Question

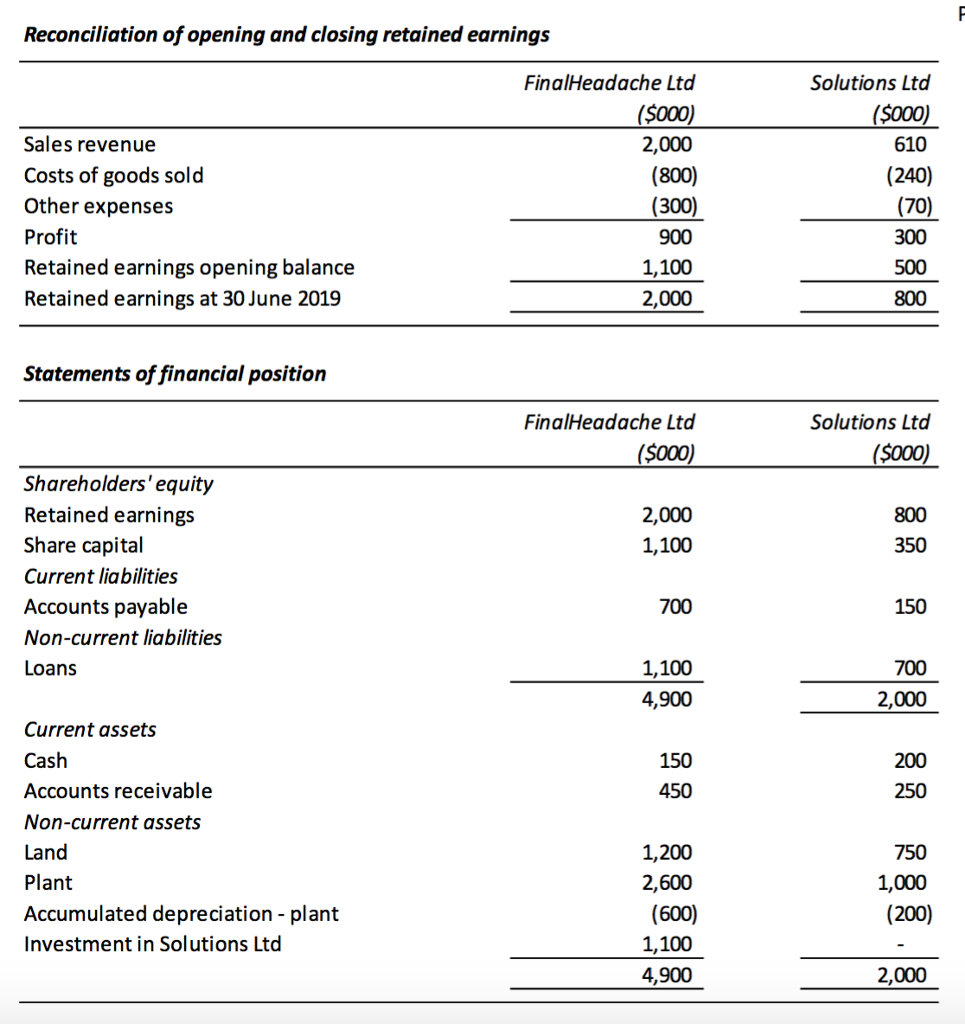

FinalHeadache Ltd acquires all of the shares in Solutions Ltd on 30 June 2018. The financial statements for FinalHeadache Ltd and Solutions Ltd at 30

FinalHeadache Ltd acquires all of the shares in Solutions Ltd on 30 June 2018. The financial statements for FinalHeadache Ltd and Solutions Ltd at 30 June 2019 (one year after acquisition) are provided below.

Additional information

FinalHeadache Ltd acquires Solutions Ltd on 30 June 2018 for $1.1 million cash.

The directors of FinalHeadache Ltd consider that in the year to 30 June 2019 the value of

goodwill has been impaired by an amount of $20 000.

There are no intragroup transactions.

Solutions Ltd did not issue any shares during 2019.

