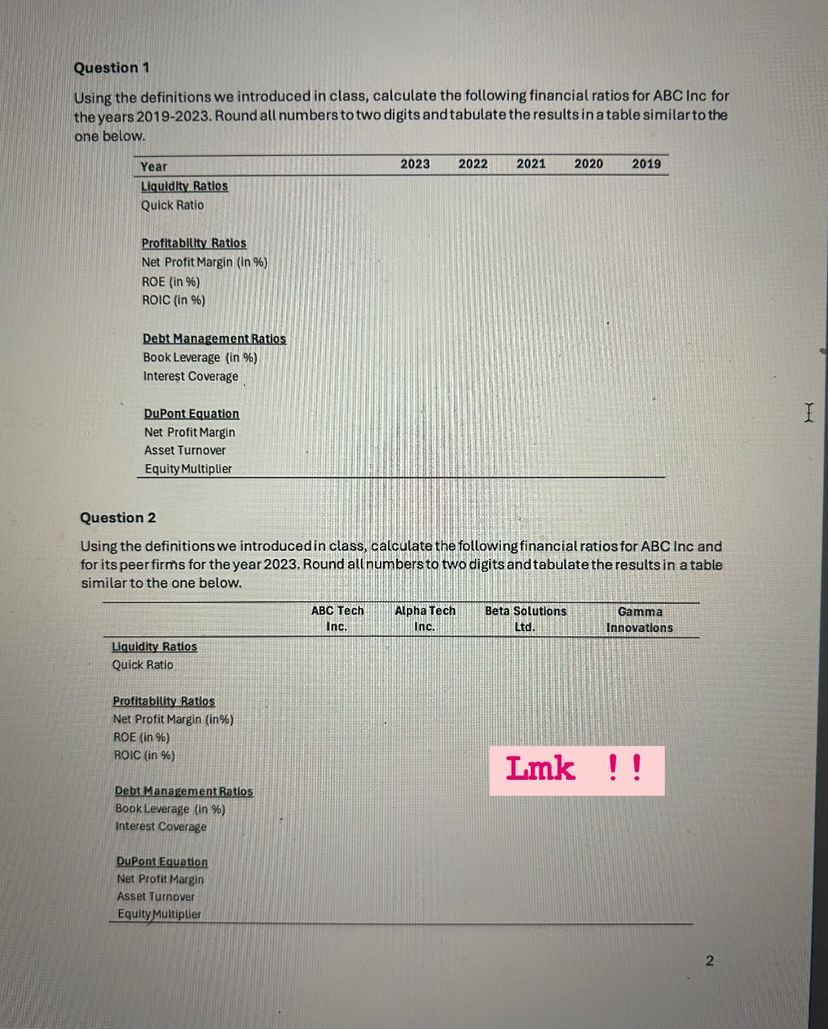

Using the definitions we introduced in class, calculate the following financial ratios for ABC inc for the years Round all numbers to two digits and tabulate the results in a table similar to the one below.

Question

Using the definitions we introduced in class, calculate the following financial ratios for ABC Inc and for its peer firms for the year Round allnumbers to two digits and tabulate the results in a table similar to the one below.

tabletableABC TechInctableAlpha TechInctableBeta SolutionsLtdtableGammaInnovationsHquidity Ratios,,,,Profitablility Ratios,,,,Net Profit Margin inROE intableROIC in tableTharDebt ManagementRatios,,,,BookLeverage in interest Coverage,,,,Dupont Equation,,,,Net Protit Margin,,,,Asset Turnover,,,,EquityMultiplier

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started