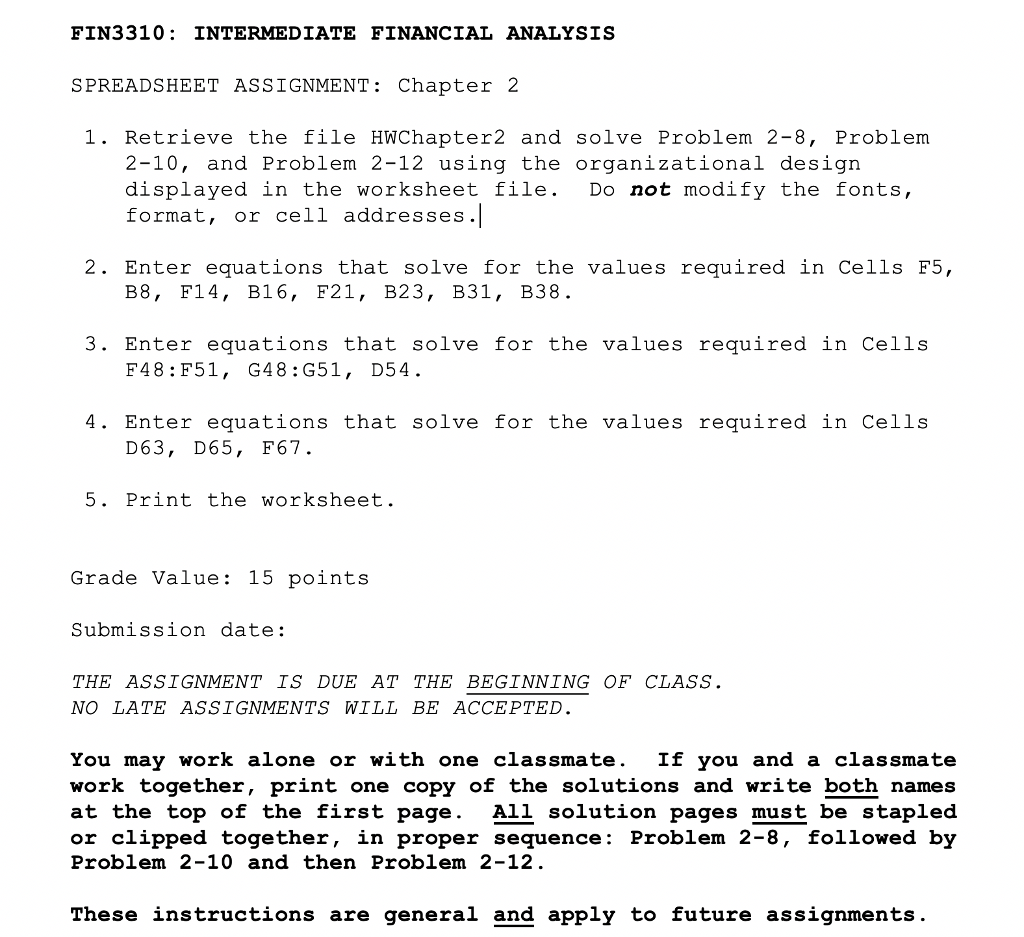

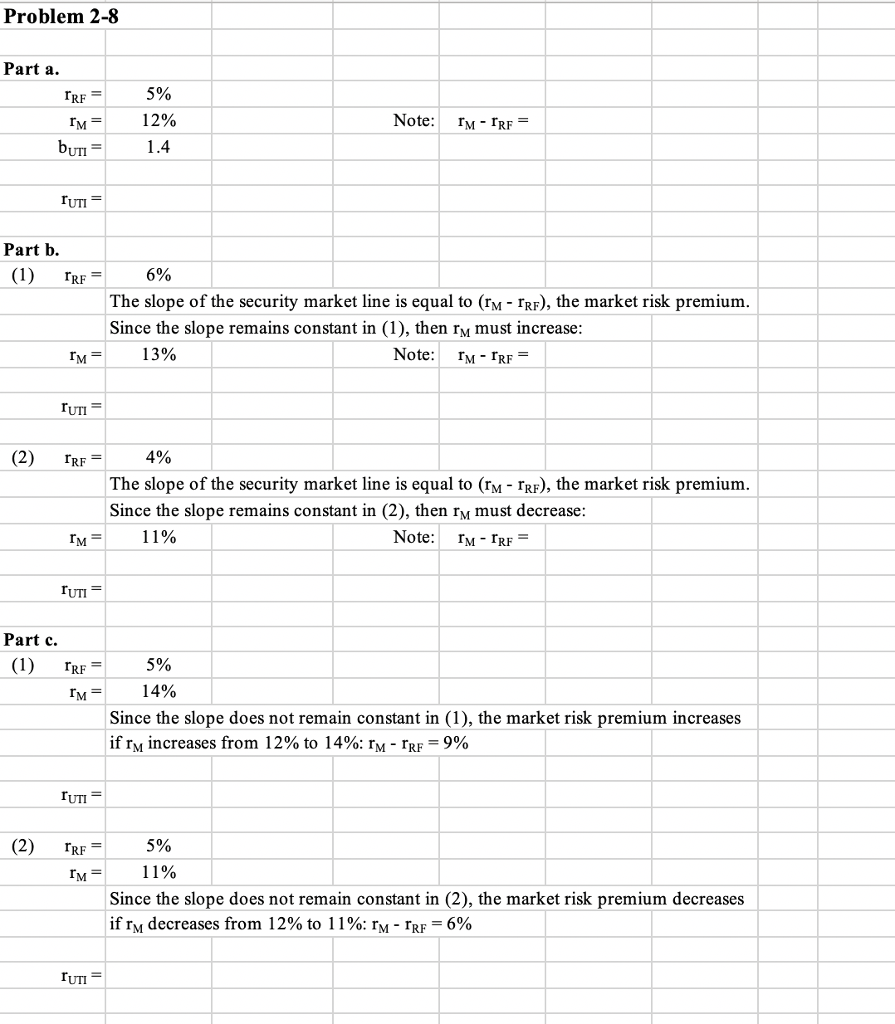

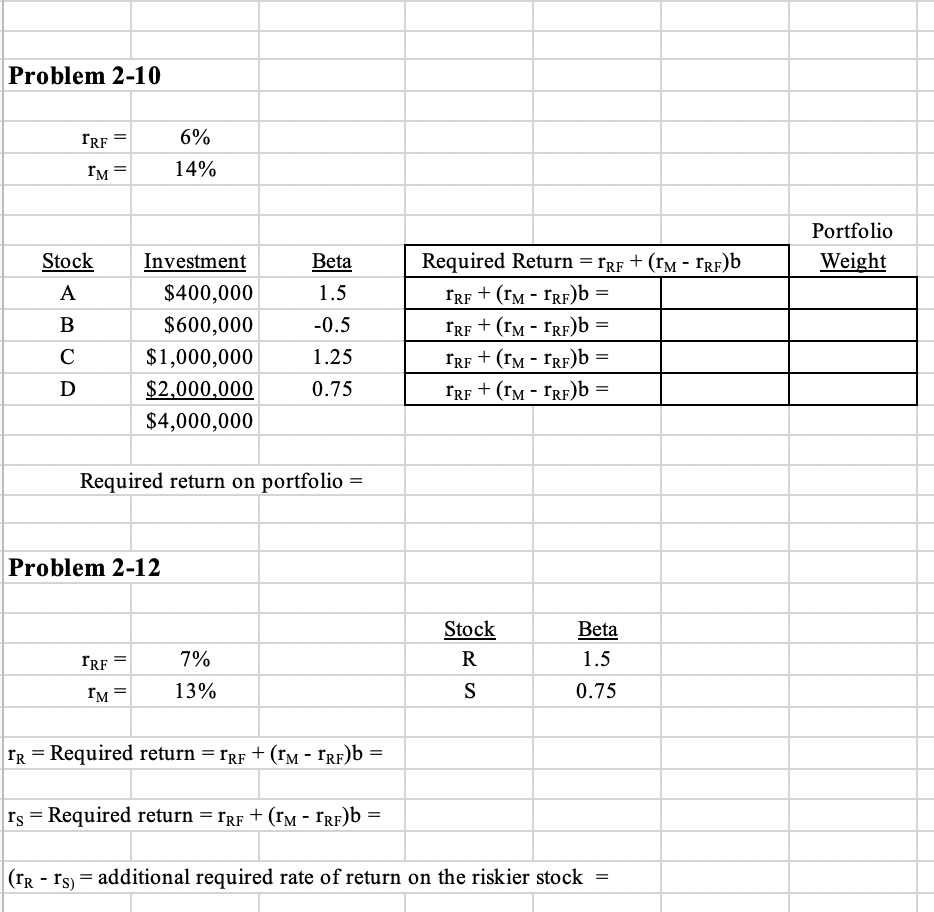

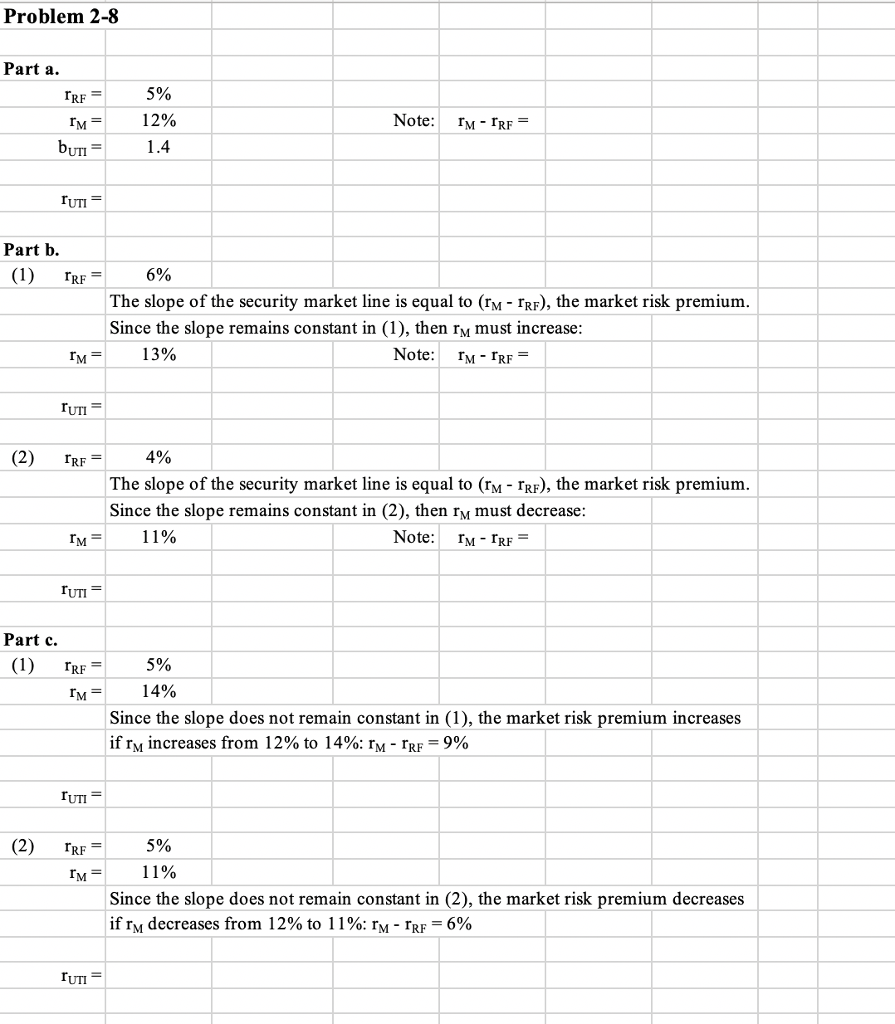

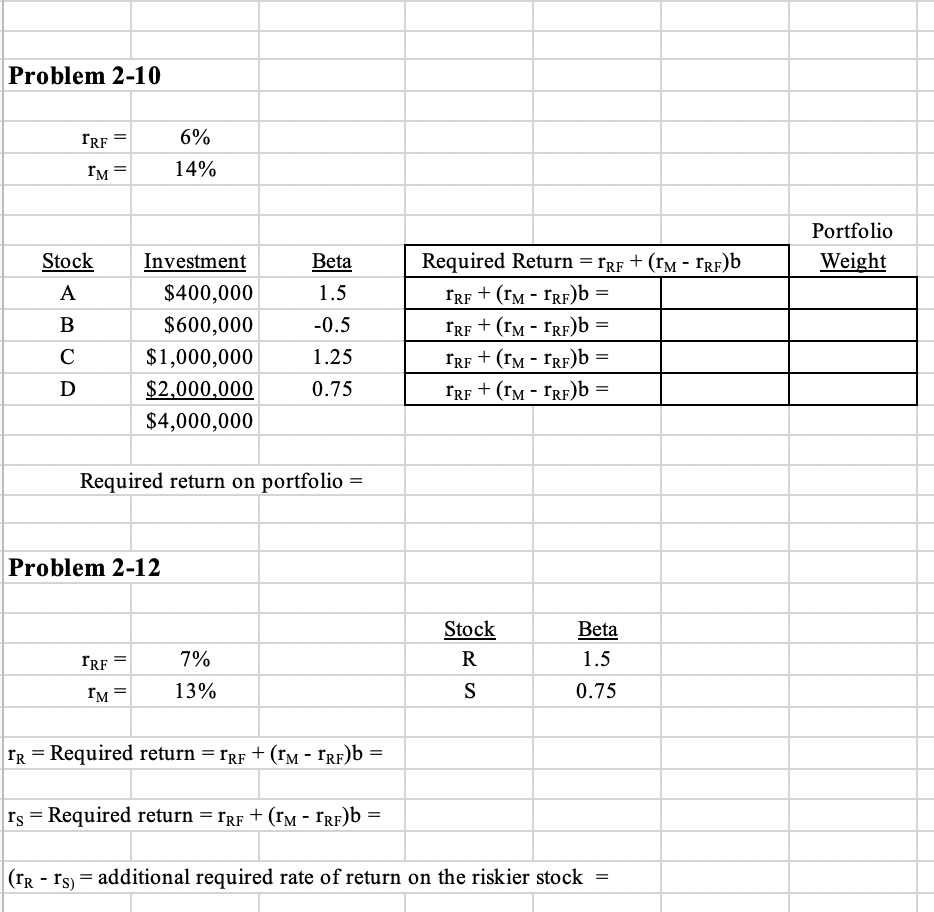

FIN3310: INTERMEDIATE FINANCIAL ANALYSIS SPREADSHEET ASSIGNMENT: Chapter 2 1. Retrieve the file HWChapter2 and solve Problem 2-8, Problem 2-10, and Problem 2-12 using the organizational design displayed in the worksheet file. Do not modify the fonts, format, or cell addresses. 2. Enter equations that solve for the values required in Cells F5, B8, F14, B16, F2, B23, B31, B38 3. Enter equations that solve for the values required in Cells F48:F51, G48:G51, D54. 