The tax rate is 30 percent

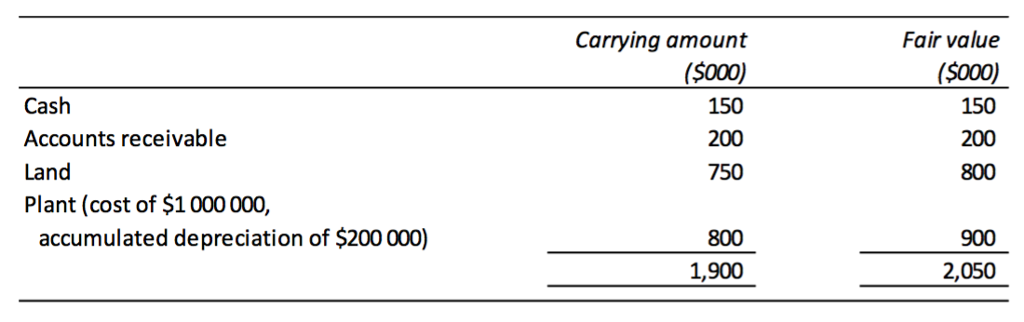

On the date at which FinalHeadache Ltd acquires Solutions Ltd, the carrying amount and

the fair value of the assets of Solutions Ltd are:

No revaluations are undertaken in Solutions Ltds accounts before consolidation.

At the date of acquisition of Solutions Ltd, Solutions Ltds liabilities amount to $1.050 million and there are no contingent liabilities.

The plant in Solutions Ltd is expected to have a remaining useful life of 10 years from 30 June 2018, and no residual value.

Required

Provide the consolidated accounts of FinalHeadache Ltd and Solutions Ltd as at 30 June 2019 with the following:

Goodwill computation

Consolidation journal entries to:

o Revalue the assets of Solutions Ltd so that goodwill can subsequently be accounted for

o Eliminate the investment in Solutions Ltd and the pre-acquisition capital and reserves of Solutions Ltd

o Recognise impairment of goodwill

o Additional depreciation and decrease in Deferred tax liability

Consolidation worksheet for FinalHeadache Ltd and its controlled entity for the

period ending 30 June 2019 showing columns of Eliminations and adjustments and

Consolidated amounts

Consolidated statement of financial position of the FinalHeadache group

Reconciliation ofopening and closing retained earnings FinalHeadache Ltd (S000) 2,000 Sales revenue Costs of goods sold (800) (300) Other expenses Profit Retained earnings opening balance 1,100 2,000 Retained earnings at 30 June 2019 Statements of financial position FinalHeadache Ltd (S000) Shareholders' equity Retained earnings 2,000 Share capital 1,100 Current liabilities Accounts payable 700 Non-current liabilities Loans 1,100 4,900 Current assets Cash 150 Accounts receivable 450 Non-current assets Land 1,200 Plant 2,600 (600) Accumulated depreciation plant Investment in Solutions Ltd 1.100 4,900 Solutions Ltd (SO00) 610 (240) (70) 800 Solutions Ltd (SO00) 350 150 700 2,000 200 250 750 1,000 (200) 2,000 Reconciliation ofopening and closing retained earnings FinalHeadache Ltd (S000) 2,000 Sales revenue Costs of goods sold (800) (300) Other expenses Profit Retained earnings opening balance 1,100 2,000 Retained earnings at 30 June 2019 Statements of financial position FinalHeadache Ltd (S000) Shareholders' equity Retained earnings 2,000 Share capital 1,100 Current liabilities Accounts payable 700 Non-current liabilities Loans 1,100 4,900 Current assets Cash 150 Accounts receivable 450 Non-current assets Land 1,200 Plant 2,600 (600) Accumulated depreciation plant Investment in Solutions Ltd 1.100 4,900 Solutions Ltd (SO00) 610 (240) (70) 800 Solutions Ltd (SO00) 350 150 700 2,000 200 250 750 1,000 (200) 2,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started