Finance FFCF

One is required to calculate the answer. not multiple choice

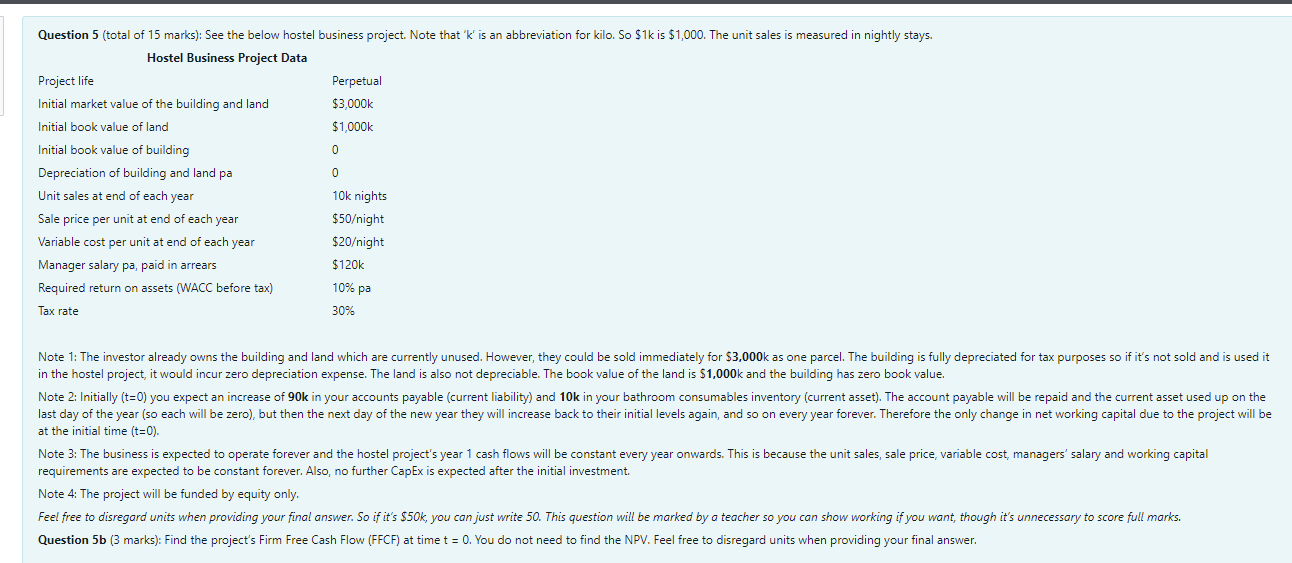

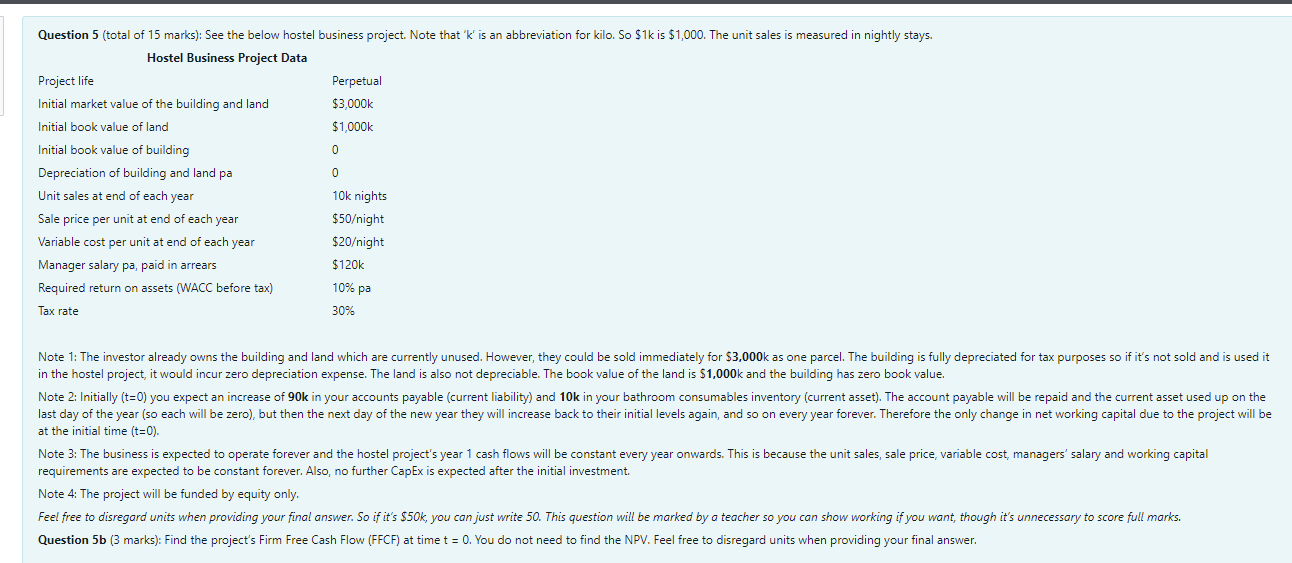

Question 5 (total of 15 marks): See the below hostel business project. Note that 'k' is an abbreviation for kilo. So $1k is $1,000. The unit sales is measured in nightly stays. Hostel Business Project Data Project life Perpetual Initial market value of the building and land $3,000k Initial book value of land $1,000k Initial book value of building 0 Depreciation of building and land pa 0 Unit sales at end of each year 10k nights Sale price per unit at end of each year $50ight Variable cost per unit at end of each year $20ight Manager salary pa, paid in arrears $120k Required return on assets (WACC before tax) 10% pa Tax rate 30% Note 1: The investor already owns the building and land which are currently unused. However, they could be sold immediately for $3,000k as one parcel. The building is fully depreciated for tax purposes so if it's not sold and is used it in the hostel project, it would incur zero depreciation expense. The land is also not depreciable. The book value of the land is $1,000k and the building has zero book value. Note 2: Initially (t=0) you expect an increase of 90k in your accounts payable (current liability) and 10k in your bathroom consumables inventory (current asset). The account payable will be repaid and the current asset used up on the last day of the year (so each will be zero), but then the next day of the new year they will increase back to their initial levels again, and so on every year forever. Therefore the only change in net working capital due to the project will be at the initial time (t=0). Note 3: The business is expected to operate forever and the hostel project's year 1 cash flows will be constant every year onwards. This is because the unit sales, sale price, variable cost, managers' salary and working capital requirements are expected to be constant forever. Also, no further CapEx is expected after the initial investment. Note 4: The project will be funded by equity only. Feel free to disregard units when providing your final answer. So if it's $50k, you can just write 50. This question will be marked by a teacher so you can show working if you want, though it's unnecessary to score full marks. Question 5b (3 marks): Find the project's Firm Free Cash Flow (FFCF) at time t = 0. You do not need to find the NPV. Feel free to disregard units when providing your final