Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial accounting PROBLEM 7-3 (103) Bank Reconciliation It was time for Trevrini Co. to complete its bank reconciliation for November 30, 2017. Below is Information

financial accounting

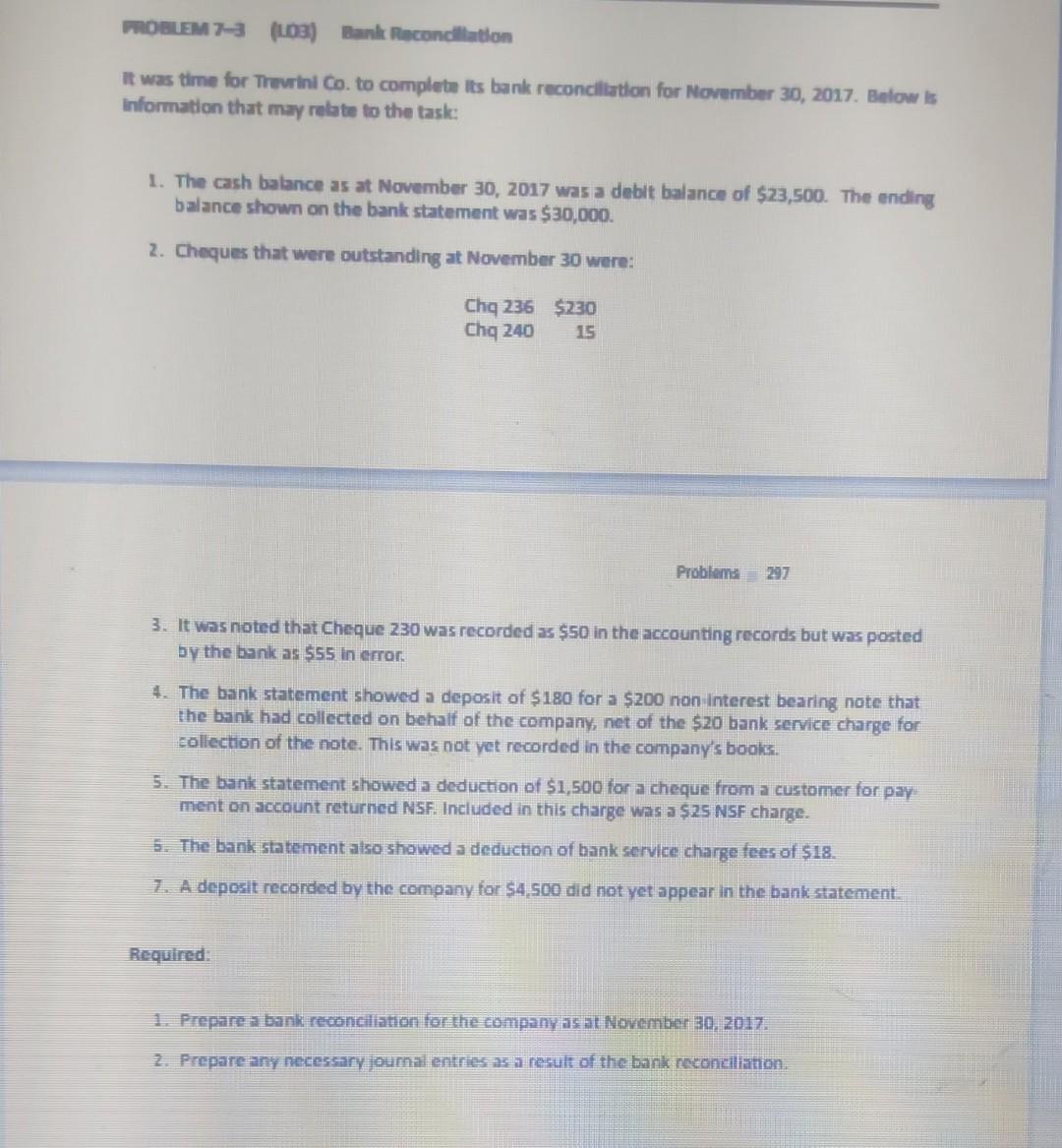

PROBLEM 7-3 (103) Bank Reconciliation It was time for Trevrini Co. to complete its bank reconciliation for November 30, 2017. Below is Information that may relate to the task: 1. The cash balance as at November 30, 2017 was a debit balance of $23,500. The ending balance shown on the bank statement was $30,000. 2. Cheques that were outstanding at November 30 were: Chq 236 $230 Chq 240 15 Problems 3. It was noted that Cheque 230 was recorded as $50 in the accounting records but was posted by the bank as $55 in error. 4. The bank statement showed a deposit of $180 for a $200 non interest bearing note that the bank had collected on behalf of the company, net of the $20 bank service charge for collection of the note. This was not yet recorded in the company's books. 5. The bank statement showed a deduction of $1,500 for a cheque from a customer for pay- ment on account returned NSF. Included in this charge was a $25 NSF charge. 5. The bank statement also showed a deduction of bank service charge fees of $18. 7. A deposit recorded by the company for $4,500 did not yet appear in the bank statement. Required: 1. Prepare a bank reconciliation for the company as at November 30, 2017. 2. Prepare any necessary journal entries as a result of the bank reconciliation. PROBLEM 7-3 (103) Bank Reconciliation It was time for Trevrini Co. to complete its bank reconciliation for November 30, 2017. Below is Information that may relate to the task: 1. The cash balance as at November 30, 2017 was a debit balance of $23,500. The ending balance shown on the bank statement was $30,000. 2. Cheques that were outstanding at November 30 were: Chq 236 $230 Chq 240 15 Problems 3. It was noted that Cheque 230 was recorded as $50 in the accounting records but was posted by the bank as $55 in error. 4. The bank statement showed a deposit of $180 for a $200 non interest bearing note that the bank had collected on behalf of the company, net of the $20 bank service charge for collection of the note. This was not yet recorded in the company's books. 5. The bank statement showed a deduction of $1,500 for a cheque from a customer for pay- ment on account returned NSF. Included in this charge was a $25 NSF charge. 5. The bank statement also showed a deduction of bank service charge fees of $18. 7. A deposit recorded by the company for $4,500 did not yet appear in the bank statement. Required: 1. Prepare a bank reconciliation for the company as at November 30, 2017. 2. Prepare any necessary journal entries as a result of the bank reconciliationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started