Global Finance case study questions, please read the pages to answer the questions, thank you so much!!! (urgent)

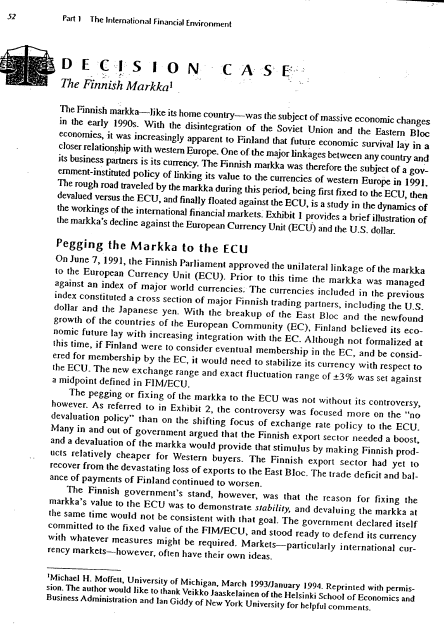

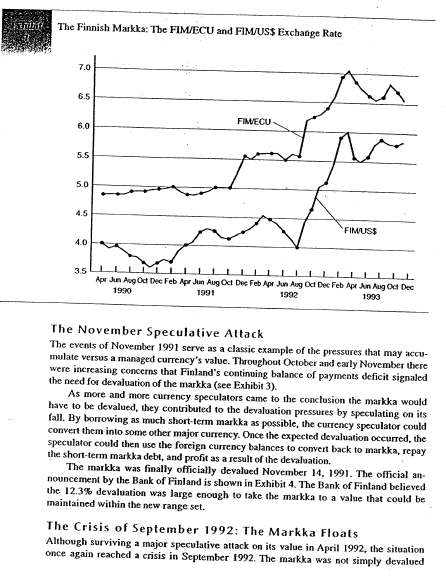

52 Part I The International Financial Environment DECISION CASE The Finnish Markka! The Finnish markka-like its home country was the subject of massive economic changes in the early 1990s. With the disintegration of the Soviet Union and the Eastern Bloc economics, it was increasingly apparent to Finland that future economic survival lay in a closer relationship with western Europe. One of the major linkages between any country and its business partners is its currency. The Finnish markka was therefore the subject of a gov- emment-instituted policy of linking its value to the currencies of western Europe in 1991. The rough road traveled by the markka during this period, being first fixed to the ECU, then devalued versus the ECU, and finally floated against the ECU, is a study in the dynamics of the workings of the international financial markets Exhibit I provides a brief illustration of the markka's decline against the European Currency Unit (ECU) and the U.S. dollar. Pegging the Markka to the ECU On June 7, 1991, the Finnish Parliament approved the unilateral linkage of the markka to the European Currency Unit (ECU). Prior to this time the markka was managed against an index of major world currencies. The currencies included in the previous index constituted a cross section of major Finnish trading partners, including the U.S. dollar and the Japanese yen. With the breakup of the East Bloc and the newfound growth of the countries of the European Community (EC). Finland believed its eco- nomic future lay with increasing integration with the EC. Although not formalized at this time, if Finland were to consider eventual membership in the EC, and be consid- ered for membership by the EC, it would need to stabilize its currency with respect to the ECU. The new exchange range and exact fluctuation range of 3% was set against a midpoint defined in FIM/ECU. The pegging or fixing of the markka to the ECU was not without its controversy, however. As referred to in Exhibit 2, the controversy was focused more on the "no devaluation policy" than on the shifting focus of exchange rate policy to the ECU. Many in and out of government argued that the Finnish export sector needed a boost. and a devaluation of the markka would provide that stimulus by making Finnish prod- ucts relatively cheaper for Western buyers. The Finnish export sector had yet to recover from the devastating loss of exports to the East Bloc. The trade deficit and bal- ance of payments of Finland continued to worsen. The Finnish government's stand, however, was that the reason for fixing the markka's value to the ECU was to demonstrate stability and devaluing the markka at the same time would not be consistent with that goal. The government declared itself committed to the fixed value of the FIMVECU, and stood ready to defend its currency with whatever measures might be required. Markets-particularly international cur- rency markets--however, often have their own ideas. "Michael H. Moffett, University of Michigan, March 1992 January 1994. Reprinted with permis- sion. The author would like to thank Veikko Jaaskelainen of the Helsinki School of Economics and Business Administration and lan Giddy of New York University for helpful comments Untit The Finnish Markka: The FIM/ECU and FIM/US$ Exchange Rate 7.0 6.5 FIMECU 6.0 5.5 5.0 4.5 FIMUS$ 4.0 3.5 IL Apr Jun Aug Od Dec Feb Apr Jun Aug Oct Dec Feb Apr Jun Aug Od Dec Feb Apr Jun Aug Oct Dec 1991 1993 The November Speculative Attack The events of November 1991 serve as a classic example of the pressures that may accu- mulate versus a managed currency's value. Throughout October and early November there were increasing concerns that Finland's continuing balance of payments deficit signaled the need for devaluation of the markka (see Exhibit 3). As more and more currency speculators came to the conclusion the markka would have to be devalued, they contributed to the devaluation pressures by speculating on its fall. By borrowing as much short-term markka as possible, the currency speculator could convert them into some other major currency. Once the expected devaluation occurred, the speculator could then use the foreign currency balances to convert back to markka, repay the short-term markka debt, and profit as a result of the devaluation. The markka was finally officially devalued November 14, 1991. The official an nouncement by the Bank of Finland is shown in Exhibit 4. The