Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Accounting by Antle & Garstka Chapter 4 Cases 4-4 (Blue Zone, Inc) Required: 1. Why is the $197,118 of Depreciation added back to net

Financial Accounting by Antle & Garstka

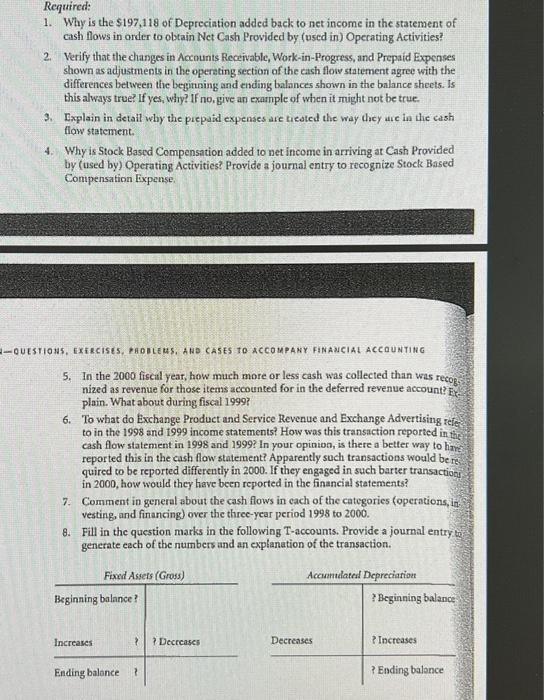

Required: 1. Why is the $197,118 of Depreciation added back to net income in the statement of cash flows in order to obtain Net Cash Provided by (used in) Operating Activities? 2. Verify that the changes in Accounts Receivable, Work-in-Progress, and Prepaid Expenses shown as adjustments in the operating section of the cash flow statement agree with the differences between the begiruing and ending balances shown in the balance sheets. Is this always true? If yes, why? If no, give an exarnple of when it might not be true. 3. Explain in detail why the prepatd expenses are tieated the way chicy are in the cash flow statement. 4. Why is Stock Based Compensation added to net income in arriving at Cash Provided by (used by) Operating Activities? Provide a journal entry to recognize Stock Based Compensation Expense. 5. In the 2000 fiscal year, how much more or less cash was collected than was recog nized as revenue for those items accounted for in the deferred revenue account? Fy? plain. What about during fiscal 1999 ? 6. To what do Exchange Product and Service Revenue and Exchange Advertising zefe to in the 1998 and 1999 income statements? How was this transaction reported in the cash flow statement in 1998 and 1999 ? In your opinion, is there a better way to have reported this in the cash flow statement? Apparently such transactions would be rs quired to be reported differently in 2000 . If they engaged in such barter transactiogy in 2000 , how would they have been reported in the financial statements? 7. Comment in general about the cash flows in each of the categories (operations, in vesting, and financing) over the three-year period 1998 to 2000. 8. Fill in the question marks in the following T-accounts. Provide a journal entry 4 generate each of the numbers and an explanation of the transaction. Required: 1. Why is the $197,118 of Depreciation added back to net income in the statement of cash flows in order to obtain Net Cash Provided by (used in) Operating Activities? 2. Verify that the changes in Accounts Receivable, Work-in-Progress, and Prepaid Expenses shown as adjustments in the operating section of the cash flow statement agree with the differences between the begiruing and ending balances shown in the balance sheets. Is this always true? If yes, why? If no, give an exarnple of when it might not be true. 3. Explain in detail why the prepatd expenses are tieated the way chicy are in the cash flow statement. 4. Why is Stock Based Compensation added to net income in arriving at Cash Provided by (used by) Operating Activities? Provide a journal entry to recognize Stock Based Compensation Expense. 5. In the 2000 fiscal year, how much more or less cash was collected than was recog nized as revenue for those items accounted for in the deferred revenue account? Fy? plain. What about during fiscal 1999 ? 6. To what do Exchange Product and Service Revenue and Exchange Advertising zefe to in the 1998 and 1999 income statements? How was this transaction reported in the cash flow statement in 1998 and 1999 ? In your opinion, is there a better way to have reported this in the cash flow statement? Apparently such transactions would be rs quired to be reported differently in 2000 . If they engaged in such barter transactiogy in 2000 , how would they have been reported in the financial statements? 7. Comment in general about the cash flows in each of the categories (operations, in vesting, and financing) over the three-year period 1998 to 2000. 8. Fill in the question marks in the following T-accounts. Provide a journal entry 4 generate each of the numbers and an explanation of the transaction Chapter 4 Cases 4-4 (Blue Zone, Inc)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started