Finance Futures Question

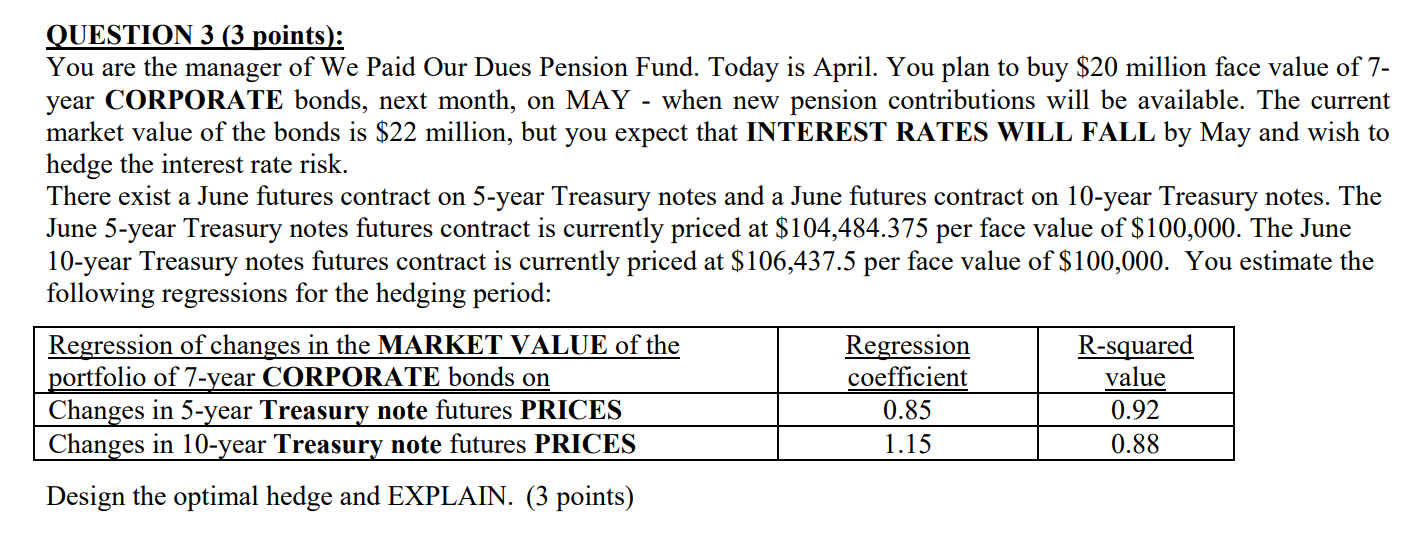

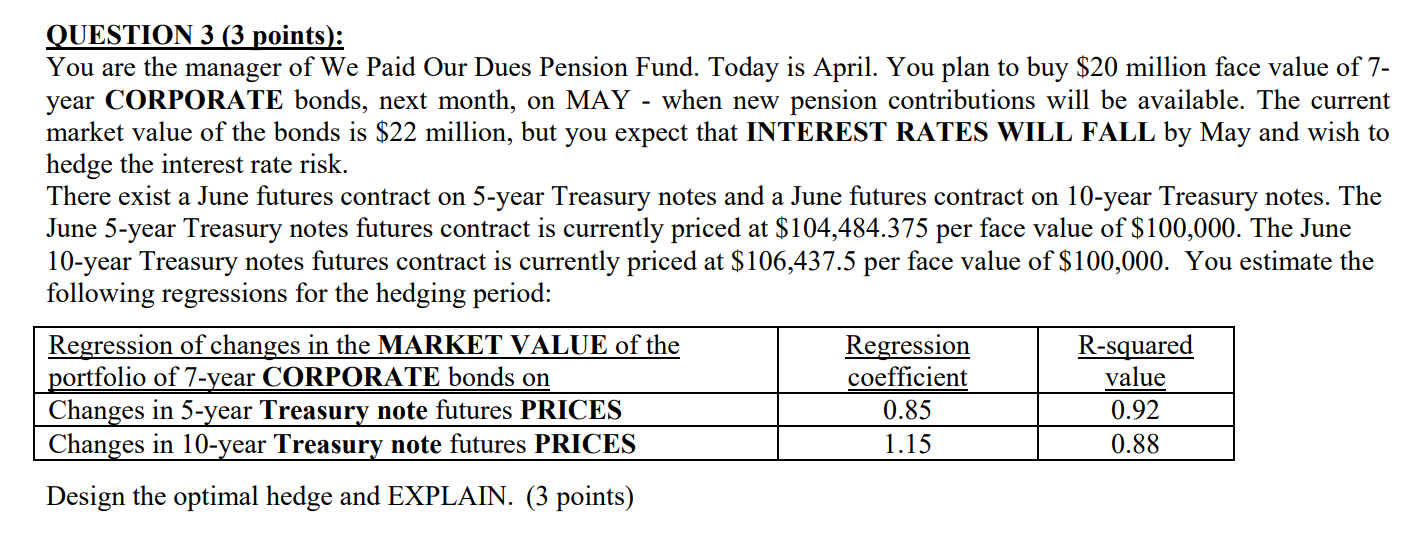

QUESTION 3 (3 points): You are the manager of We Paid Our Dues Pension Fund. Today is April. You plan to buy $20 million face value of 7- year CORPORATE bonds, next month, on MAY - when new pension contributions will be available. The current market value of the bonds is $22 million, but you expect that INTEREST RATES WILL FALL by May and wish to hedge the interest rate risk. There exist a June futures contract on 5-year Treasury notes and a June futures contract on 10-year Treasury notes. The June 5-year Treasury notes futures contract is currently priced at $104,484.375 per face value of $100,000. The June 10-year Treasury notes futures contract is currently priced at $106,437.5 per face value of $100,000. You estimate the following regressions for the hedging period: Regression of changes in the MARKET VALUE of the Regression R-squared portfolio of 7-year CORPORATE bonds on coefficient value | Changes in 5-year Treasury note futures PRICES 0.85 0.92 Changes in 10-year Treasury note futures PRICES 1.15 0.88 Design the optimal hedge and EXPLAIN. (3 points) QUESTION 3 (3 points): You are the manager of We Paid Our Dues Pension Fund. Today is April. You plan to buy $20 million face value of 7- year CORPORATE bonds, next month, on MAY - when new pension contributions will be available. The current market value of the bonds is $22 million, but you expect that INTEREST RATES WILL FALL by May and wish to hedge the interest rate risk. There exist a June futures contract on 5-year Treasury notes and a June futures contract on 10-year Treasury notes. The June 5-year Treasury notes futures contract is currently priced at $104,484.375 per face value of $100,000. The June 10-year Treasury notes futures contract is currently priced at $106,437.5 per face value of $100,000. You estimate the following regressions for the hedging period: Regression of changes in the MARKET VALUE of the Regression R-squared portfolio of 7-year CORPORATE bonds on coefficient value | Changes in 5-year Treasury note futures PRICES 0.85 0.92 Changes in 10-year Treasury note futures PRICES 1.15 0.88 Design the optimal hedge and EXPLAIN. (3 points)