4. Enter equations that solve for the values required in Cells D63, D65, F67. 5. Print the worksheet. Grade Value: 15 points Submission date: THE ASSIGNMENT IS DUE AT THE BEGINNING OF CLASS NO LATE ASSIGNMENTS WILL BE ACCEPTED You may work alone or with one classmate. If you and a classmate work together, print one copy of the solutions and write both names at the top of the first page. All solution pages must be stapled or clipped together, in proper sequence: Problem 2-8, followed by Problem 2-10 and then Problem 2-12 These instructions are general and apply to future assignments. Problem 2-8 Part a. 5% TRF "M- UTI 12% Note IM - IRF IUTI Part b. (1) rRF 6% The slope of the security market line is equal to (rM - rRF), the market risk premium Since the slope remains constant in (1), then rM must increase 13% Note: rM -IRF "M- ruT (2) IRF 4% The slope of the security market line is equal to (rM - IRF), the market risk premium Since the slope remains constant in (2), then rM must decrease 11% Note: rM IRF "M- Part c. (1) rRF- 5% 14% "M- Since the slope does not remain constant in (1), the market risk premium increases if rM increases from 12% to 14%. rM-rRF-9% TUTI 5% 11% (2) rRF- "M- Since the slope does not remain constant in (2), the market risk premium decreases ifrM decreases from 12% to 1 1%: rM-rRF-6% TUTI Problem 2-10 IRF 5% "M- 14% Portfolio Weight Stock Investment $400,000 $600,000 $1,000,000 2,000,000 $4,000,000 Beta 1.5 0.5 1.25 0.75 Required Return - rRF + (rM - IRF)b Required return on portfolio - Problem 2-12 Stock Beta 1.5 0.75 IRF 7% 13% rR-Required returnrRF (rM - IRf)b- rs - Required return -IRF + (rM - rRF)b- "M- (rr - Is)- additional required rate of return on the riskier stock