financial and managerial accounting 14th

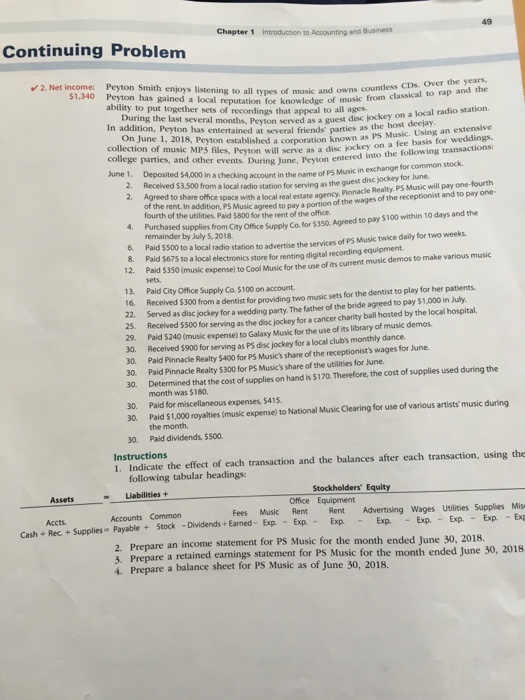

Chapter 1 Introduction to Accounting and Business 49 Continuing Problem 2. Net income: Peyton Smith enjoys listening 8 to all types of music and owns countless CDs. Over the years reputation for knowledge of music from classical to rap and the $1,340 Peyton has gained a local all ability to put together sets of recordings that appeal to all ages During the last several months, Peyton served a In addition, Peyton has entertained at several friends' parties as the a guest disc jockey on a local radio station host deejay On June 1, 2018, Peyton established a corporation known as collection of music MP3 files, Peyton will serve as a dise jockey n college parties, and other events. Du PS Music. Using an extensive ing June, Peyton entered into the following transactions: 54,000 in a checking account in the name of PS Music in exchange for common stock 2. Received $3,500 from a local radio station for serving as the gu est disc jockey for June of the rent. in addition, PS Music fourth of the utilities Paid $800 for the rent of the office. with a local real estate agency, Pinnacle Realty. PS Music will pay one-fourth agreed to pay a portion of the wages of the receptionist and to pay one- Office Supply Co. for $350 Agreed to pay $100 within 10 days and the remainder by July 5, 2018. o station to advertise the services of PS Music twice daily for two weeks. 8. Paid $675 to a local electronics store for renting digital recording equipment. 12. Paid $350 (music expense) to Cool Music for the use of its current music demos to make various music 13. Paid City Office Supply Co $100 on account 5300 from a dentist for 22 Served as discjockey for a wedding party. The father of the bride agreed to pay $1,000 in July. 25. Received $500 for serving as the disc jockey for a cancer charity ball hosted by the local hospital. 29. Paid $240 (music expense) to Galaxy Music for the use of its library of music demos 30. Received $900 for serving as PS disc jockey for a local club's monthly dance 30. Paid Pinnacle Realty $400 for PS Music's share of the receptionist's wages for June. 30. Paid Pinnacle Realty $300 for PS Music's share of the utilities for June. 30. Determined that the cost of supplies on hand is $170.Therefore, the cost of supplies used during the month was $180. 30. Paid for miscellaneous expenses, $415 30. Paid $1,000 royalties (music expense) to National Music Clearing for use of various artists' music during the month. Paid dividends, $500. 30. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings: Stockholders' Equity Assets Office Equipment Accounts Common Fees Music Rent Rent Advertising Wages Utilities Supplies Mis Cash + Rec+Supplies- Payable + Stock -Dividends + Earned- ExpExp. Exp.ExpExp. Exp. Exp. - for PS Music for the month ended June 30, 2018. Prepare an income statement 2. 4. Prepare a balance sheet for PS Music as of June 30, 2018. a retained earnings statement for PS Music for the month ended June 30, 2018