Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FIN 6 5 5 0 Homework 4 Consider a $ 6 0 0 , 0 0 0 , 0 0 0 mortgage pool consisting of

FIN

Homework

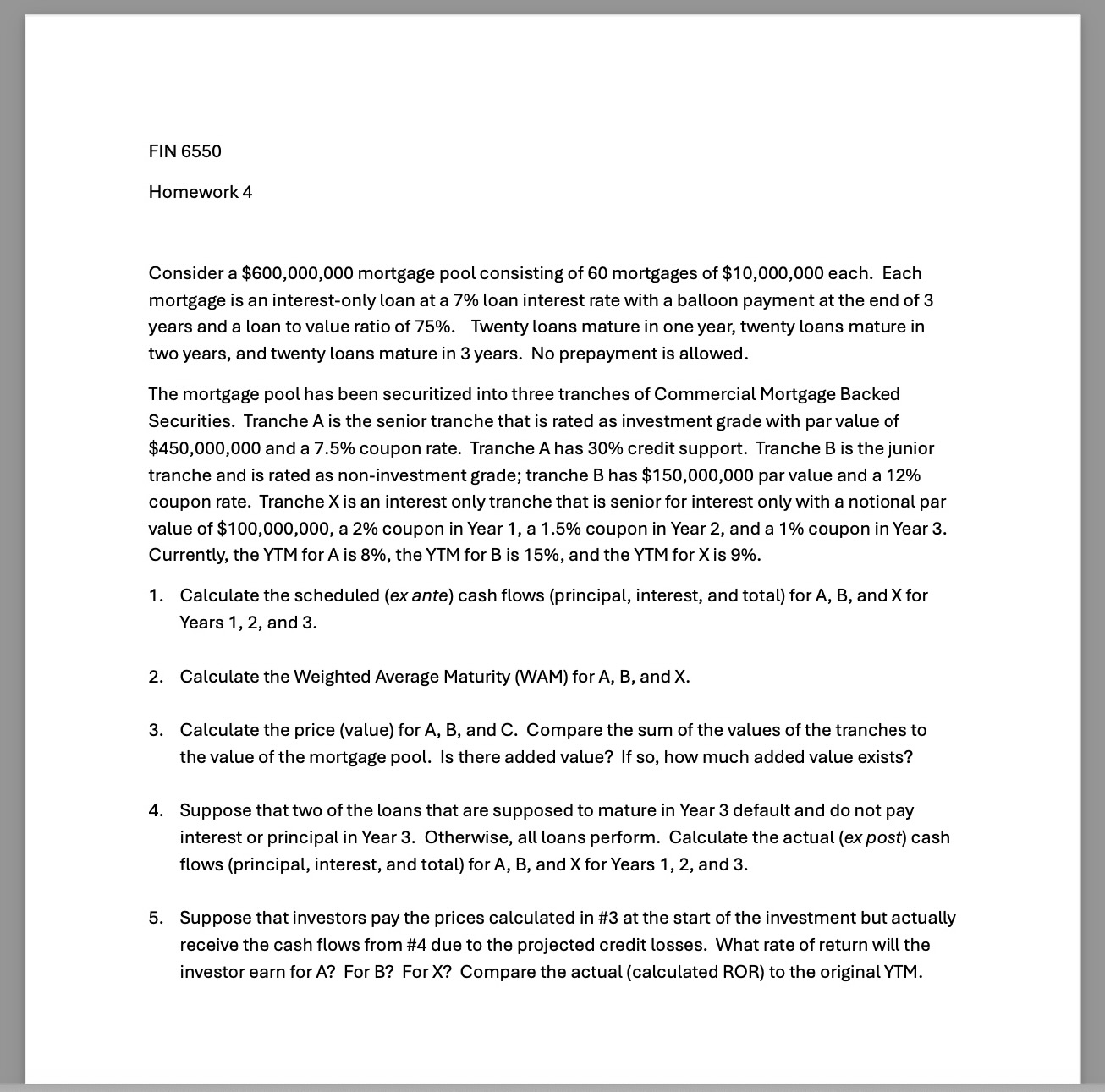

Consider a $ mortgage pool consisting of mortgages of $ each. Each

mortgage is an interestonly loan at a loan interest rate with a balloon payment at the end of

years and a loan to value ratio of Twenty loans mature in one year, twenty loans mature in

two years, and twenty loans mature in years. No prepayment is allowed.

The mortgage pool has been securitized into three tranches of Commercial Mortgage Backed

Securities. Tranche is the senior tranche that is rated as investment grade with par value of

$ and a coupon rate. Tranche A has credit support. Tranche is the junior

tranche and is rated as noninvestment grade; tranche B has $ par value and a

coupon rate. Tranche is an interest only tranche that is senior for interest only with a notional par

value of $ a coupon in Year a coupon in Year and a coupon in Year

Currently, the YTM for A is the YTM for B is and the YTM for X is

Calculate the scheduled ex ante cash flows principal interest, and total for and for

Years and

Calculate the Weighted Average Maturity WAM for A B and X

Calculate the price value for A B and C Compare the sum of the values of the tranches to

the value of the mortgage pool. Is there added value? If so how much added value exists?

Suppose that two of the loans that are supposed to mature in Year default and do not pay

interest or principal in Year Otherwise, all loans perform. Calculate the actual ex post cash

flows principal interest, and total for A B and X for Years and

Suppose that investors pay the prices calculated in # at the start of the investment but actually

receive the cash flows from # due to the projected credit losses. What rate of return will the

investor earn for A For B For X Compare the actual calculated ROR to the original YTM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started