Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Accounting (a) Bonus Sdn. Bhd. enter into a lease agreement with Knight Bhd. on 1 January 2021 for a machine tagged as A7812. In

Financial Accounting

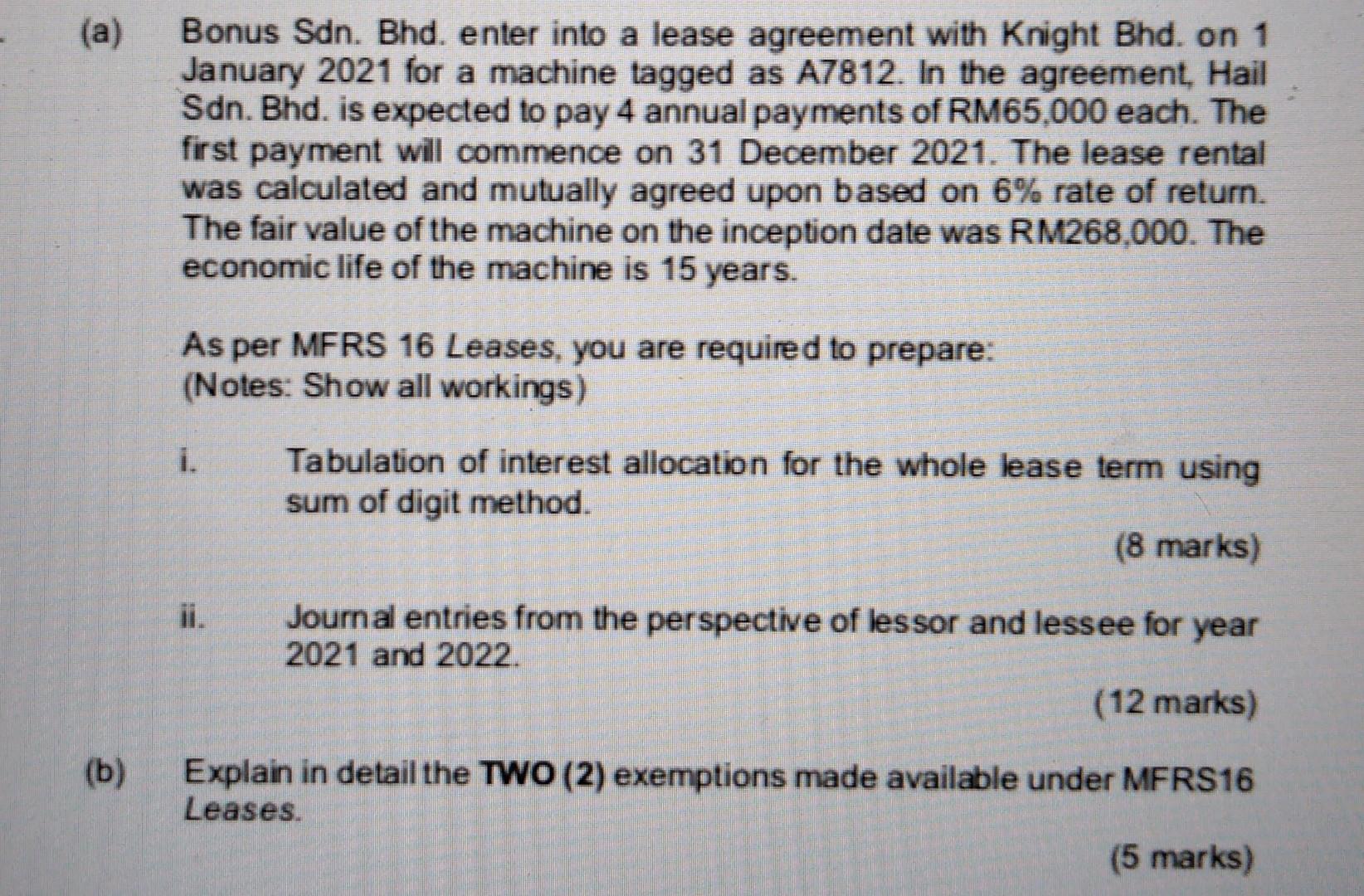

(a) Bonus Sdn. Bhd. enter into a lease agreement with Knight Bhd. on 1 January 2021 for a machine tagged as A7812. In the agreement, Hail Sdn. Bhd. is expected to pay 4 annual payments of RM65.000 each. The first payment will commence on 31 December 2021. The lease rental was calculated and mutually agreed upon based on 6% rate of return. The fair value of the machine on the inception date was RM268,000. The economic life of the machine is 15 years. As per MFRS 16 Leases, you are required to prepare: (Notes: Show all workings) i. Tabulation of interest allocation for the whole lease term using sum of digit method. (8 marks) ii. Journal entries from the perspective of lessor and lessee for year 2021 and 2022. (12 marks) (b) Explain in detail the TWO (2) exemptions made available under MFRS16 Leases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started