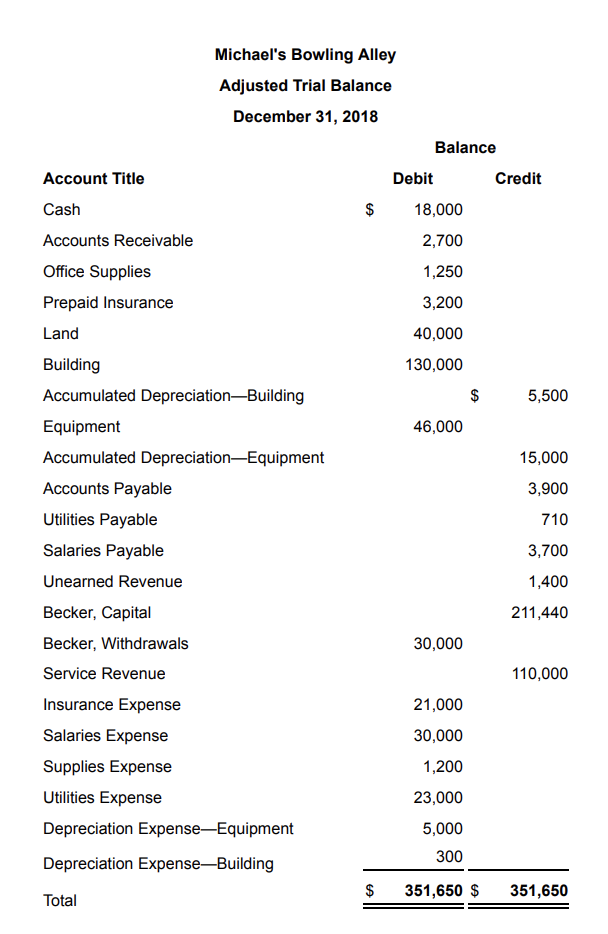

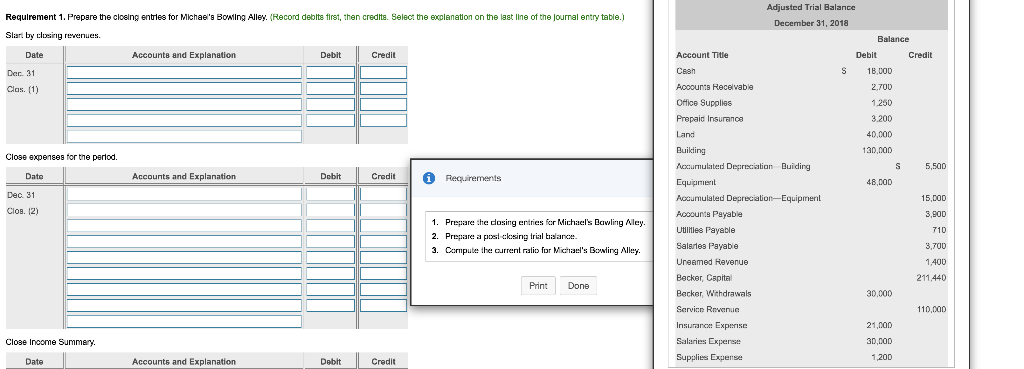

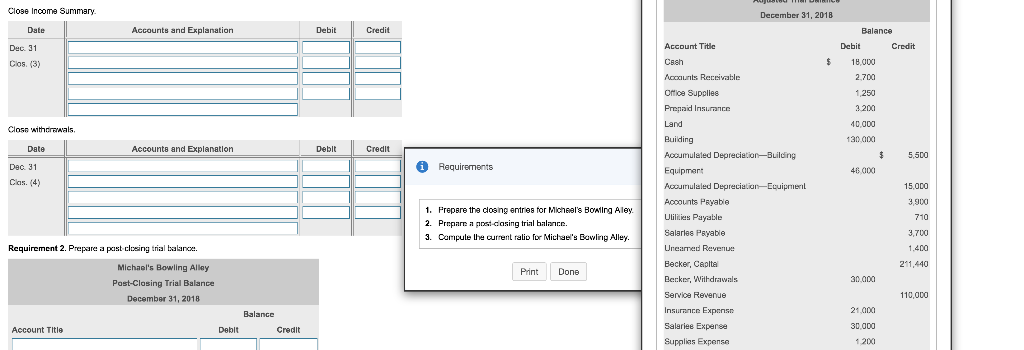

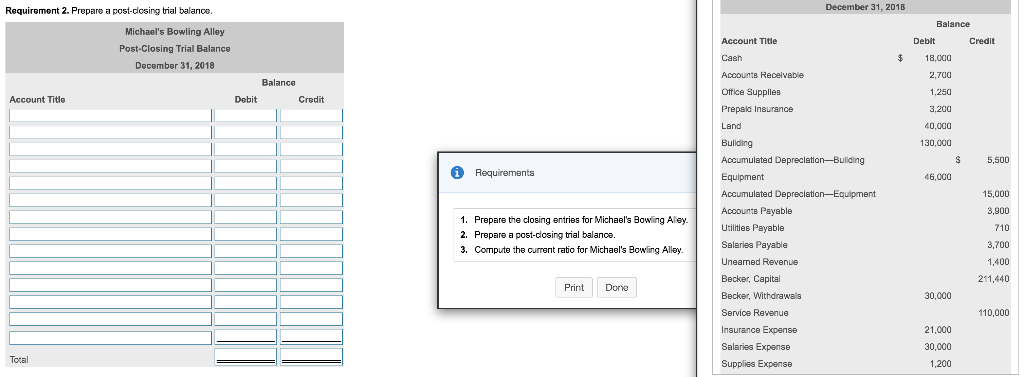

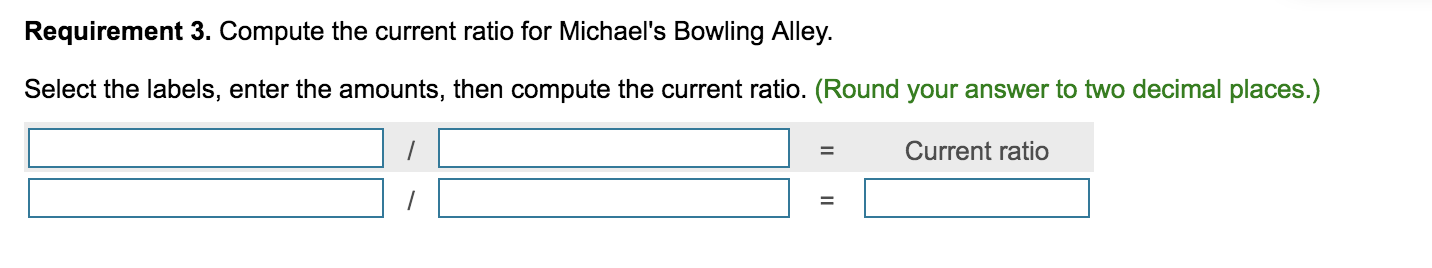

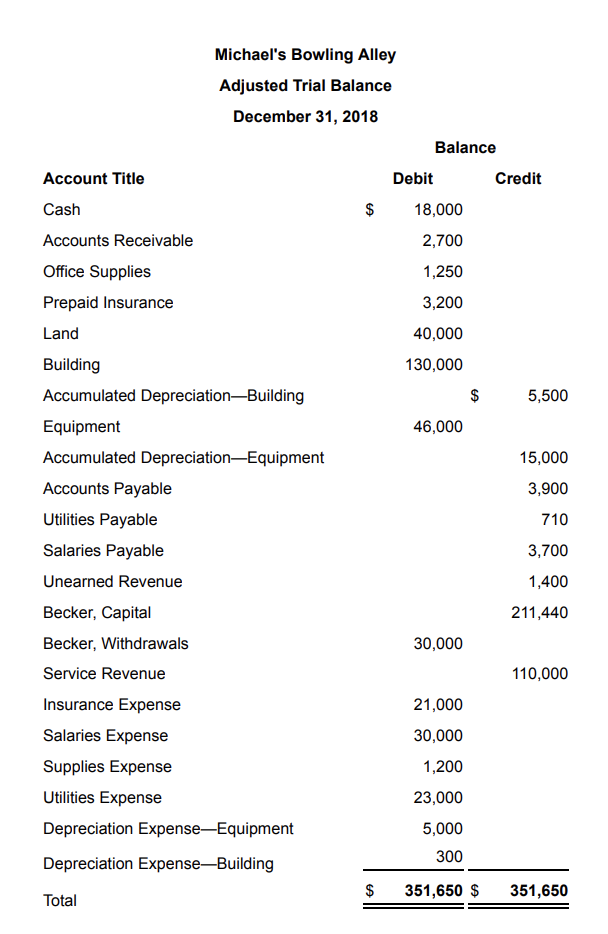

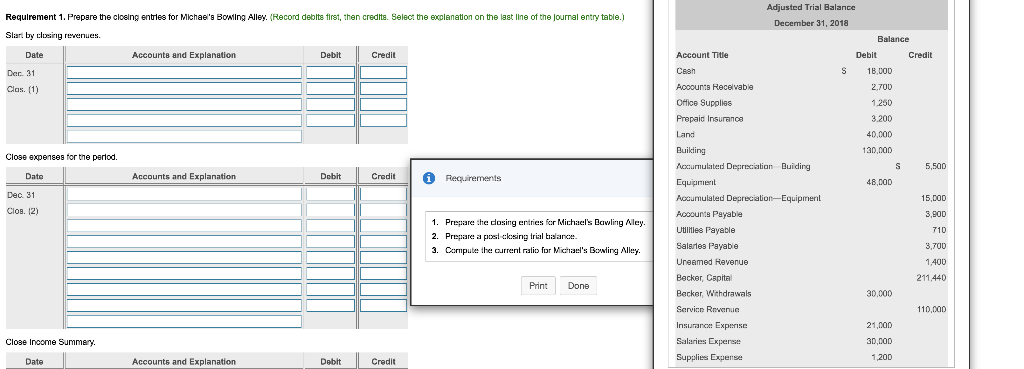

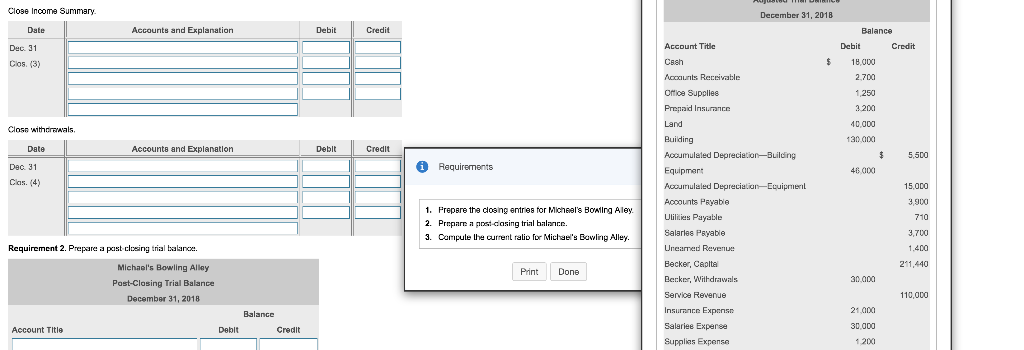

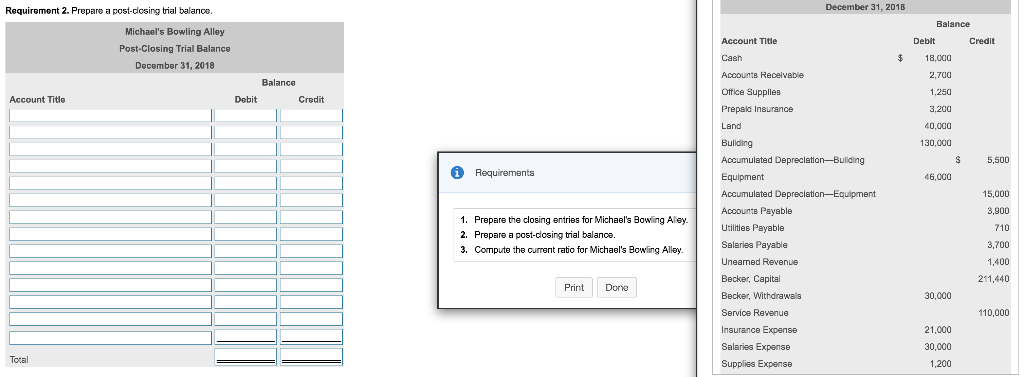

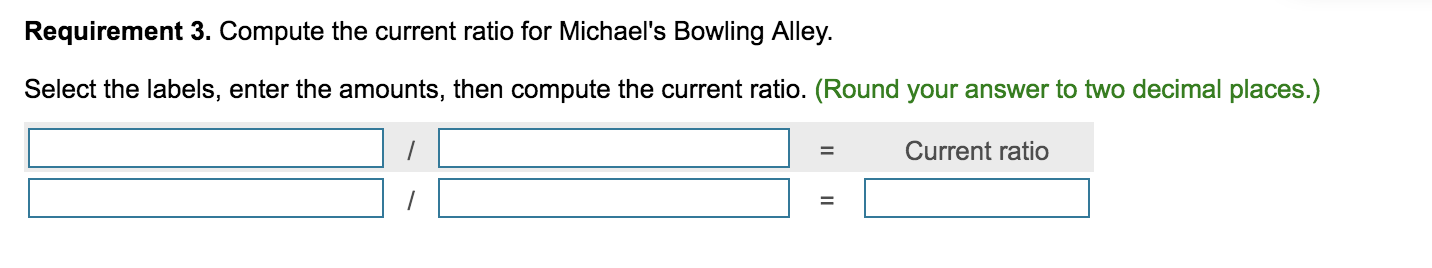

Requirement 1. Prepare the closing entries for Michael's Bowling Alley. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Slar by closing revenues. Accounts and Explanation Debit Credit Dec 31 Clas. (1) Date Close expenses for the period. Date Accounts and Explanation Dobit | Credit i Requirements Adjusted Trial Balance December 31, 2018 Balance Account Title Debit Credit Cesh 18,000 Accounts Receivable 2.700 Office Supplies 1.250 Prepaid Insurance 3.200 Land 