Bank of Finland believed the 12.3% devaluation was large enough to take the markka to a value that could be maintained within the new range set. The Crisis of September 1992: The Markka Floats Although surviving a major speculative attack on its value in April 1992, the situation once again reached a crisis in September 1992. The markka was not simply devalued tautie Finmark Under Attack Stockholm Finland's central bank caved into a massive wave of currency speculation and allowed the markka to float in global foreign-exchange markets, presaging an imminent devaluation of as much as 20%, analysts said. The decision to uncouple the markka from its fixed intervention range against the European currency unit came after the close of trading Thursday in Helsinki, In volatile international trading, the markka immediately plunged nearly 10%. London traders said the markka stabilized at about 5.5270VECU, compared with about 5.0100/ECU at the close of trading in Helsinki. The weakest markka value allowed under the central bank's previous exchange rate policy was 5.0220VECU. Scurce: Stephen D. Moore. "Finland Leis Markka Float: Devaluation Dwe-1115-1691. Reprinied by permission of The Wall Street Journal E. 1991 Dow Jones & Co., Inc. All rights reserved wouldwide RUM Devaluation of Markka On November 14, 1991, the Bank of Finland decided to temporarily float the markka because of mounting pressure against the currency in the foreign exchange market. On the following day, Novem ber 15, the Government decided on the basis of a proposal by the Parliamentary Supervisory Board of the Bank of Finland to raise the limits of the markka's fluctuation range against the ECU by 14 per- cent, implying a 12.3 percent fall in the external value of the markka. The new midpoint is 5.55841 (FIM/ECU), and the markka may now Muctuate against the ECU in a range of 5.39166 to 5.72516. Source: The Bank of Finland Ballerin, December 1991, vol. 69, no. 12.p.11. Lithibit Finland Lets Markka Float Stockholm-The Bank of Finland allowed the markka to float freely against all currencies, aban- doning its altempts to maintain a fixed exchange rate policy and paving the way for the second devaluation of the markka in less than 10 months. Sveriges Riksbank, the central bank in neighbor ing Sweden, responded to the spillover from the Finnish crisis by raising its marginal interest rate to 24% from 16%, the biggest single interest rate increase in the Riksbank's 324-year history. In Brussels, a spokesman for the European Community Commission said it regretted Finland's decision to abandon the link with the EC's semi-fixed currency grid and allow the markka to float. He noted that any candidate country to join the EC's planned economic and monetary union must respect the membership rules for the European Monetary Union agreed to in the Maastricht Treaty. Source: Robert Flint, Finland Lens Makta Float, Leading to Record Increase in Swedish Interest Raie." 99/92. Reprinted by permission of The Wall Sareer Journal, 1992 Dow Jones & Co. Inc. All rights reserved worldwide. Fri Finnish Markka Linked to ECU Finland's new centre-right Government and the Bank of Finland decided in June to link the markka to the European Currency Unit (ECU) without devaluation. The decision was taken unilat- erally by Finland, Sweden and Norway had earlier taken similar action. Immediately after the Government and the Bank of Finland had announced their intention to align themselves more and more closely with European monetary policy, domestic interest rates began falling. At the same time, the Government banished the possibility of devaluation from the country's economic pol- icy--at least momentarily. For Finland, the change in the currency system means that the markka's exchange rate will be more stable in relation to Western European currencies. The exclusion of the American dollar and the Japanese yen from the Finnish currency basket increases the exchange rate risks with which Finnish companies mais contend, because the markka will no longer follow the development of those currencies' exchange rates. The strongest criticism of the ECU decision, especially the no-devaluation part of it, came from Finnish export industries and MTK, the organisation representing farmers and forest owners. The Chairman of Confederation of Finnish Industries, Casimir Ehrnrooth, later resigned in protest at the decision. Finland's decision was welcomed in international circles. Both the Commission of the European Communities and individual EC countries expressed their satisfaction. One immedi- ate effect of the ECU linkage was to reverse the outward