Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fin221 The variable growth common stock valuation model: a. finds the sum of the present value of dividends during the initial period and the present

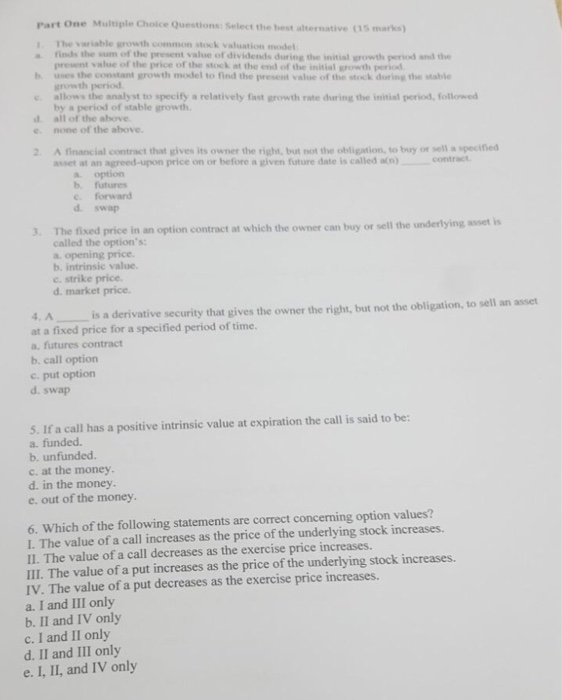

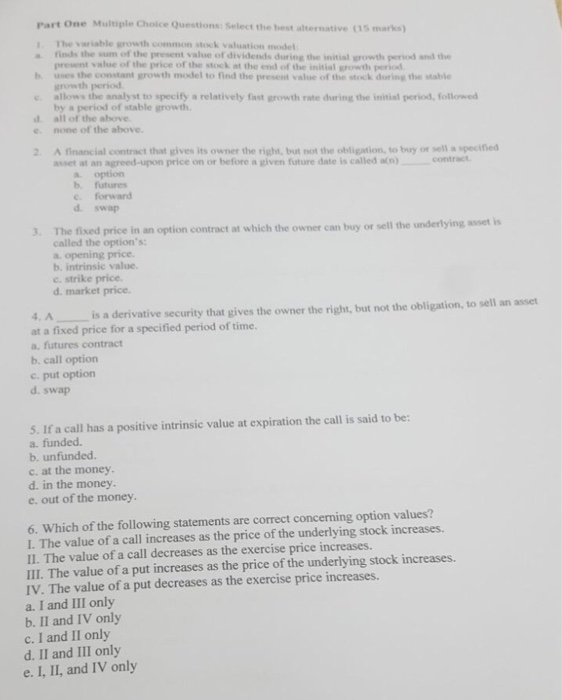

Fin221 The variable growth common stock valuation model: a. finds the sum of the present value of dividends during the initial period and the present value of the price of the stock at the end of the initial growth period. b. uses the constant growth model to find the present value of the stock during the stable growth period. c. allows the analyst to specify a relatively fast growth rate during the initial period, followed by period of stable growth. d. all of the above. e. none of the above. A financial contract that gives its owner the right, but not the obligation, to buy or sell-specified asset at an agreed-upon price on or before a given future date is called a(n) _______ contract. a. option b. futures c. forward d. swap The fixed price in an option contract at which the owner can buy or sell the underlying asset is called the option's: a. opening price. b. intrinsic value. e. strike price. d. market price. A _____ is a derivative security that gives the owner the right, but not the obligation, to sell an asset at a fixed price for a specified period of time. a. futures contract b. call option c. put option d. swap If a call has a positive intrinsic value at expiration the call is said to be: a. funded. b. unfunded. c. at the money. d. in the money. e. out of the money. Which of the following statements are correct concerning option values? I. The value of a call increases as the price of the underlying stock increases. II. The value of a call decreases as the exercise price increases. III. The value of a put increases as the price of the underlying stock increases. IV. The value of a put decreases as the exercise price increases. a. I and III only b. II and IV only c. I and II only d. II and III only e. I, II, and IV only

Fin221 The variable growth common stock valuation model: a. finds the sum of the present value of dividends during the initial period and the present value of the price of the stock at the end of the initial growth period. b. uses the constant growth model to find the present value of the stock during the stable growth period. c. allows the analyst to specify a relatively fast growth rate during the initial period, followed by period of stable growth. d. all of the above. e. none of the above. A financial contract that gives its owner the right, but not the obligation, to buy or sell-specified asset at an agreed-upon price on or before a given future date is called a(n) _______ contract. a. option b. futures c. forward d. swap The fixed price in an option contract at which the owner can buy or sell the underlying asset is called the option's: a. opening price. b. intrinsic value. e. strike price. d. market price. A _____ is a derivative security that gives the owner the right, but not the obligation, to sell an asset at a fixed price for a specified period of time. a. futures contract b. call option c. put option d. swap If a call has a positive intrinsic value at expiration the call is said to be: a. funded. b. unfunded. c. at the money. d. in the money. e. out of the money. Which of the following statements are correct concerning option values? I. The value of a call increases as the price of the underlying stock increases. II. The value of a call decreases as the exercise price increases. III. The value of a put increases as the price of the underlying stock increases. IV. The value of a put decreases as the exercise price increases. a. I and III only b. II and IV only c. I and II only d. II and III only e. I, II, and IV only

Fin221

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started