40,000 Building 130,000 Accumulated Depreciation Building S 5,500 Equipment 48.000 Accumulated Depreciation-Equipment 15,000 Accounts Payable 3,900 Uulities Payable Salarles Payable 3.700 Uneamed Revenue 1,400 Becker, Capital 211,440 Becker, Withdrawals 30.000 Service Revenue 110,000 Insurance Experise 21,000 Salaries Expense 30,000 Supplies Expense 1,200 Dec 31 Clon. 2) 710 1. Prepare the closing entries for Michael's Eawling Aley. 2. Prepare a fost closing trial brilance 3. Computer the current ralio for Michael's Bowling Alley Print Done Close Income Summary Date Accounts and Explanation Debit Credit Close Income Summary December 31, 2018 Date Accounts and Explanation Debit Credit Balance Credit Dec. 31 Clos (3) Debit 18.000 2.700 1250 3.200 40.000 130.000 Close withdrawals Date Accounts and Explanation Debit Credit 5,500 Requirements Dec 31 Clas. (4) 46.000 Account Title Cash Accounts Receivable Office Supplies Prepaid Insurance Land Building Accumulated Depreciation-Building Equipment Accumulaled Depreciation-Ecuipmenil Accounts Payable Ullis Payable Salaries Payable Uneamed Revenue Becker, Capital Becker, Withdrawals Service Revenue Insurance Expense Salariee Expense Supplies Expense 15.000 3.900 7-10 1. Prepare the closing entries for Michael's Bowling Aley. 2. Prepare a post-casing trial balance. 3. Compule the current ralio for Michae's Bowling Alley. Requirement 2. Prepare a past closing trial balance. 3,700 1.400 211.440 Print Done Michael's Bowling Alley Post-Closing Trial Balance December 31, 2018 30.000 110,000 Balance Account Title Debit Credit 21.000 30 000 1200 Requirement 2. Prepare a post-closing trial balance. December 31, 2018 Account Title Cash $ Michael's Bowling Alley Post-Closing Trial Balance December 31, 2018 Balance Debit Credit Accounts Receivable Office Supplies Prepaid Insurance Account Title Land Requirements Balance Debit Credit 18.000 2,700 1,250 3,200 40,000 130,000 5,500 46,000 15,000 3,900 710 3,700 1400 211,440 30,000 110,000 21,000 30,000 1,200 Building Accumulated Depreciation Building Equipment Accumulated Depreciation Equipment Accounts Payable Utilities Payable Salaries Payable Uneamed Revenue Becker, Capital Becker, Withdrawals Service Revenue Insurance Expense Salaries Expense Supplies Expense 1. Prepare the closing entries for Michael's Bowling Alley 2. Prepare a post-closing trial balance. 3. Compute the current ratio for Michael's Bowling Alley. Print Done Total Requirement 3. Compute the current ratio for Michael's Bowling Alley. Select the labels, enter the amounts, then compute the current ratio. (Round your answer to two decimal places.) = Current ratio