flow of currency that had been a prob lem for Finland in recent months. Source: Wings, Finnair high Magazine, AngelSeptember 1991.p 30 Reprimed with permission against the ECU this time, it was set free to float (see Exhibit 5). And floator sinkit did. By March 1993 the markka had depreciated from about FIM6.2/ECU in September to over FIM7.1/ECU.2 If it is any consolation to the Finns, the currency crisis to which the markka fell vic- tim in early September swept across the European Community in the second and third weeks of September. When it was all over, the British pound sterling and the Italian lira had both withdrawn from active participation in the European Monetary System and allowed their currencies to float. Continuing attacks on the Spanish peseta, Portuguese escudo, and Irish punt forced their devaluation within the EMS. By November, the Swedish krona and Norwegian krone had both been devalued versus the ECU as well. Although misery may love company, the falling values of other "satellite currencies" to the central currencies of Europe, the ECU and the German mark, was little comfort. As described in Exhibit 6, the Finnish government relied heavily on the international finan- cial markets for the sale of much of its government debt, and that market was now in question. If the government of Finland states its intention to borrow a foreign currency such as the U.S. dollar, and at the same time is experiencing rapid currency depreciation, foreign investors question the ability of the borrower to actually repay the debt. 2 Against the U.S. dollar it was even worse. The markka fell from FIM4.VUSD in August 1992 to more than FIM6.0/USD in March 1993. Vior Finland's Reception in the International Financial Market The Republic of Finland was in New York last Friday, presenting its economic policies and prospects to the local investment community. Friday's meeting had been planned some time before the Euro- pean currency crisis had started to build momentum, and it provided a useful lesson for US investors on what recent events will mean for those nations whose currencies were whipped senseless by the hurricane of speculation that swept through Europe last week Matti Vanhala, a member of the board of the Bank of Finland, assured his audience that the decision to float the Finnish markka was taken before, not after, the Bank had spent a high propor tion of the national foreign currency reserves in supporting the currency. Central bank governor Sirkka Hamalainen was due to present a speech to the investors, but was unable to attend. In her prepared notes, she said that the markka would be "fixed against EC currencies again, but only when it is realistic to do so. Our ambitions concerning integration in Europe, including member- ship in the EC, have not changed." However, her speech added that it was "impossible to say how long it will take before a credible basis exists for fixing the exchange rate." One of the big tasks facing the Republic, along with other European nations caught in the cur rency crossfire, is the rebuilding of foreign exchange reserves, which the central bank govemor admitted to having been "insufficient" when the currency Storm first started to brew up. Partly as a result of this, estimated borrowings by the central government for the current year are estimated to rise to 30% of GDP. or around FIM150bn, and nearly 40% of GDP next year. 41% of Finnish gov. ernment debt has been raised in the domestic markets, the rest in foreign ones. Most European market professionals view that there was no point in talking about what the Currency crisis might have cost Finland, or any other issuer in terms of yield price of debt). Investors at the moment aren't buying at any price. "It is like the old Russian joke. The taxis in Moscow were very cheap, but you just couldn't get any." Source Finland. Biding Time. International Financing Review (IFR) 7,991992. p. 7. Reprinted with permission. Access to international financial markets is critical for countries of all sizes, but most importantly for those that are relatively small. Economic growth requires capital, and without access to international sources, government and industry may be forced to settle for slower growth and lower prospects. Only time will tell the degree to which the markka will eventually be "markked down." Case Questions 1. What did Finland really believe it would gain by pegging the value of the Finnish maskka to the ECU? 2. What conditions motivate international investors and speculators to aid the exchange rate goals of central banks? To hinder the goals? 