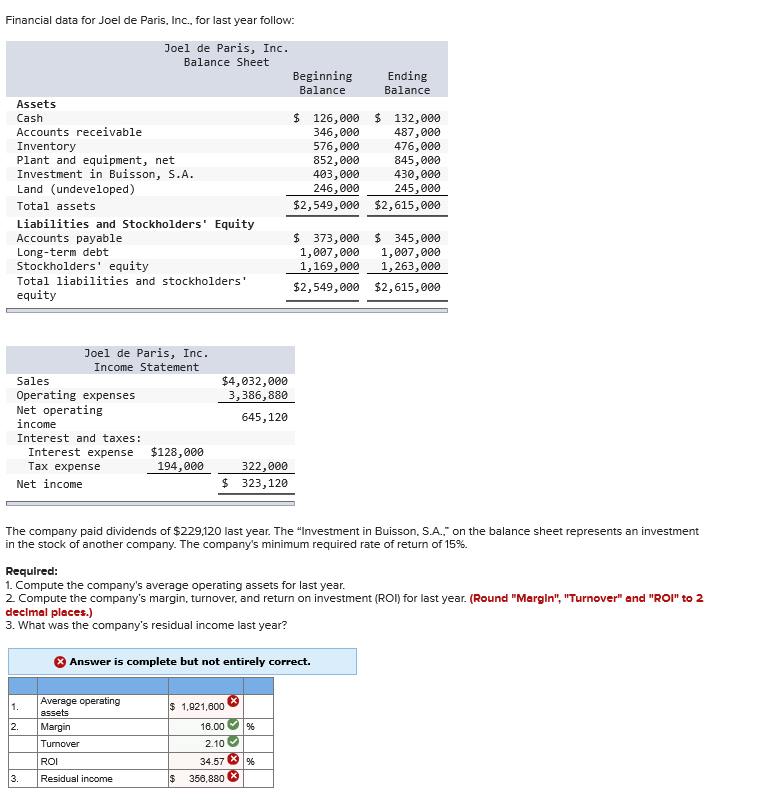

Question: Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Ending Balance Balance Assets Cash $ 126,000

Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Ending Balance Balance Assets Cash $ 126,000 $ 132,000 Accounts receivable 346,000 487,000 Inventory 576,000 476,000 Plant and equipment, net 852,000 845,000 Investment in Buisson, S.A. 403,000 430,000 Land (undeveloped) 246,000_ 245,000 Total assets $2,549,000 $2,615,000 Liabilities and Stockholders' Equity Accounts payable $ 373,000 $ 345,000 Long-term debt 1,007,000 1,007,000 Stockholders' equity 1,169,000 1,263,000 Total liabilities and stockholders' $2,549,000 $2,615,000 equity Joel de Paris, Inc. Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense $128,000 Tax expense 194,000 Net income $4,032,000 3,386,880 645,120 322,000 323,120 $ The company paid dividends of $229,120 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15%. Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.) 3. What was the company's residual income last year? Answer is complete but not entirely correct. Average operating assets Margin Turnover ROI Residual income $ 1,921,600 16.00 2.10 34.57 % $ 358,880 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts