Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Assets Cash Accounts receivable Inventory Plant and equipment, net

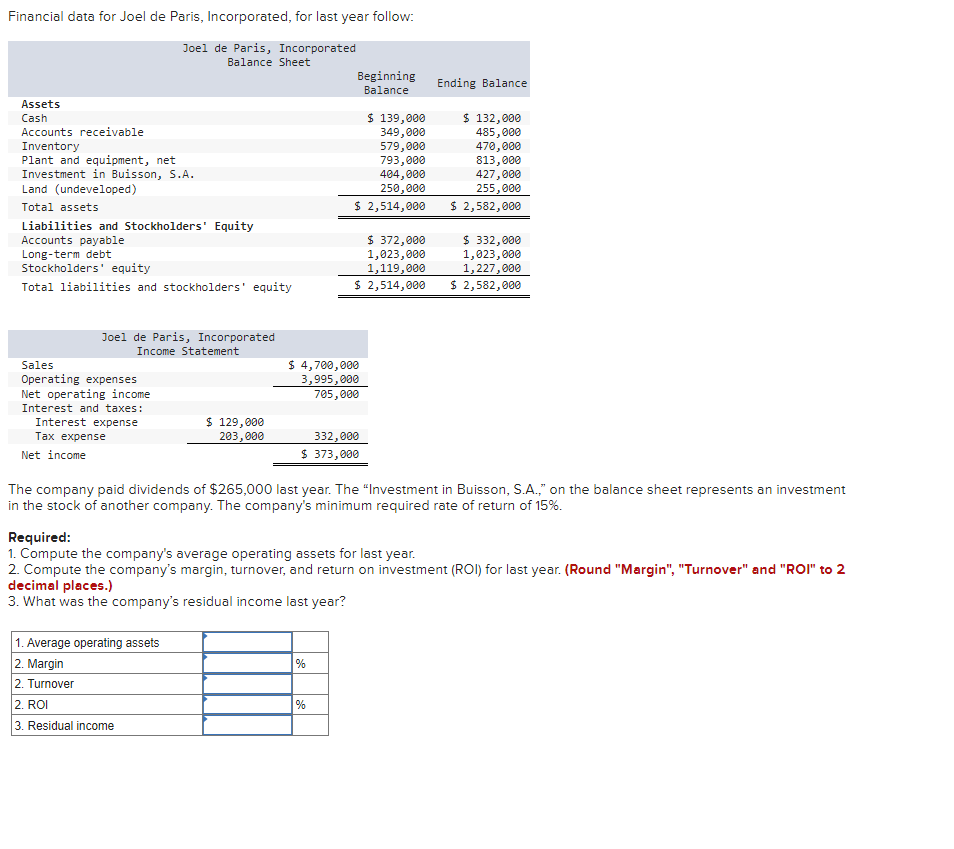

Financial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Assets Cash Accounts receivable Inventory Plant and equipment, net Balance Sheet Beginning Balance Ending Balance $ 139,000 $ 132,000 349,000 579,000 793,000 404,000 250,000 485,000 470,000 813,000 427,000 255,000 Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity $ 2,514,000 $ 372,000 1,023,000 1,119,000 $ 2,582,000 $ 332,000 1,023,000 1,227,000 $ 2,514,000 $ 2,582,000 Joel de Paris, Incorporated Income Statement $ 4,700,000 3,995,000 705,000 Sales Operating expenses Interest and taxes: Net operating income Interest expense Tax expense Net income $ 129,000 203,000 332,000 $ 373,000 The company paid dividends of $265,000 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15%. Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.) 3. What was the company's residual income last year? 1. Average operating assets 2. Margin 2. Turnover 2. ROI 3. Residual income % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started