3. How is this repeated cycle of devaluation and depreciation likely to alter Finland's access to the international capital markets? 52 Part I The International Financial Environment DECISION CASE The Finnish Markka! The Finnish markka-like its home country was the subject of massive economic changes in the early 1990s. With the disintegration of the Soviet Union and the Eastern Bloc economics, it was increasingly apparent to Finland that future economic survival lay in a closer relationship with western Europe. One of the major linkages between any country and its business partners is its currency. The Finnish markka was therefore the subject of a gov- emment-instituted policy of linking its value to the currencies of western Europe in 1991. The rough road traveled by the markka during this period, being first fixed to the ECU, then devalued versus the ECU, and finally floated against the ECU, is a study in the dynamics of the workings of the international financial markets Exhibit I provides a brief illustration of the markka's decline against the European Currency Unit (ECU) and the U.S. dollar. Pegging the Markka to the ECU On June 7, 1991, the Finnish Parliament approved the unilateral linkage of the markka to the European Currency Unit (ECU). Prior to this time the markka was managed against an index of major world currencies. The currencies included in the previous index constituted a cross section of major Finnish trading partners, including the U.S. dollar and the Japanese yen. With the breakup of the East Bloc and the newfound growth of the countries of the European Community (EC). Finland believed its eco- nomic future lay with increasing integration with the EC. Although not formalized at this time, if Finland were to consider eventual membership in the EC, and be consid- ered for membership by the EC, it would need to stabilize its currency with respect to the ECU. The new exchange range and exact fluctuation range of 3% was set against a midpoint defined in FIM/ECU. The pegging or fixing of the markka to the ECU was not without its controversy, however. As referred to in Exhibit 2, the controversy was focused more on the "no devaluation policy" than on the shifting focus of exchange rate policy to the ECU. Many in and out of government argued that the Finnish export sector needed a boost. and a devaluation of the markka would provide that stimulus by making Finnish prod- ucts relatively cheaper for Western buyers. The Finnish export sector had yet to recover from the devastating loss of exports to the East Bloc. The trade deficit and bal- ance of payments of Finland continued to worsen. The Finnish government's stand, however, was that the reason for fixing the markka's value to the ECU was to demonstrate stability and devaluing the markka at the same time would not be consistent with that goal. The government declared itself committed to the fixed value of the FIMVECU, and stood ready to defend its currency with whatever measures might be required. Markets-particularly international cur- rency markets--however, often have their own ideas. "Michael H. Moffett, University of Michigan, March 1992 January 1994. Reprinted with permis- sion. The author would like to thank Veikko Jaaskelainen of the Helsinki School of Economics and Business Administration and lan Giddy of New York University for helpful comments Untit The Finnish Markka: The FIM/ECU and FIM/US$ Exchange Rate 7.0 6.5 FIMECU 6.0 5.5 5.0 4.5 FIMUS$ 4.0 3.5 IL Apr Jun Aug Od Dec Feb Apr Jun Aug Oct Dec Feb Apr Jun Aug Od Dec Feb Apr Jun Aug Oct Dec 1991 1993 The November Speculative Attack The events of November 1991 serve as a classic example of the pressures that may accu- mulate versus a managed currency's value. Throughout October and early November there were increasing concerns that Finland's continuing balance of payments deficit signaled the need for devaluation of the markka (see Exhibit 3). As more and more currency speculators came to the conclusion the markka would have to be devalued, they contributed to the devaluation pressures by speculating on its fall. By borrowing as much short-term markka as possible, the currency speculator could convert them into some other major currency. Once the expected devaluation occurred, the speculator could then use the foreign currency balances to convert back to markka, repay the short-term markka debt, and profit as a result of the devaluation. The markka was finally officially devalued November 14, 1991. The official an nouncement by the Bank of Finland is shown in Exhibit 4. The Bank of Finland believed the 12.3% devaluation was large enough to take the markka to a value