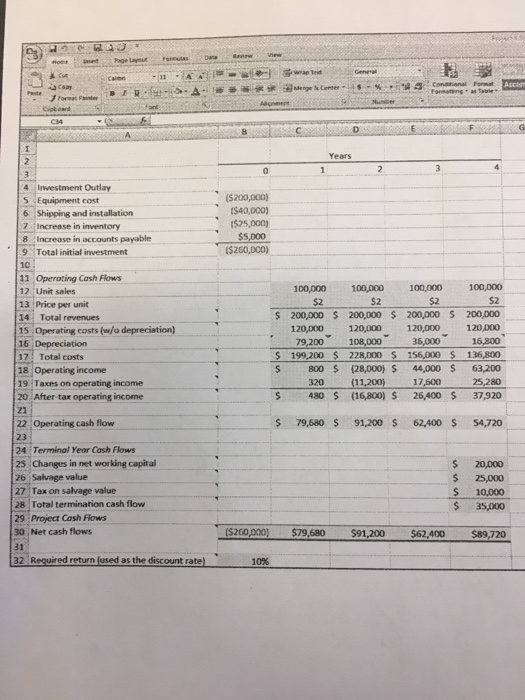

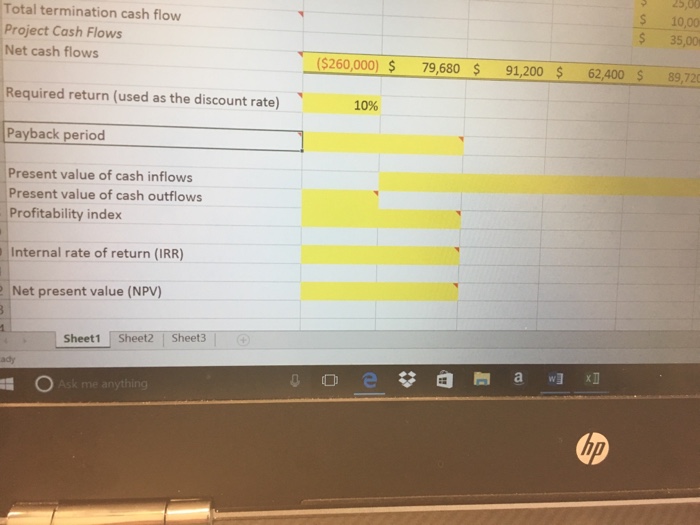

FINA 3562 Project 4 evaluate an investment project. Learning objective: Students will learn how to use different methods to rements in Excel Please analyze the following minicase and answer the questions by deriving the solutions on spreadsheets. You can use Project 4 format.xlsx to work on this project. This file is available not meet Blackboard. Please set formulae by referencing to the data in Excelspreadsheets. If you do this requirement, you will be asked to re-work on the project. You can work with another student on this project or work alone. Please put your name(s) in your Excel spreadsheets. This project accounts for 6% of your overall grade 26, 11:59 pm on Blackboard Due date: April Minicase lemon Allied expanding into the fruit juice business with a new fresh and you Food Products is considering the director of capital budgeting, product. Assume that you were recently hired as assistant to must evaluate the new project. to Allied's Fort Myers plant; The lemon juice would be produced in an unused building adjacent would cost $200,000, plus Allied owns the building, which is fully depreciated. The required equipment an additional $40.000 for shipping and installation. In addition, inventories would rise by $25,000, while accounts payable would go up by $5,000. All of these costs would be incurred today (i.e. at t-o). By a special ruling, the machinery could be depreciated under the Modified Accelerated Cost Recovery and System (MACRS system) as 4-year property. The applicable depreciation rates are 33%, 45%, 15%, The project is expected to operate for 4 years, at which time it will be terminated. The cash inflows are assumed to begin 1 year after the project is undertaken, or atta 1, and to continue out to t 4. At the end of the project's life (t 4), the equipment is expected to have a salvage value of $25,000 Unit sales are expected to total 100,000 units per year, and the expected sales price is$2.00 per unit Cash operating costs for the project (total operating costs less depreciation) are to total 60 expected percent of dollar sales. Allied's rate is 40%, and its weighted average cost of 10% Tentatively, the lemon juice project is assumed to be equal to Allied's other assets. it should be You have been asked to evaluate the project and to make a recommendation as to whether accepted or rejected. You are performing the analysis to answer the following questions. Questions 1. What the payback period of the project? If the cut-off payback period is 3 years, should we accept is or reject the project? Why? 2 what is the profitability index of the project? Should the project be accepted? Why? 3. what is the internal rate of return (IRR) of the project? Should the project be accepted? Why? 4. What is the net present value (NPV) of the project? Should the project be accepted?why