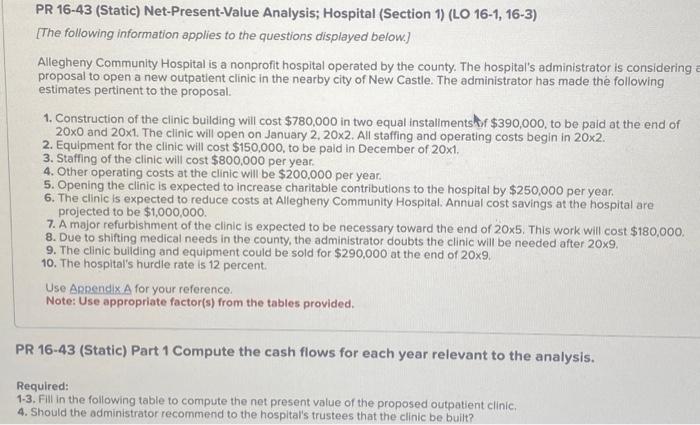

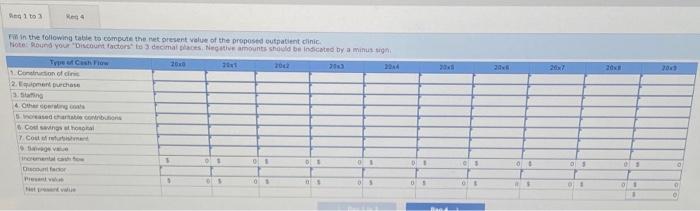

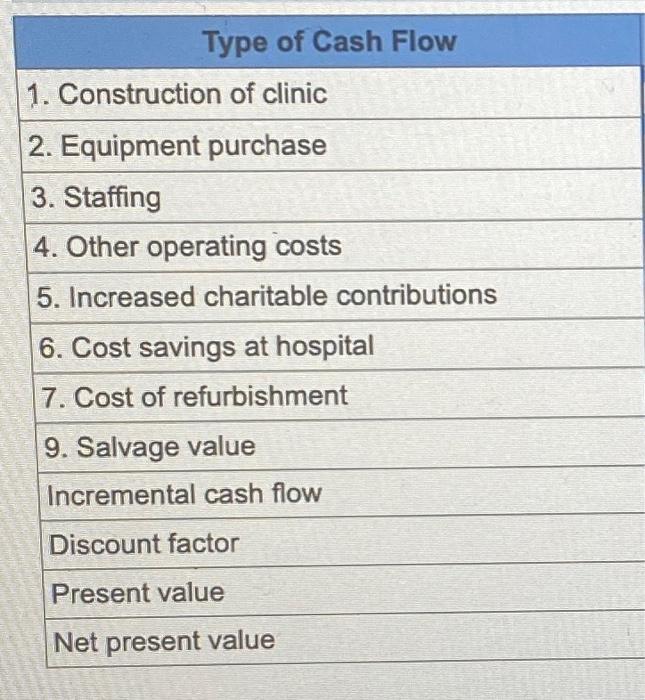

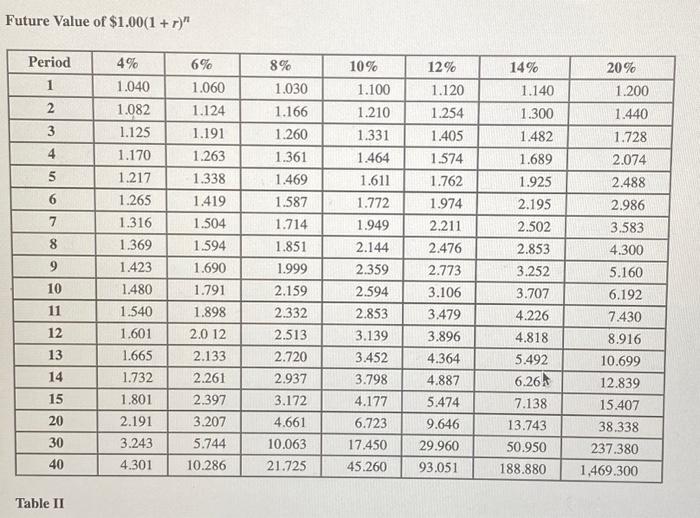

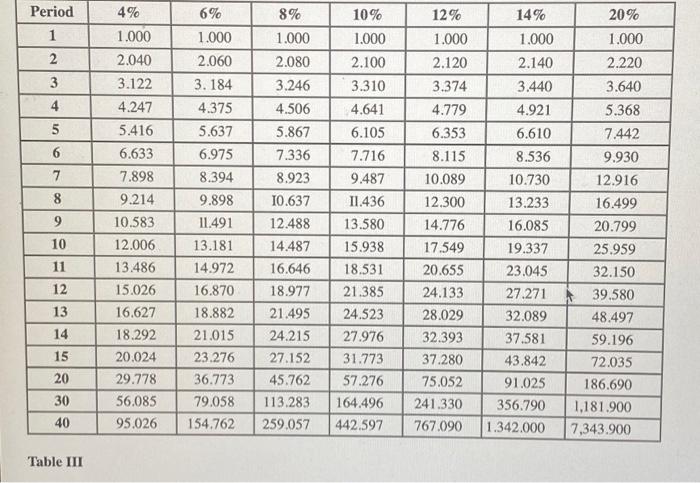

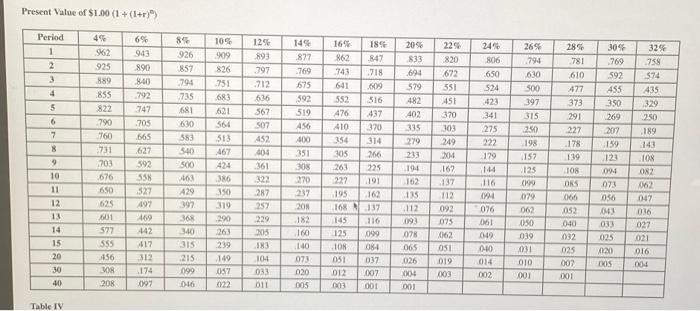

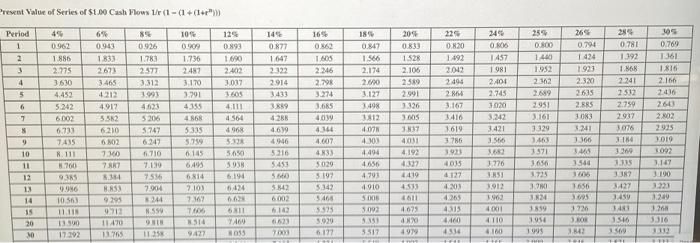

Fin in the following table to compule the ret present value of the proposted eutpatient clinic Present Value of Series of $1.00 Cash Flows Ur(1(1+(1+rn)) Table III Type of Cash Flow 1. Construction of clinic 2. Equipment purchase 3. Staffing 4. Other operating costs 5. Increased charitable contributions 6. Cost savings at hospital 7. Cost of refurbishment 9. Salvage value Incremental cash flow Discount factor Present value Net present value Future Value of $1.00(1+r)n Iabie 11 PR 16-43 (Static) Net-Present-Value Analysis; Hospital (Section 1) (LO 16-1, 16-3) [The following information applies to the questions displayed below.] Allegheny Community Hospital is a nonprofit hospital operated by the county. The hospital's administrator is considering proposal to open a new outpatient clinic in the nearby city of New Castle. The administrator has made the following estimates pertinent to the proposal. 1. Construction of the clinic building will cost $780,000 in two equal instaliments $,$390,000, to be paid at the end of 200 and 201. The clinic will open on January 2, 202. All staffing and operating costs begin in 202. 2. Equipment for the clinic will cost $150,000, to be pald in December of 201. 3. Staffing of the clinic will cost $800,000 per year. 4. Other operating costs at the clinic will be $200,000 per year. 5. Opening the clinic is expected to increase charitable contributions to the hospital by $250,000 per year. 6. The clinic is expected to reduce costs at Allegheny Community Hospital. Annual cost savings at the hospital are projected to be $1,000,000. 7. A major refurbishment of the clinic is expected to be necessary toward the end of 205. This work will cost $180,000. 8. Due to shifting medical needs in the county, the administrator doubts the clinic will be needed after 209. 9. The clinic building and equipment could be sold for $290,000 at the end of 209. 10. The hospital's hurdle rate is 12 percent. Use ARpendix A for your reference. Note: Use appropriate factor(s) from the tables provided. PR 16-43 (Static) Part 1 Compute the cash flows for each year relevant to the analysis. Required: 1.3. Fill in the following table to compute the net present value of the proposed outpatient clinic. 4. Should the administrator recommend to the hospital's trustees that the clinic be built? Present Vulue of $1.00(1+(1+r)0)