that could be maintained within the new range set. The Crisis of September 1992: The Markka Floats Although surviving a major speculative attack on its value in April 1992, the situation once again reached a crisis in September 1992. The markka was not simply devalued tautie Finmark Under Attack Stockholm Finland's central bank caved into a massive wave of currency speculation and allowed the markka to float in global foreign-exchange markets, presaging an imminent devaluation of as much as 20%, analysts said. The decision to uncouple the markka from its fixed intervention range against the European currency unit came after the close of trading Thursday in Helsinki, In volatile international trading, the markka immediately plunged nearly 10%. London traders said the markka stabilized at about 5.5270VECU, compared with about 5.0100/ECU at the close of trading in Helsinki. The weakest markka value allowed under the central bank's previous exchange rate policy was 5.0220VECU. Scurce: Stephen D. Moore. "Finland Leis Markka Float: Devaluation Dwe-1115-1691. Reprinied by permission of The Wall Street Journal E. 1991 Dow Jones & Co., Inc. All rights reserved wouldwide RUM Devaluation of Markka On November 14, 1991, the Bank of Finland decided to temporarily float the markka because of mounting pressure against the currency in the foreign exchange market. On the following day, Novem ber 15, the Government decided on the basis of a proposal by the Parliamentary Supervisory Board of the Bank of Finland to raise the limits of the markka's fluctuation range against the ECU by 14 per- cent, implying a 12.3 percent fall in the external value of the markka. The new midpoint is 5.55841 (FIM/ECU), and the markka may now Muctuate against the ECU in a range of 5.39166 to 5.72516. Source: The Bank of Finland Ballerin, December 1991, vol. 69, no. 12.p.11. Lithibit Finland Lets Markka Float Stockholm-The Bank of Finland allowed the markka to float freely against all currencies, aban- doning its altempts to maintain a fixed exchange rate policy and paving the way for the second devaluation of the markka in less than 10 months. Sveriges Riksbank, the central bank in neighbor ing Sweden, responded to the spillover from the Finnish crisis by raising its marginal interest rate to 24% from 16%, the biggest single interest rate increase in the Riksbank's 324-year history. In Brussels, a spokesman for the European Community Commission said it regretted Finland's decision to abandon the link with the EC's semi-fixed currency grid and allow the markka to float. He noted that any candidate country to join the EC's planned economic and monetary union must respect the membership rules for the European Monetary Union agreed to in the Maastricht Treaty. Source: Robert Flint, Finland Lens Makta Float, Leading to Record Increase in Swedish Interest Raie." 99/92. Reprinted by permission of The Wall Sareer Journal, 1992 Dow Jones & Co. Inc. All rights reserved worldwide. Fri Finnish Markka Linked to ECU Finland's new centre-right Government and the Bank of Finland decided in June to link the markka to the European Currency Unit (ECU) without devaluation. The decision was taken unilat- erally by Finland, Sweden and Norway had earlier taken similar action. Immediately after the Government and the Bank of Finland had announced their intention to align themselves more and more closely with European monetary policy, domestic interest rates began falling. At the same time, the Government banished the possibility of devaluation from the country's economic pol- icy--at least momentarily. For Finland, the change in the currency system means that the markka's exchange rate will be more stable in relation to Western European currencies. The exclusion of the American dollar and the Japanese yen from the Finnish currency basket increases the exchange rate risks with which Finnish companies mais contend, because the markka will no longer follow the development of those currencies' exchange rates. The strongest criticism of the ECU decision, especially the no-devaluation part of it, came from Finnish export industries and MTK, the organisation representing farmers and forest owners. The Chairman of Confederation of Finnish Industries, Casimir Ehrnrooth, later resigned in protest at the decision. Finland's decision was welcomed in international circles. Both the Commission of the European Communities and individual EC countries expressed their satisfaction. One immedi- ate effect of the ECU linkage was to reverse the outward flow of currency that had been a prob lem for Finland in recent months. Source: Wings, Finnair high