Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial accounting . Please see the page one by one Give me a right answer. Thank u A. Detail of the Statement of Financial Position

Financial accounting .

Please see the page one by one Give me a right answer. Thank u

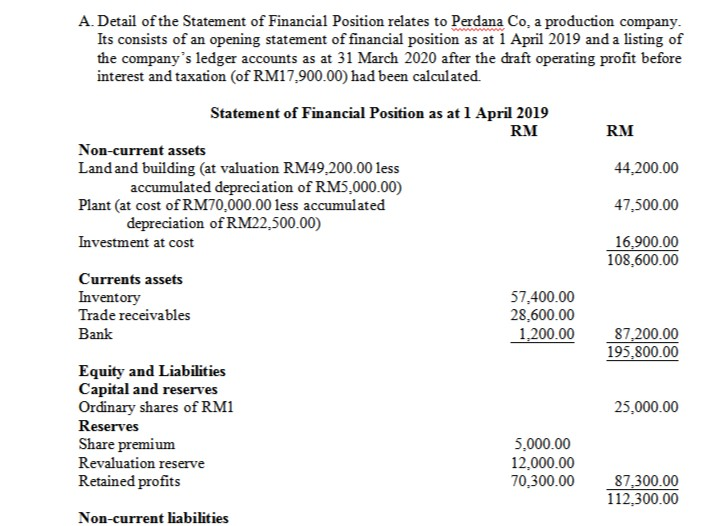

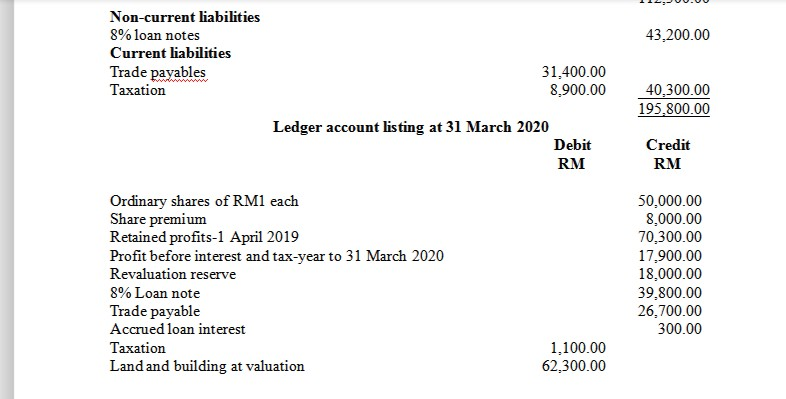

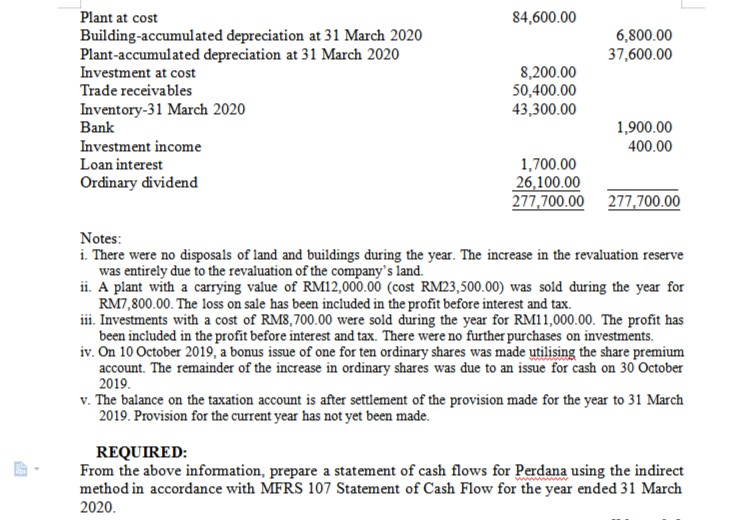

A. Detail of the Statement of Financial Position relates to Perdana Co, a production company. Its consists of an opening statement of financial position as at 1 April 2019 and a listing of the company's ledger accounts as at 31 March 2020 after the draft operating profit before interest and taxation (of RM17,900.00) had been calculated RM Statement of Financial Position as at 1 April 2019 RM Non-current assets Land and building (at valuation RM49,200.00 less accumulated depreciation of RM5,000.00) Plant (at cost of RM70,000.00 less accumulated depreciation of RM22,500.00) Investment at cost 44.200.00 47,500.00 16,900.00 108.600.00 Currents assets Inventory Trade receivables Bank 57,400.00 28,600.00 1,200.00 87,200.00 195,800.00 25,000.00 Equity and Liabilities Capital and reserves Ordinary shares of RM1 Reserves Share premium Revaluation reserve Retained profits 5,000.00 12,000.00 70,300.00 87,300.00 112,300.00 Non-current liabilities 43,200.00 Non-current liabilities 8% loan notes Current liabilities Trade payables Taxation wwwwww 31,400.00 8.900.00 40,300.00 195,800.00 Ledger account listing at 31 March 2020 Debit RM Credit RM Ordinary shares of RM1 each Share premium Retained profits-1 April 2019 Profit before interest and tax-year to 31 March 2020 Revaluation reserve 8% Loan note Trade payable Accrued loan interest Taxation Land and building at valuation 50,000.00 8.000.00 70,300.00 17,900.00 18,000.00 39.800.00 26,700.00 300.00 1,100.00 62,300.00 Plant at cost Building-accumulated depreciation at 31 March 2020 Plant-accumulated depreciation at 31 March 2020 Investment at cost Trade receivables Inventory-31 March 2020 Bank Investment income Loan interest Ordinary dividend 84,600.00 6,800.00 37,600.00 8,200.00 50,400.00 43,300.00 1,900.00 400.00 1,700.00 26,100.00 277,700.00 277,700.00 Notes: i. There were no disposals of land and buildings during the year. The increase in the revaluation reserve was entirely due to the revaluation of the company's land. ii. A plant with a carrying value of RM12,000.00 (cost RM23,500.00) was sold during the year for RM7,800.00. The loss on sale has been included in the profit before interest and tax. iii. Investments with a cost of RM8,700.00 were sold during the year for RM11,000.00. The profit has been included in the profit before interest and tax. There were no further purchases on investments. iv. On 10 October 2019, a bonus issue of one for ten ordinary shares was made utilising the share premium account. The remainder of the increase in ordinary shares was due to an issue for cash on 30 October 2019. V. The balance on the taxation account is after settlement of the provision made for the year to 31 March 2019. Provision for the current year has not yet been made. REQUIRED: From the above information, prepare a statement of cash flows for Perdana using the indirect method in accordance with MFRS 107 Statement of Cash Flow for the year ended 31 March 2020. B. After two years of business, the Camelia Ladder Company decided to apply for a bank loan to finance a new store. Although the company had been successful, it had never prepared a cash budget. The owner of Camelia Ladder Company used the information from the first two years of business to reconstruct cash forecast, and he presented them with his financial statements as though they had been prepared as part of the company's planning REQUIRED: Do you think this behaviour was ethical? What would you do in similar circumstances? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started