Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial accounting Financial Accounting Facts: Falcon, Inc. purchased two identical inventory items: -The first item purchased cost $5. - The second item purchased cost $6.

financial accounting

Financial Accounting

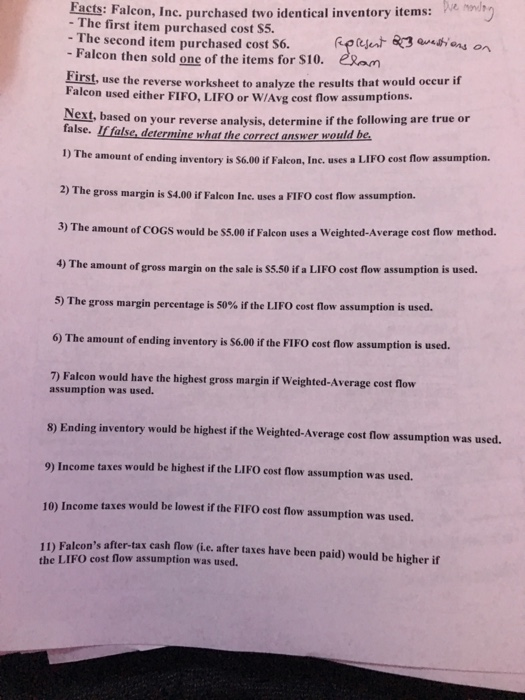

Facts: Falcon, Inc. purchased two identical inventory items: -The first item purchased cost $5. - The second item purchased cost $6. - Falcon then sold one of the items for $10. eRam Rpesent &3 eiors on First, use the reverse worksheet to analyze the results that would occur if Falcon used either FIFO, LIFO or W/Avg cost flow assumptions. Next, based on your reverse analysis, determine if the following are true or false. If false, determine what the correct answer would be ) The amount of ending inventory is $6.00 if Falcon, Inc. uses a LIFO cost flow assumption. 2) The gross margin is $4.00 if Falcon Inc. uses a FIFO cost flow assumption. 3) The amount of COGS would be $5.00 if Falcon uses a Weighted-Average cost flow method. 4) The amount of gross margin on the sale is $5.50 if a LIFO cost flow assumption is used. 5) The gross margin pereentage is 50% if the LIFO cost flow assumption is used. 6) The amount of ending inventory is $6.00 if the FIFO cost flow assumption is used. 7) Falcon would have the highest gross margin if Weighted-Average cost flow assumption was used. 8) Ending inventory would be highest if the Weighted-Average cost flow assumption was used. 9) Income taxes would be highest if the LIFO cost flow assumption was used. 10) Income taxes would be lowest if the FIFO cost flow assumption was used. 11) Falcon's after-tax cash flow (i.e. after taxes have been paid) would be higher if the LIFO cost flow assumption was used Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started