Magazine, AngelSeptember 1991.p 30 Reprimed with permission against the ECU this time, it was set free to float (see Exhibit 5). And floator sinkit did. By March 1993 the markka had depreciated from about FIM6.2/ECU in September to over FIM7.1/ECU.2 If it is any consolation to the Finns, the currency crisis to which the markka fell vic- tim in early September swept across the European Community in the second and third weeks of September. When it was all over, the British pound sterling and the Italian lira had both withdrawn from active participation in the European Monetary System and allowed their currencies to float. Continuing attacks on the Spanish peseta, Portuguese escudo, and Irish punt forced their devaluation within the EMS. By November, the Swedish krona and Norwegian krone had both been devalued versus the ECU as well. Although misery may love company, the falling values of other "satellite currencies" to the central currencies of Europe, the ECU and the German mark, was little comfort. As described in Exhibit 6, the Finnish government relied heavily on the international finan- cial markets for the sale of much of its government debt, and that market was now in question. If the government of Finland states its intention to borrow a foreign currency such as the U.S. dollar, and at the same time is experiencing rapid currency depreciation, foreign investors question the ability of the borrower to actually repay the debt. 2 Against the U.S. dollar it was even worse. The markka fell from FIM4.VUSD in August 1992 to more than FIM6.0/USD in March 1993. Vior Finland's Reception in the International Financial Market The Republic of Finland was in New York last Friday, presenting its economic policies and prospects to the local investment community. Friday's meeting had been planned some time before the Euro- pean currency crisis had started to build momentum, and it provided a useful lesson for US investors on what recent events will mean for those nations whose currencies were whipped senseless by the hurricane of speculation that swept through Europe last week Matti Vanhala, a member of the board of the Bank of Finland, assured his audience that the decision to float the Finnish markka was taken before, not after, the Bank had spent a high propor tion of the national foreign currency reserves in supporting the currency. Central bank governor Sirkka Hamalainen was due to present a speech to the investors, but was unable to attend. In her prepared notes, she said that the markka would be "fixed against EC currencies again, but only when it is realistic to do so. Our ambitions concerning integration in Europe, including member- ship in the EC, have not changed." However, her speech added that it was "impossible to say how long it will take before a credible basis exists for fixing the exchange rate." One of the big tasks facing the Republic, along with other European nations caught in the cur rency crossfire, is the rebuilding of foreign exchange reserves, which the central bank govemor admitted to having been "insufficient" when the currency Storm first started to brew up. Partly as a result of this, estimated borrowings by the central government for the current year are estimated to rise to 30% of GDP. or around FIM150bn, and nearly 40% of GDP next year. 41% of Finnish gov. ernment debt has been raised in the domestic markets, the rest in foreign ones. Most European market professionals view that there was no point in talking about what the Currency crisis might have cost Finland, or any other issuer in terms of yield price of debt). Investors at the moment aren't buying at any price. "It is like the old Russian joke. The taxis in Moscow were very cheap, but you just couldn't get any." Source Finland. Biding Time. International Financing Review (IFR) 7,991992. p. 7. Reprinted with permission. Access to international financial markets is critical for countries of all sizes, but most importantly for those that are relatively small. Economic growth requires capital, and without access to international sources, government and industry may be forced to settle for slower growth and lower prospects. Only time will tell the degree to which the markka will eventually be "markked down." Case Questions 1. What did Finland really believe it would gain by pegging the value of the Finnish maskka to the ECU? 2. What conditions motivate international investors and speculators to aid the exchange rate goals of central banks? To hinder the goals? 3. How is this repeated cycle of devaluation and depreciation likely to alter Finland's access to the international capital markets