Answered step by step

Verified Expert Solution

Question

1 Approved Answer

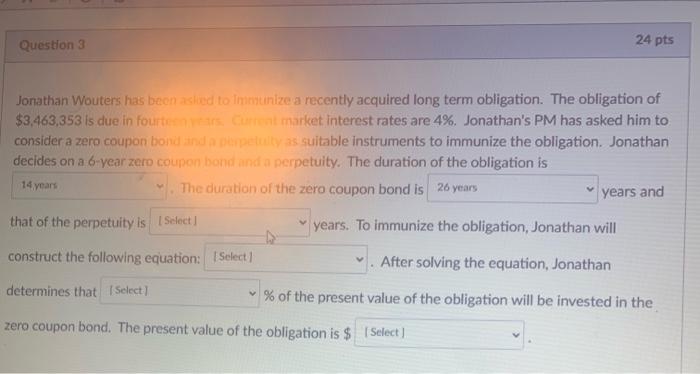

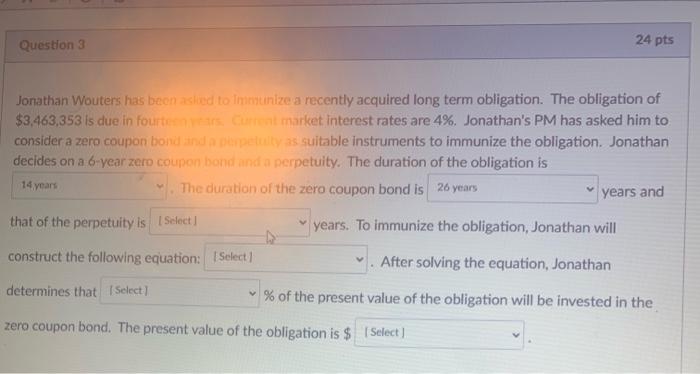

financ Question 3 24 pts 14 years Jonathan Wouters has been asiled to imunize a recently acquired long term obligation. The obligation of $3,463,353 is

financ

Question 3 24 pts 14 years Jonathan Wouters has been asiled to imunize a recently acquired long term obligation. The obligation of $3,463,353 is due in fourtes Current market interest rates are 4%. Jonathan's PM has asked him to consider a zero coupon bond and pretulty as suitable instruments to immunize the obligation. Jonathan decides on a 6-year zero coupon bond and in perpetuity. The duration of the obligation is The duration of the zero coupon bond is 26 years years and that of the perpetuity is Select years. To immunize the obligation, Jonathan will construct the following equation: Select . After solving the equation, Jonathan determines that Select) % of the present value of the obligation will be invested in the zero coupon bond. The present value of the obligation is $ Select Question 3 24 pts 14 years Jonathan Wouters has been asiled to imunize a recently acquired long term obligation. The obligation of $3,463,353 is due in fourtes Current market interest rates are 4%. Jonathan's PM has asked him to consider a zero coupon bond and pretulty as suitable instruments to immunize the obligation. Jonathan decides on a 6-year zero coupon bond and in perpetuity. The duration of the obligation is The duration of the zero coupon bond is 26 years years and that of the perpetuity is Select years. To immunize the obligation, Jonathan will construct the following equation: Select . After solving the equation, Jonathan determines that Select) % of the present value of the obligation will be invested in the zero coupon bond. The present value of the obligation is $ Select

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started